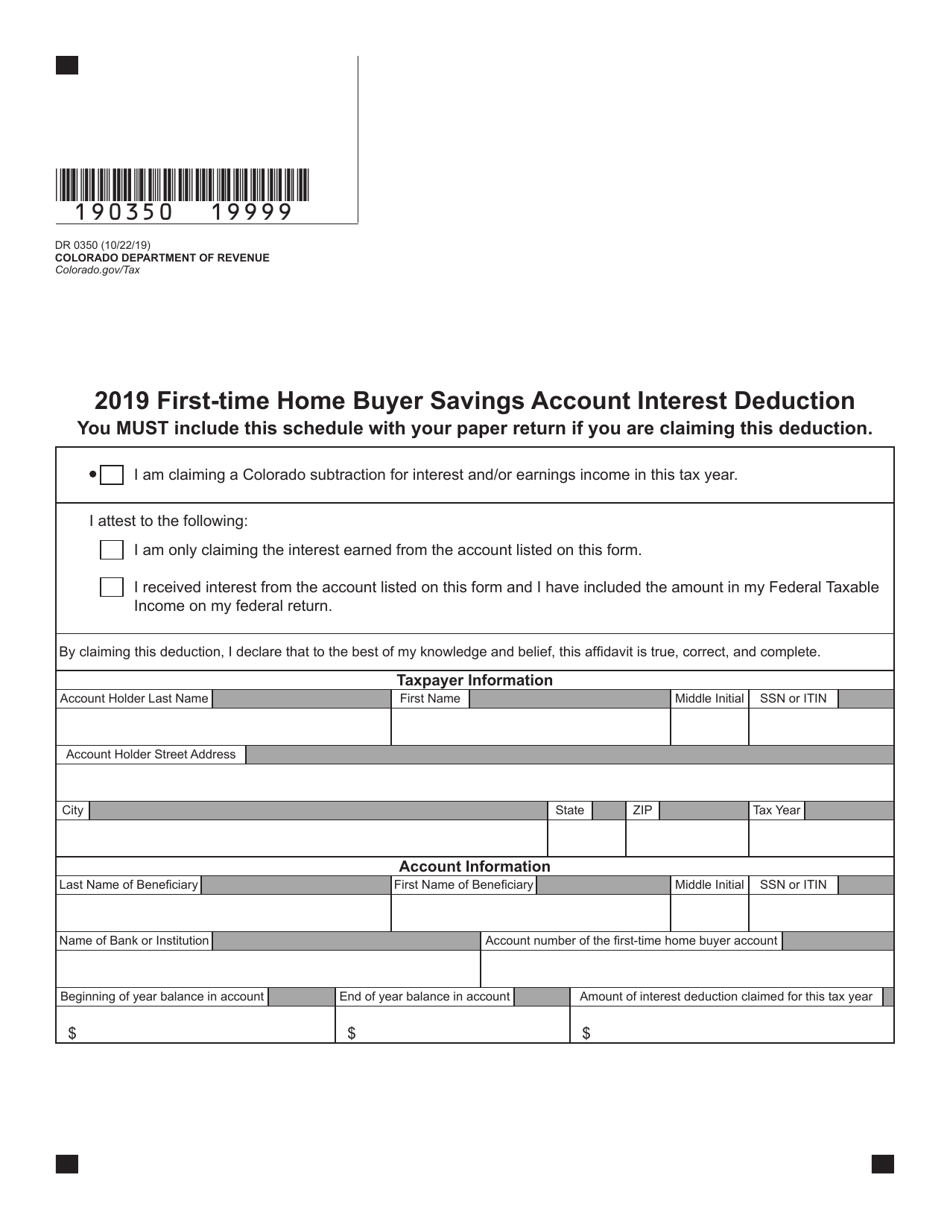

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0350

for the current year.

