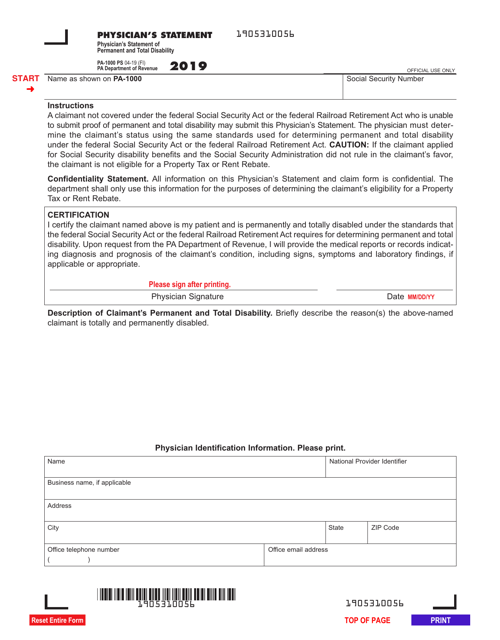

This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-1000 PS

for the current year.

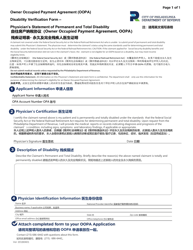

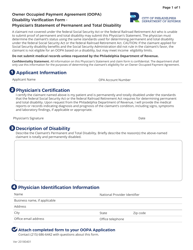

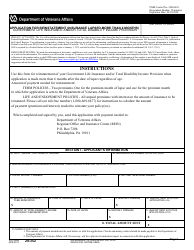

Form PA-1000 PS Physician's Statement of Permanent and Total Disability - Pennsylvania

What Is Form PA-1000 PS?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

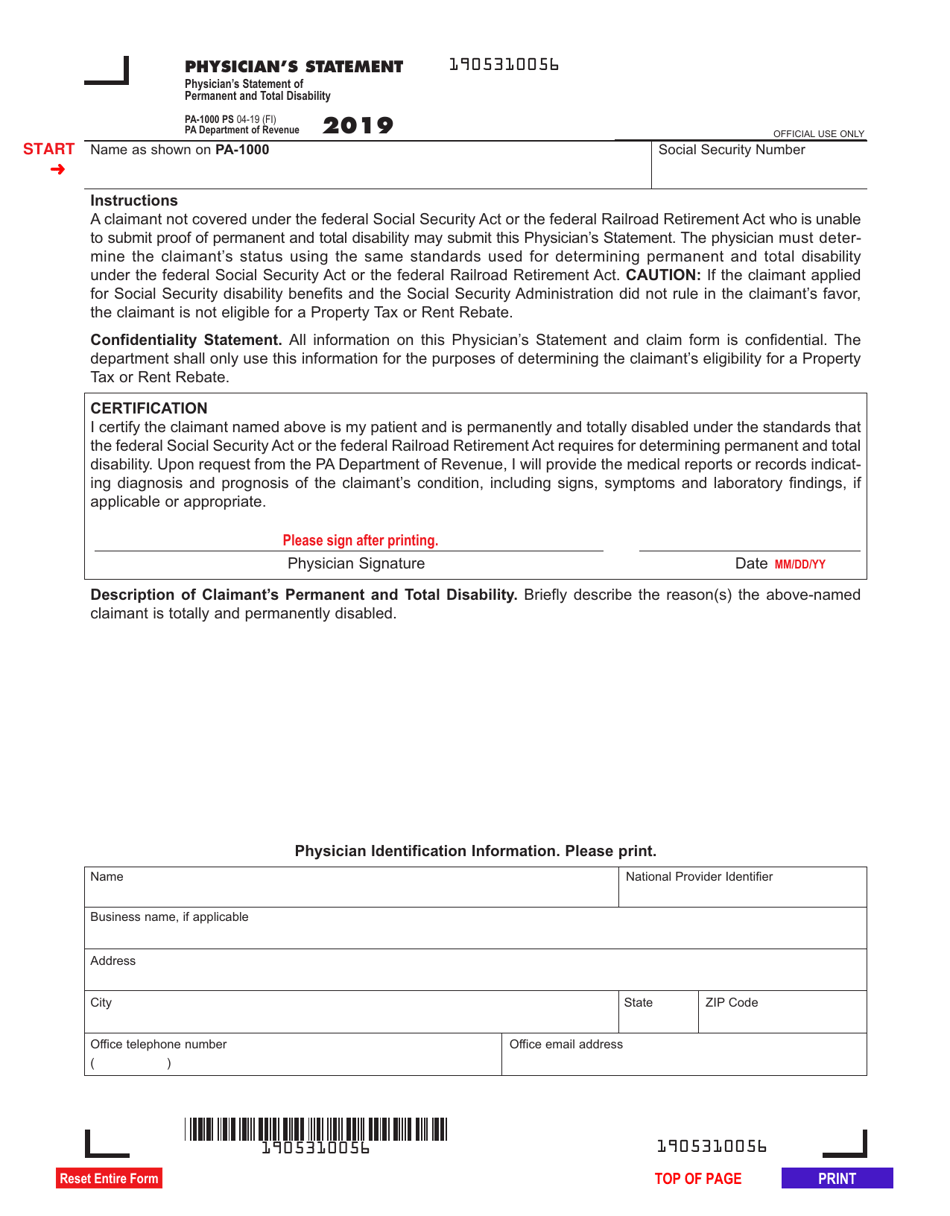

Q: What is Form PA-1000 PS?

A: Form PA-1000 PS is the Physician's Statement of Permanent and Total Disability in Pennsylvania.

Q: Who needs to fill out Form PA-1000 PS?

A: Individuals who are applying for property tax relief in Pennsylvania due to permanent and total disability.

Q: What information is required on Form PA-1000 PS?

A: The form asks for personal information of the disabled individual, medical information regarding their disability, and details about their income and property.

Q: What is the purpose of Form PA-1000 PS?

A: The purpose of this form is to determine eligibility for property tax relief for individuals with permanent and total disabilities in Pennsylvania.

Q: Are there any filing fees for Form PA-1000 PS?

A: No, there are no filing fees associated with Form PA-1000 PS.

Q: When is the deadline for submitting Form PA-1000 PS?

A: The deadline for submitting Form PA-1000 PS varies by county in Pennsylvania. It is best to check with your local County Assessment Office for the specific deadline.

Q: What supporting documents should I include with Form PA-1000 PS?

A: Supporting documents may include medical records, proof of income, and proof of property ownership. It is recommended to check with your local County Assessment Office for specific requirements.

Q: What happens after I submit Form PA-1000 PS?

A: After submitting Form PA-1000 PS, your application will be reviewed by the County Assessment Office. If approved, you will receive property tax relief based on your eligibility.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 PS by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.