Mortgage Commitment Letter Template

What Is a Mortgage Commitment Letter?

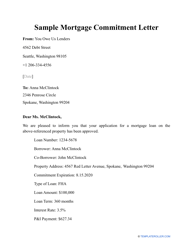

A Mortgage Commitment Letter is a written document prepared by the lender and sent to the borrower after the latter's mortgage application was approved. This statement lists the terms and conditions the parties have negotiated and serves as confirmation the mortgage agreement will soon be signed. Once the borrower receives this letter, they know their mortgage is on the way. Download a printable Mortgage Commitment Letter template via the link below.

Alternate Name:

- Mortgage Loan Commitment Letter.

How Long Does it Take to Get a Mortgage Commitment Letter?

In order to help speed the home buying process along and to avoid being outbid by another prospective buyer, it is important to be pre-approved for a home loan before shopping for a home. This step also needs to be completed before you will receive a Mortgage Commitment Letter. To begin this process you will want to consider how much you are able to pay each month for your mortgage comfortably.

There are also automated underwriting systems lenders will use to assess your income, bank balances, and approval for a credit check based on the information you provide them, so accuracy is key. Once these items are completed it will usually take between 30 to 45 days before you receive a Mortgage Loan Commitment Letter.

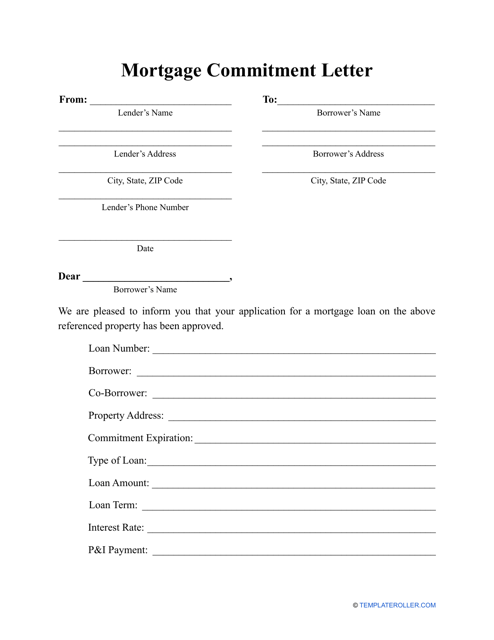

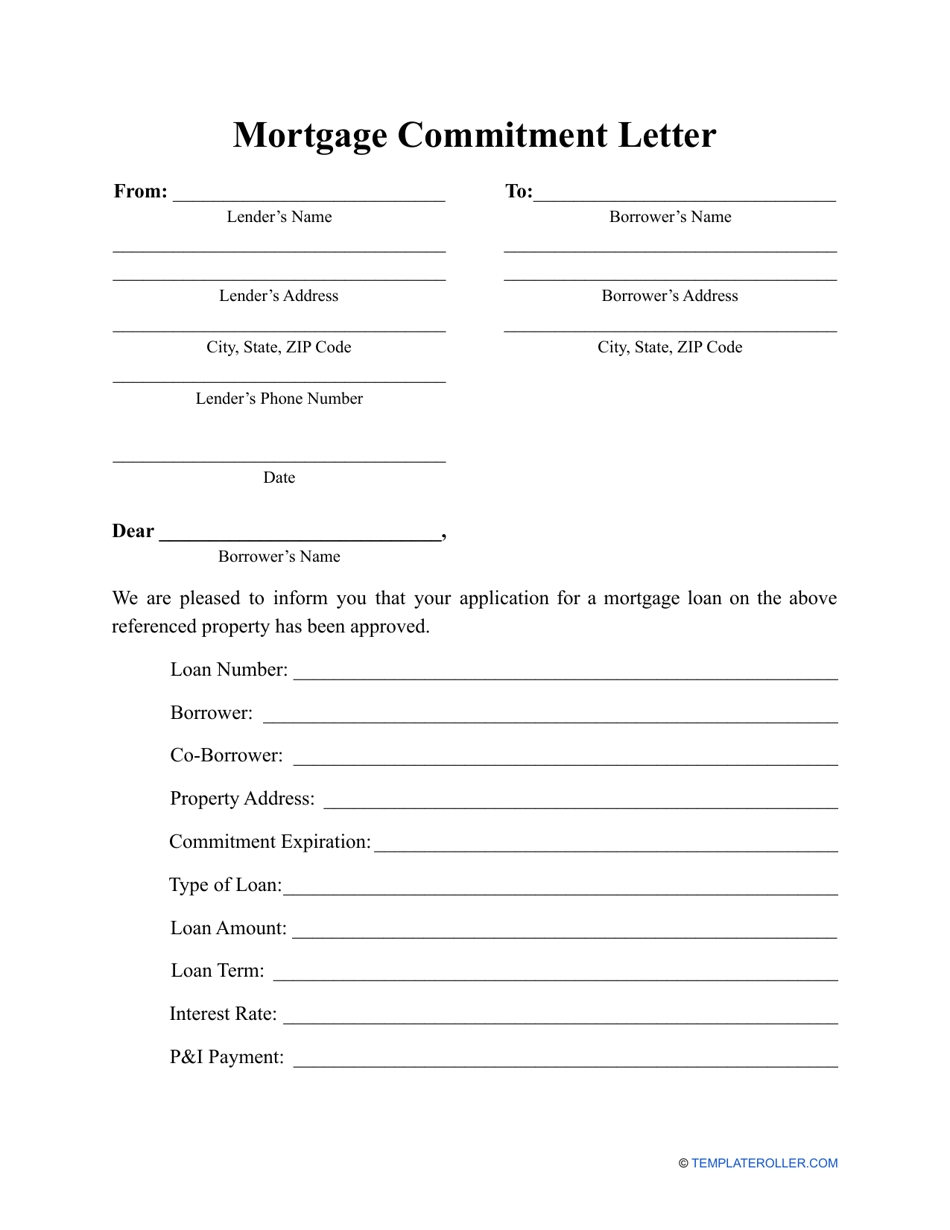

How to Write a Mortgage Commitment Letter?

