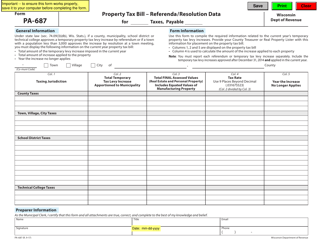

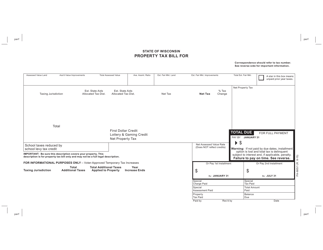

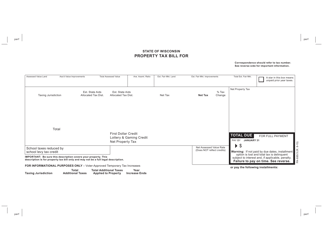

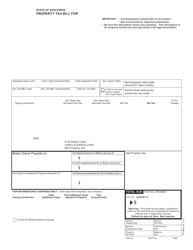

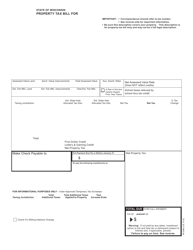

Form PC-203 Instructions for Calculations in Property Tax Rolls - Wisconsin

What Is Form PC-203?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

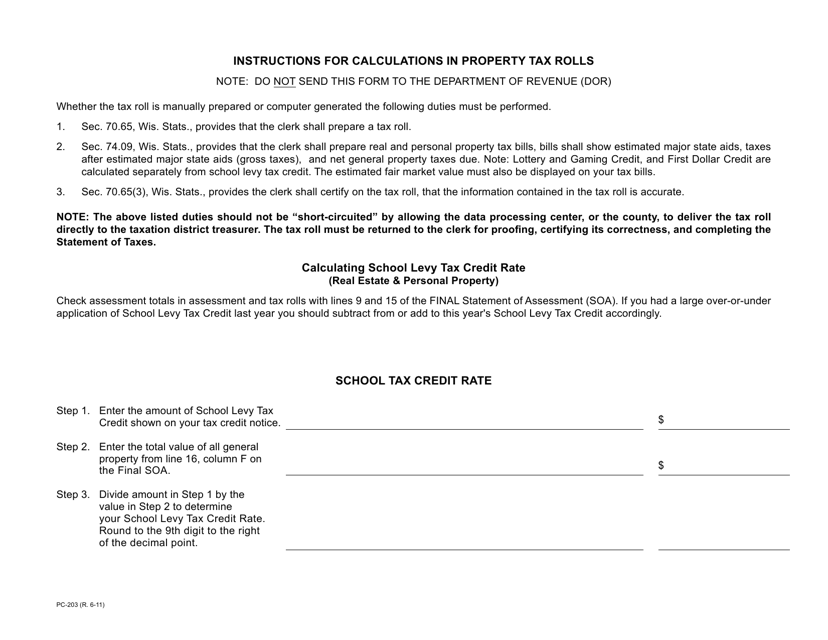

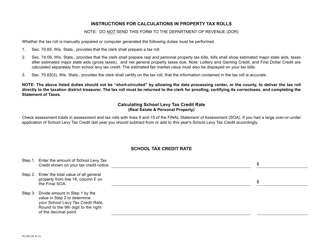

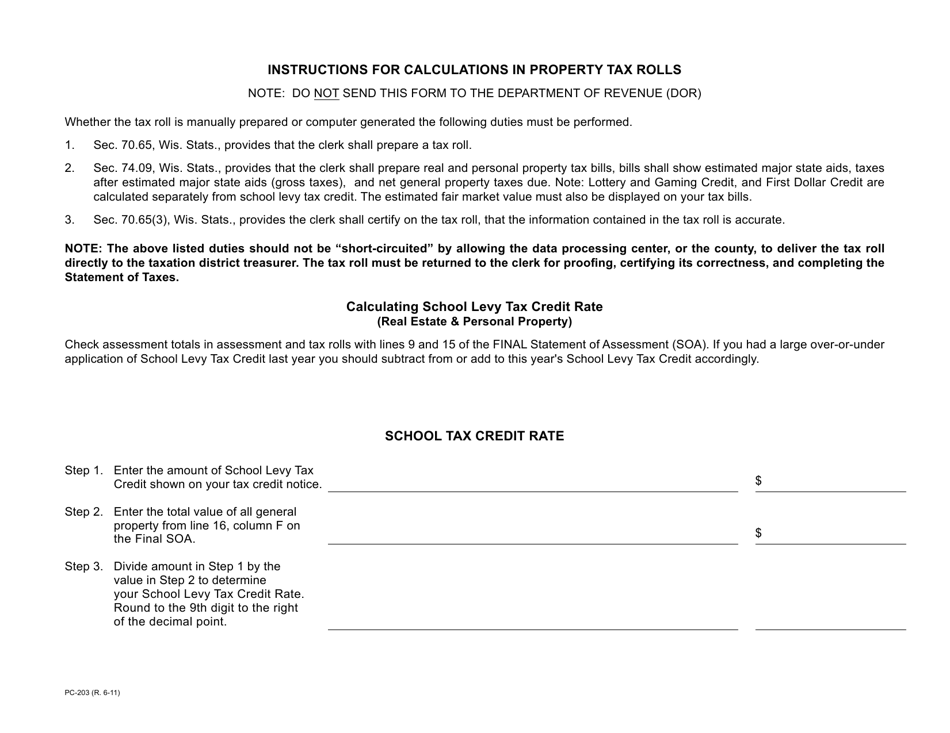

Q: What is Form PC-203?

A: Form PC-203 is a document used for calculations in property tax rolls in Wisconsin.

Q: Who completes Form PC-203?

A: The assessor or the person responsible for preparing the property tax rolls completes Form PC-203.

