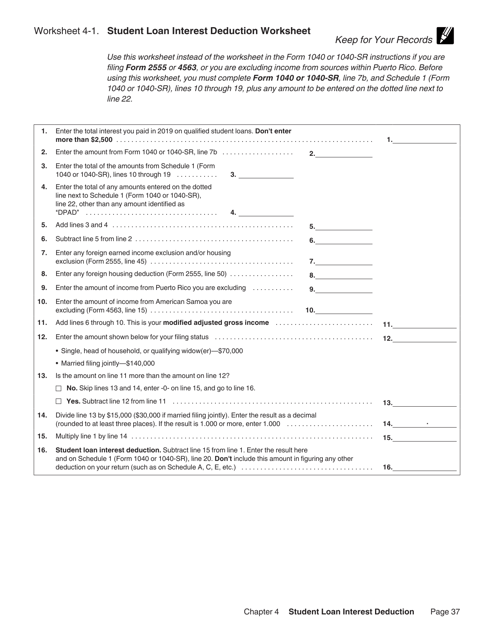

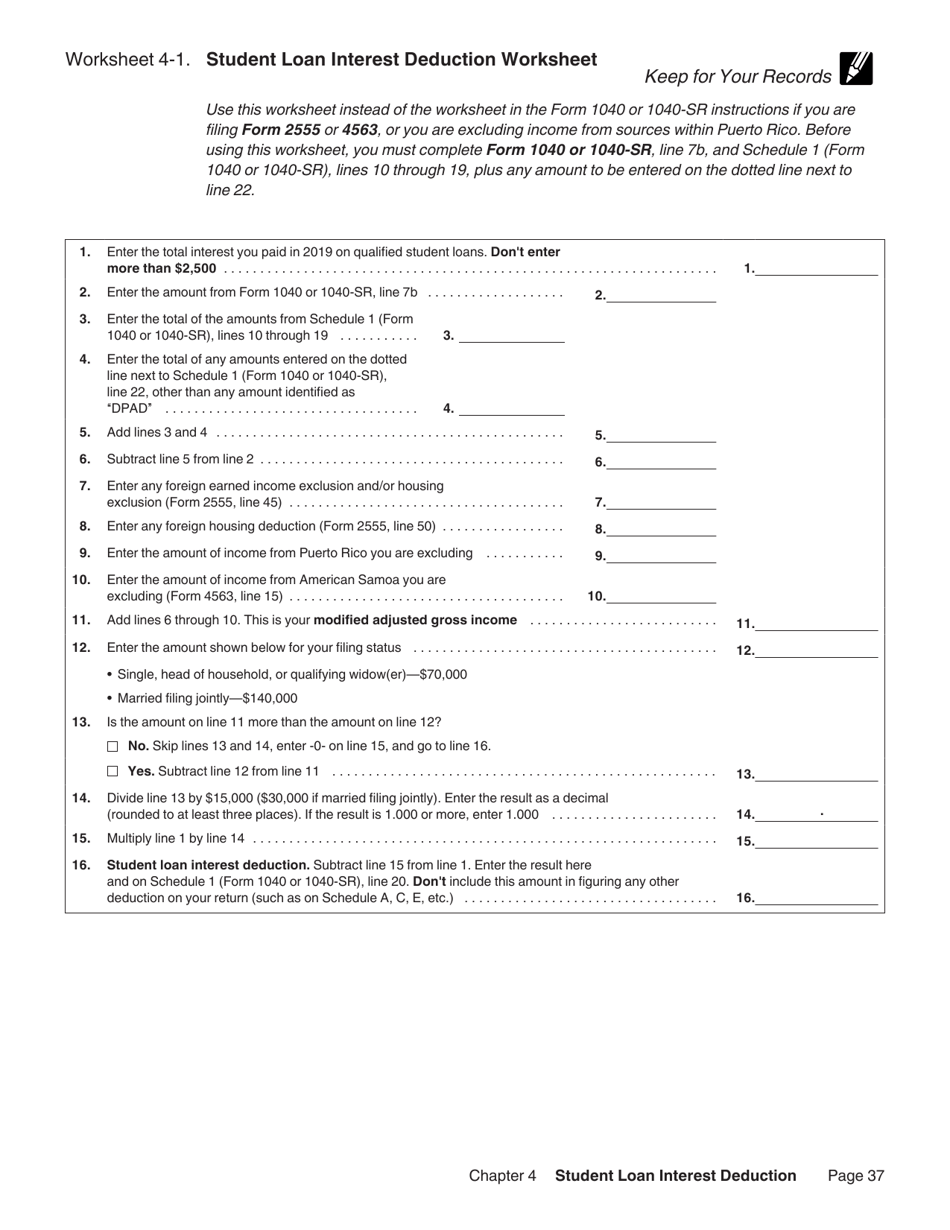

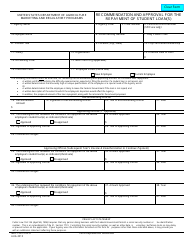

Student Loan Interest Deduction Worksheet (Publication 970)

Student Loan Interest Deduction Worksheet (Publication 970) is a 1-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is the Student Loan Interest Deduction Worksheet?

A: The Student Loan Interest Deduction Worksheet is a document provided by the IRS to help taxpayers calculate their eligibility and amount of deduction for student loan interest.

Q: What is the purpose of the Student Loan Interest Deduction?

A: The purpose of the Student Loan Interest Deduction is to provide tax relief to individuals who have paid interest on qualifying student loans.

Q: Who is eligible for the Student Loan Interest Deduction?

A: You may be eligible for the Student Loan Interest Deduction if you paid interest on a qualified student loan and meet certain income requirements.

Q: How much can I deduct for student loan interest?

A: The maximum deduction for student loan interest is $2,500 per tax year, subject to income limitations.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.