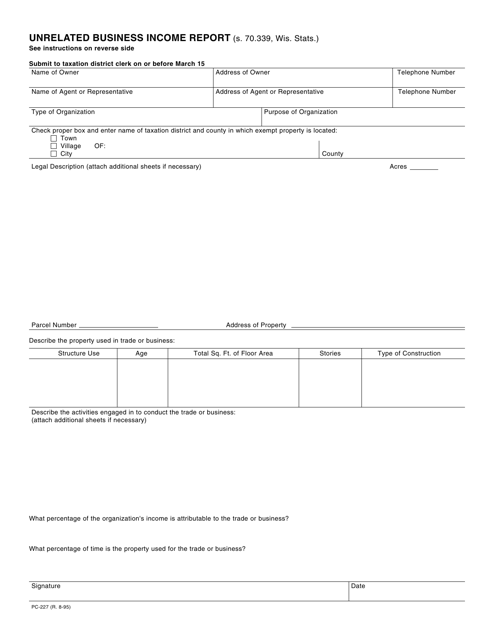

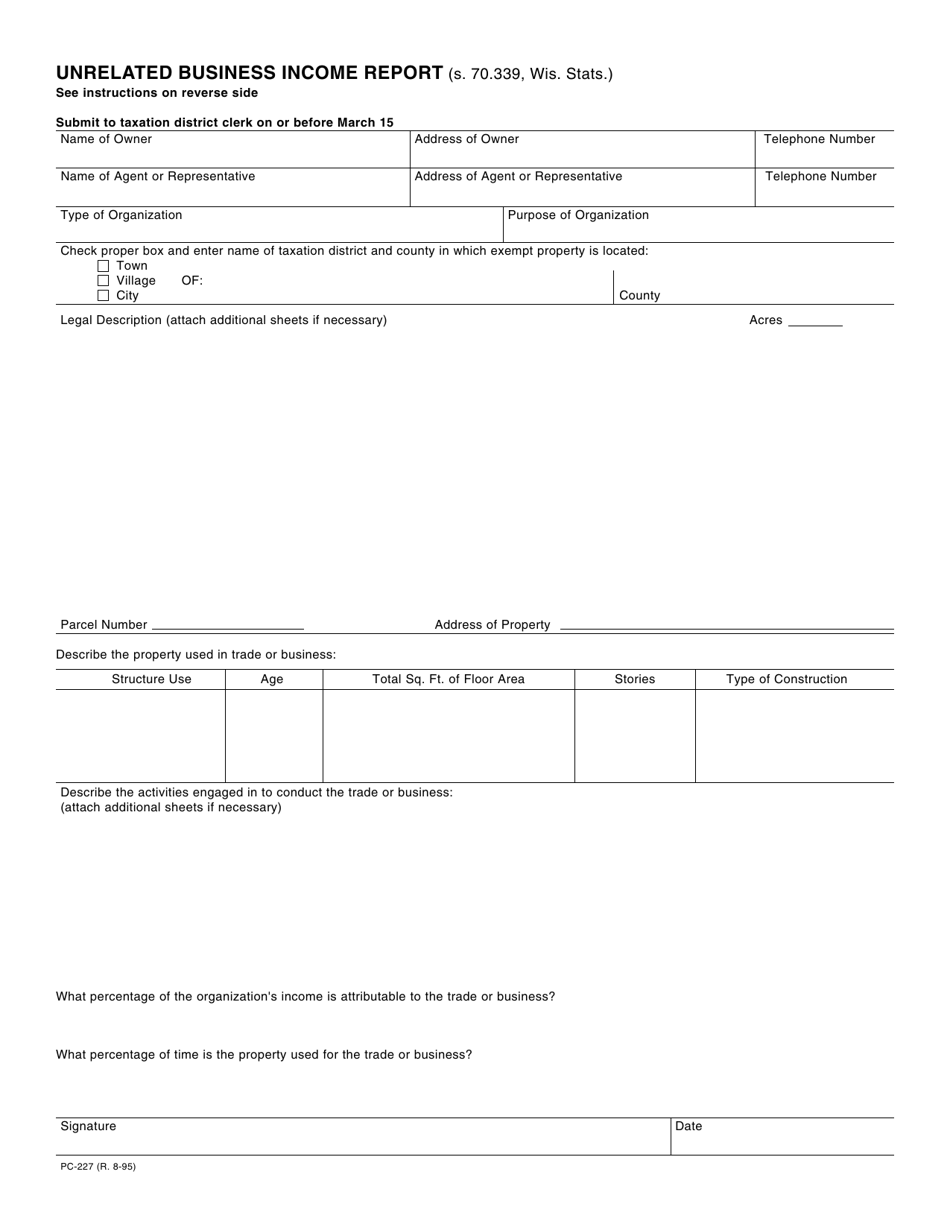

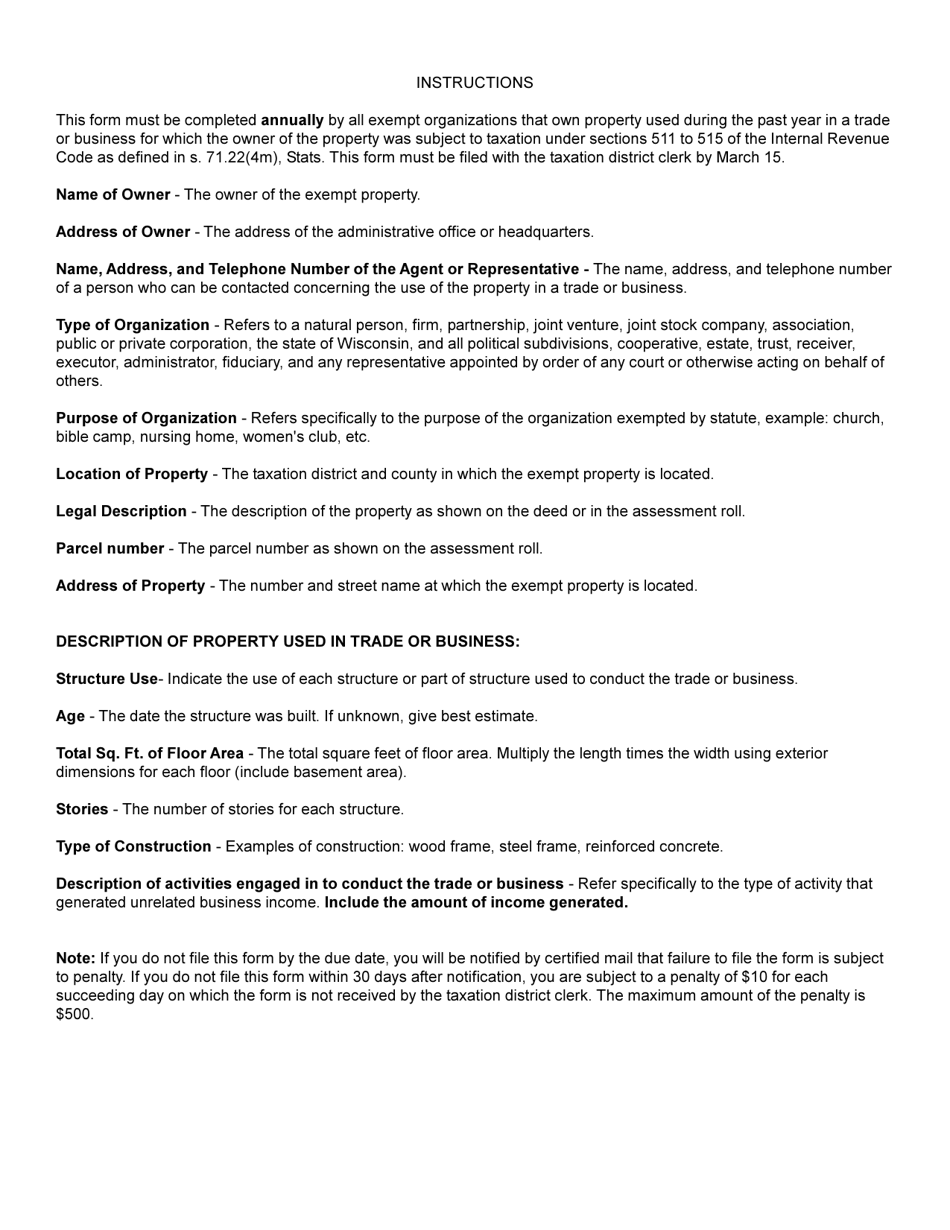

Form PC-227 Unrelated Business Income Report - Wisconsin

What Is Form PC-227?

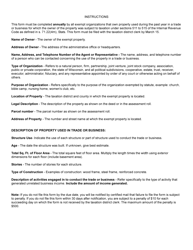

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PC-227?

A: Form PC-227 is the Unrelated Business Income Report for Wisconsin.

Q: Who needs to file Form PC-227?

A: Nonprofit organizations in Wisconsin that have unrelated business income need to file Form PC-227.

Q: What is unrelated business income?

A: Unrelated business income is income generated by a nonprofit organization that is not related to their primary exempt purposes.

Q: What information is required on Form PC-227?

A: Form PC-227 requires information about the organization, description of the unrelated business activities, and details of the income and expenses.

Q: When is Form PC-227 due?

A: Form PC-227 is due on the 15th day of the 5th month following the close of the organization's fiscal year.

Q: Are there any penalties for not filing Form PC-227?

A: Yes, there can be penalties for not filing Form PC-227, including monetary penalties and loss of tax-exempt status.

Q: Is Form PC-227 required for all nonprofit organizations in Wisconsin?

A: No, only nonprofit organizations that have unrelated business income are required to file Form PC-227.

Form Details:

- Released on August 1, 1995;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PC-227 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.