Debt Validation Letter Template

What Is a Debt Validation Letter?

A Debt Validation Letter refers to two related documents used by debtors and collection agencies alike:

- If you represent your own interests or act on behalf of the organization, you can send a Debt Validation Letter to make sure the debt is real. Within a month of the collection agency's first contact with you, you have the right to demand information about your debt.

- If you are a debt collector and you receive a letter from the debtor with a request to mail them information about their debt, prepare a Debt Validation Letter to verify details listed in the document sent to you.

All consumers have the right to request information about their credit history and debts they owe in particular. Within thirty days of receiving the demand for debt payment, any person or company can contact the debt collector and learn more about their claims. In their turn, collection agencies have the duty to respond and send all details related to the debt in question.

Alternate Names:

- Letter of Debt Validation;

- Validation of Debt Letter.

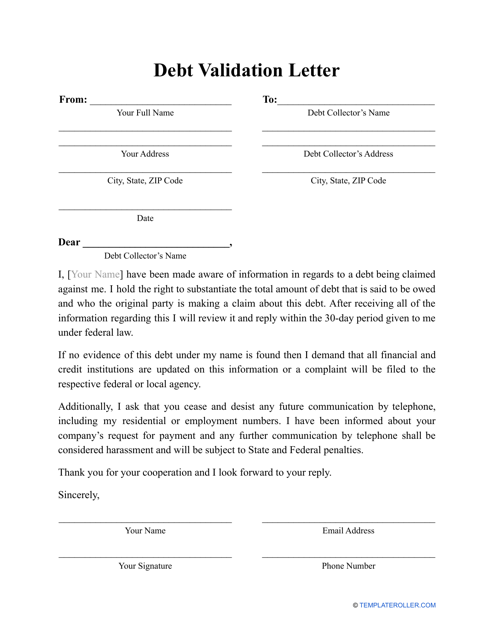

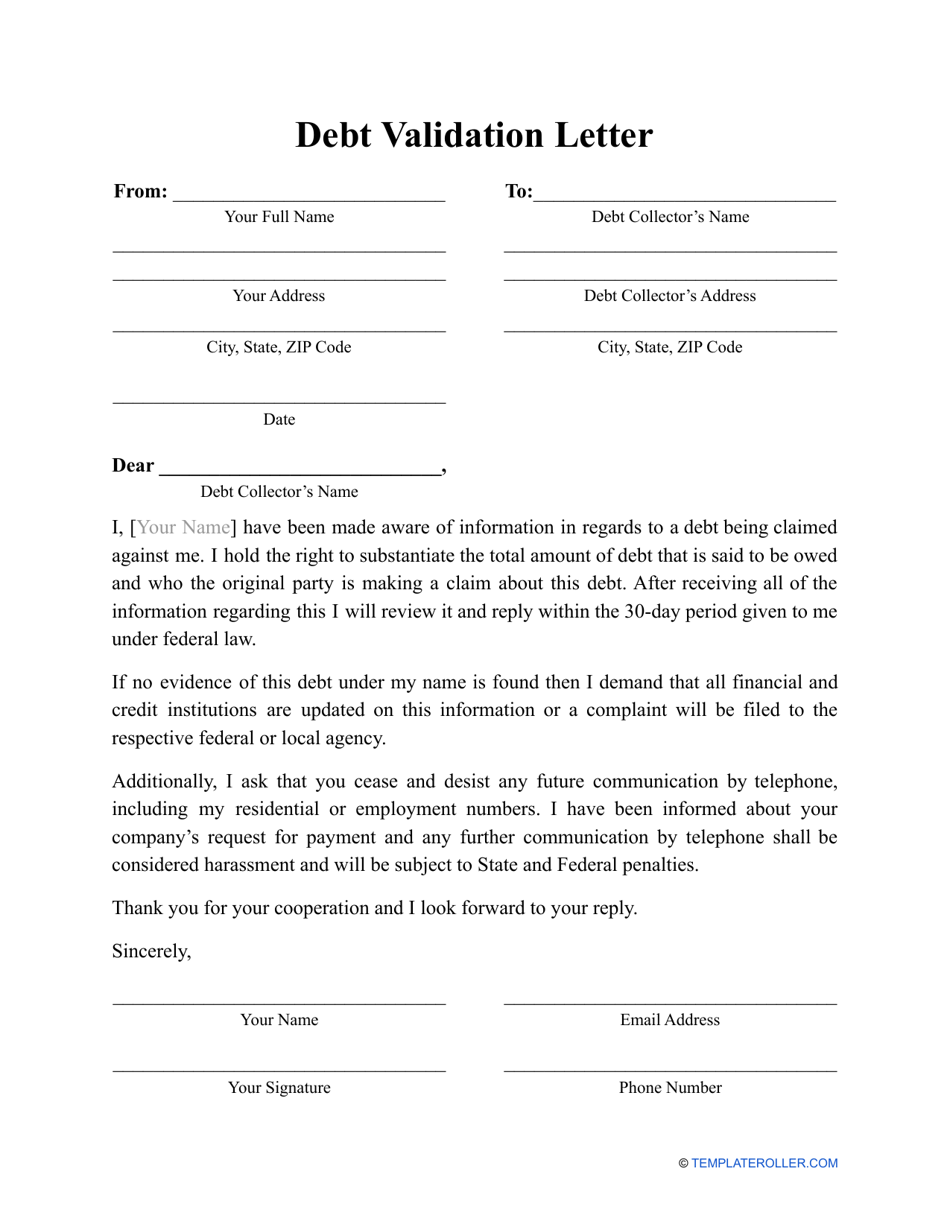

Download out printable Debt Validation Letter template through the link below. The document is customizable - you will be able to add sections and demands suitable for your situation.

How to Write a Debt Validation Letter?

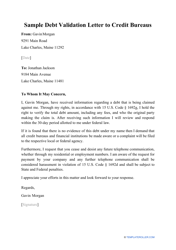

There are various reasons to fill out a Letter of Debt Validation. For instance, you have received calls from your medical provider or the collection agency they work with and they demand you to pay your debts to the medical facility - in this case, complete a Debt Validation Letter for medical bills to make sure you pay the correct amount of money. A Debt Validation Letter to credit bureaus will help you dispute their unfair demands and fight their harassment if they keep calling you, your family, and colleagues with the claim that you owe them money, yet you are not convinced the information they provide on the phone call is true.

If you were contacted by the debt collector and want to make sure your debt is valid, follow these steps to create a Validation of Debt Letter:

