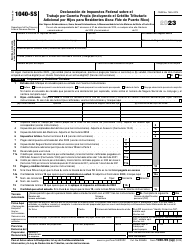

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-SS

for the current year.

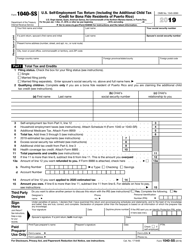

Instructions for IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

This document contains official instructions for IRS Form 1040-SS , U.S. Self-employment Tax Return (Including the Bona Fide Residents of Puerto Rico) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-SS is available for download through this link.

FAQ

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is the U.S. Self-employment Tax Return specifically designed for self-employed individuals.

Q: Who should file IRS Form 1040-SS?

A: Self-employed individuals who are bona fide residents of Puerto Rico should file IRS Form 1040-SS.

Q: What is the purpose of IRS Form 1040-SS?

A: The purpose of IRS Form 1040-SS is to report self-employment income and calculate the self-employment tax.

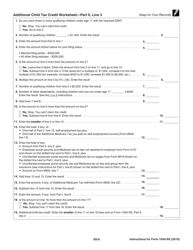

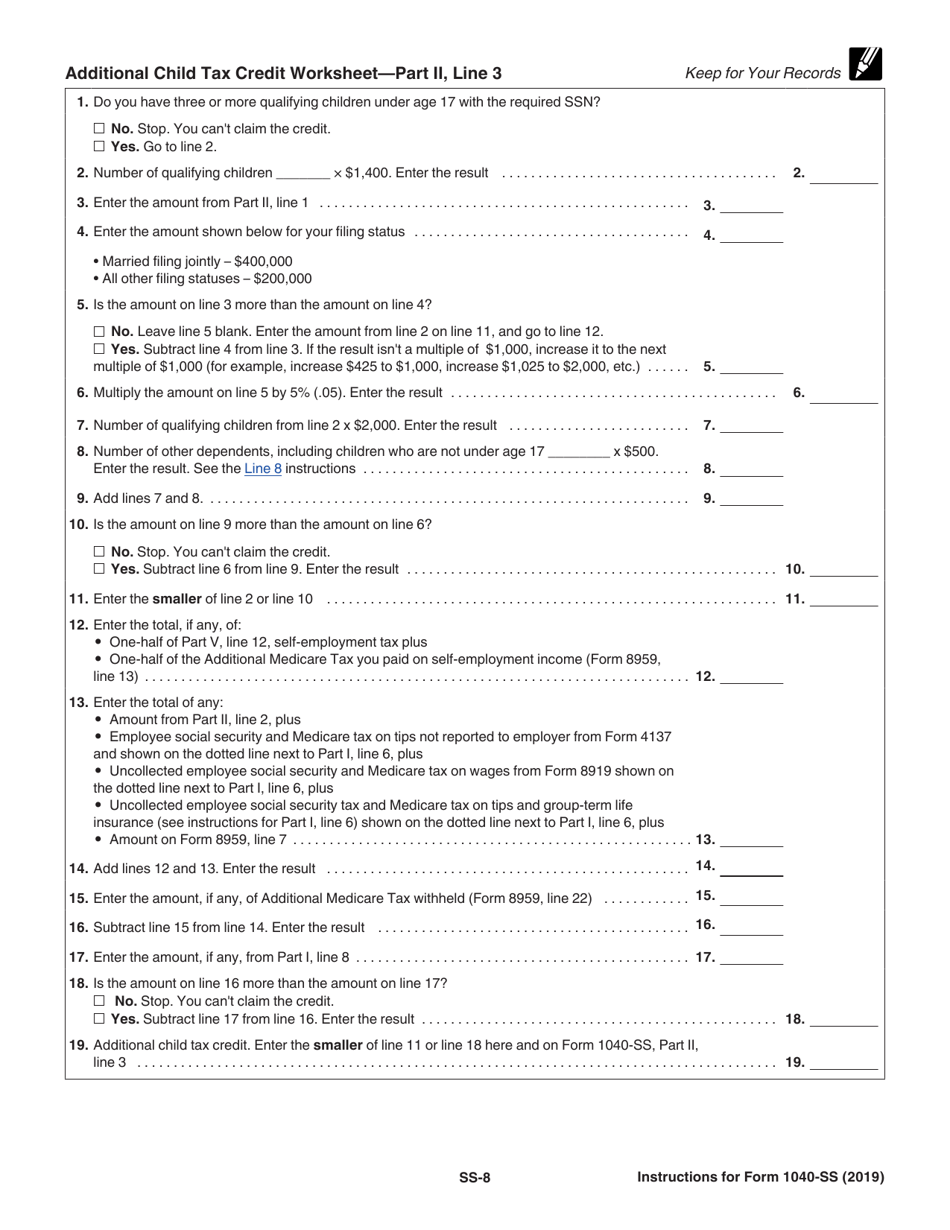

Q: What is the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico?

A: The Additional Child Tax Credit for Bona Fide Residents of Puerto Rico is a tax credit for qualifying residents of Puerto Rico who have children.

Q: Are there any specific requirements to be considered a bona fide resident of Puerto Rico?

A: Yes, there are specific requirements to be considered a bona fide resident of Puerto Rico, such as having a tax home in Puerto Rico and spending a certain amount of time there.

Q: What is the self-employment tax?

A: The self-employment tax is a tax that self-employed individuals are required to pay to fund their Social Security and Medicare benefits.

Q: Can I claim the Additional Child Tax Credit on IRS Form 1040-SS?

A: Yes, you can claim the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico on IRS Form 1040-SS.

Q: What documents do I need to complete IRS Form 1040-SS?

A: You will need documentation of your self-employment income, expenses, and any qualifying children for the Additional Child Tax Credit.

Q: When is the deadline to file IRS Form 1040-SS?

A: The deadline to file IRS Form 1040-SS is usually April 15th, unless it falls on a weekend or holiday.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.