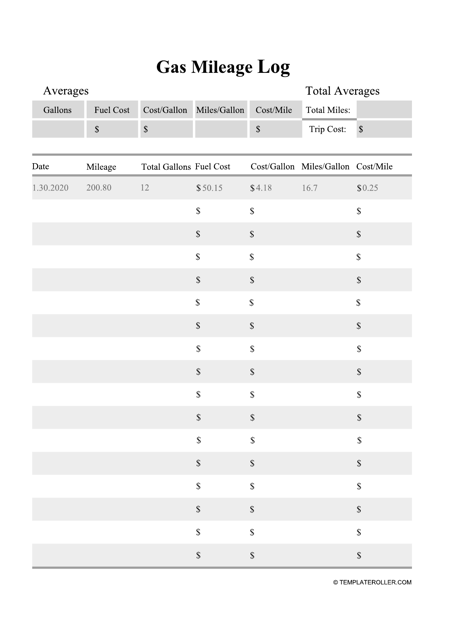

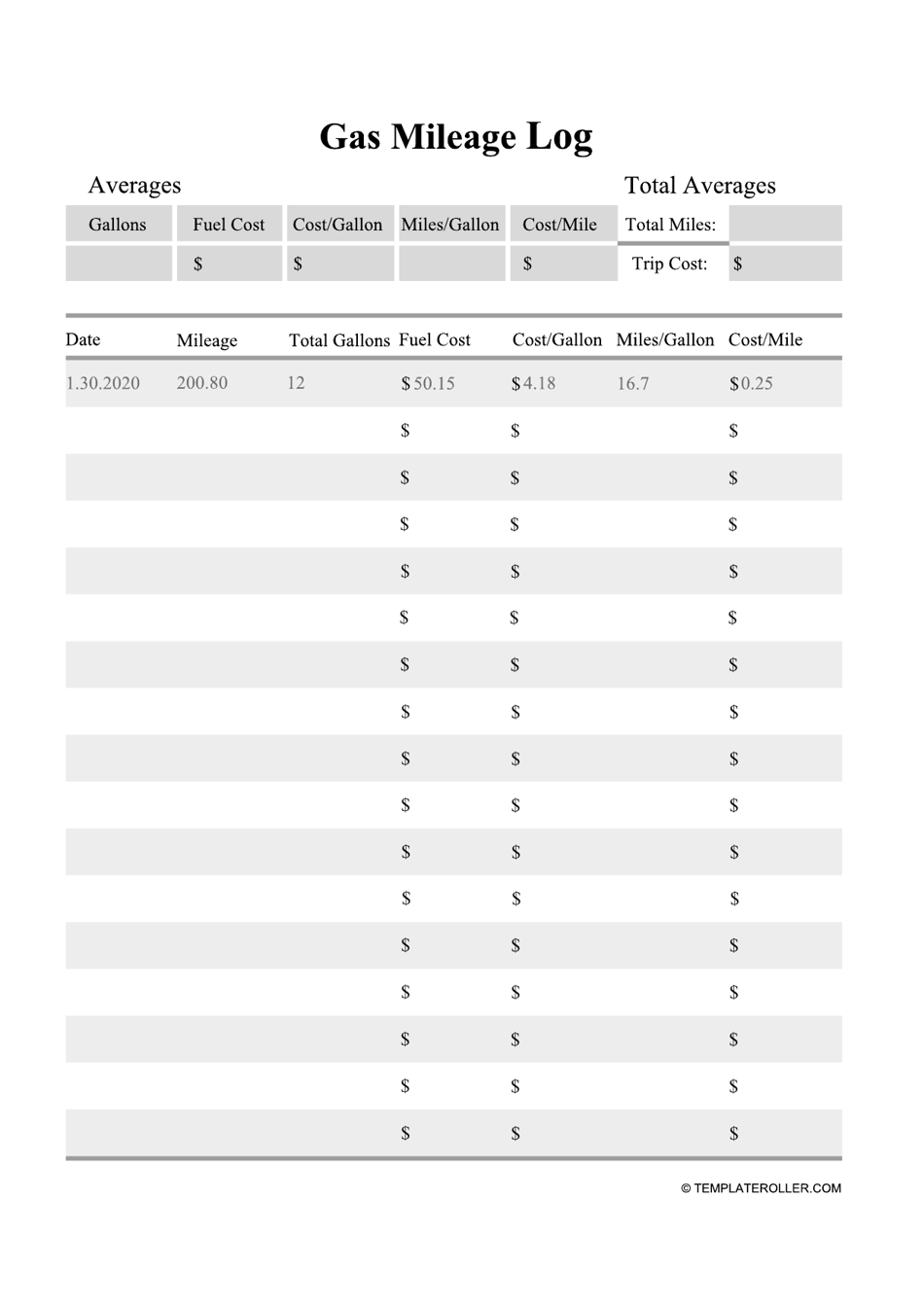

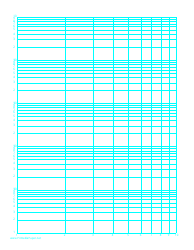

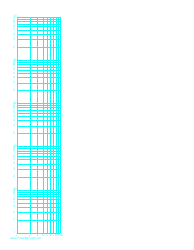

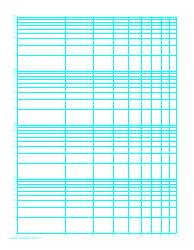

Gas Mileage Log Template

What Is a Gas Mileage Log?

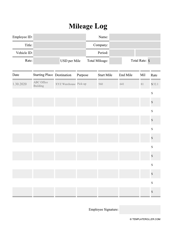

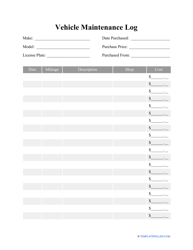

A Gas Mileage Log is a document that records your vehicle gas consumption and mileage. Additionally, you can keep track of your vehicle's maintenance, service, and repair expenses. Individuals and businesses face many problems related to the consumption of various types of fuel. It is also necessary to monitor driving routes - you may use a Driving Log Sheet for that.

Fuel management is equally important, as there may be a gas leak that can seriously affect the vehicle, so the best option is to record all of the gas usage. Moreover, if a vehicle operator uses their own vehicle for business purposes, it is possible to deduct a percentage of driving-related expenses from their taxable income.

To keep an accurate record of any business-related driving and activities, use a Gas Mileage Log Sheet - you may download a ready-made one through the link below.

How to Keep a Driving Log With Mileage and Gas?

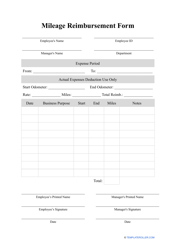

