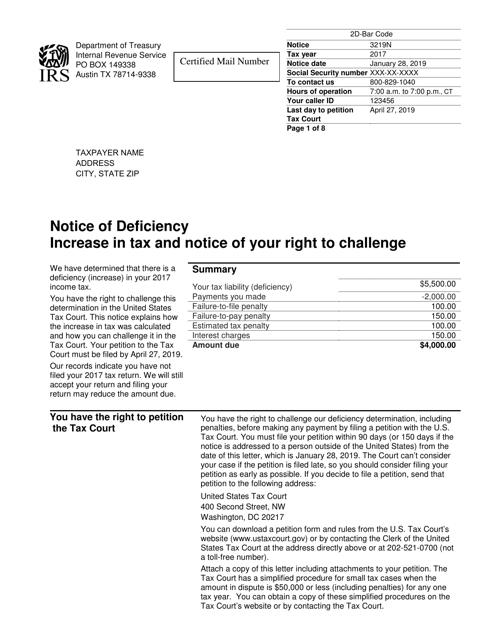

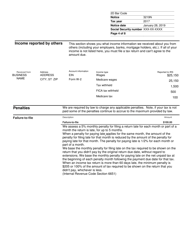

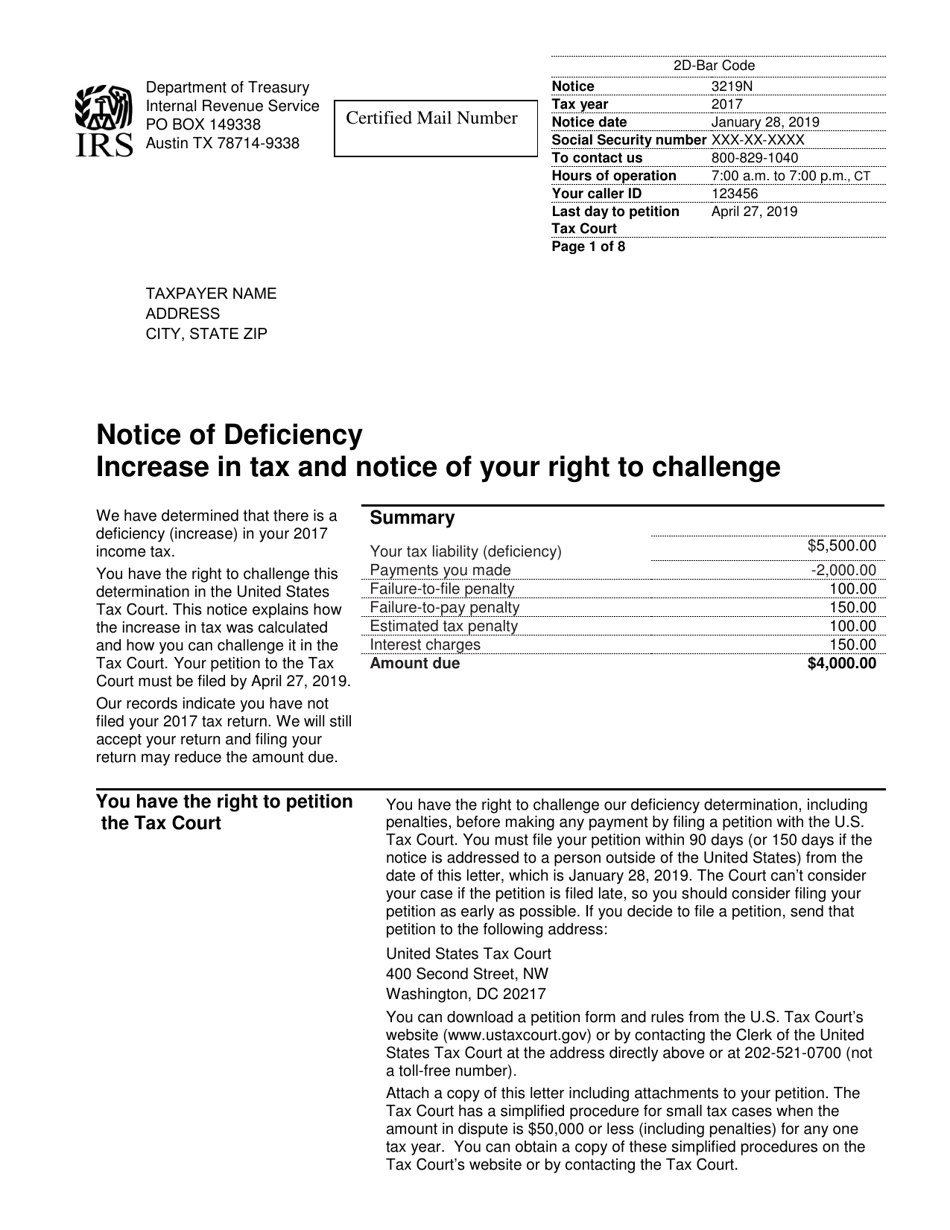

