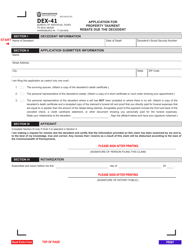

Form DFO-03 (EX) Property Tax / Rent Rebate Preparation Guide - Pennsylvania

What Is Form DFO-03 (EX)?

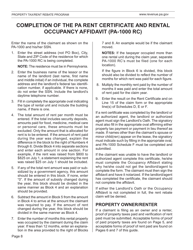

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DFO-03 (EX)?

A: Form DFO-03 (EX) is the Property Tax/Rent Rebate Preparation Guide in Pennsylvania.

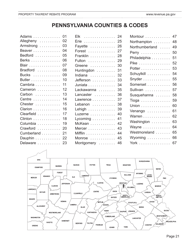

Q: Who is eligible for the Property Tax/Rent Rebate?

A: Pennsylvania residents who are 65 years or older, widows or widowers age 50 or older, and people with disabilities who are 18 years or older.

Q: What is the purpose of the Property Tax/Rent Rebate?

A: The purpose of the rebate is to provide financial assistance to eligible individuals to help offset the cost of property taxes or rent.

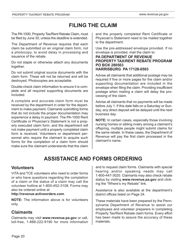

Q: When is the deadline to apply for the Property Tax/Rent Rebate?

A: The deadline to apply is usually June 30th of the year following the tax year for which you are applying.

