This version of the form is not currently in use and is provided for reference only. Download this version of

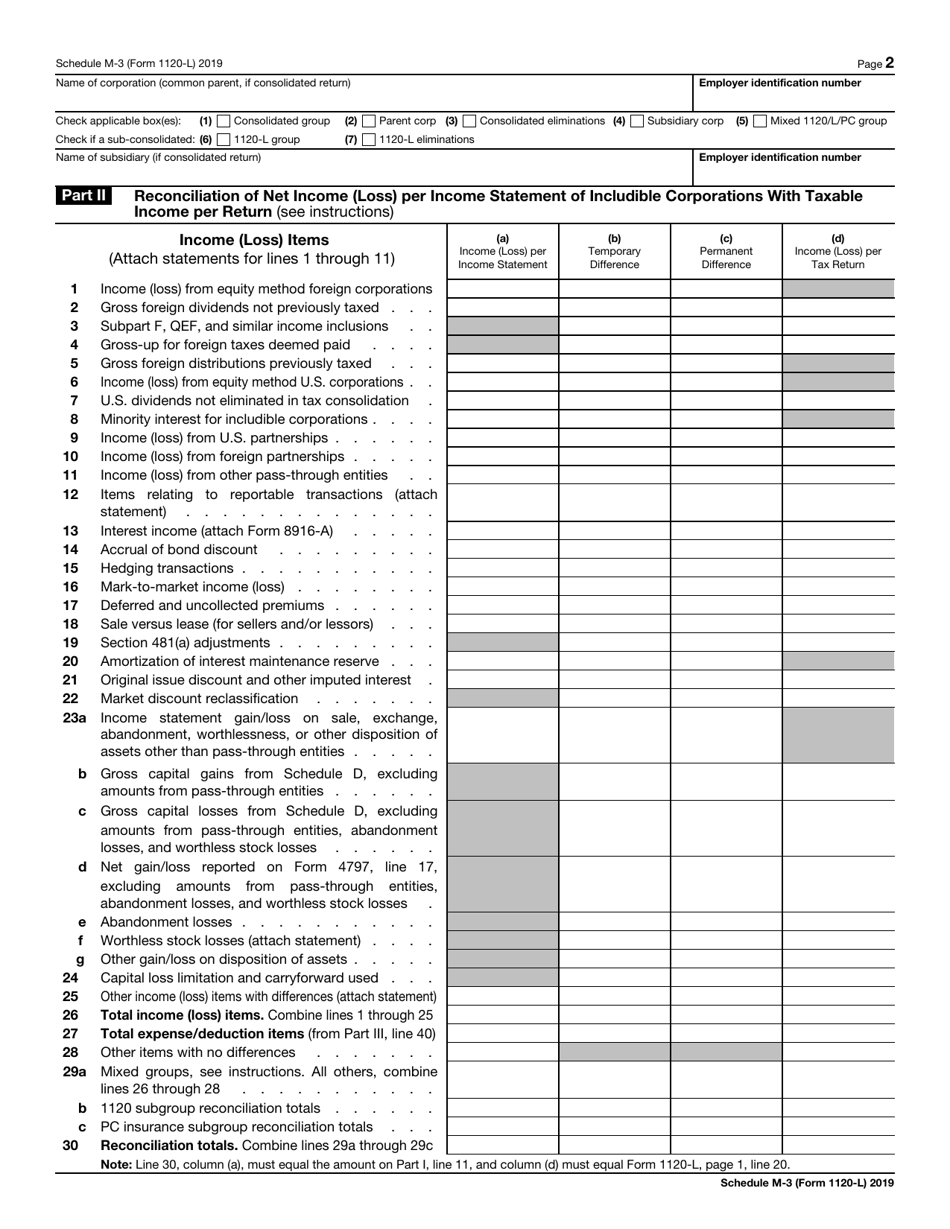

IRS Form 1120-L Schedule M-3

for the current year.

