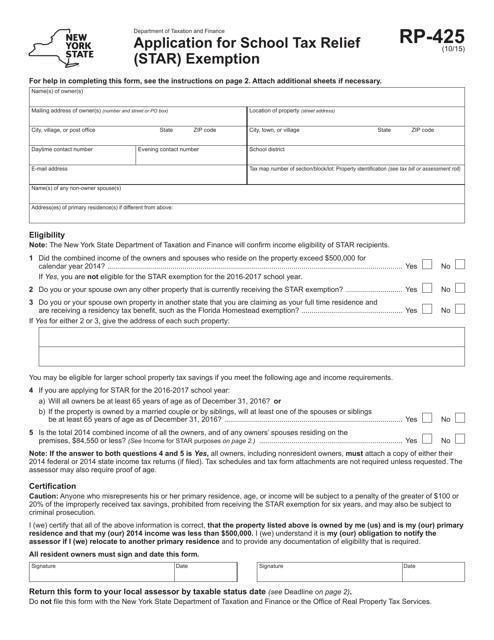

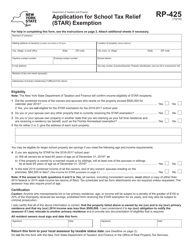

Form RP-425 Application for School Tax Relief (Star) Exemption - New York

What Is Form RP-425?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RP-425 form?

A: The RP-425 form is the Application for School Tax Relief (STAR) Exemption in New York.

Q: What is the STAR exemption?

A: The STAR exemption is a tax relief program that provides benefits to eligible homeowners in New York.

Q: Who is eligible for the STAR exemption?

A: To be eligible for the STAR exemption, you must be the owner of the property and use it as your primary residence.

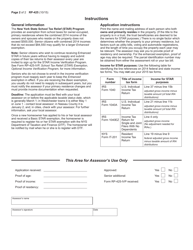

Q: How do I apply for the STAR exemption?

A: To apply for the STAR exemption, you need to complete the RP-425 form and submit it to your local assessor's office.

Q: What documents do I need to include with the RP-425 form?

A: You may need to include documents such as proof of residency, income verification, and proof of ownership with the RP-425 form.

Q: When is the deadline to submit the RP-425 form?

A: The deadline to submit the RP-425 form varies by locality. You should check with your local assessor's office for the specific deadline.

Q: What are the benefits of the STAR exemption?

A: The STAR exemption can provide a reduction in property taxes for eligible homeowners in New York.

Q: Is the STAR exemption available in all parts of New York?

A: Yes, the STAR exemption is available in all parts of New York, but the specific benefits and requirements may vary by locality.

Q: What should I do if I have questions about the RP-425 form or the STAR exemption?

A: If you have questions about the RP-425 form or the STAR exemption, you should contact your local assessor's office for assistance.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

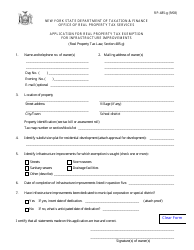

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

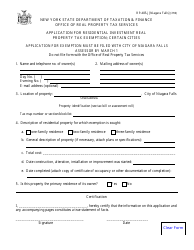

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

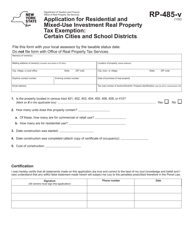

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

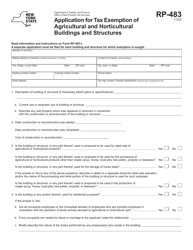

![Document preview: Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)