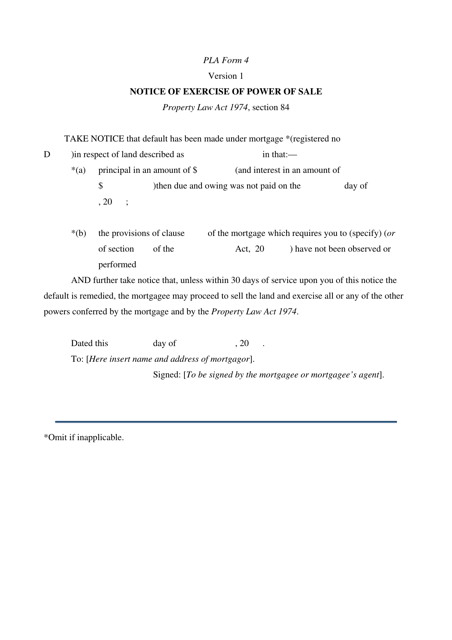

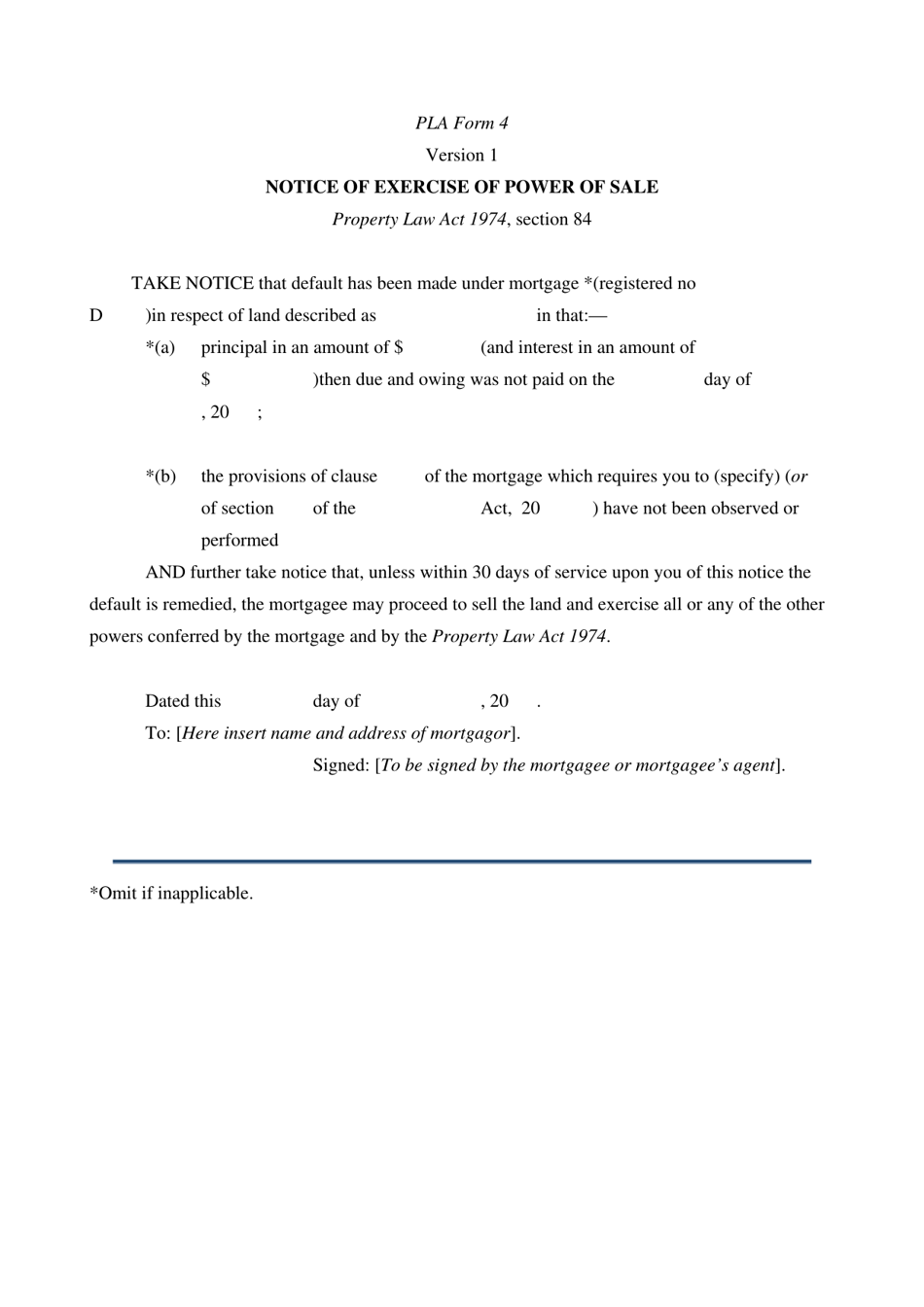

Form 4 Notice of Exercise of Power of Sale - Queensland, Australia

Form 4 Notice of Exercise of Power of Sale in Queensland, Australia is a legal document used in the process of foreclosure. This form is typically served by a mortgagee (lender) to the mortgagor (borrower) when the borrower has defaulted on the loan and the lender wishes to exercise their right to sell the property to recover the outstanding debt. It serves as a formal notification that the mortgagee intends to initiate the power of sale process, which ultimately enables them to sell the property to repay the debt owed.

In Queensland, Australia, the Form 4 Notice of Exercise of Power of Sale is typically filed by a mortgagee (lender) or their authorized representative. This form is used to officially notify the property owner and other interested parties that the mortgagee intends to exercise their power of sale and sell the property to recover the outstanding loan amount.

FAQ

Q: What is a Form 4 Notice of Exercise of Power of Sale?

A: A Form 4 Notice of Exercise of Power of Sale is a legal document used in Queensland, Australia, when a lender wishes to exercise their power of sale over a mortgaged property.

Q: Why would a lender exercise their power of sale?

A: A lender may exercise their power of sale if the borrower defaults on their mortgage payments or breaches the terms of the loan agreement.

Q: What are the requirements for serving a Form 4 Notice in Queensland?

A: To serve a Form 4 Notice of Exercise of Power of Sale in Queensland, the lender must have a valid mortgage or charge over the property, and the borrower must be in default or breach of the loan agreement. The notice must be served in accordance with the requirements under the Property Law Act 1974.

