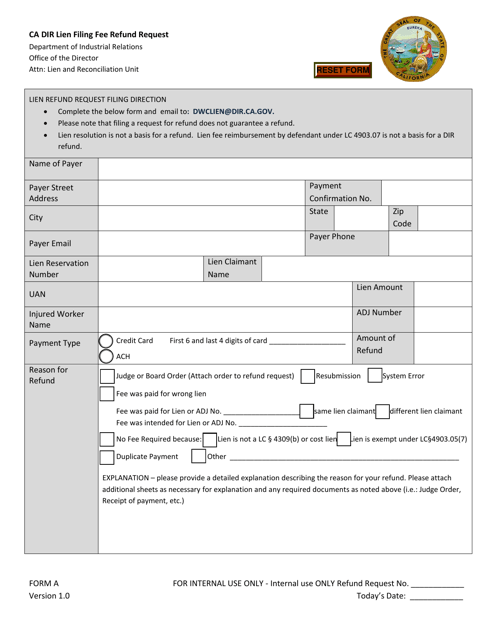

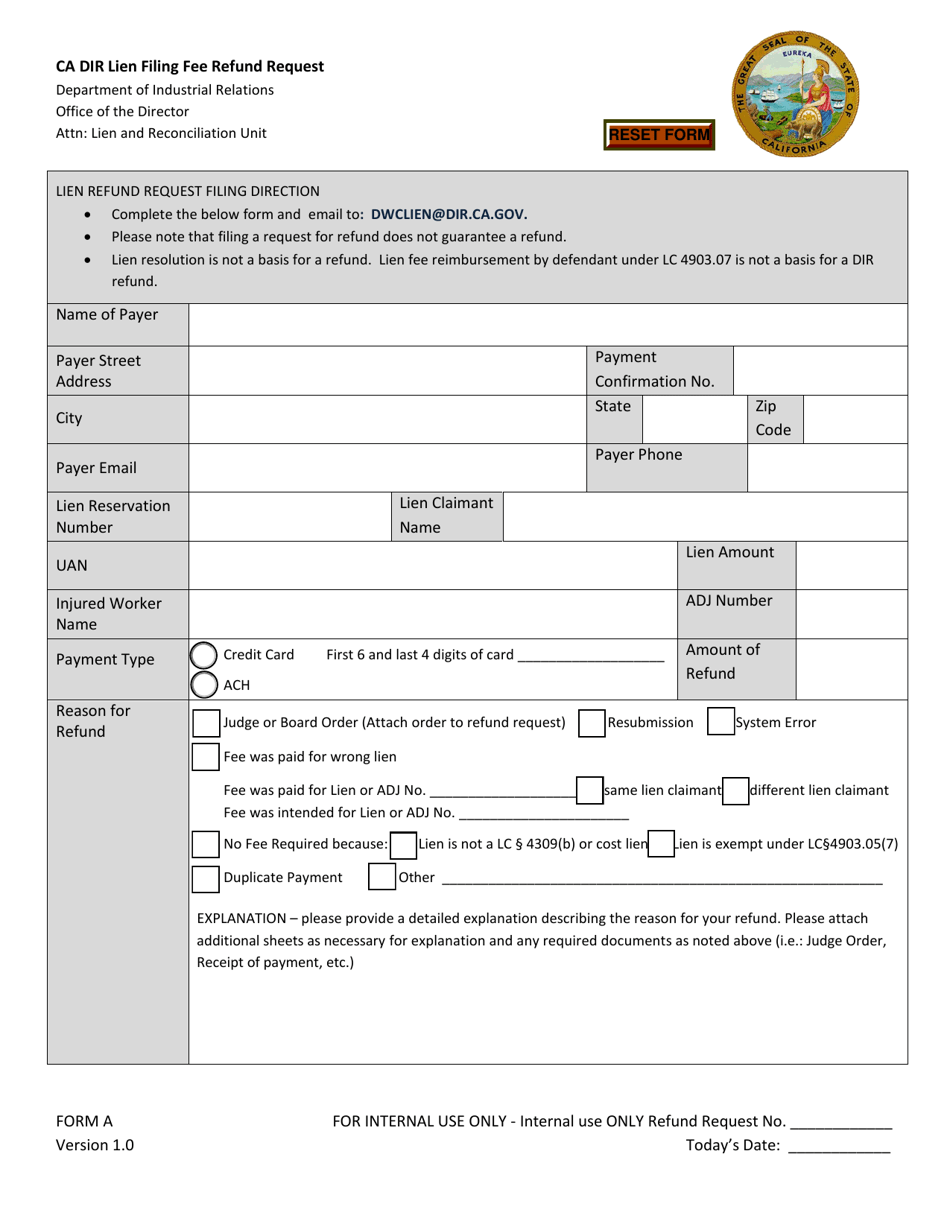

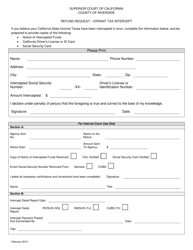

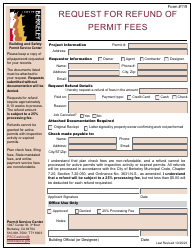

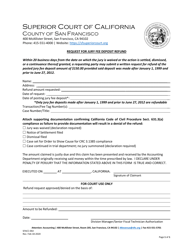

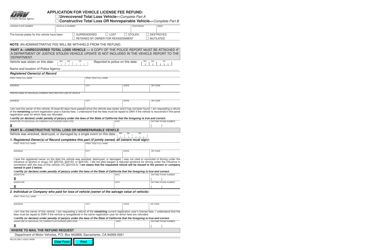

Form A Lien Filing Fees Refund Request - California

What Is Form A?

This is a legal form that was released by the California Department of Industrial Relations - Division of Workers' Compensation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

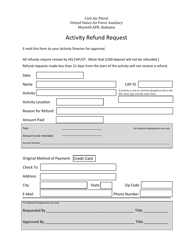

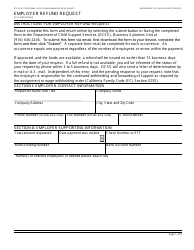

Q: What is a lien filingfees refund request?

A: A lien filing fees refund request is a request for a refund of the filing fees paid to file a lien in California.

Q: How can I request a lien filing fees refund?

A: You can request a lien filing fees refund by submitting a completed Form A Lien Filing Fees Refund Request to the appropriate office in California.

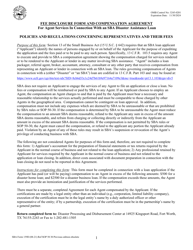

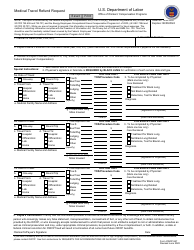

Q: What is the purpose of filing a lien?

A: Filing a lien is a legal action taken to secure the payment of a debt.

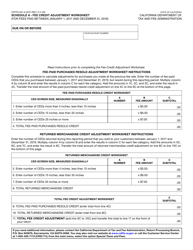

Q: Are lien filing fees refundable?

A: Yes, lien filing fees are refundable if certain conditions are met.

Q: What are the conditions for a lien filing fees refund?

A: The conditions for a lien filing fees refund may vary depending on the specific circumstances. It is best to refer to the official guidelines or consult with the appropriate office in California for specific information.

Form Details:

- The latest edition provided by the California Department of Industrial Relations - Division of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations - Division of Workers' Compensation.