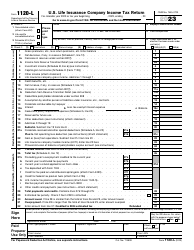

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-RIC

for the current year.

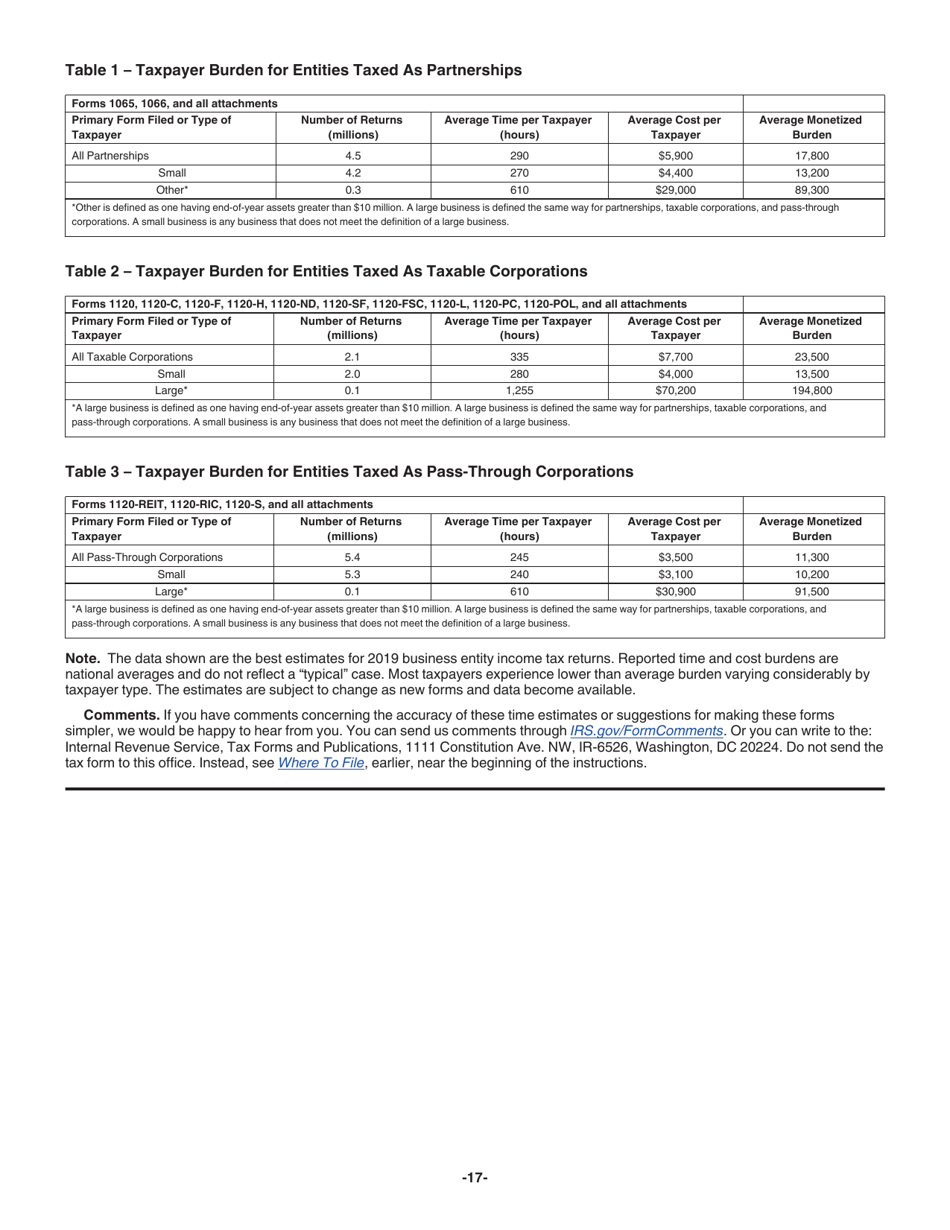

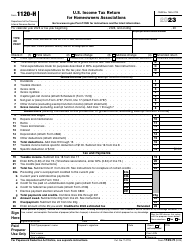

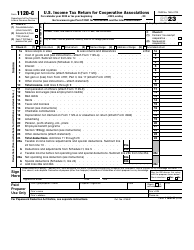

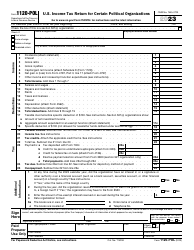

Instructions for IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

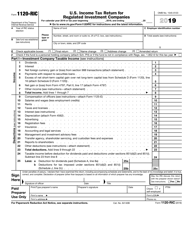

This document contains official instructions for IRS Form 1120-RIC , U.S. Income Tax Return for Regulated Investment Companies - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-RIC is available for download through this link.

FAQ

Q: What is Form 1120-RIC?

A: Form 1120-RIC is the U.S. Income Tax Return for Regulated Investment Companies.

Q: Who needs to file Form 1120-RIC?

A: Regulated Investment Companies (RICs) need to file Form 1120-RIC.

Q: What is the purpose of Form 1120-RIC?

A: Form 1120-RIC is used to report and pay income taxes for RICs.

Q: When is the due date for filing Form 1120-RIC?

A: The due date for filing Form 1120-RIC is generally March 15th.

Q: Can the due date for filing Form 1120-RIC be extended?

A: Yes, the due date for filing Form 1120-RIC can be extended by filing Form 7004.

Q: Is there a penalty for filing Form 1120-RIC late?

A: Yes, there may be a penalty for filing Form 1120-RIC late. It is important to file by the due date or obtain an extension.

Q: Are there any special rules or requirements for RICs?

A: Yes, RICs have specific tax rules and requirements that must be followed.

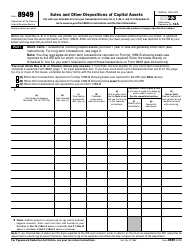

Q: What other forms may be required to be filed with Form 1120-RIC?

A: RICs may need to file additional forms, such as Schedule M-3 or Schedule K-1, depending on their specific circumstances.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.