Q: What information is included in a Form 4 Notice?

A: A Form 4 Notice of Exercise of Power of Sale typically includes details of the mortgage, the amount owed, the default or breach by the borrower, and the lender's intention to sell the property to recover the debt.

Q: What steps can a borrower take upon receiving a Form 4 Notice?

A: Upon receiving a Form 4 Notice of Exercise of Power of Sale, a borrower can seek legal advice to explore potential options, such as negotiating with the lender, refinancing the loan, or disputing the validity of the notice.

Q: How much time does a borrower have to respond to a Form 4 Notice?

A: The time frame for a borrower to respond to a Form 4 Notice may vary depending on the specific circumstances and any applicable court orders. It is important for borrowers to act promptly and seek legal advice to protect their interests.

Q: What happens if the property is sold after issuing the Form 4 Notice?

A: If the property is sold after the issuance of a Form 4 Notice of Exercise of Power of Sale, the lender may use the sale proceeds to satisfy the outstanding debt. Any surplus proceeds, if applicable, will be returned to the borrower.

Q: Can a borrower stop the sale of the property after a Form 4 Notice has been served?

A: A borrower may have options to stop the sale of the property after a Form 4 Notice has been served, such as resolving the default or breach, negotiating with the lender, or seeking legal recourse. It is important to seek legal advice in such situations.

Q: Are there any legal rights or protections for borrowers in Queensland?

A: Yes, borrowers in Queensland have legal rights and protections under the law, including the right to dispute the validity of a Form 4 Notice, the right to seek legal advice and representation, and the right to pursue legal remedies if their rights have been violated.