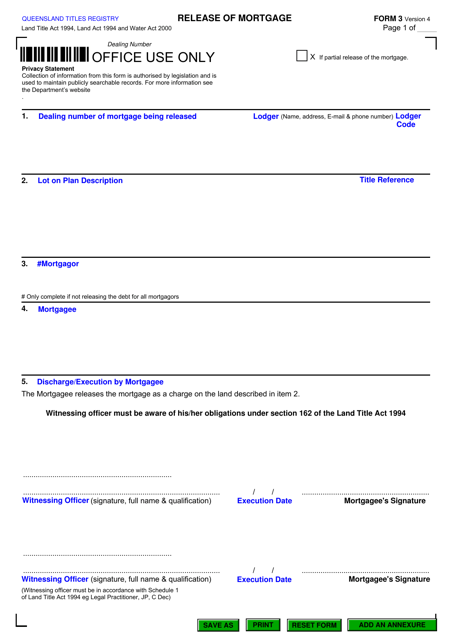

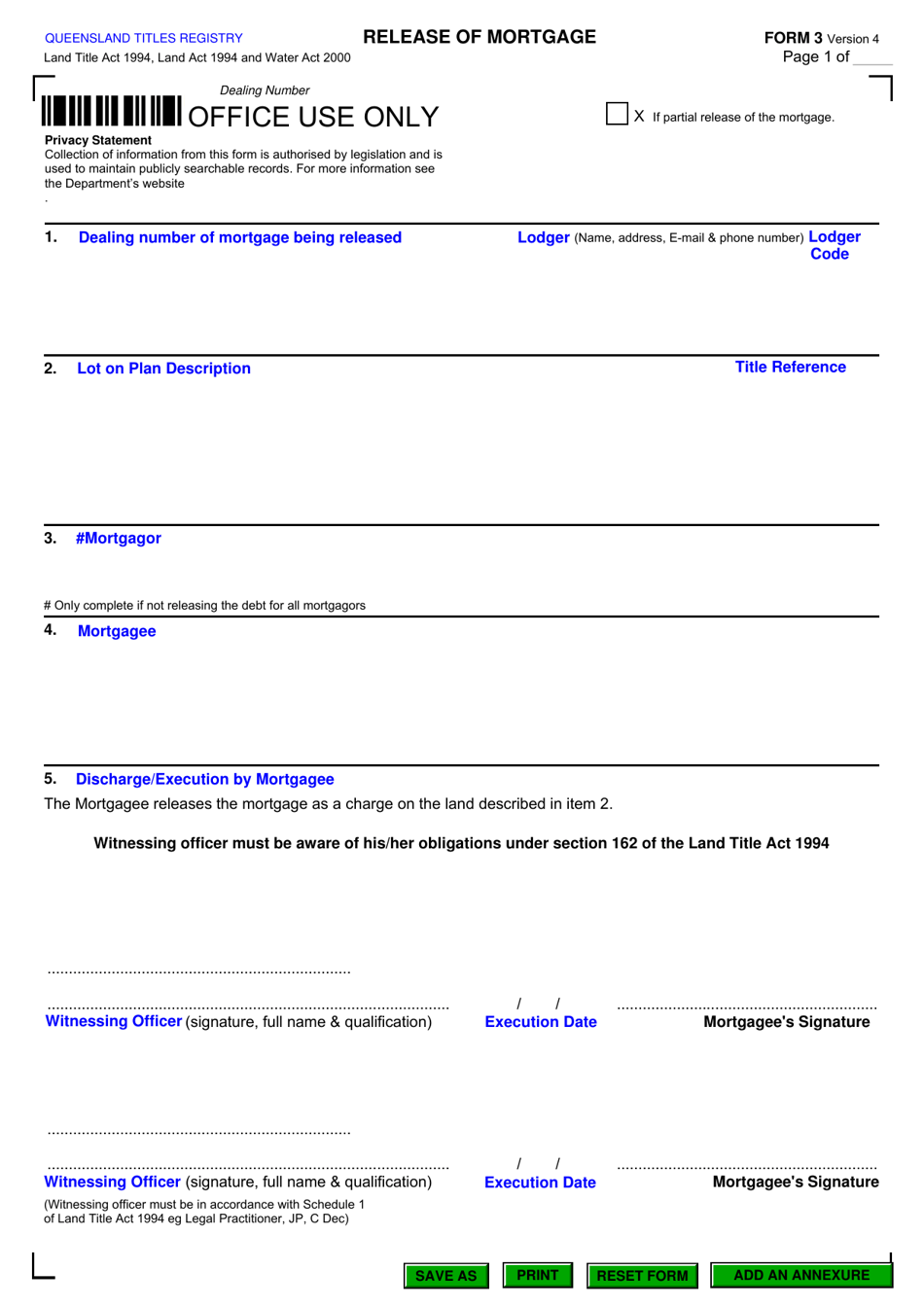

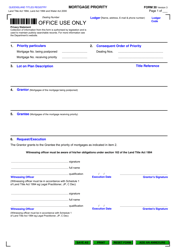

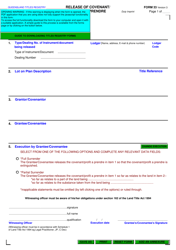

Form 3 Release of Mortgage - Queensland, Australia

Form 3 Release of Mortgage - Queensland, Australia is used to release and discharge a mortgage once it has been paid off in full. It is a legal document that acknowledges the satisfaction of the mortgage and releases the property from the mortgage debt.

FAQ

Q: What is a Form 3 Release of Mortgage?

A: A Form 3 Release of Mortgage is a legal document used in Queensland, Australia to release a mortgage on a property.

Q: Who prepares the Form 3 Release of Mortgage?

A: Typically, the mortgagee (lender) prepares the Form 3 Release of Mortgage.

Q: What information is included in the Form 3 Release of Mortgage?

A: The Form 3 Release of Mortgage includes details of the mortgage, such as the names of the mortgagor (borrower) and mortgagee, property information, and the date of the release.

Q: Is the Form 3 Release of Mortgage required in Queensland?

A: Yes, the Form 3 Release of Mortgage is a required document to release a mortgage in Queensland.

Q: What should I do with the completed Form 3 Release of Mortgage?

A: Once completed, the Form 3 Release of Mortgage should be lodged with the Land Registry in Queensland.

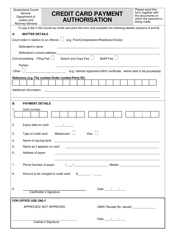

Q: Is there a fee for lodging the Form 3 Release of Mortgage?

A: Yes, there is a fee for lodging the Form 3 Release of Mortgage with the Land Registry in Queensland. The fee can vary, so it's best to check with the Land Registry or consult a legal professional.

Q: What happens after the Form 3 Release of Mortgage is lodged?

A: After the Form 3 Release of Mortgage is lodged and processed by the Land Registry, the mortgage will be officially released, and the property will no longer be encumbered by the mortgage.