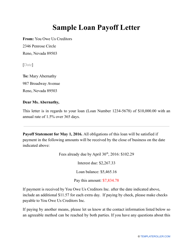

Loan Payoff Letter Template

What Is a Loan Payoff Letter?

A Loan Payoff Letter is a document that contains detailed information related to a loan and instructions on how to pay it off. Composing the letter and forwarding it to their debtor is the responsibility of the lender. Providing this letter allows mortgage lenders to assess how much of the applicant's income is used to repay existing loans.

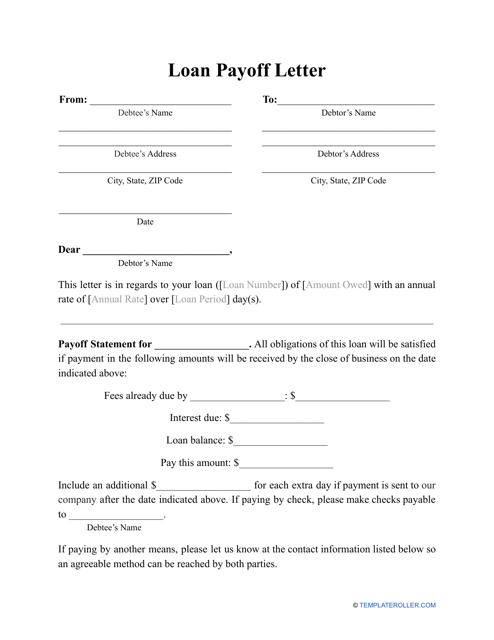

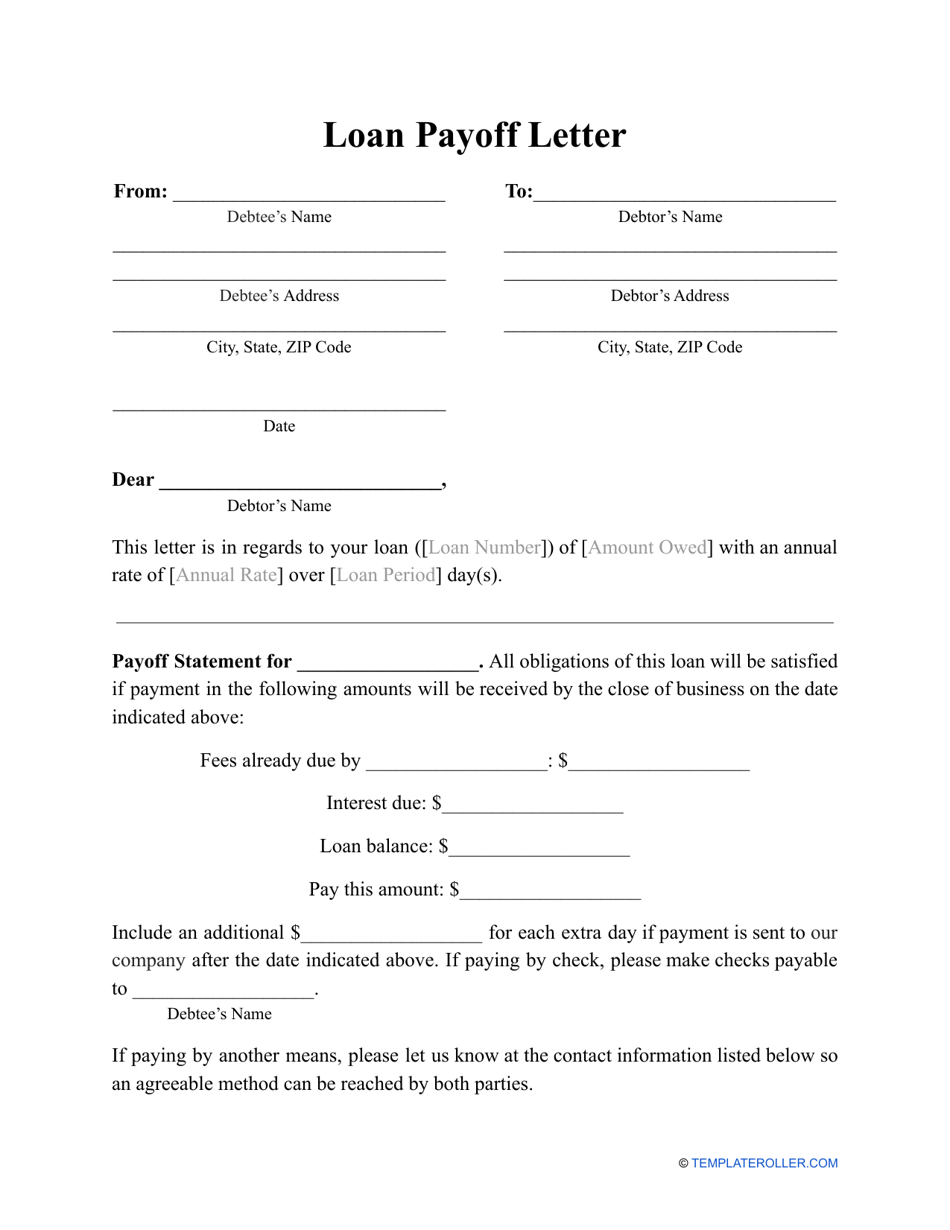

A printable Loan Payoff Letter template can be found through the link below.

The debtor can make a Loan Payoff Letter request not only at the beginning of payments but also after the final repayment of the loan. This letter can be helpful if, for example, the owner of a vehicle has just paid a loan for it and decides to sell this vehicle. The seller needs time to obtain the Lien Release, replace the title, and receive the confirmation of ownership. A Loan Payoff Letter can confirm the absence of a loan on a vehicle and facilitate the transaction.

How to Get a Loan Payoff Letter?

The debtor looking to get a Loan Payoff Letter should request it from their lender. For this purpose, it is necessary to call or write to customer service. Some lenders provide their clients with an automated online system that allows making an online request. Usually, the debtor receives their Loan Payoff Letter within 6-10 business days.

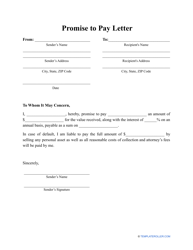

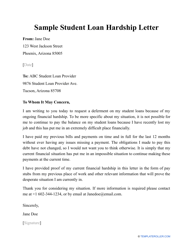

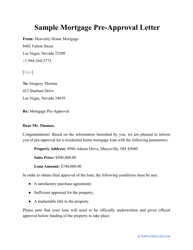

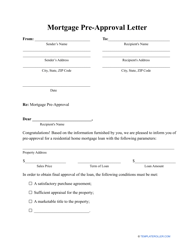

How to Write a Loan Payoff Letter?

To create a sample Loan Payoff Letter that will lay out all of the details necessary for a borrower to complete in order to pay off a loan in full, you will want to include the following information:

- Your organization's logo and contact information as the header of the page.

- A centered headline in bold stating "Loan Payoff Letter."

- The name and full address of the lender. If there is a specific agent in charge of the account, include their name and title.

- A memo introduction (either ATTN or RE) with the borrower's name, full address, and the number of the account.

- Opening salutations to the borrower.

- An introductory statement that you have received a request from the borrower that they would like to pay off the remaining balance of their loan by the next payment due date. Include the amount of the original loan and how much of the remaining loan still needs to be paid. You will need to calculate the additional interest accumulated to give the borrower a clear, final total amount due and that this amount must be paid by the due date listed.

- Instruct the borrower that if the payment is not received by the due date the loan will continue to accrue interest and you as the lender reserve the right to include additional fees since they failed to submit the final payment on time.

- Clearly indicate how the final payment can be made (over the phone, by mail, or in-person) and all acceptable forms of payment. Provide the borrower a full mailing address where they can send the final payment and a way for the borrower to check on the status of their payment to ensure it was received by the due date listed above.

