This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-5/624

for the current year.

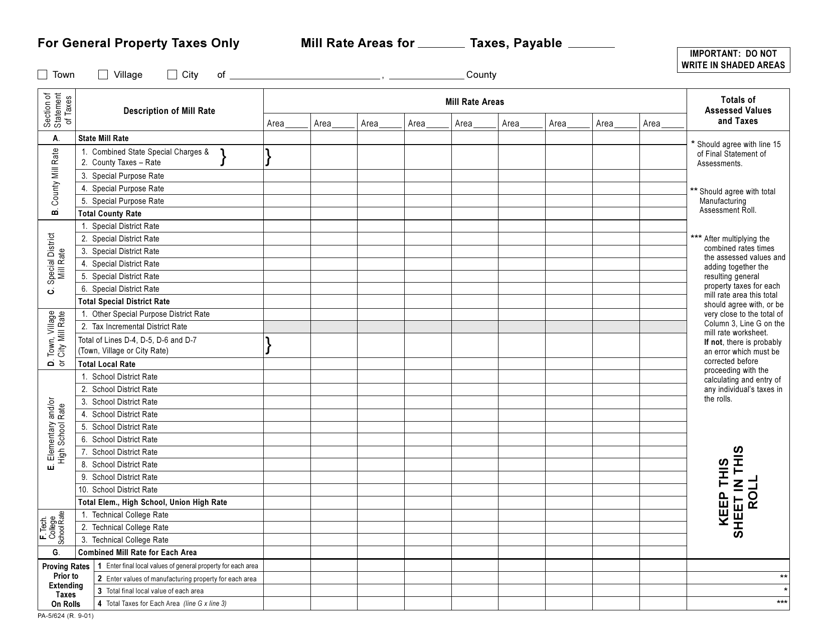

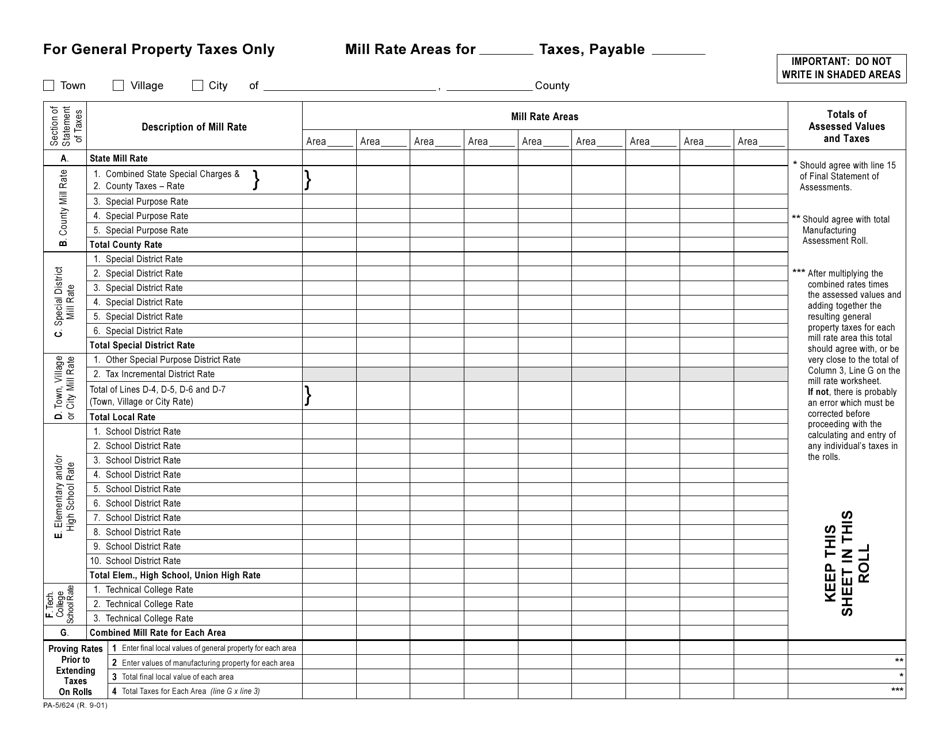

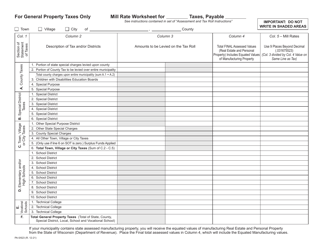

Form PA-5 / 624 Mill Rate Areas - Wisconsin

What Is Form PA-5/624?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-5/624?

A: Form PA-5/624 is a tax form used in Wisconsin.

Q: What is a mill rate?

A: A mill rate is the amount of tax payable per dollar of the assessed value of a property.

Q: What are Mill Rate Areas in Wisconsin?

A: Mill Rate Areas in Wisconsin are geographic areas with different mill rates.

Q: How are Mill Rate Areas determined?

A: Mill Rate Areas are determined by local governing bodies, such as cities, towns, or counties.

Q: Why are Mill Rate Areas important?

A: Mill Rate Areas determine the property tax rate for the residents within each area.

Q: What is the purpose of Form PA-5/624?

A: Form PA-5/624 is used to report the mill rate of a specific area in Wisconsin.

Q: Who needs to fill out Form PA-5/624?

A: Local governing bodies in Wisconsin need to fill out Form PA-5/624.

Form Details:

- Released on September 1, 2001;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-5/624 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.