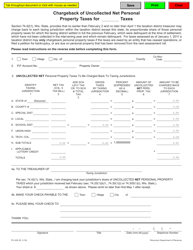

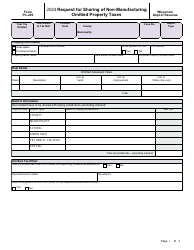

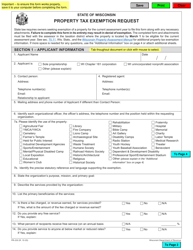

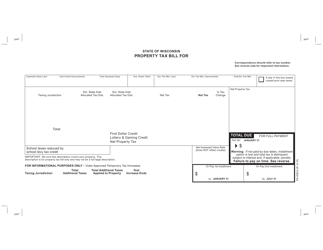

Q: What information is required on Form PC-203?

A: Form PC-203 requires information such as property identification, assessed values, and adjustments.

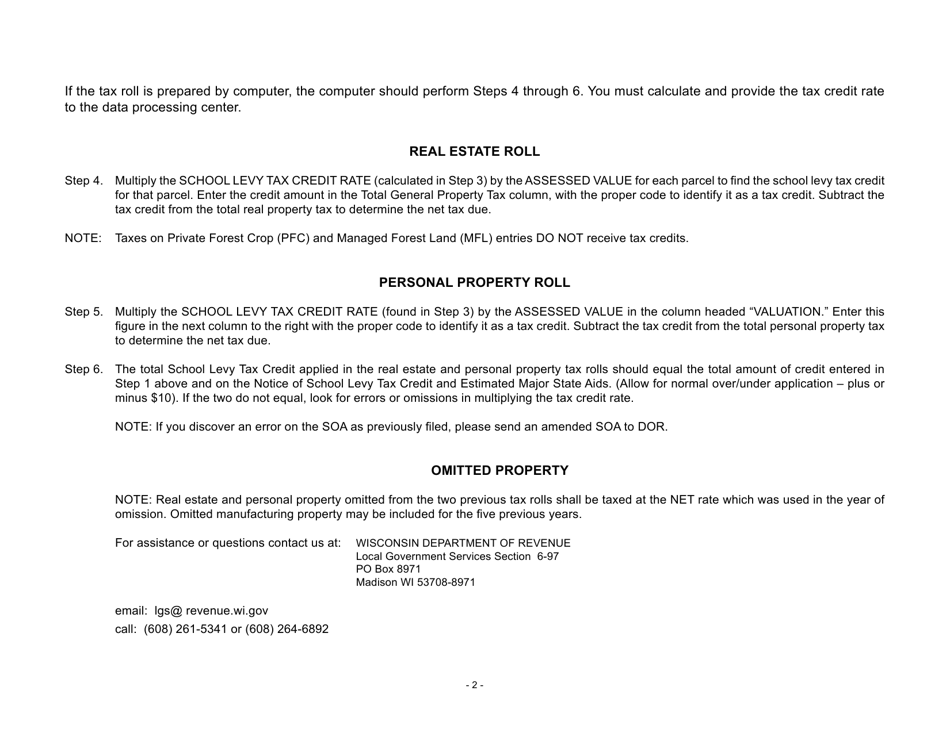

Q: What are the instructions for completing Form PC-203?

A: The instructions for completing Form PC-203 are provided in the document.

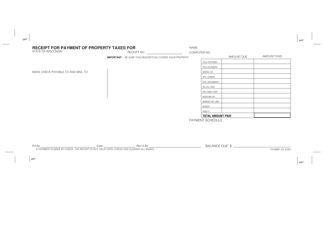

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PC-203 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.