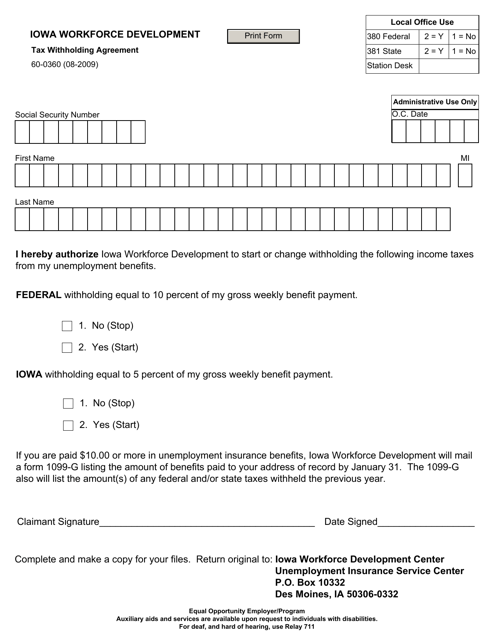

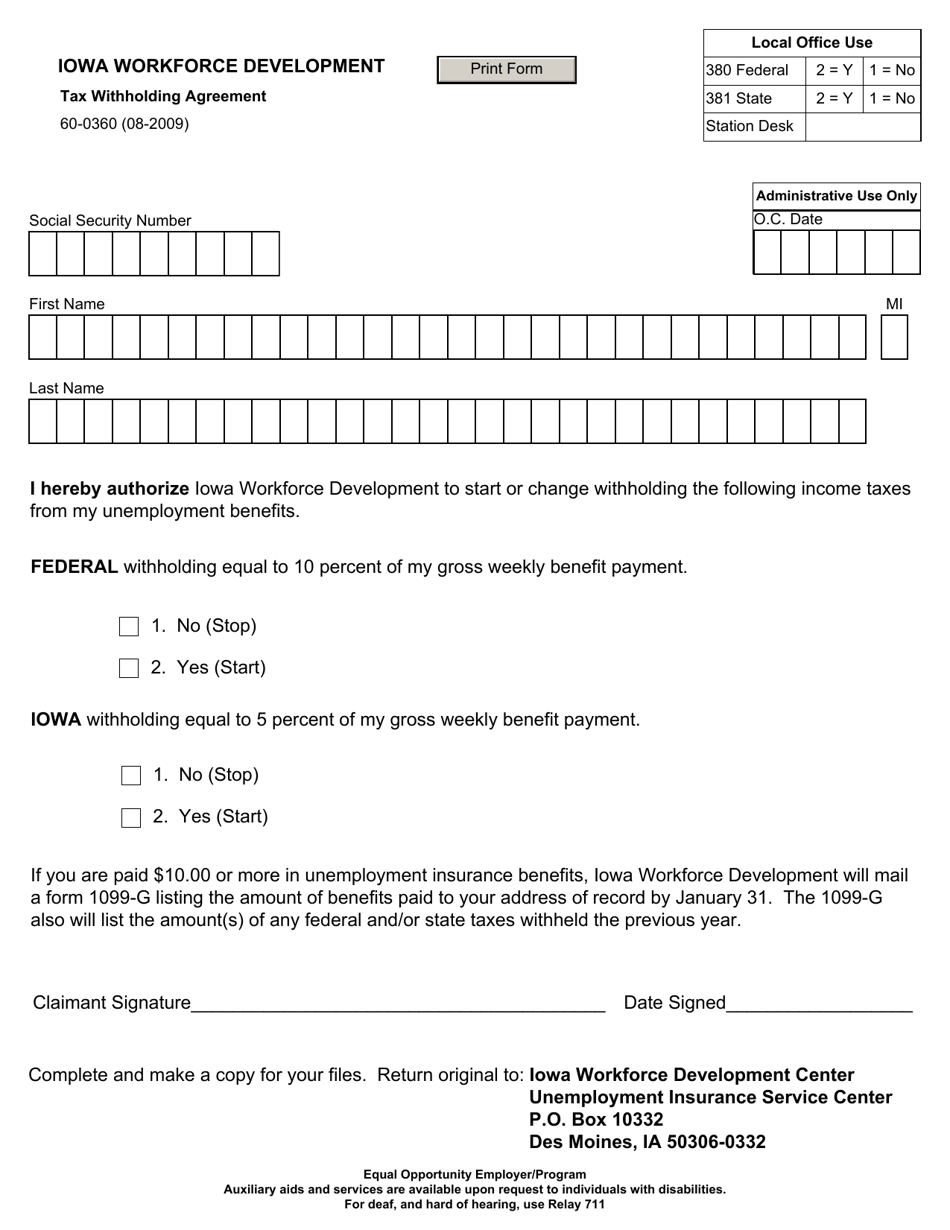

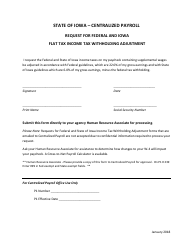

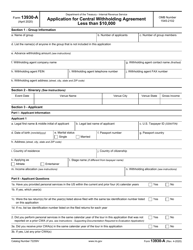

Form 60-0360 Tax Withholding Agreement - Iowa

What Is Form 60-0360?

This is a legal form that was released by the Iowa Workforce Development - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-0360?

A: Form 60-0360 is a Tax Withholding Agreement for Iowa.

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses who are withholding Iowa income tax from nonresident employees.

Q: What is the purpose of this form?

A: The purpose of Form 60-0360 is to establish an agreement between the employer and the Iowa Department of Revenue for withholding Iowa income tax.

Q: Are there any fees associated with filing this form?

A: No, there are no fees associated with filing Form 60-0360.

Q: When should this form be filed?

A: This form should be filed as soon as you start withholding Iowa income tax from nonresident employees.

Q: What information is needed to fill out this form?

A: You will need the employer's name, address, and federal employer identification number (FEIN), as well as the nonresident employee's name, address, and social security number.

Q: Is there a deadline for filing this form?

A: There is no specific deadline for filing Form 60-0360, but it is recommended to file it as soon as possible.

Q: What are the consequences of not filing this form?

A: Failure to file Form 60-0360 may result in penalties or interest charges.

Q: Can this form be filed electronically?

A: Yes, Form 60-0360 can be filed electronically through the Iowa Department of Revenue's eFile & Pay system.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the Iowa Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 60-0360 by clicking the link below or browse more documents and templates provided by the Iowa Workforce Development.