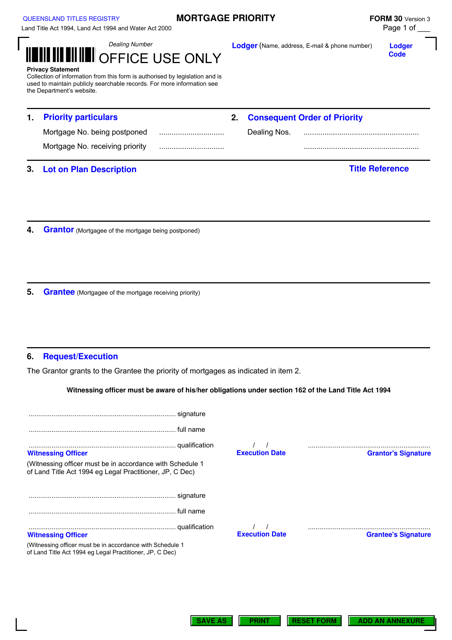

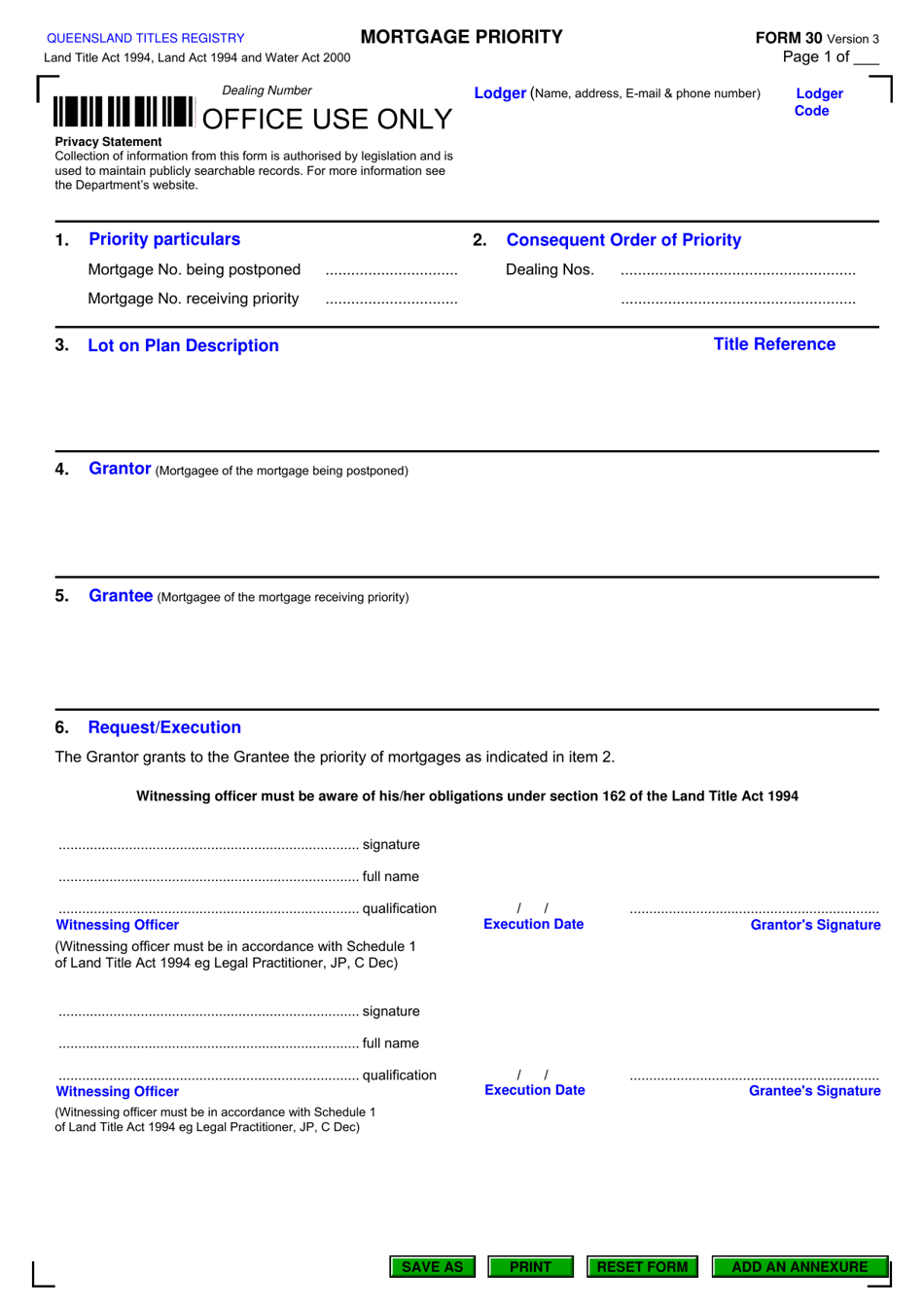

Form 30 Mortgage Priority - Queensland, Australia

Form 30 Mortgage Priority in Queensland, Australia is a legal document used for the purpose of registering a mortgage on a property. It is used to establish the priority of a mortgage against competing interests in the property, giving the lender a higher claim on the property in case of default by the borrower. This form is typically submitted to the Land Titles Office or the Registrar of Titles to ensure the mortgage is officially recorded and recognized.

The Form 30 Mortgage Priority in Queensland, Australia is typically filed by the mortgagee or the lender. This form is used to establish the priority of a mortgage or other registered interest in land. It ensures that the mortgagee's interest in the property is secured and recognized against other claims or interests.

FAQ

Q: What is Form 30 Mortgage Priority in Queensland, Australia?

A: Form 30 Mortgage Priority refers to a legal document filed with the Queensland Land Registry Office to establish the priority of mortgage on a property.

Q: Why is Form 30 Mortgage Priority important?

A: Form 30 Mortgage Priority is important as it determines the ranking or priority of a mortgage. It ensures that the mortgagee (lender) has a secured interest in the property, which can be crucial in the event of default or foreclosure.

Q: How do I file Form 30 Mortgage Priority in Queensland?

A: To file Form 30 Mortgage Priority in Queensland, you need to complete the form provided by the Queensland Land Registry Office. The completed form, along with the required fee, should be submitted to the Land Registry Office.

Q: What information is required for filing Form 30 Mortgage Priority?

A: When filing Form 30 Mortgage Priority, you will typically need to provide details such as the property address, mortgagee's name and address, loan amount, and any relevant encumbrances or caveats.

Q: Is there a fee to file Form 30 Mortgage Priority?

A: Yes, there is a fee associated with filing Form 30 Mortgage Priority. The fee may vary, so it's best to check with the Queensland Land Registry Office for the current fee schedule.

Q: How long does it take to process Form 30 Mortgage Priority?

A: The processing time for Form 30 Mortgage Priority can vary, but it typically takes a few business days. It's advisable to submit the form well in advance to allow for any processing delays.

Q: Can I amend or cancel Form 30 Mortgage Priority once it's filed?

A: Yes, you can amend or cancel Form 30 Mortgage Priority by submitting the appropriate form to the Queensland Land Registry Office. There may be additional fees associated with amending or canceling the priority.

Q: What happens if I don't file Form 30 Mortgage Priority?

A: If you don't file Form 30 Mortgage Priority, your mortgage may not have priority over other creditors or subsequent mortgages. This could potentially affect your rights and interests in the property.

Q: Can I get legal assistance for filing Form 30 Mortgage Priority?

A: Yes, if you need assistance with filing Form 30 Mortgage Priority or have any legal questions, it's recommended to consult with a solicitor or conveyancer who specializes in property law.