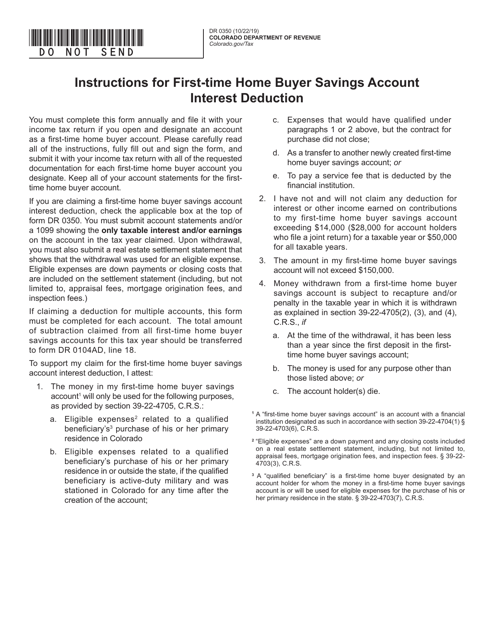

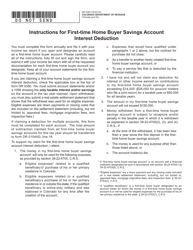

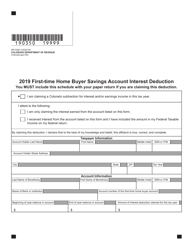

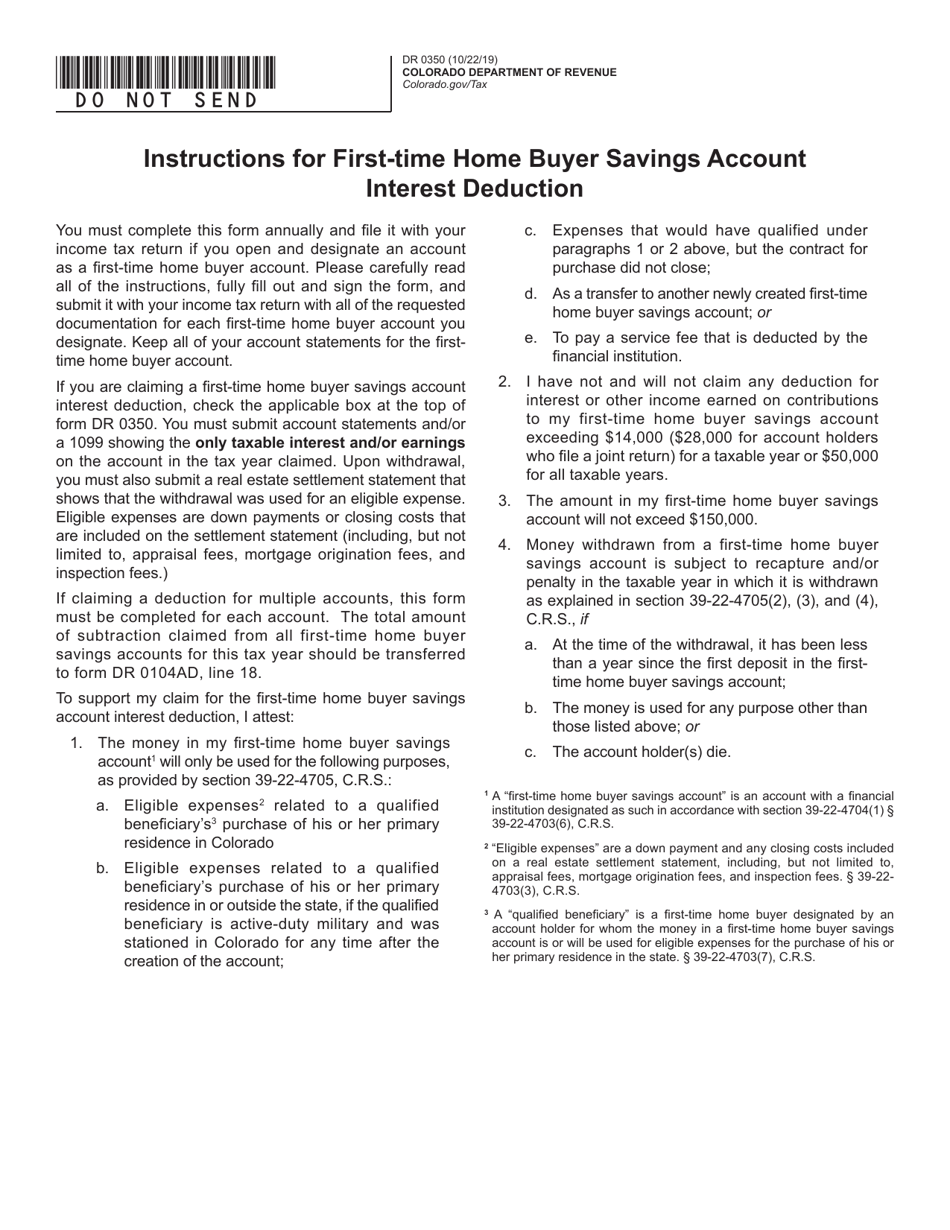

Form DR0350 First-Time Home Buyer Savings Account Interest Deduction - Colorado

What Is Form DR0350?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0350?

A: Form DR0350 is a tax form used by residents of Colorado to claim the First-Time Home Buyer Savings Account Interest Deduction.

Q: Who can use Form DR0350?

A: Form DR0350 can be used by individuals who are residents of Colorado and have a First-Time Home Buyer Savings Account.

Q: What is the First-Time Home Buyer Savings Account Interest Deduction?

A: The First-Time Home Buyer Savings Account Interest Deduction is a tax benefit that allows qualifying individuals to deduct the interest earned on their First-Time Home Buyer Savings Account.

Q: How do I qualify for the First-Time Home Buyer Savings Account Interest Deduction?

A: To qualify for the First-Time Home Buyer Savings Account Interest Deduction, you must be a Colorado resident and have a First-Time Home Buyer Savings Account.

Q: When is the deadline to file Form DR0350?

A: The deadline to file Form DR0350 is generally the same as the deadline for filing your Colorado state income tax return, which is April 15th.

Q: What should I do if I have questions about completing Form DR0350?

A: If you have questions about completing Form DR0350, you can consult the instructions provided with the form or contact the Colorado Department of Revenue for assistance.

Form Details:

- Released on October 22, 2019;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0350 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.