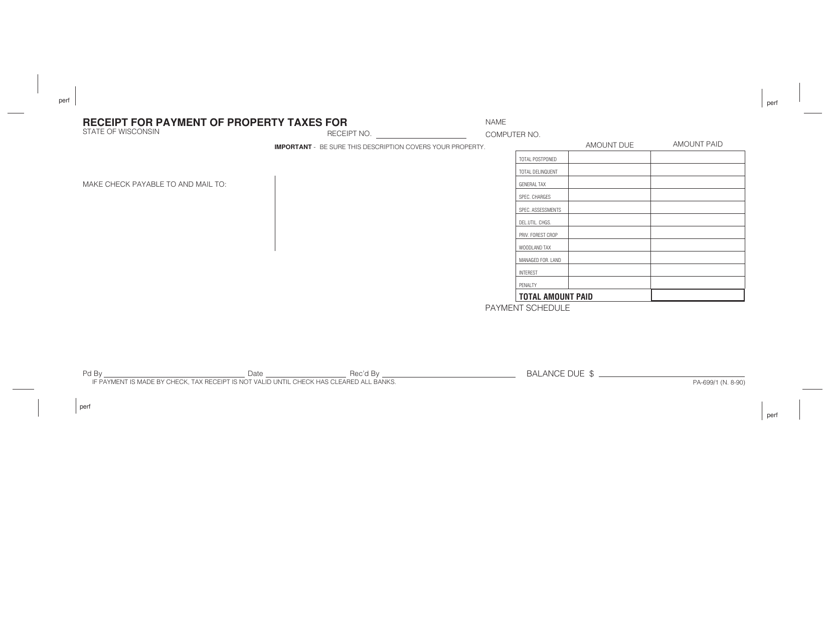

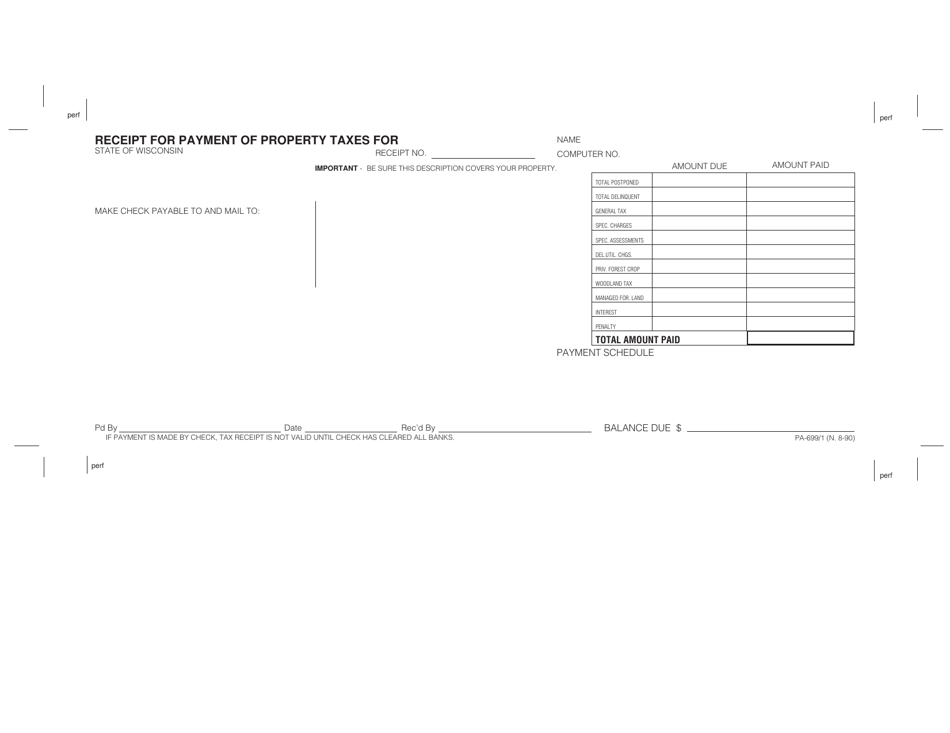

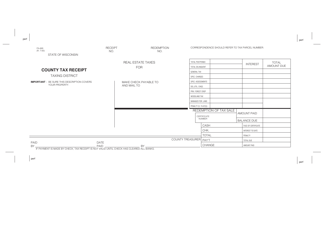

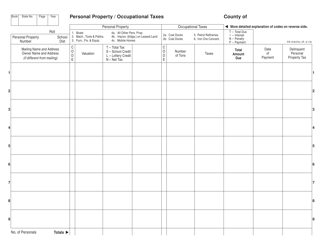

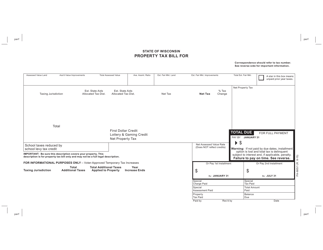

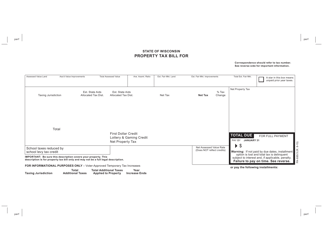

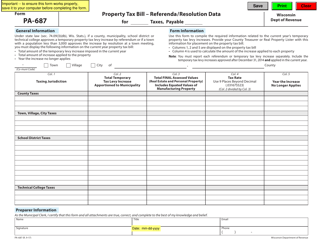

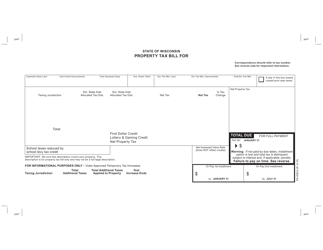

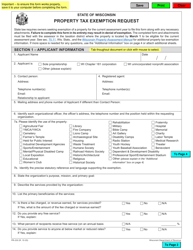

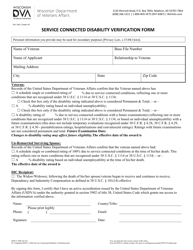

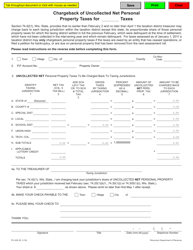

Form PA-699 / 1 Receipt for Payment of Property Taxes - Wisconsin

What Is Form PA-699/1?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-699/1?

A: Form PA-699/1 is a receipt for payment of property taxes in Wisconsin.

Q: What is the purpose of Form PA-699/1?

A: The purpose of Form PA-699/1 is to provide a receipt for payment of property taxes in Wisconsin.

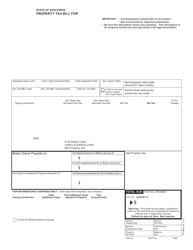

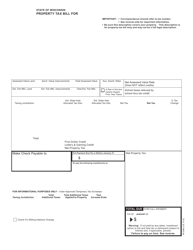

Q: How do I fill out Form PA-699/1?

A: To fill out Form PA-699/1, you need to provide your name, address, property information, and payment details.

Q: Do I need to include payment with Form PA-699/1?

A: Yes, you need to include payment for your property taxes with Form PA-699/1.

Q: When is the deadline to submit Form PA-699/1?

A: The deadline to submit Form PA-699/1 varies by county. Contact your local treasurer's office for the deadline.

Q: What happens if I don't pay my property taxes on time?

A: If you don't pay your property taxes on time, you may incur penalties and interest.

Q: Can I appeal my property tax assessment?

A: Yes, you can appeal your property tax assessment. Contact your local assessor's office for more information.

Q: Is Form PA-699/1 applicable to both residential and commercial properties?

A: Yes, Form PA-699/1 is applicable to both residential and commercial properties in Wisconsin.

Form Details:

- Released on August 1, 1990;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-699/1 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.