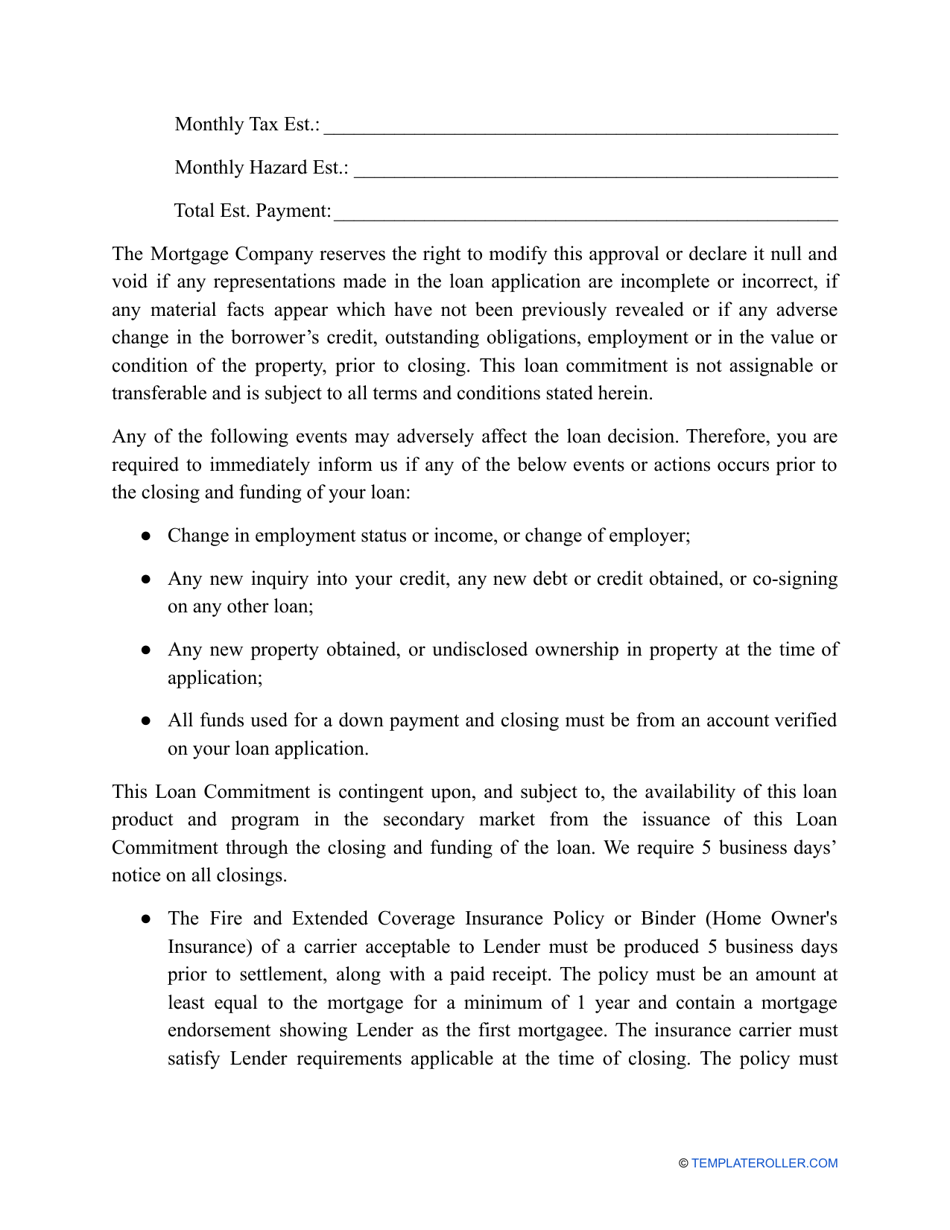

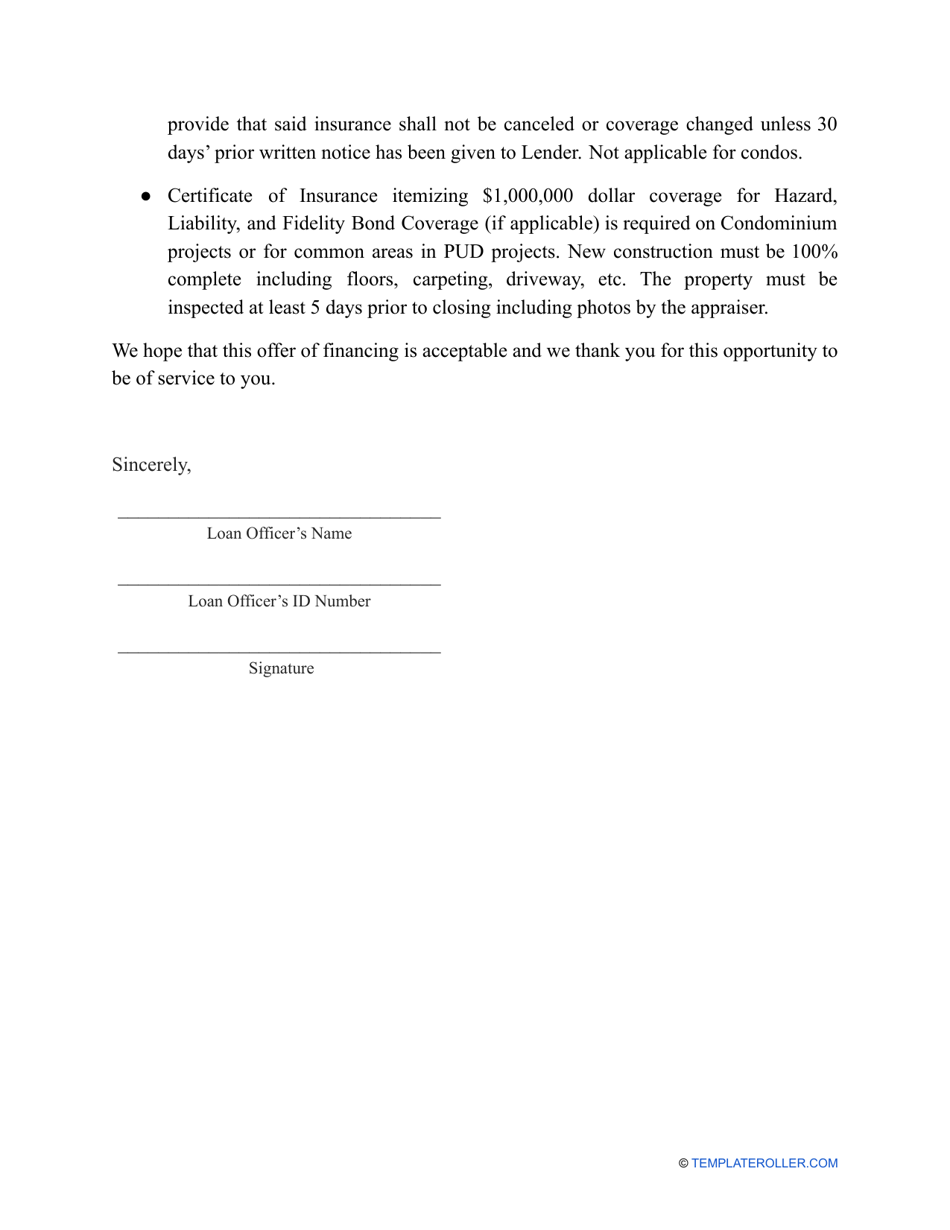

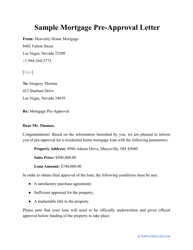

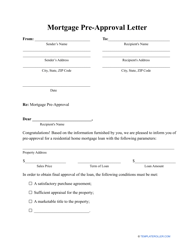

Usually, a Mortgage Commitment Letter contains the following information:

- The identification of the parties that have negotiated the upcoming loan. There is no need to add much information here - you can expand this section, as well as many others, in the future contract.

- The type of loan you have agreed upon and its amount. Congratulate the borrower - their application was reviewed and approved. Promise your commitment to the mortgage.

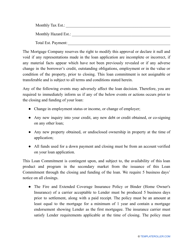

- State the loan's interest rate. Do not forget to include the payment schedule and the necessary fees.

- The terms of the loan - for example, the borrower will pay back the mortgage in twenty years.

- The special conditions that must be met in the next two or three weeks. The lender may expected updated financial statements or latest tax returns, the results of a home inspection, or the prepared down payment on the house. If the borrower sells their house and buys a different one with the help of a mortgage instead, they need to provide proof of the sale before the mortgage can be finalized.

- The signature of the lender. State your contact details so that the borrower contacts you as soon as they can. Since this document does not have legal value and simply precedes the formal agreement, there is no need to notarize it.

How to Get Out of a Mortgage Commitment Letter?

If you decide that you do not want to commit to the mortgage, you are not legally bound to sign the Mortgage Commitment Letter before you have signed it. However, this process also applies to the seller, and they are also able to back out of the agreement if the documents have not been signed.

Related Letter Templates: