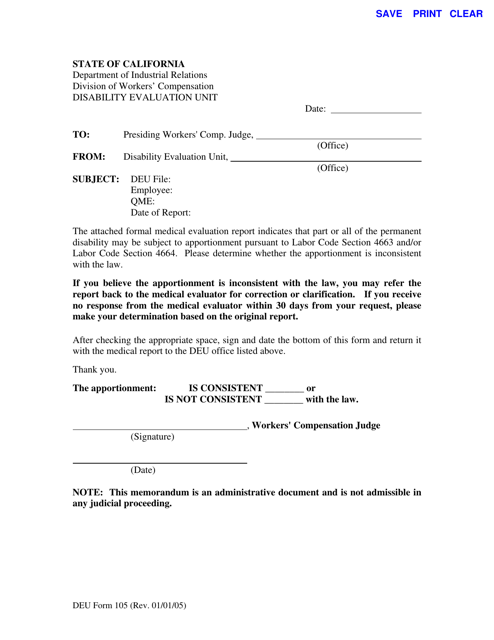

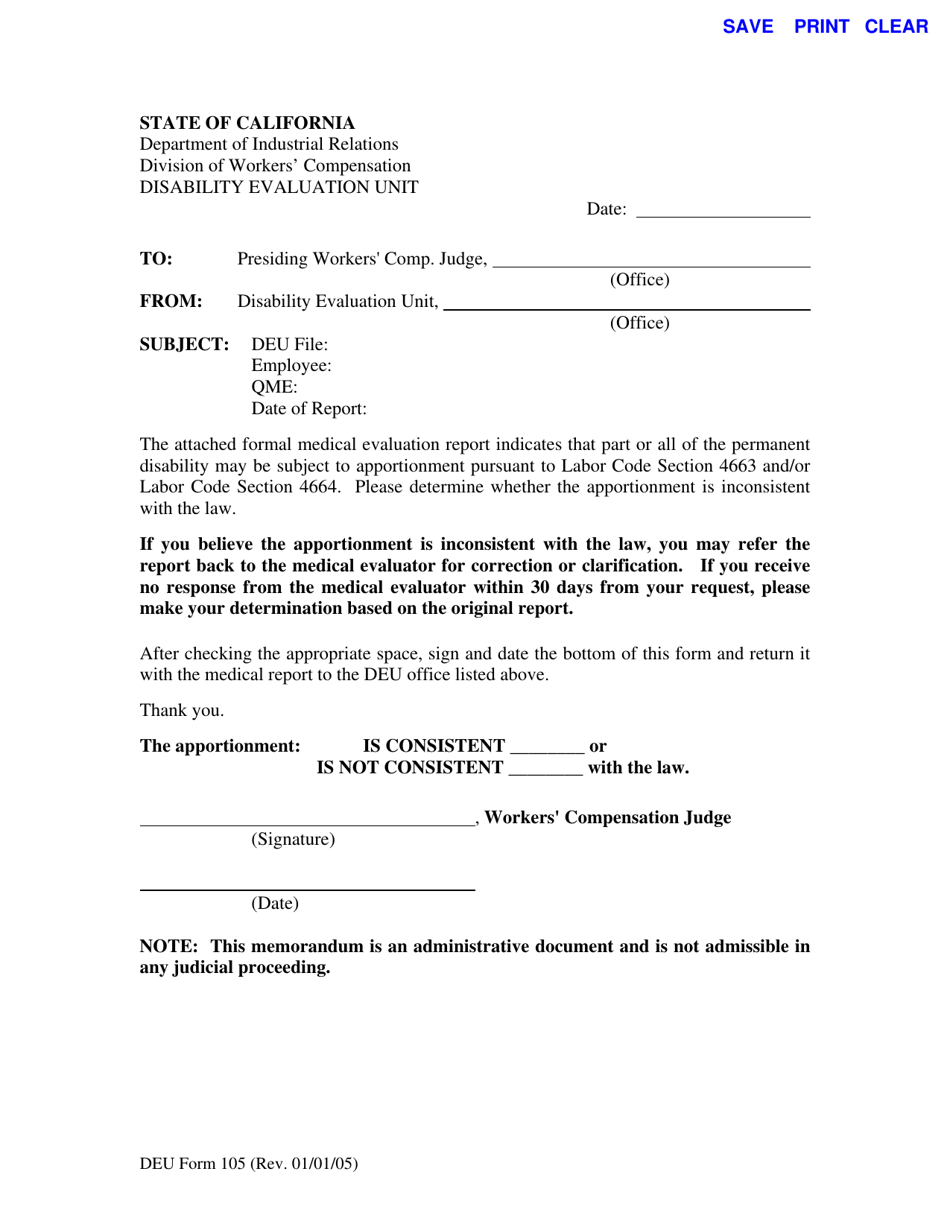

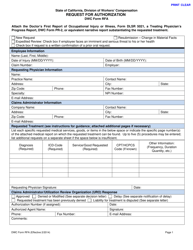

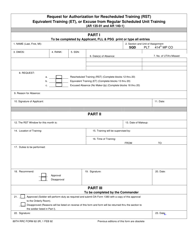

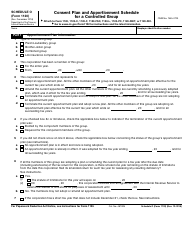

DEU Form 105 Apportionment Request - California

What Is DEU Form 105?

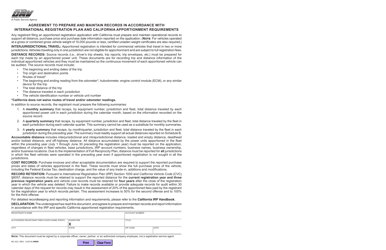

This is a legal form that was released by the California Department of Industrial Relations - Division of Workers' Compensation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DEU Form 105 Apportionment Request?

A: DEU Form 105 Apportionment Request is a form used in California to request the apportionment of taxes paid by a corporation or a limited liability company (LLC) to different states.

Q: What is the purpose of DEU Form 105 Apportionment Request?

A: The purpose of DEU Form 105 Apportionment Request is to allocate and distribute the taxes paid by a corporation or LLC to different states based on their respective income generated in each state.

Q: Who needs to file DEU Form 105 Apportionment Request?

A: Corporations and LLCs that conduct business in multiple states and have income or activities in California need to file DEU Form 105 Apportionment Request.

Q: What information is required to complete DEU Form 105 Apportionment Request?

A: To complete DEU Form 105 Apportionment Request, you will need to provide the income and apportionment factors for each state where the corporation or LLC does business, as well as supporting documentation such as tax returns and financial statements.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the California Department of Industrial Relations - Division of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DEU Form 105 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations - Division of Workers' Compensation.