This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3520-A

for the current year.

Instructions for IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

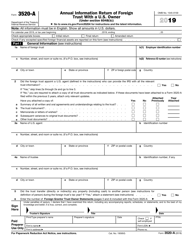

This document contains official instructions for IRS Form 3520-A , Annual Information Return of Foreign Trust With a U.S. Owner - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3520-A is available for download through this link.

FAQ

Q: What is IRS Form 3520-A?

A: IRS Form 3520-A is an Annual Information Return of Foreign Trust with a U.S. Owner.

Q: Who needs to file IRS Form 3520-A?

A: Any U.S. person who is a grantor or beneficiary of a foreign trust must file IRS Form 3520-A.

Q: When is the filing deadline for IRS Form 3520-A?

A: The filing deadline for IRS Form 3520-A is the 15th day of the 3rd month following the end of the trust's tax year.

Q: What information is required to complete IRS Form 3520-A?

A: IRS Form 3520-A requires information about the foreign trust and its U.S. owner, including income and distribution information.

Q: Can IRS Form 3520-A be filed electronically?

A: No, IRS Form 3520-A cannot be filed electronically. It must be filed by mail to the address provided in the form's instructions.

Q: What are the consequences of not filing IRS Form 3520-A?

A: Failure to file IRS Form 3520-A can result in substantial penalties, including potential criminal penalties.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.