- If the borrower finds they will be unable to complete the final payment by the due date, but wants to notify your offices ahead of the due date to avoid additional fees, provide them with instructions for requesting a postponement of the final payment.

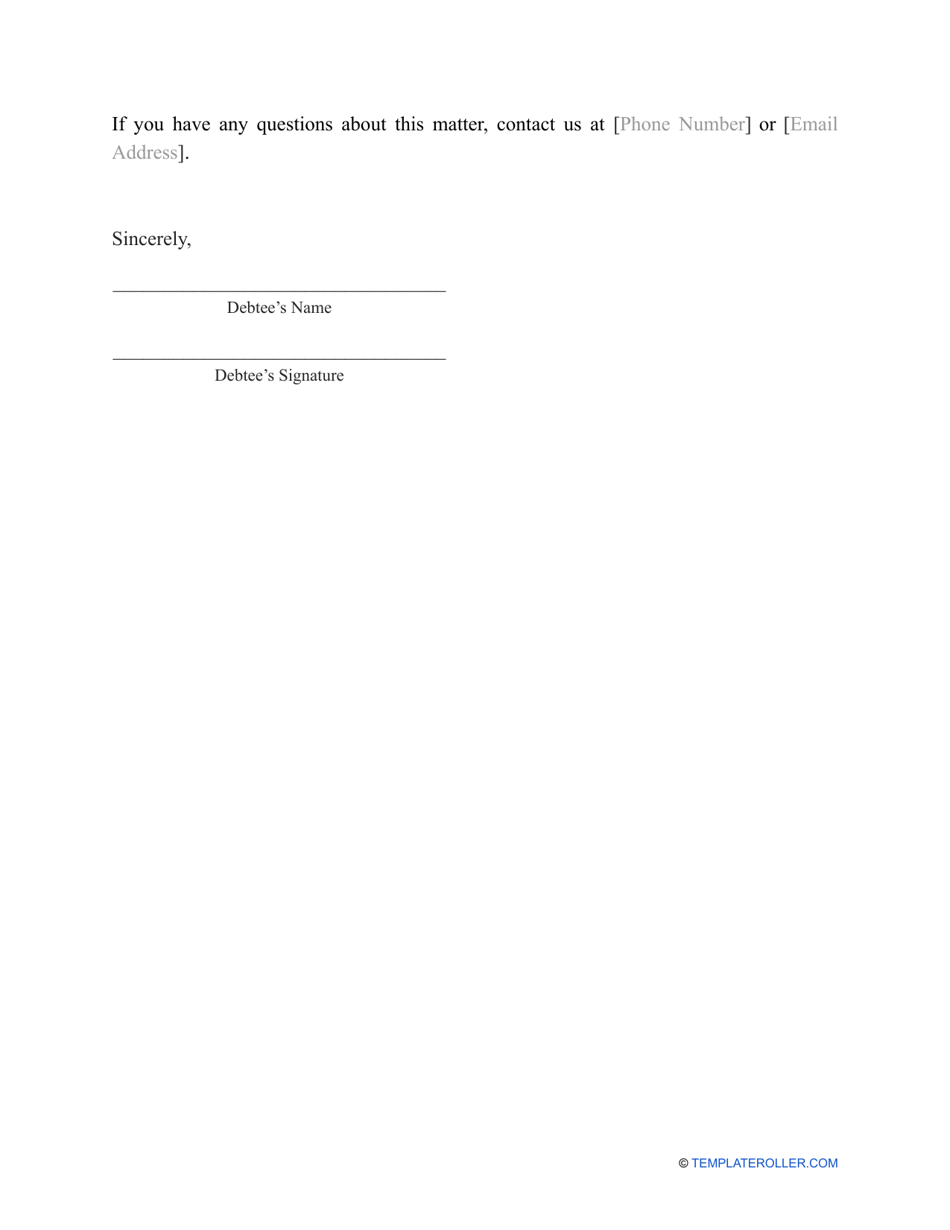

- Closing statement to contact your office if there are additional questions.

- Closing salutations.

- Your name, title, and the lending agency's name.

Related Templates and Topics: