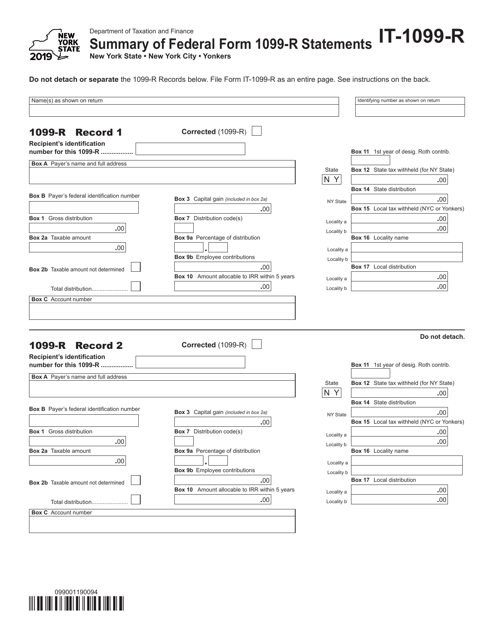

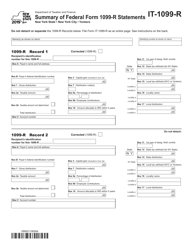

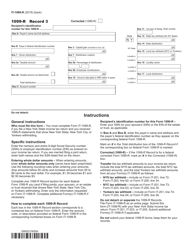

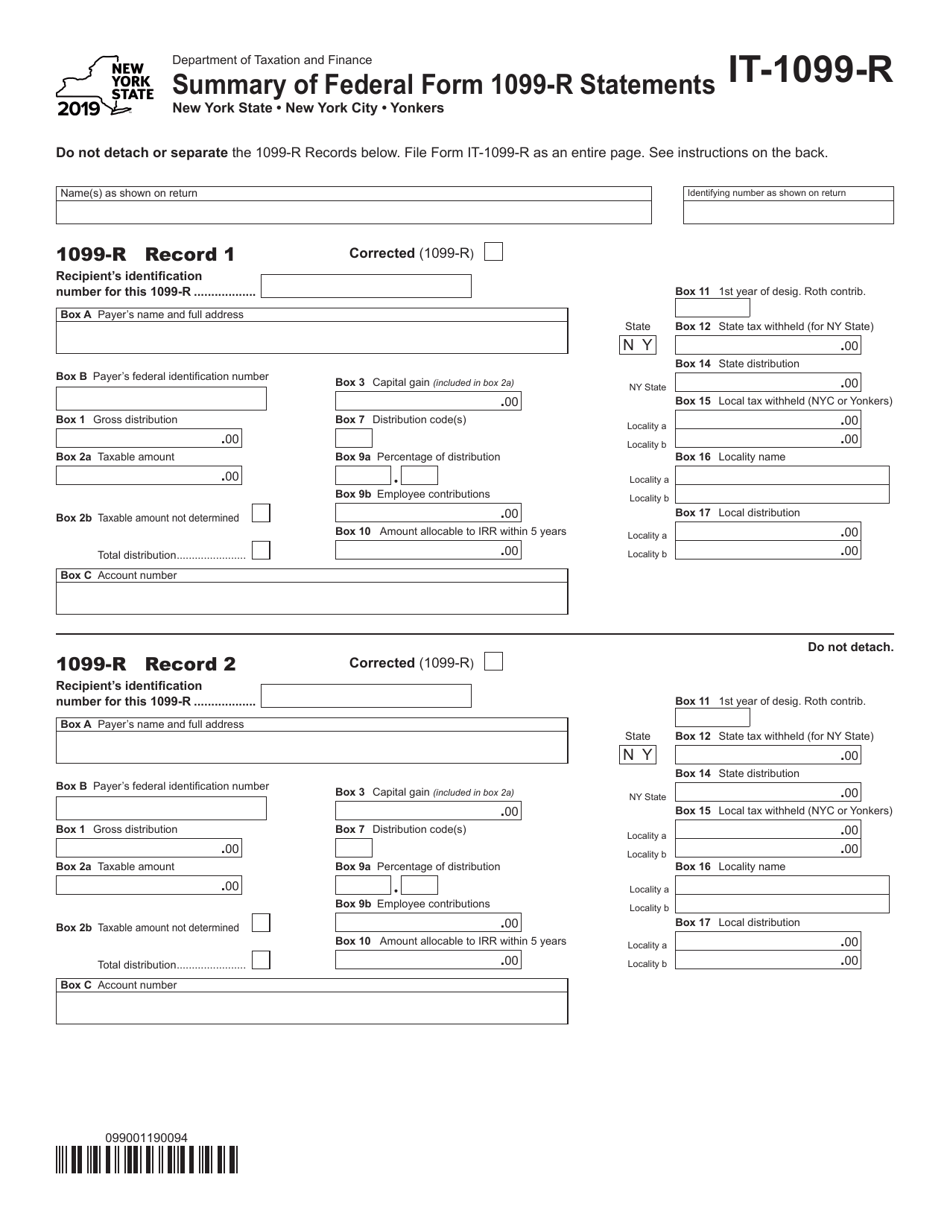

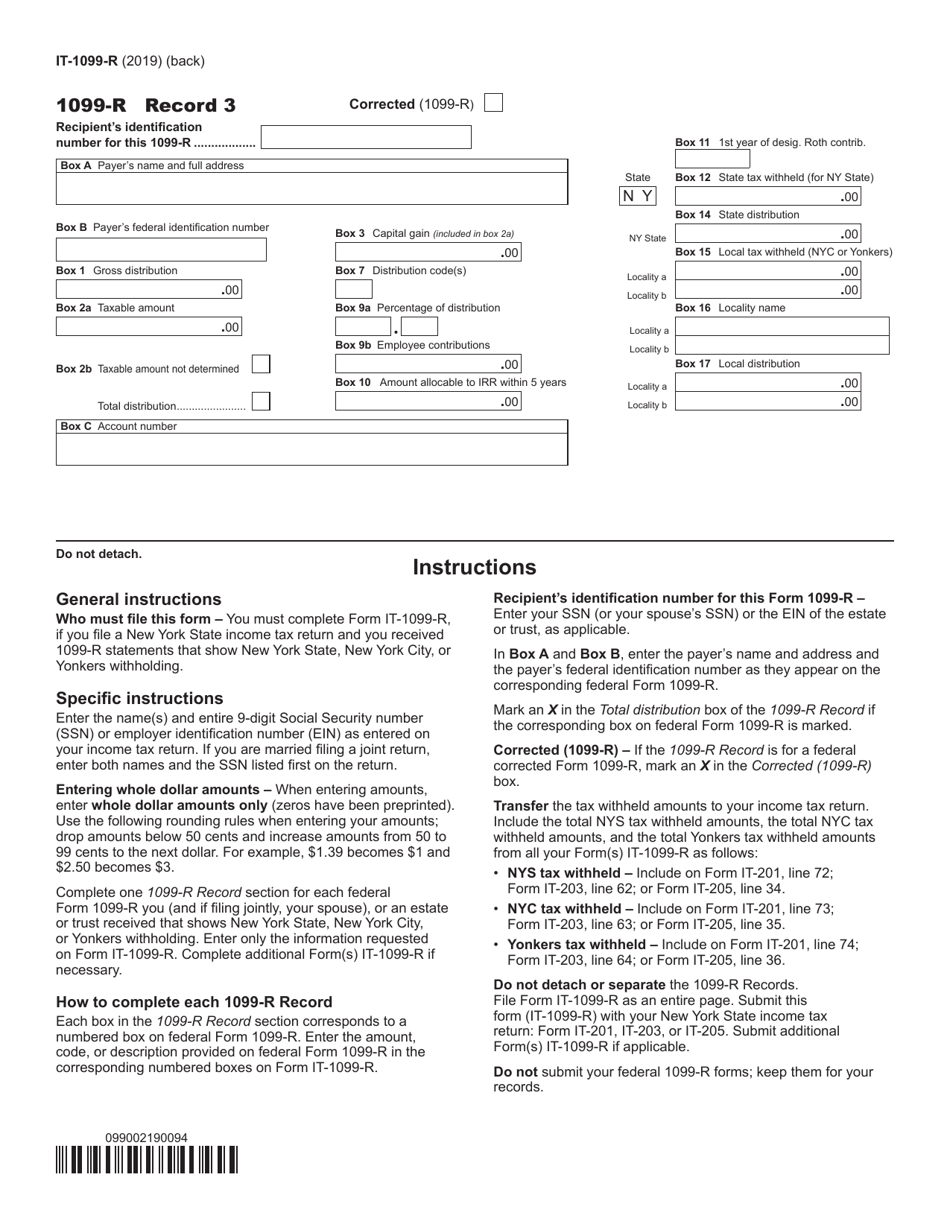

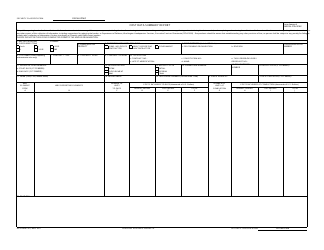

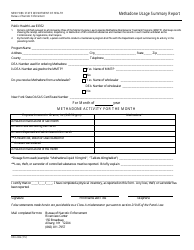

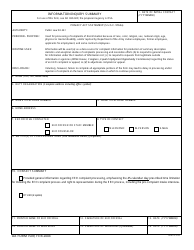

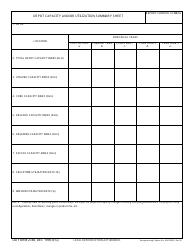

Form IT-1099-R Summary of Federal Form 1099-r Statements - New York

What Is Form IT-1099-R?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

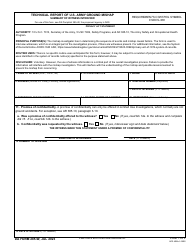

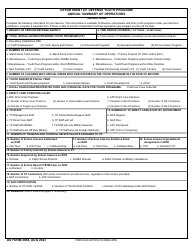

Q: What is Form IT-1099-R?

A: Form IT-1099-R is a summary of federal Form 1099-R statements for taxpayers in New York.

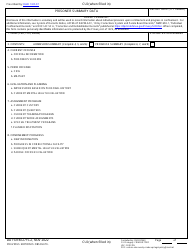

