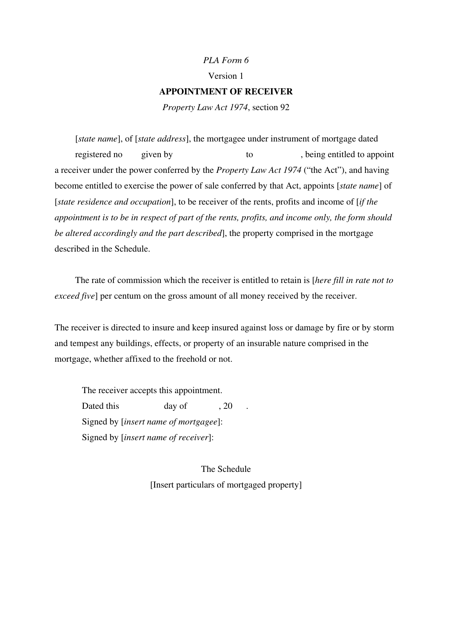

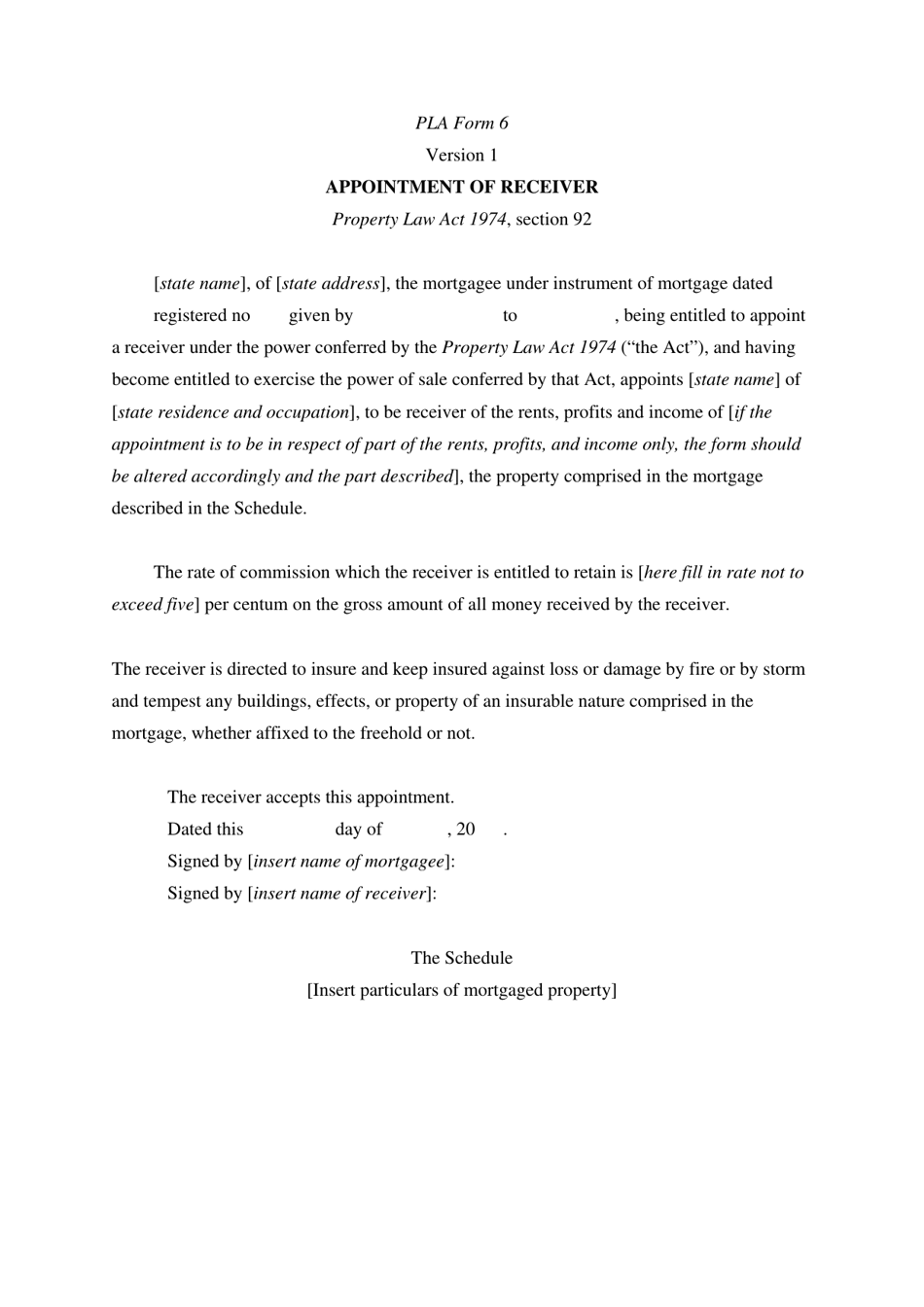

Form 6 Appointment of Receiver - Queensland, Australia

Form 6 Appointment of Receiver in Queensland, Australia is used for the appointment of a receiver by a secured creditor. It is a legal document that allows the receiver to take control of and manage the assets of a debtor in order to recover the debt owed to the secured creditor.

FAQ

Q: What is Form 6?

A: Form 6 is a legal document used for the appointment of a receiver in Queensland, Australia.

Q: What is the purpose of Form 6?

A: The purpose of Form 6 is to appoint a receiver for the management and realization of property or assets.

Q: Who can use Form 6?

A: Form 6 can be used by a secured creditor who wishes to appoint a receiver to recover their debt.

Q: What is a receiver?

A: A receiver is a person appointed to take control and manage the assets of a company or an individual.

Q: What are the responsibilities of a receiver?

A: The responsibilities of a receiver include collecting and selling assets, managing the affairs of the debtor, and distributing the proceeds to the secured creditor.

Q: Are there any specific requirements for completing Form 6?

A: Yes, there are specific requirements for completing Form 6, including providing details of the creditor, debtor, assets to be managed, and the reasons for the appointment.

Q: Are there any time limits for filing Form 6?

A: It is recommended to file Form 6 as soon as possible to secure the appointment of a receiver. However, there may be specific time limits depending on the circumstances.

Q: Can I appoint a receiver without using Form 6?

A: No, Form 6 is the prescribed form for the appointment of a receiver in Queensland, Australia.