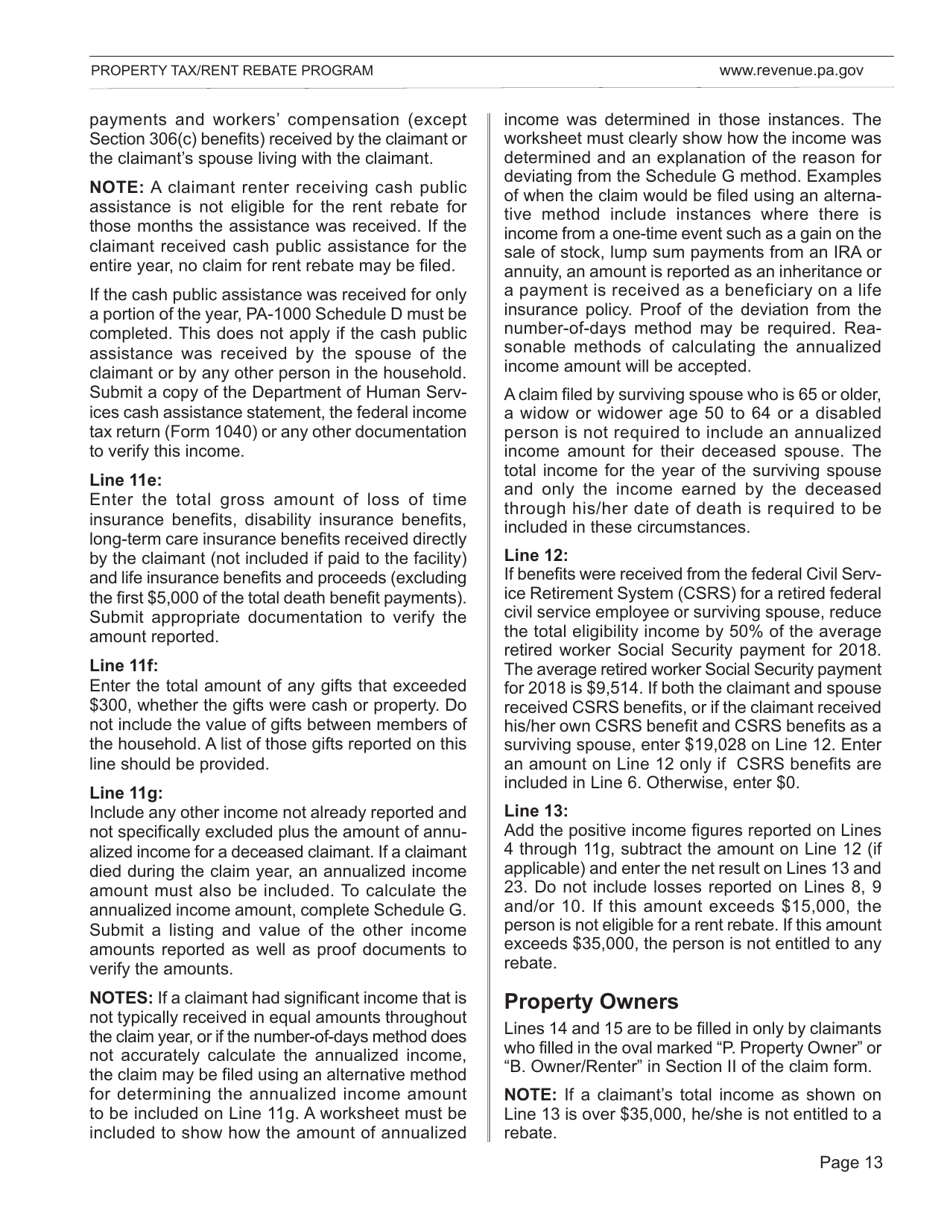

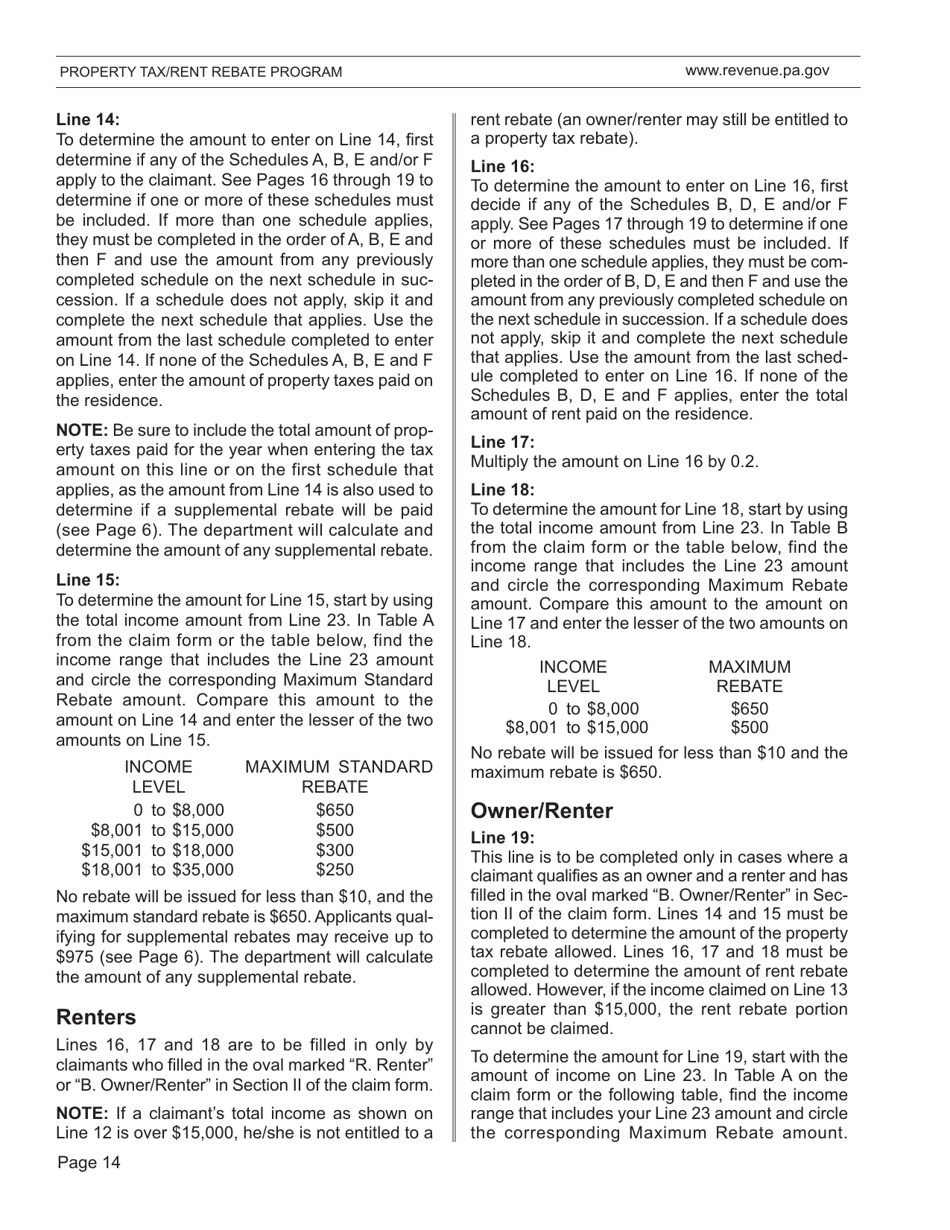

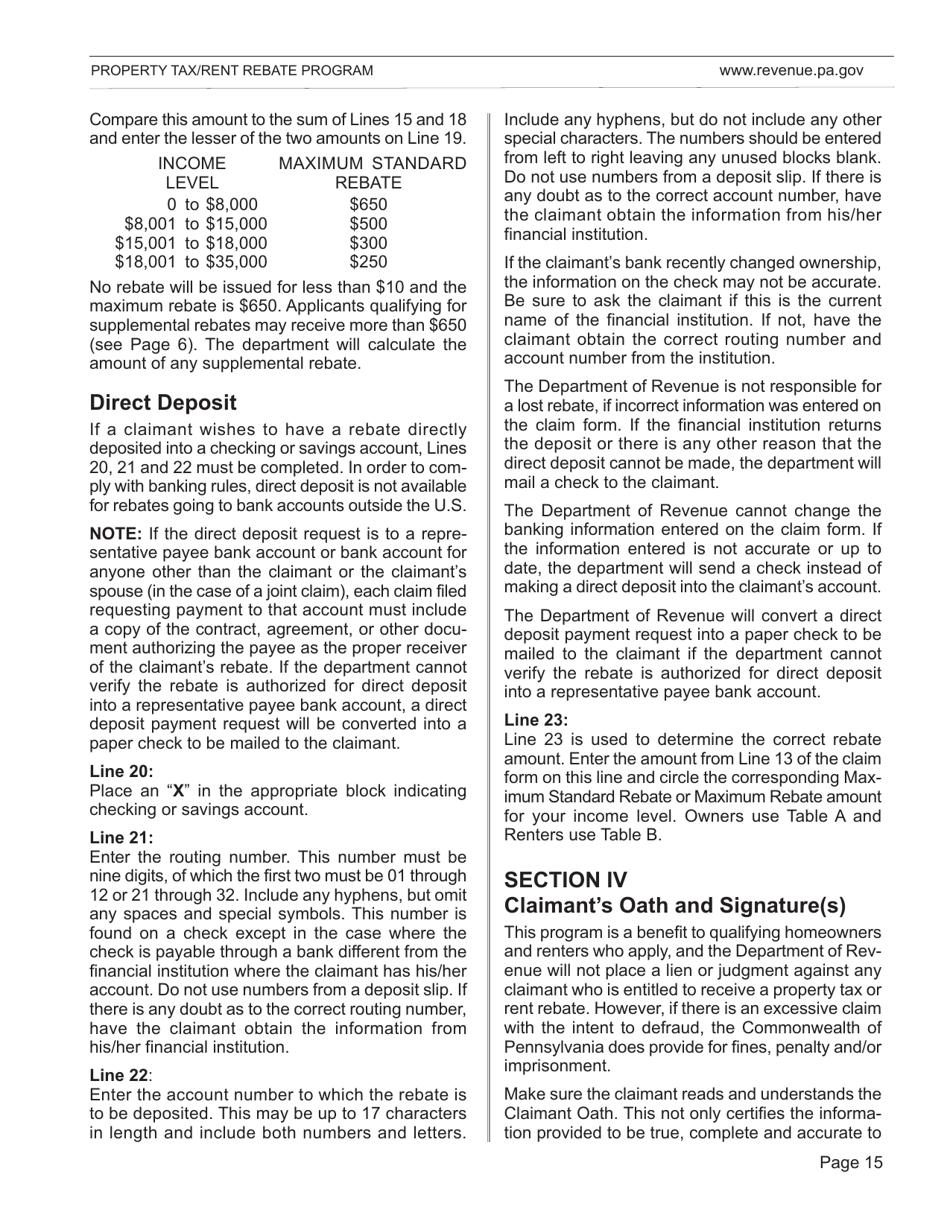

Q: How much rebate can I expect to receive?

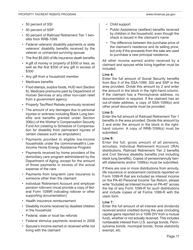

A: The amount of rebate you can receive depends on your income and the amount of property taxes or rent you paid.

Q: Are Social Security benefits counted as income for the rebate?

A: No, Social Security benefits are not counted as income for the rebate.

Q: How long does it take to receive the rebate?

A: It typically takes about six to eight weeks to process the rebate once your application is received.

Q: What should I do if I made an error on my application?

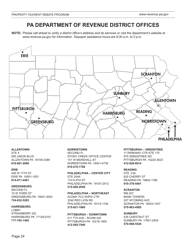

A: If you made an error on your application, you should contact the Pennsylvania Department of Revenue to request a correction.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DFO-03 (EX) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.