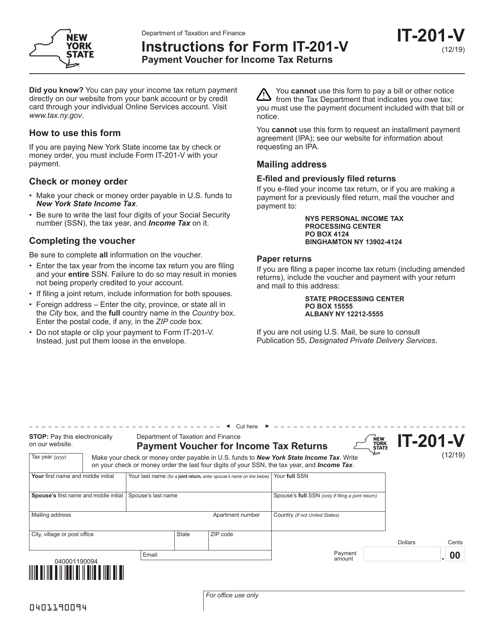

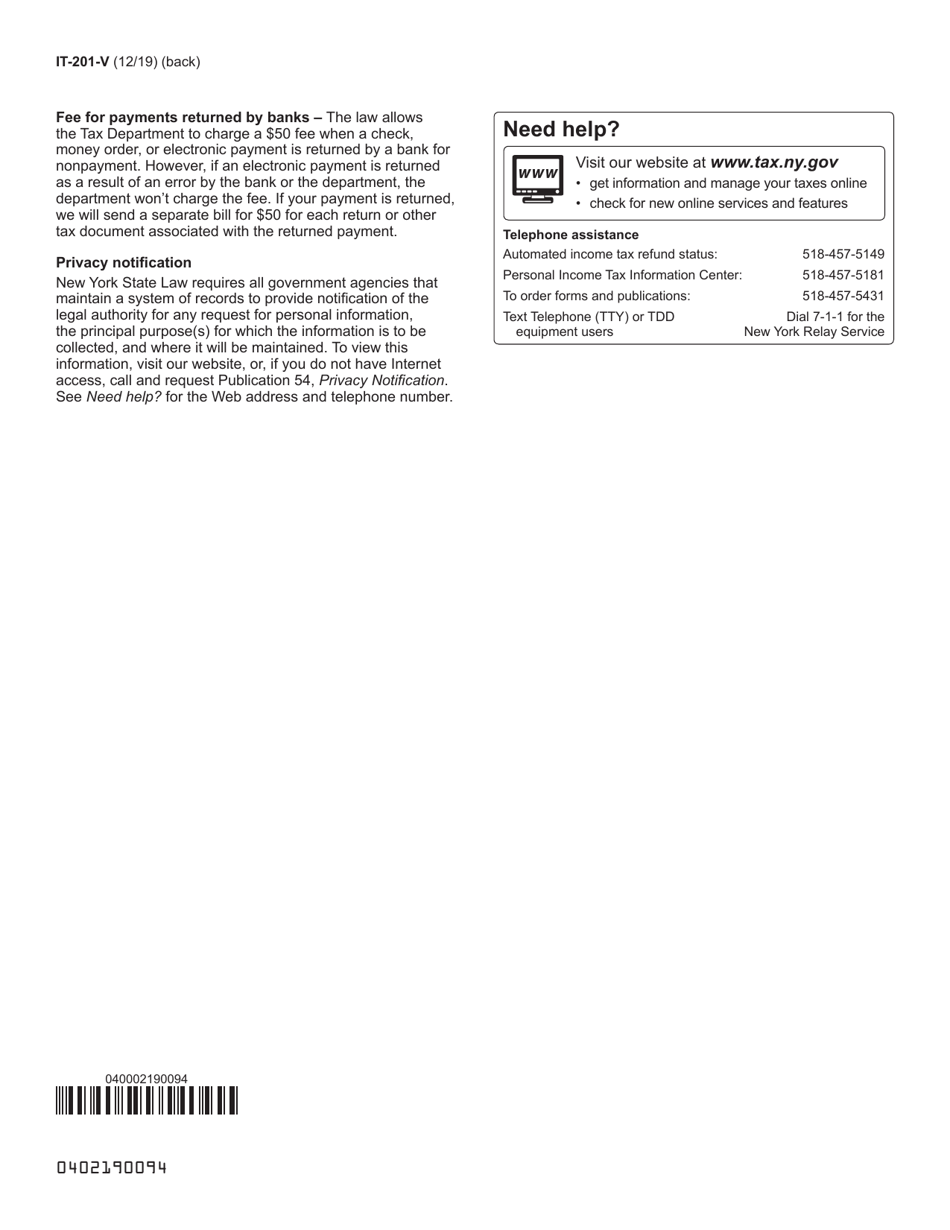

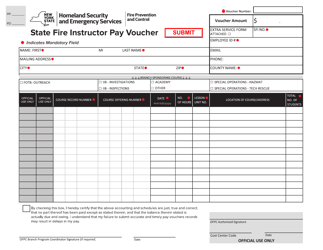

Form IT-201-V Payment Voucher for Income Tax Returns - New York

What Is Form IT-201-V?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-201-V?

A: Form IT-201-V is a payment voucher for income tax returns in New York.

Q: Who needs to use Form IT-201-V?

A: Anyone filing an income tax return in New York may need to use Form IT-201-V if they owe additional tax.

Q: What is the purpose of Form IT-201-V?

A: The purpose of Form IT-201-V is to provide a means for taxpayers to submit payment for any additional tax owed along with their income tax return.

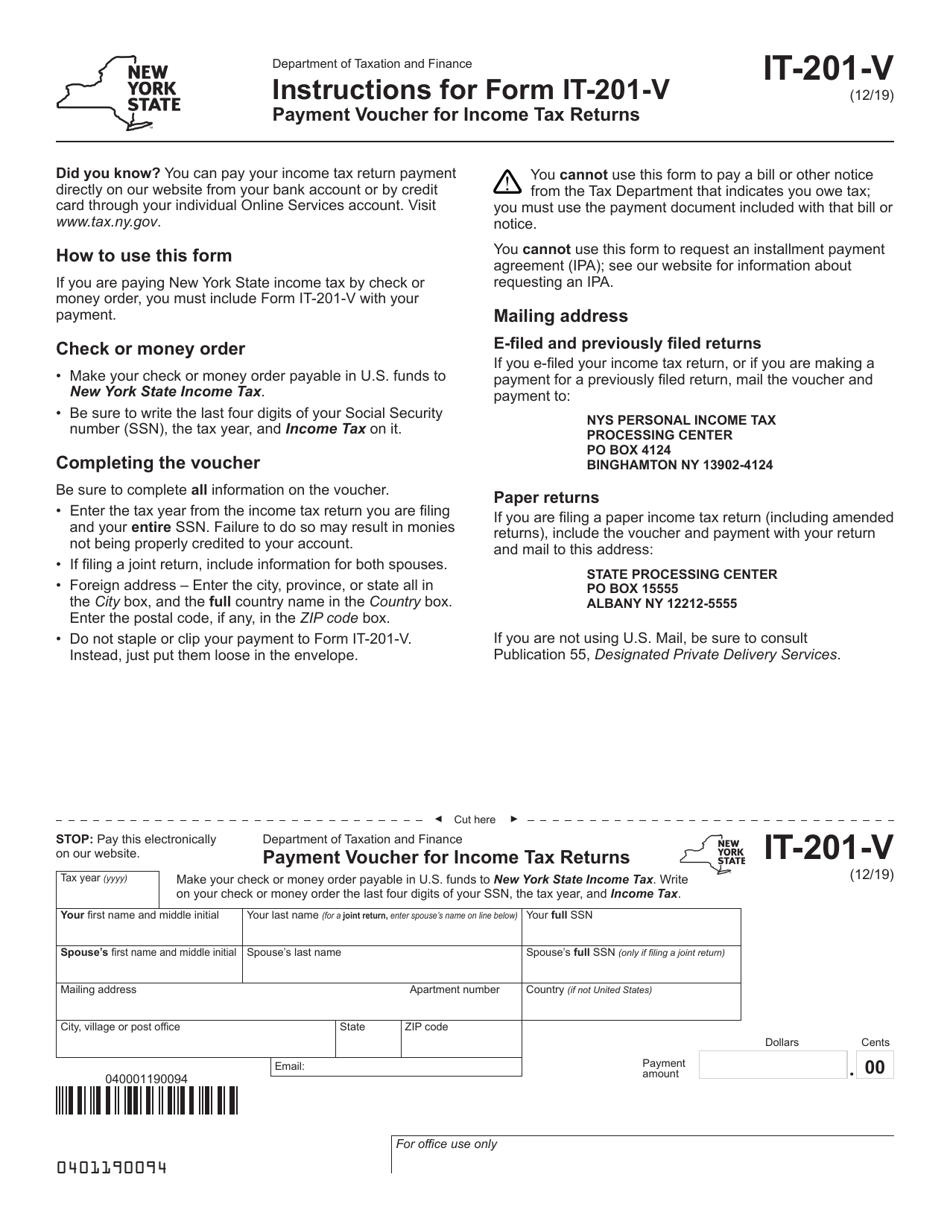

Q: What information do I need to fill out Form IT-201-V?

A: You will need to fill out your name, address, tax year, and the amount of additional tax owed.

Q: When is Form IT-201-V due?

A: Form IT-201-V is due on the same date as your income tax return, which is typically April 15th.

Q: What happens if I don't pay the tax owed by the due date?

A: If you don't pay the tax owed by the due date, you may be subject to penalties and interest charges.

Q: Can I request an extension to file my income tax return?

A: Yes, you can request an extension to file your income tax return, but you still need to pay any tax owed by the original due date.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-201-V by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.