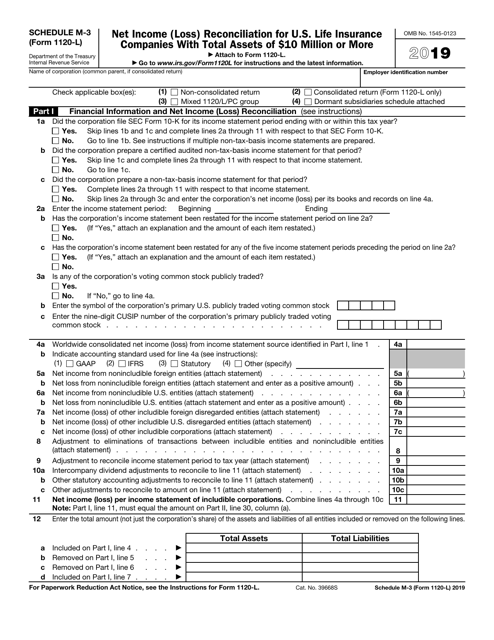

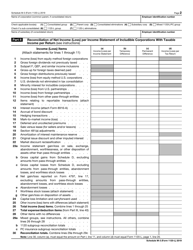

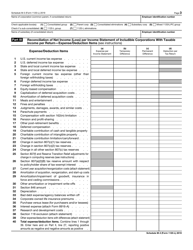

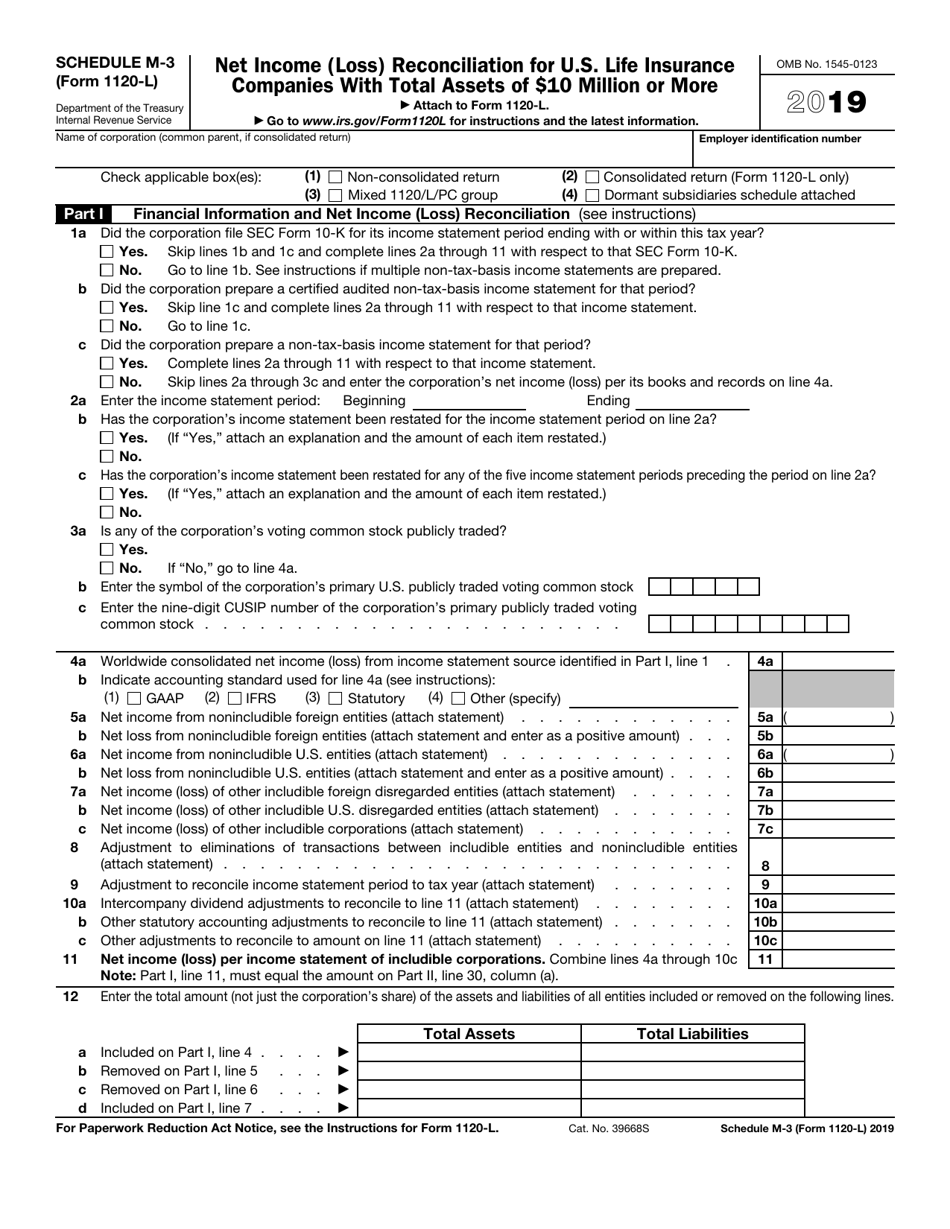

IRS Form 1120-L Schedule M-3 Net Income (Loss) Reconciliation for U.S. Life Insurance Companies With Total Assets of $10 Million or More

What Is IRS Form 1120-L Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-L, U.S. Life Insurance Company Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is a tax form for U.S. life insurance companies with total assets of $10 million or more.

Q: What is Schedule M-3?

A: Schedule M-3 is a part of IRS Form 1120-L that reconciles net income (loss) for U.S. life insurance companies.

Q: Who needs to file Form 1120-L?

A: U.S. life insurance companies with total assets of $10 million or more need to file Form 1120-L.

Q: What does Schedule M-3 do?

A: Schedule M-3 reconciles net income (loss) for U.S. life insurance companies.

Q: Why is Schedule M-3 important?

A: Schedule M-3 provides the IRS with a detailed reconciliation of net income (loss) for U.S. life insurance companies.

Q: Are there any thresholds for filing Form 1120-L?

A: Yes, U.S. life insurance companies must have total assets of $10 million or more to be required to file Form 1120-L.

Q: Is Form 1120-L complicated to fill out?

A: Form 1120-L can be complex, especially Schedule M-3. It is recommended to seek professional assistance or consult the instructions provided by the IRS.

Q: When is Form 1120-L due?

A: Form 1120-L is due on the 15th day of the 3rd month following the end of the tax year.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-L Schedule M-3 through the link below or browse more documents in our library of IRS Forms.