Q: Who needs to file Form IT-1099-R?

A: Taxpayers in New York who have received Form 1099-R statements need to file Form IT-1099-R.

Q: What is the purpose of Form IT-1099-R?

A: The purpose of Form IT-1099-R is to report income from pensions, annuities, and other retirement plans in New York.

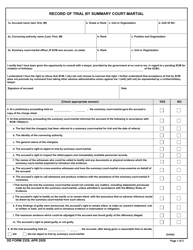

Q: When is the deadline to file Form IT-1099-R?

A: The deadline to file Form IT-1099-R is the same as the federal deadline for filing your income tax return, usually April 15th.

Q: Can I e-file Form IT-1099-R?

A: Yes, you can e-file Form IT-1099-R if you are filing your New York state income tax return electronically.

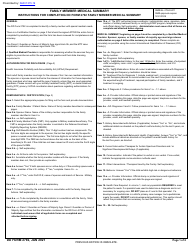

Q: What should I do if I made a mistake on Form IT-1099-R?

A: If you made a mistake on Form IT-1099-R, you should file an amended form as soon as possible to correct the error.

Q: Do I need to include copies of the Form 1099-R statements with Form IT-1099-R?

A: No, you do not need to include copies of the Form 1099-R statements with Form IT-1099-R, but you should keep them for your records.

Q: Is there a fee for filing Form IT-1099-R?

A: There is no fee for filing Form IT-1099-R.

Q: Who should I contact if I have questions about Form IT-1099-R?

A: If you have questions about Form IT-1099-R, you can contact the New York State Department of Taxation and Finance.

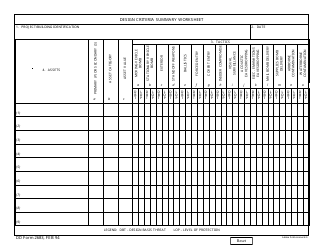

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-1099-R by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.