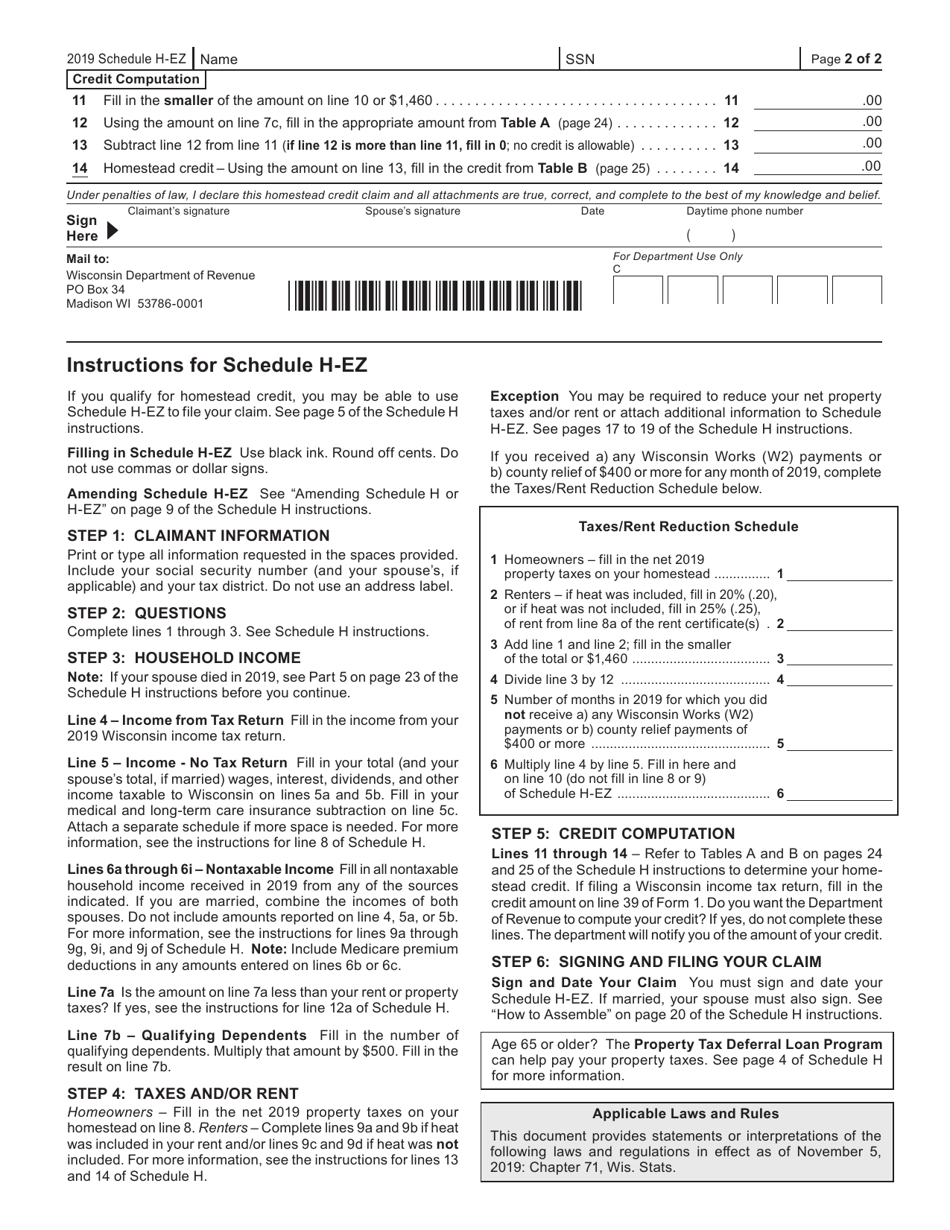

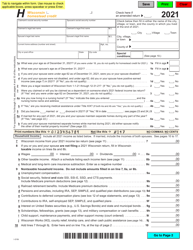

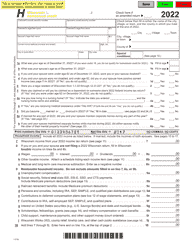

This version of the form is not currently in use and is provided for reference only. Download this version of

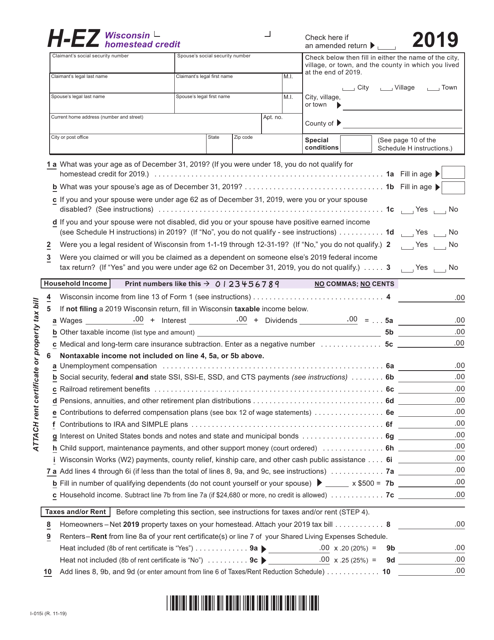

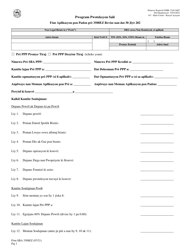

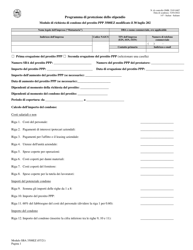

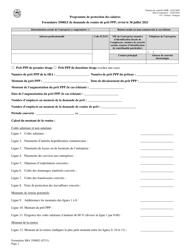

Form I-015I Schedule H-EZ

for the current year.

Form I-015I Schedule H-EZ Wisconsin Homestead Credit - Wisconsin

What Is Form I-015I Schedule H-EZ?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-015I Schedule H-EZ?

A: Form I-015I Schedule H-EZ is a tax form specific to the state of Wisconsin. It is used to claim the Wisconsin Homestead Credit.

Q: What is the Wisconsin Homestead Credit?

A: The Wisconsin Homestead Credit is a tax credit designed to provide property tax relief to low-income homeowners in the state of Wisconsin.

Q: Who is eligible to claim the Wisconsin Homestead Credit?

A: Eligibility for the Wisconsin Homestead Credit is based on income, residency, and other requirements. Low-income homeowners in Wisconsin may be eligible to claim this credit.

Q: What is Schedule H-EZ?

A: Schedule H-EZ is a simplified version of the Wisconsin Homestead Credit application. It is for taxpayers who meet certain income and residency requirements and do not have a qualifying dependent.

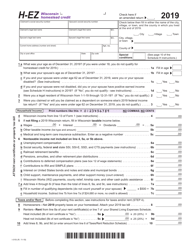

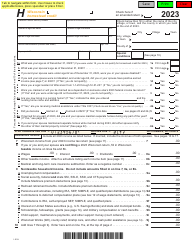

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-015I Schedule H-EZ by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.