Create a table to document how much you spend on gas, including price per gallon, and track the mileage on your vehicle's odometer. Follow these steps to draft a Gas and Mileage Log:

- Write down the actual date gas was used and the starting date of the trip.

- Describe the vehicle. Usually, a vehicle identification number is enough, but you are free to add other details such as its model, make, year, and type.

- Record your destination and the purpose of your trip.

- Enter the vehicle's beginning and ending mileage. You may also use a separate Mileage Log template to register this information.

- Indicate the gasoline type - 87 octane, 90+ octane, E85, or diesel.

- Write down how many gallons of gas were pumped and its price.

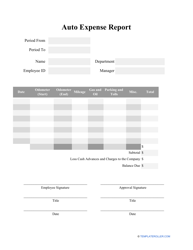

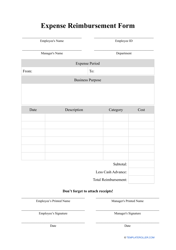

- Calculate mileage reimbursement - multiply the number of miles driven by the reimbursement rate established by your employer.

- Provide the employee's name and the vehicle operator's name.

- Do not forget to include toll and other trip-related costs.

- Once you have completed the template, sign it below and write down your name.

If you file an income tax return containing a mileage deduction, attach a statement containing specific information that confirms your use of a personal vehicle for work. You must keep a Gas Mileage Log in your records for up to three years.

Related Forms and Templates: