Debt Dispute Letter Template

What Is a Debt Dispute Letter?

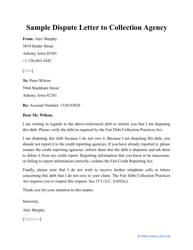

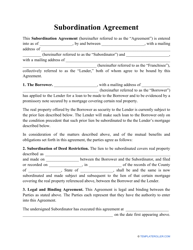

A Debt Dispute Letter is a written refusal to accept debt in response to a collector's notice. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. There's an official procedure to follow if you decide to enter a dispute with either a creditor or a debt collector, acting on behalf of a creditor. It is important to gather knowledgeable resources to know where you stand.

Alternate Name:

- Debt Collection Dispute Letter.

After receiving a debt collector's notice, you have 30 days to dispute a debt. Your written reply is the Letter of Debt Dispute. During this 30-day window, collectors will not be eligible to collect payments from you or take you to court.

You can download a customizable and printable Debt Dispute Letter through the link below.

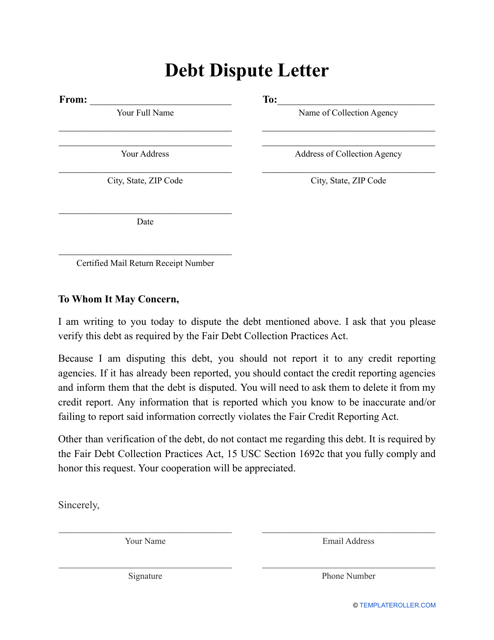

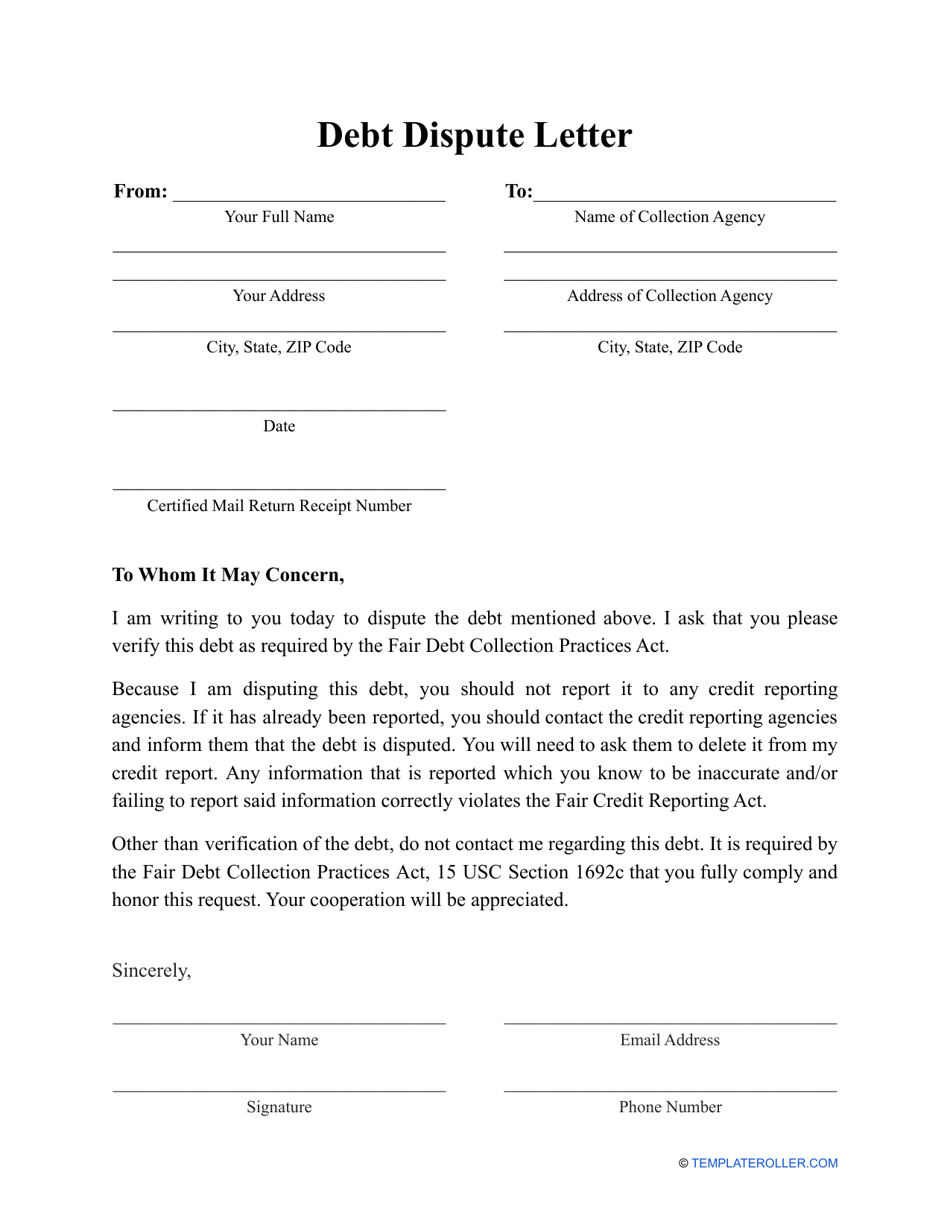

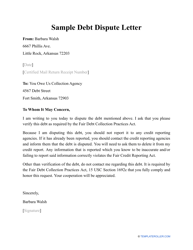

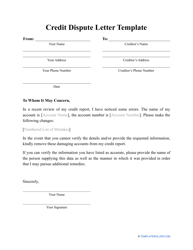

How to Write a Debt Dispute Letter?

To write a Debt Dispute Letter, you will need to follow the following steps:

- Write your name, full address with ZIP code, and current date.

- State the collector's name and address.

- List the account number in reference to a dispute.

- Make your statement, notifying the opponent of your intentions to dispute a debt in question.

- Provide reasons, based on which you disagree.

- Mention the Fair Debt Collection Practices Act that gives you the right to engage in a dispute and that you have a valid reason to support your point of view.

- Request debt-validating documentation that can serve as proof that you are the right person to accept and pay the charges, including verification of your responsibility and copies of any judgments. This shall include financial details and dates when this debt was incurred.

- The collector will have to verify the legal right to collect a debt in question from you.

Be very specific describing the reasons why you believe the debt is not yours, why the amount you are supposed to pay differs from the collector's records, or because of what else you think there was a mistake. While making the statements mentioned above, the Federal Trade Commission advises people to try to provide as little personal information as possible. Any personal information can be used against you if legal action will be taken in the future.

To conclude the letter sign and date it. Make sure to use certified mail to post your letter, with proof of a receipt. Keep a personal copy on file for future references if such a need occurs.

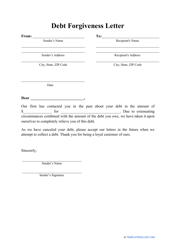

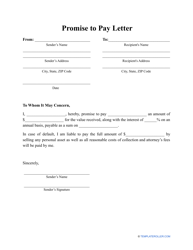

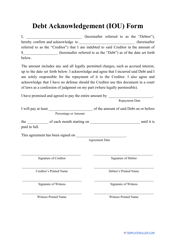

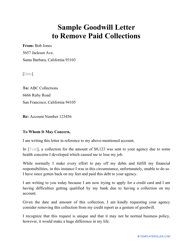

Not what you were looking for? Check out these related templates: