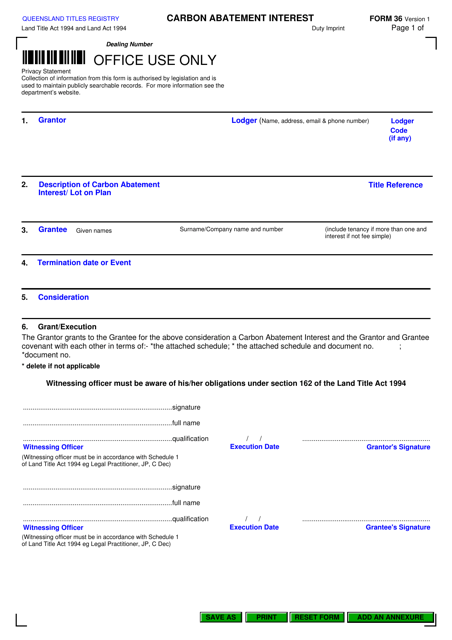

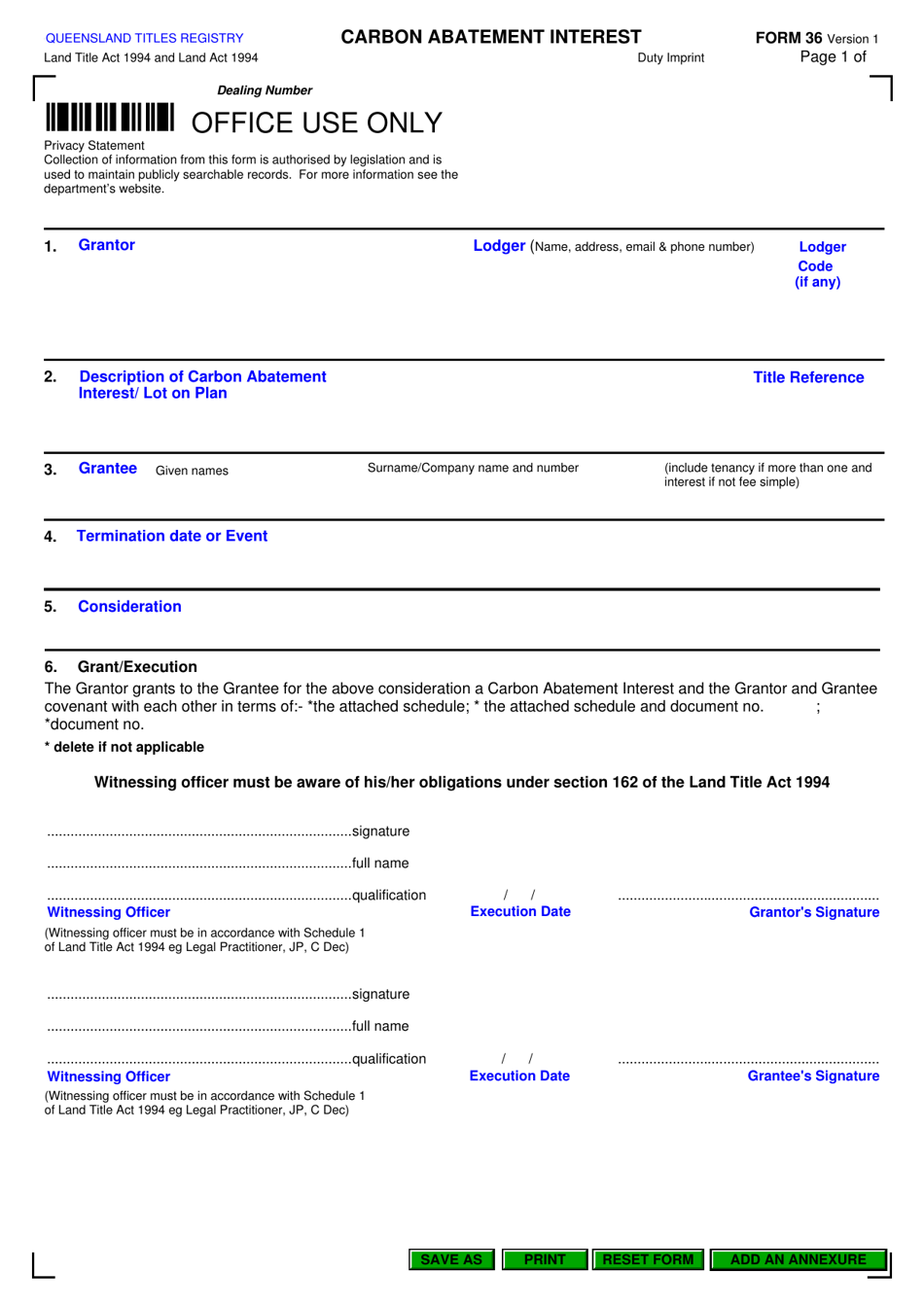

Form 36 Carbon Abatement Interest - Queensland, Australia

Form 36 Carbon Abatement Interest in Queensland, Australia is used for reporting and claiming carbon abatement interest credits. These credits are provided to entities that undertake activities to reduce greenhouse gas emissions in the state.

The Form 36 Carbon Abatement Interest in Queensland, Australia is filed by individuals or entities who wish to claim an interest in the carbon abatement activities mentioned in the form.

FAQ

Q: What is Form 36 Carbon Abatement Interest?

A: Form 36 Carbon Abatement Interest is a document used in Queensland, Australia to claim interest on the abatement of carbon emissions.

Q: Who can use Form 36 Carbon Abatement Interest?

A: Any individual or organization in Queensland, Australia who has engaged in activities that reduce carbon emissions can use Form 36 Carbon Abatement Interest to claim interest on their abatement.

Q: What is the purpose of Form 36 Carbon Abatement Interest?

A: The purpose of Form 36 Carbon Abatement Interest is to provide a mechanism for individuals and organizations to receive financial incentives for their efforts in reducing carbon emissions.

Q: Are there any eligibility requirements to use Form 36 Carbon Abatement Interest?

A: Yes, there may be eligibility requirements to use Form 36 Carbon Abatement Interest. It is important to review the instructions and guidelines provided with the form or consult with the relevant government department to determine eligibility.