- Introduce yourself and add your contact information for further communication. If the debt collector contacted you using the telephone number you rarely use, you can offer them other ways of reaching you.

- Ask for the name of the original creditor.

- Request copies of documentation that confirm your financial obligations to the creditor. For instance, you can demand the last billing statement signed by the creditor and the exact amount of money you currently owe.

- Ask the debtor to verify their authority - they may mail you a copy of the license that gives them the authorization to collect debt in your county or state.

- Sign and date the letter.

If you were asked by the debtor to verify the debt belongs to them, indicate the amount of debt, state the name of the creditor, certify the validity of the debt, and confirm your authority to collect the debt from this person or entity. You can attach documents that demonstrate your status, a copy of the agreement with the creditor, and statements or notices that affirm the existing debt.

How to Send a Debt Validation Letter?

It is highly recommended to send the Letter of Debt Validation via certified mail to obtain proof of receipt. As long as you include all necessary information in the document and know the date it was delivered to the recipient, you have evidence of correspondence and will be able to refer to it in case of any disagreements or issues in the future.

What to Do After Receiving a Debt Validation Letter?

Here is what you need to do after you receive a Debt Validation Letter:

- Creditors who are asked to verify the existence of the debt and the accuracy of the information (name of the debtor, the exact amount of debt, and other details from their credit report) must provide the letter writer with the Debt Validation Letter response. You cannot continue with collection efforts unless you respond, so to seek payment from the debtor, maintain regular contact and answer questions asked by the other party.

- Debtors who obtain verification of their debt have different options. You may dispute the validity of the debt, ask the creditor for supplemental documentation that confirms it if they did not send you enough information, or agree with their demands and start fulfilling your financial obligations.

Not what you were looking for? Check out these related topics: