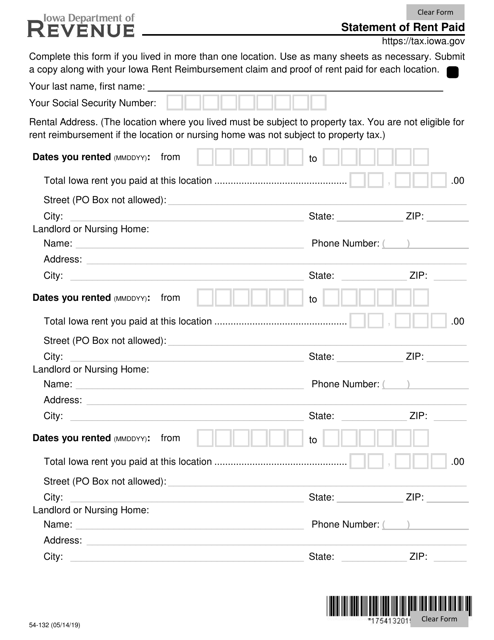

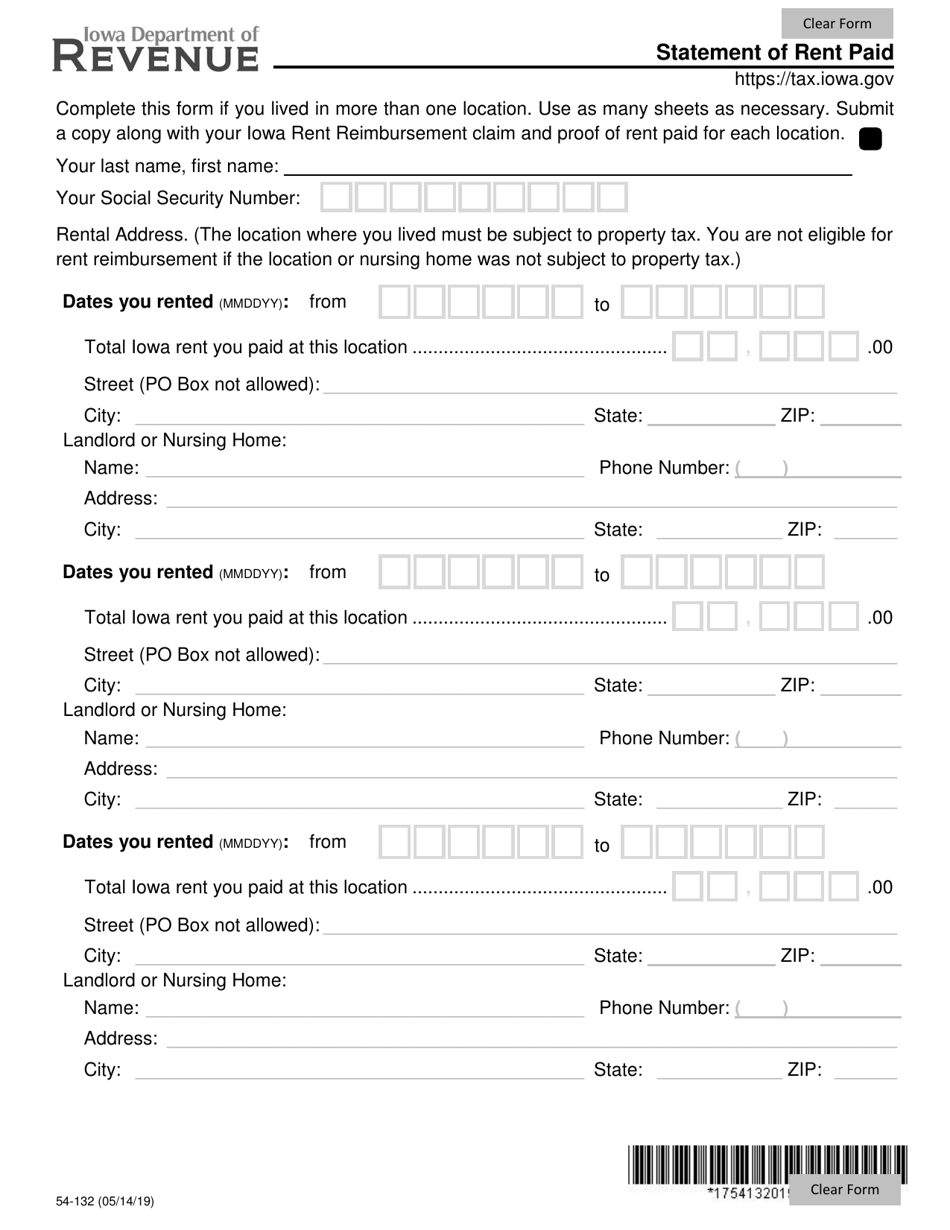

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 54-132

for the current year.

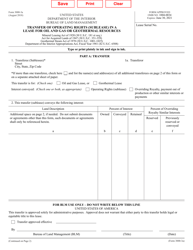

Form 54-132 Statement of Rent Paid - Iowa

What Is Form 54-132?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-132?

A: Form 54-132 is the Statement of Rent Paid for the state of Iowa.

Q: Who needs to file Form 54-132?

A: Individuals who paid rent for their residence in the state of Iowa may need to file Form 54-132.

Q: What is the purpose of Form 54-132?

A: The purpose of Form 54-132 is to claim a rent deduction on your Iowa state income tax return.

Q: What information is required on Form 54-132?

A: Form 54-132 requires information such as the landlord's name, address, and taxpayer identification number, as well as the amount of rent paid.

Q: When is the deadline to file Form 54-132?

A: Form 54-132 must be filed by April 30th of the year following the tax year in which the rent was paid.

Q: Are there any limitations to the rent deduction?

A: Yes, there are limitations to the rent deduction. You should refer to the instructions on Form 54-132 for more information.

Q: Can I e-file Form 54-132?

A: Yes, you can e-file Form 54-132 if you choose to do so. Check with the Iowa Department of Revenue for more information on e-filing options.

Form Details:

- Released on May 14, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-132 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.