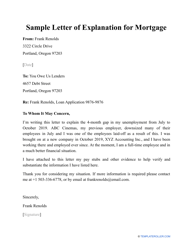

Sample Letter of Explanation for Mortgage

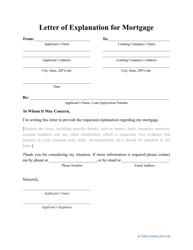

A Letter of Explanation for Mortgage is a written document filled out by a borrower in order to explain their financial situation and obtain a mortgage. Sent to a prospective lender, this letter allows the individual who prepared it to elaborate on certain details that may have been omitted in the mortgage application or the interview with the lender. Whether you are self-employed and need to verify your source of income, disclose your employment situation, explain a gap in employment, or tell the lender more about negative credit history, a document like this can be the final step needed to get the mortgage.

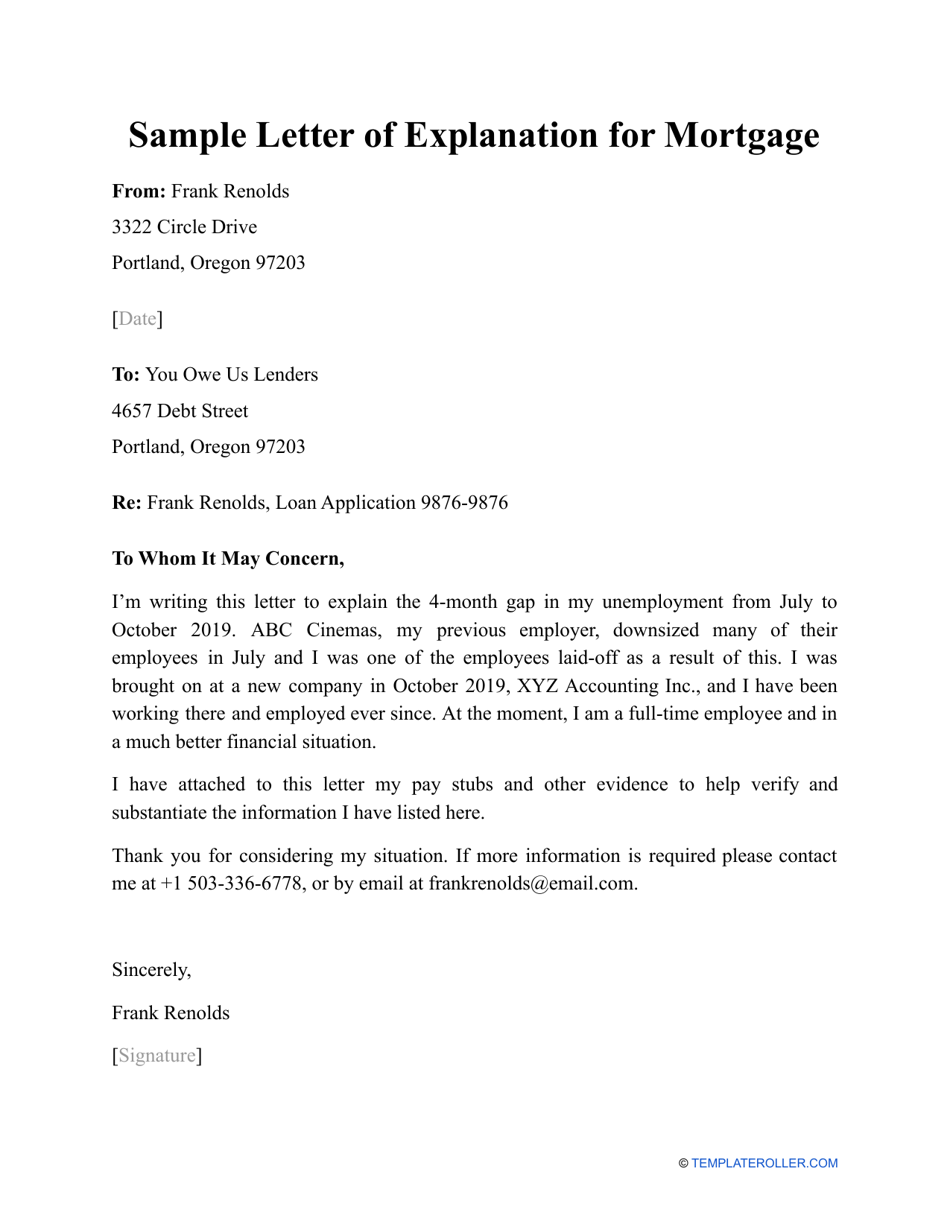

A Sample Letter of Explanation for Mortgage can be found via the link below. To compose a successful letter, you need to identify yourself and specify the reason for writing the letter, answer questions and clarify issues regarding the potential mortgage, and add your contact information so that the lender can reach out to you and negotiate the mortgage agreement in detail. Note that your statement should be supported by documentation - bank statements, pay stubs, tax returns, and other proof that shows you still qualify for the mortgage approval.

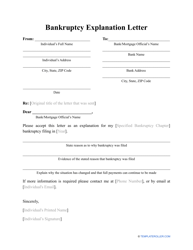

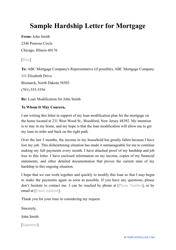

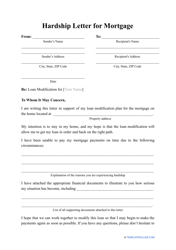

Haven't found the template you're looking for? Take a look at the related templates and samples below: