This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-117

for the current year.

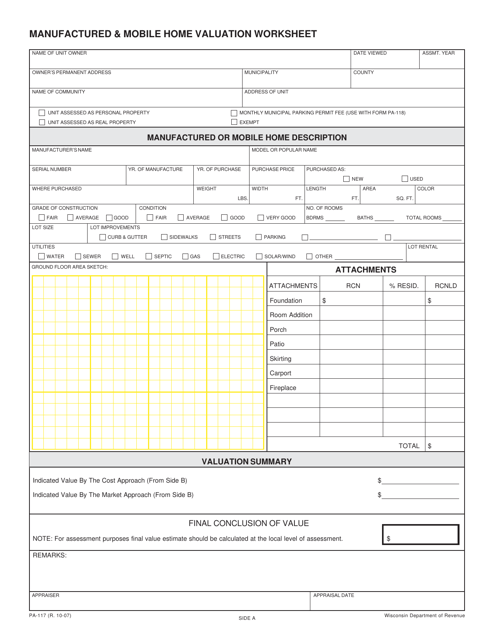

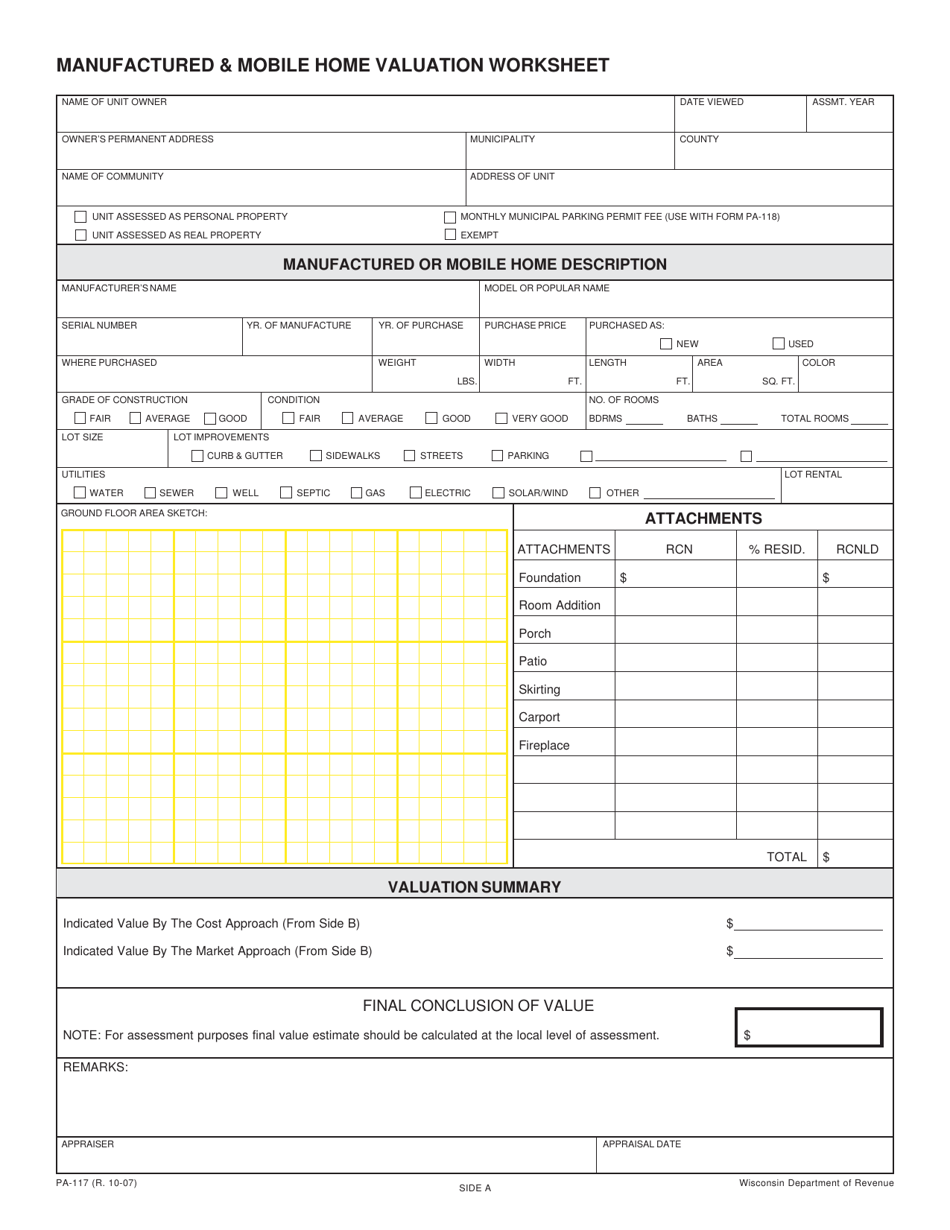

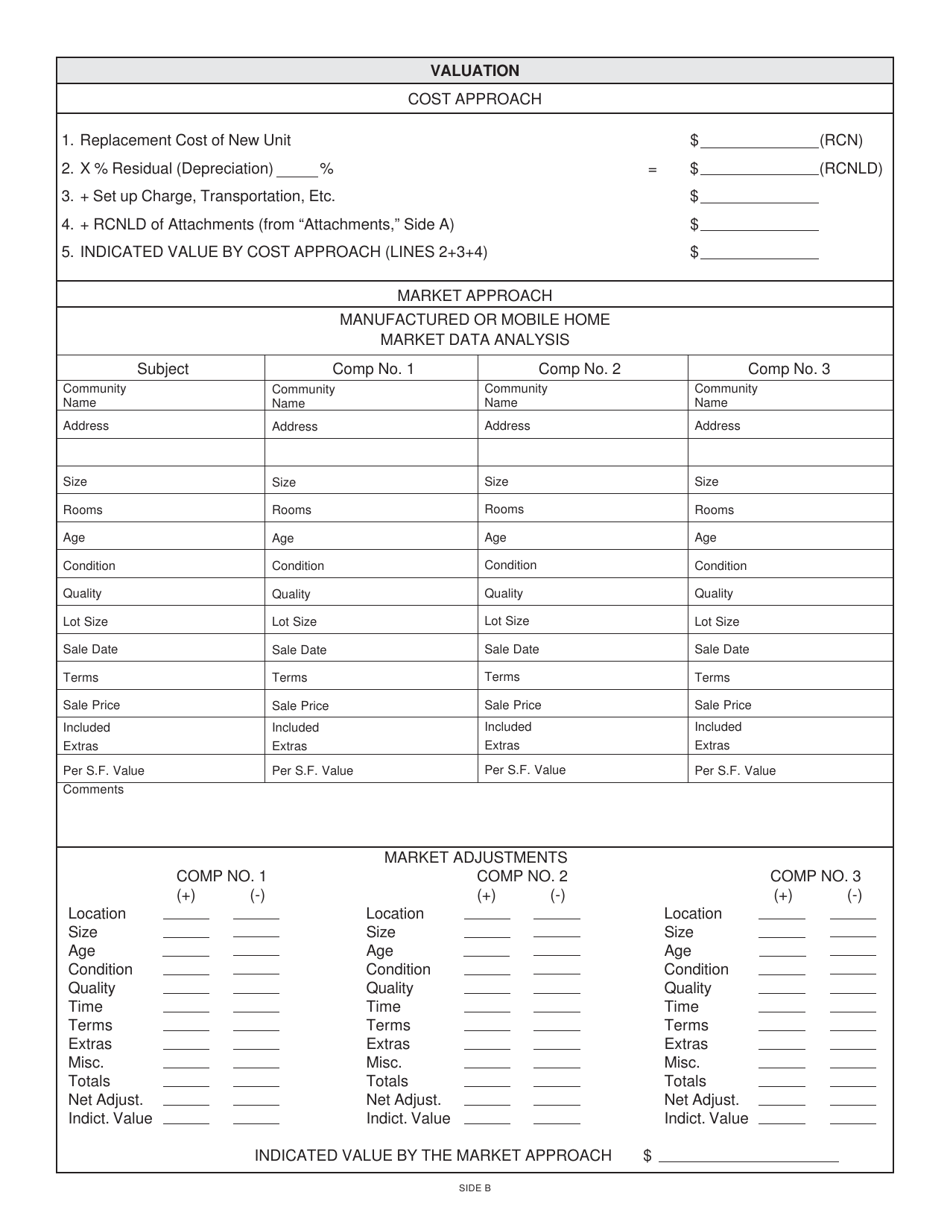

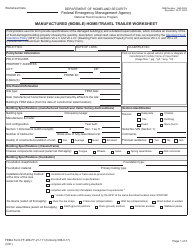

Form PA-117 Manufactured & Mobile Home Valuation Worksheet - Wisconsin

What Is Form PA-117?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-117?

A: Form PA-117 is the Manufactured & Mobile Home Valuation Worksheet used in Wisconsin.

Q: What is the purpose of Form PA-117?

A: The purpose of Form PA-117 is to determine the assessed value of manufactured and mobile homes in Wisconsin.

Q: Who needs to fill out Form PA-117?

A: Owners of manufactured and mobile homes in Wisconsin are required to fill out Form PA-117.

Q: What information is needed to fill out Form PA-117?

A: Form PA-117 requires information about the size, age, condition, and location of the manufactured or mobile home.

Q: When is Form PA-117 due?

A: Form PA-117 is typically due by March 1st of each year.

Q: Are there any fees associated with Form PA-117?

A: There are no fees associated with filing Form PA-117.

Q: What happens after I submit Form PA-117?

A: After submitting Form PA-117, the assessor will review the information and determine the assessed value of the manufactured or mobile home.

Q: Can I appeal the assessed value determined from Form PA-117?

A: Yes, if you disagree with the assessed value, you can appeal the decision to your local Board of Review.

Q: Are there any tax exemptions or credits available for manufactured or mobile homes in Wisconsin?

A: Yes, certain exemptions and credits may be available based on factors such as age, income, and disability. Contact the Wisconsin Department of Revenue for more information.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-117 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.