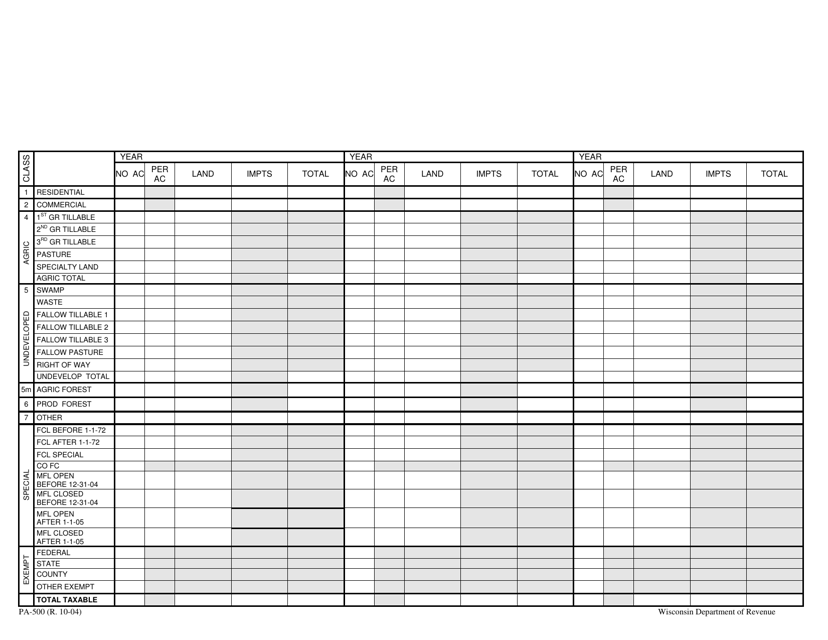

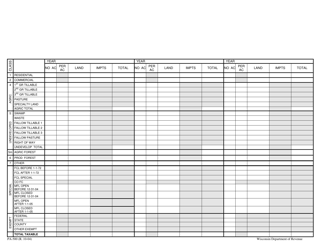

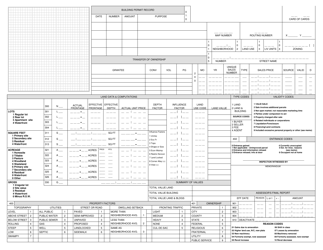

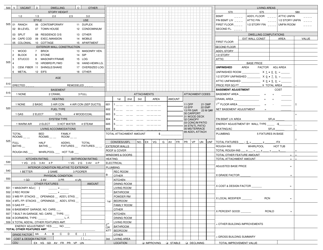

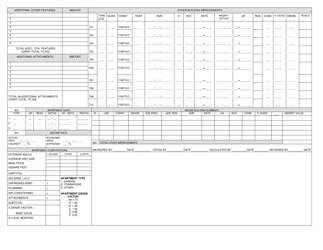

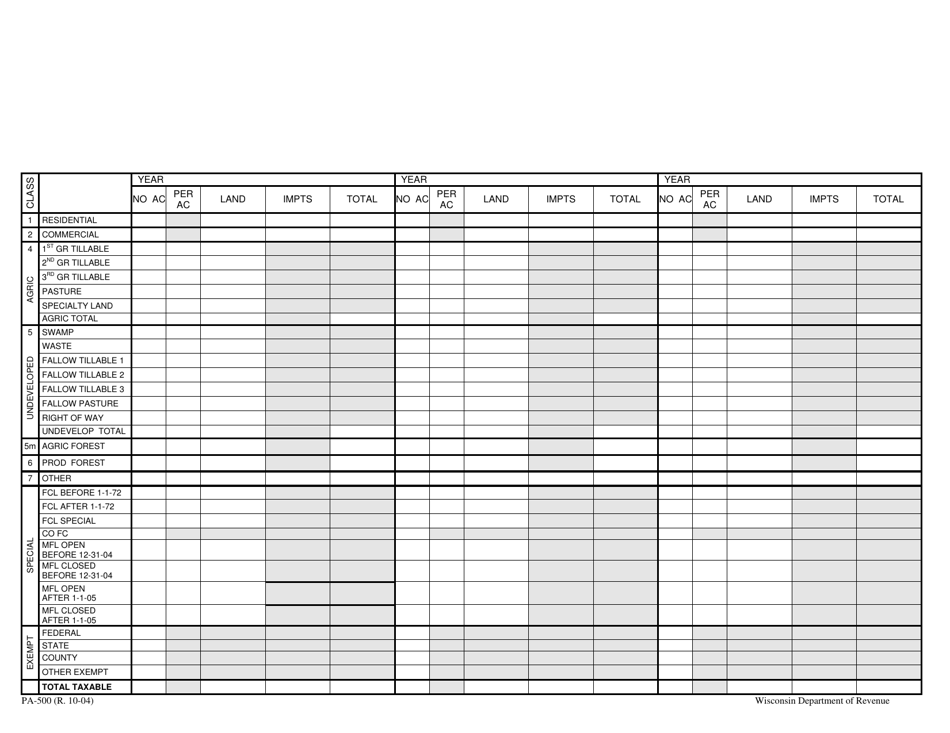

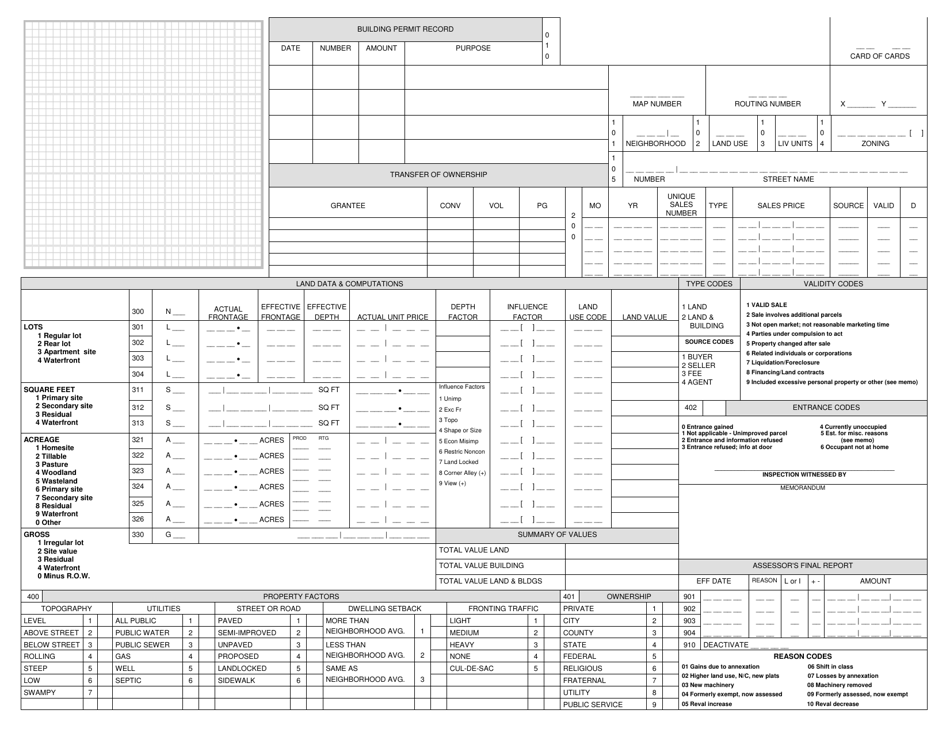

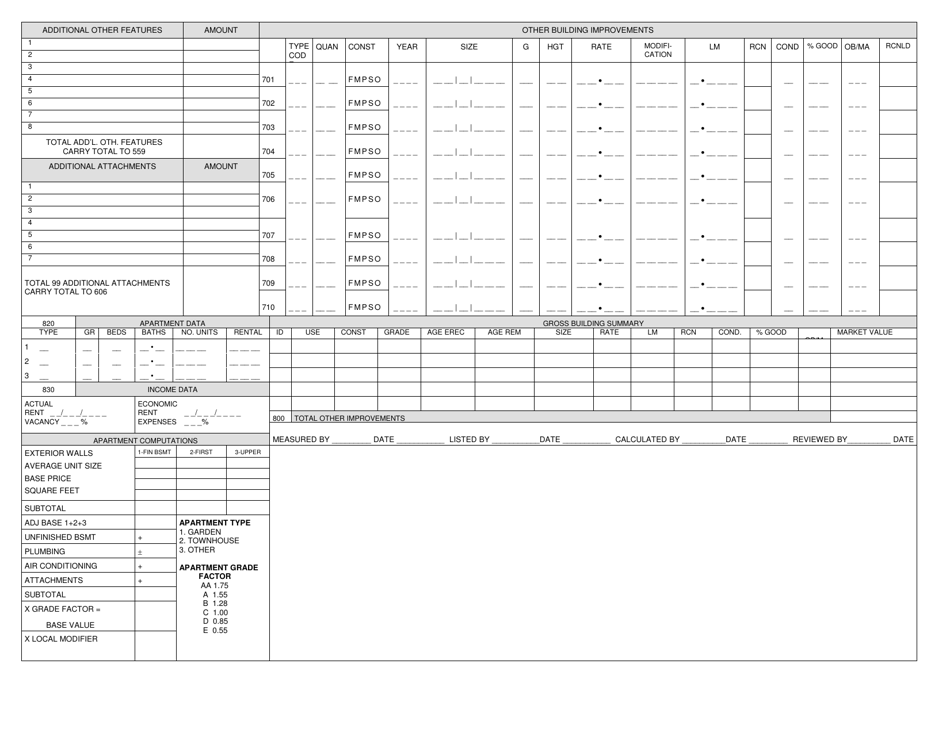

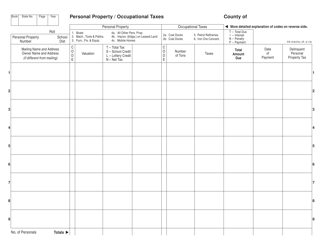

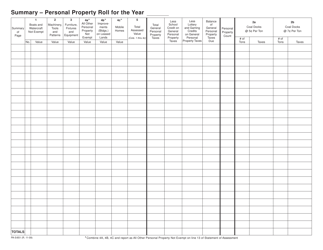

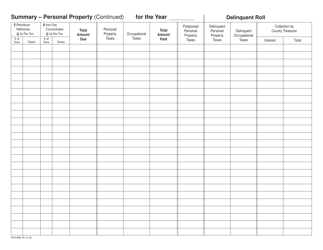

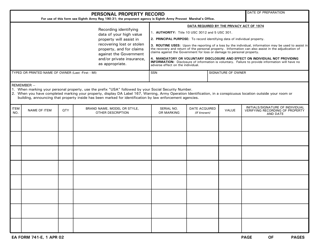

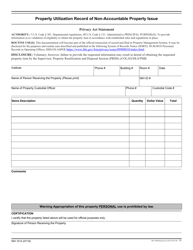

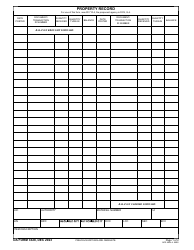

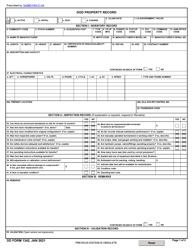

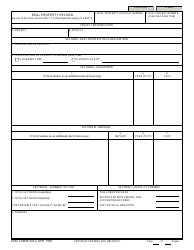

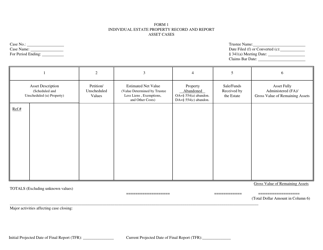

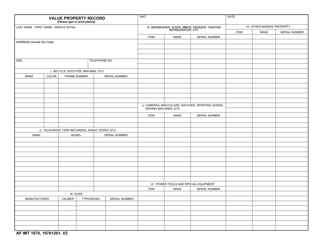

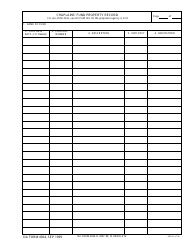

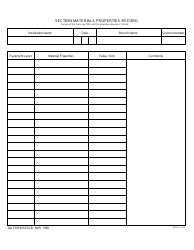

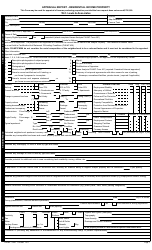

Form PA-500 Residential Property Record - Wisconsin

What Is Form PA-500?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-500?

A: Form PA-500 is the Residential Property Record form used in Wisconsin.

Q: Who needs to fill out Form PA-500?

A: Property owners in Wisconsin need to fill out Form PA-500.

Q: What information is required on Form PA-500?

A: Form PA-500 requires information about the property owner, property details, and any recent changes or improvements made to the property.

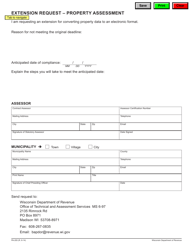

Q: Are there any deadlines for filing Form PA-500?

A: Yes, Form PA-500 must be filed by January 31st of each year.

Q: What happens if I don't file Form PA-500?

A: Failure to file Form PA-500 may result in penalties or fines.

Q: Is there a fee for filing Form PA-500?

A: As of now, there is no fee for filing Form PA-500.

Q: Can I make changes to my Form PA-500 after submitting it?

A: Yes, you can make changes to your Form PA-500 by submitting an amended form.

Q: Who should I contact for support or further information about Form PA-500?

A: For support or further information about Form PA-500, you can contact the Wisconsin Department of Revenue.

Form Details:

- Released on October 1, 2004;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-500 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.