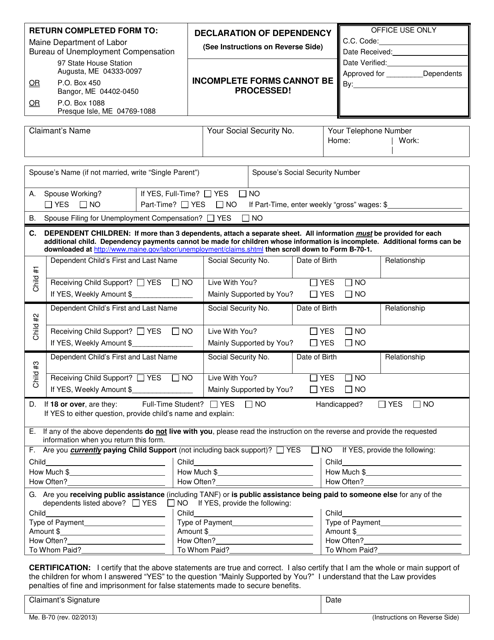

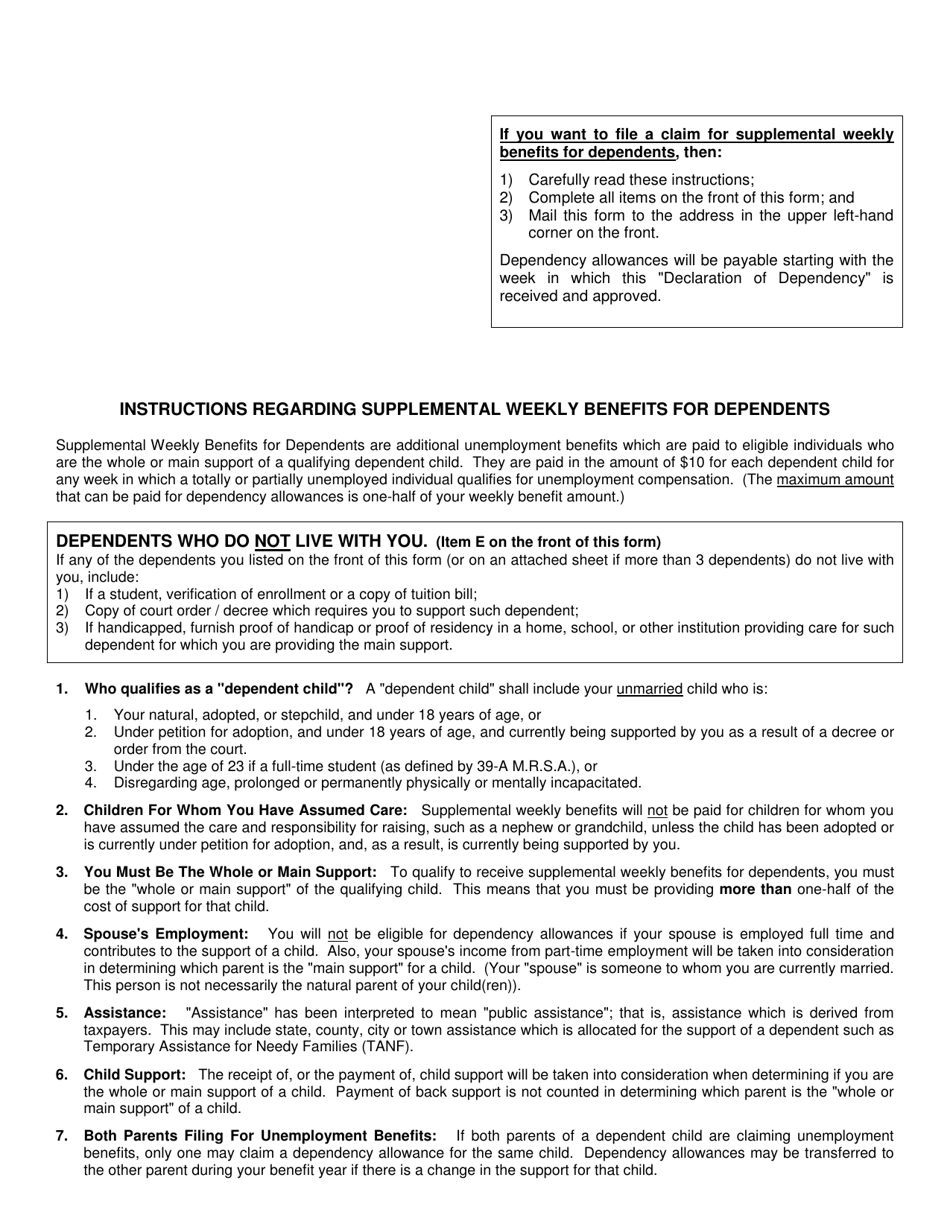

Form B-70 Declaration of Dependency - Maine

What Is Form B-70?

This is a legal form that was released by the Maine Department of Labor - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-70 Declaration of Dependency?

A: Form B-70 Declaration of Dependency is a form used in the state of Maine to declare a dependent for tax purposes.

Q: Who needs to fill out Form B-70 Declaration of Dependency?

A: Individuals who have a qualifying dependent and meet certain criteria need to fill out this form.

Q: What is the purpose of Form B-70 Declaration of Dependency?

A: The purpose of this form is to claim a dependent for tax benefits, such as head of householdfiling status or certain tax credits.

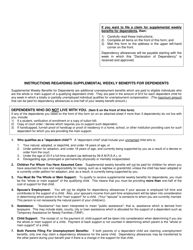

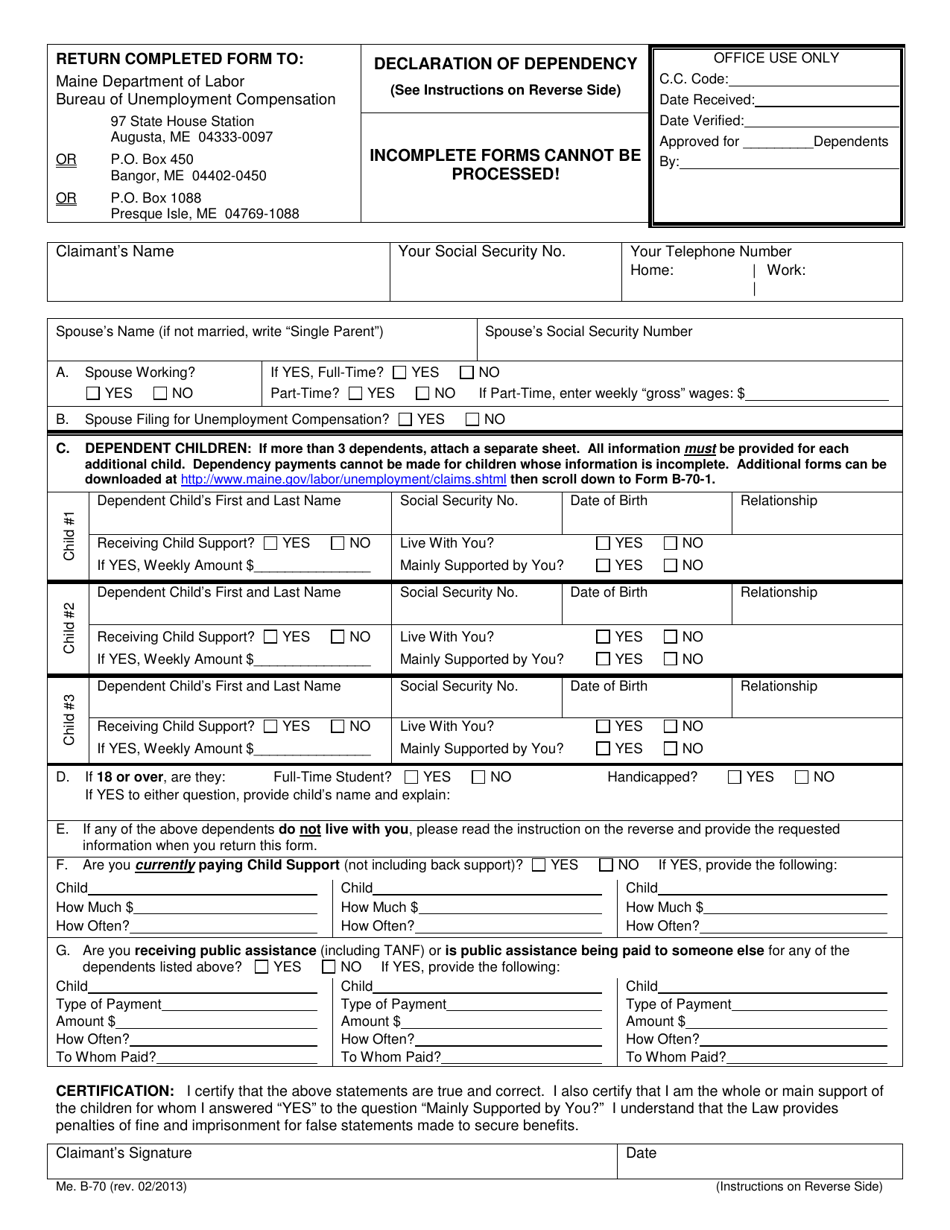

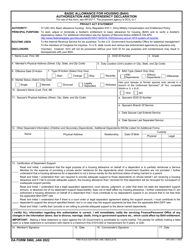

Q: What information is required on Form B-70 Declaration of Dependency?

A: The form requires information about the dependent, including their relationship to the taxpayer, Social Security number, and other details.

Q: Is Form B-70 Declaration of Dependency only for residents of Maine?

A: Yes, this form is specifically for residents of Maine.

Q: Can I claim multiple dependents on Form B-70 Declaration of Dependency?

A: Yes, you can claim multiple dependents on this form if they meet the qualifying criteria.

Q: Are there any deadlines for submitting Form B-70 Declaration of Dependency?

A: The form should be submitted with your tax return by the filing deadline, which is usually April 15th.

Q: What happens if I submit Form B-70 Declaration of Dependency with incorrect information?

A: If you submit the form with incorrect information, it may lead to delays in processing your tax return or potential penalties.

Q: Can I amend Form B-70 Declaration of Dependency if I made a mistake?

A: Yes, you can file an amended form if you made a mistake on your original declaration.

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the Maine Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-70 by clicking the link below or browse more documents and templates provided by the Maine Department of Labor.