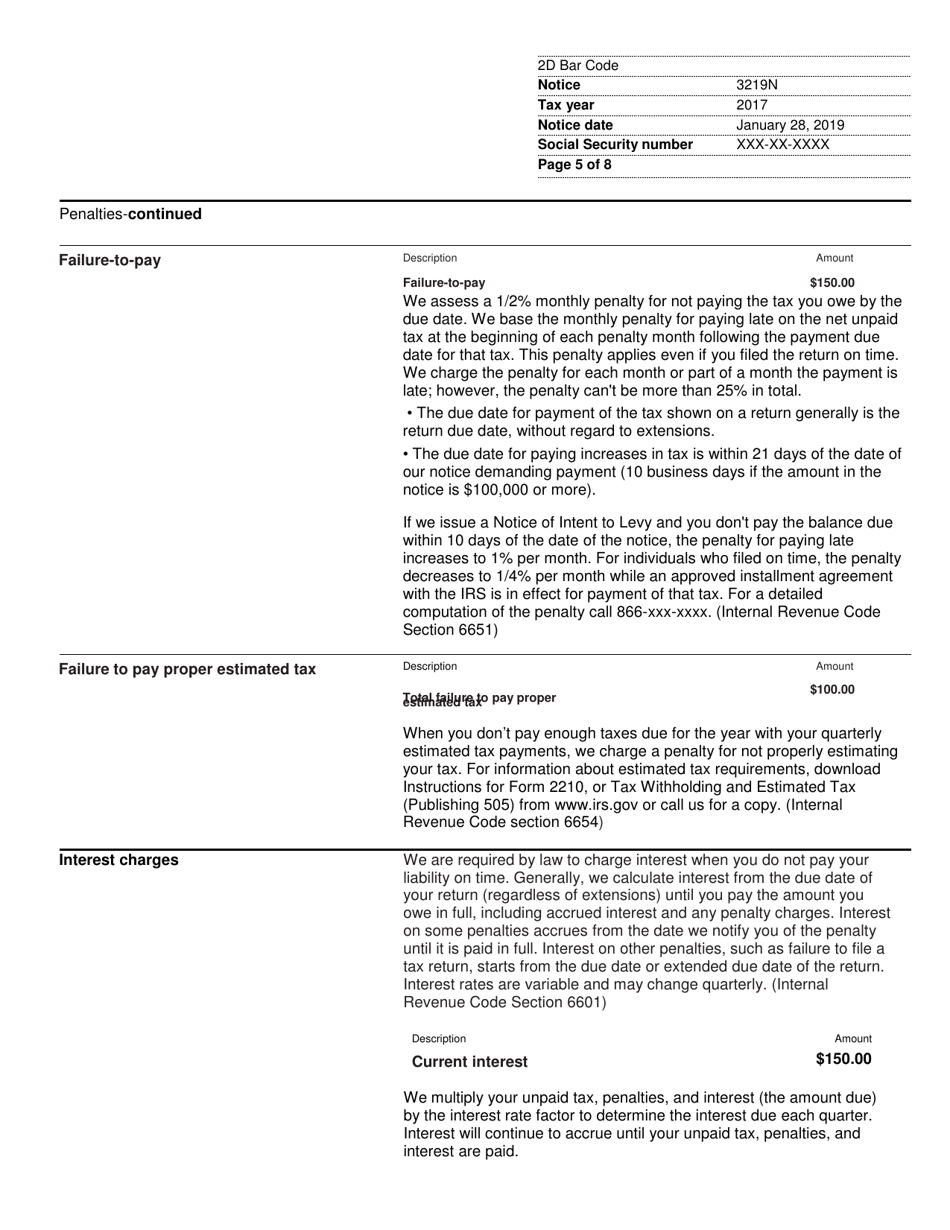

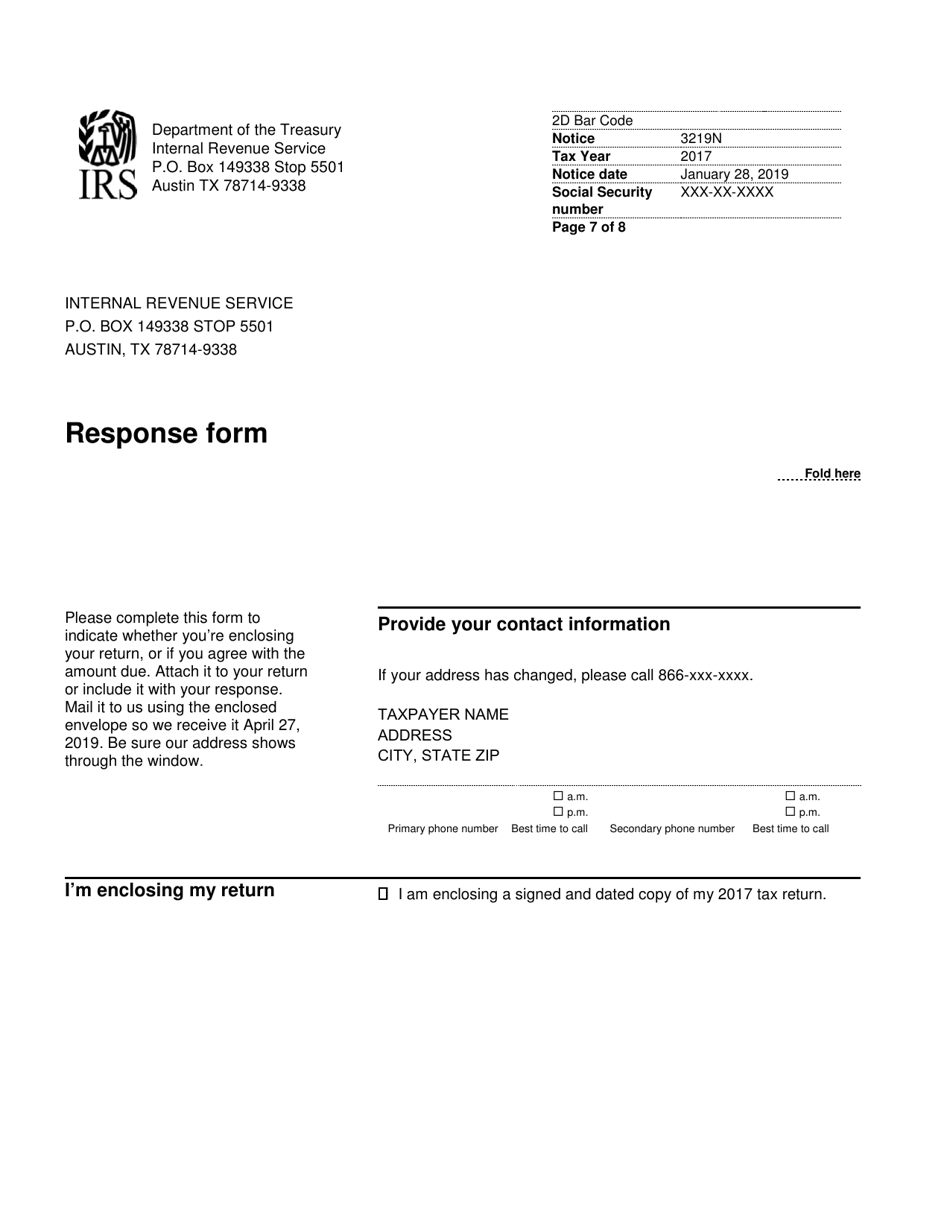

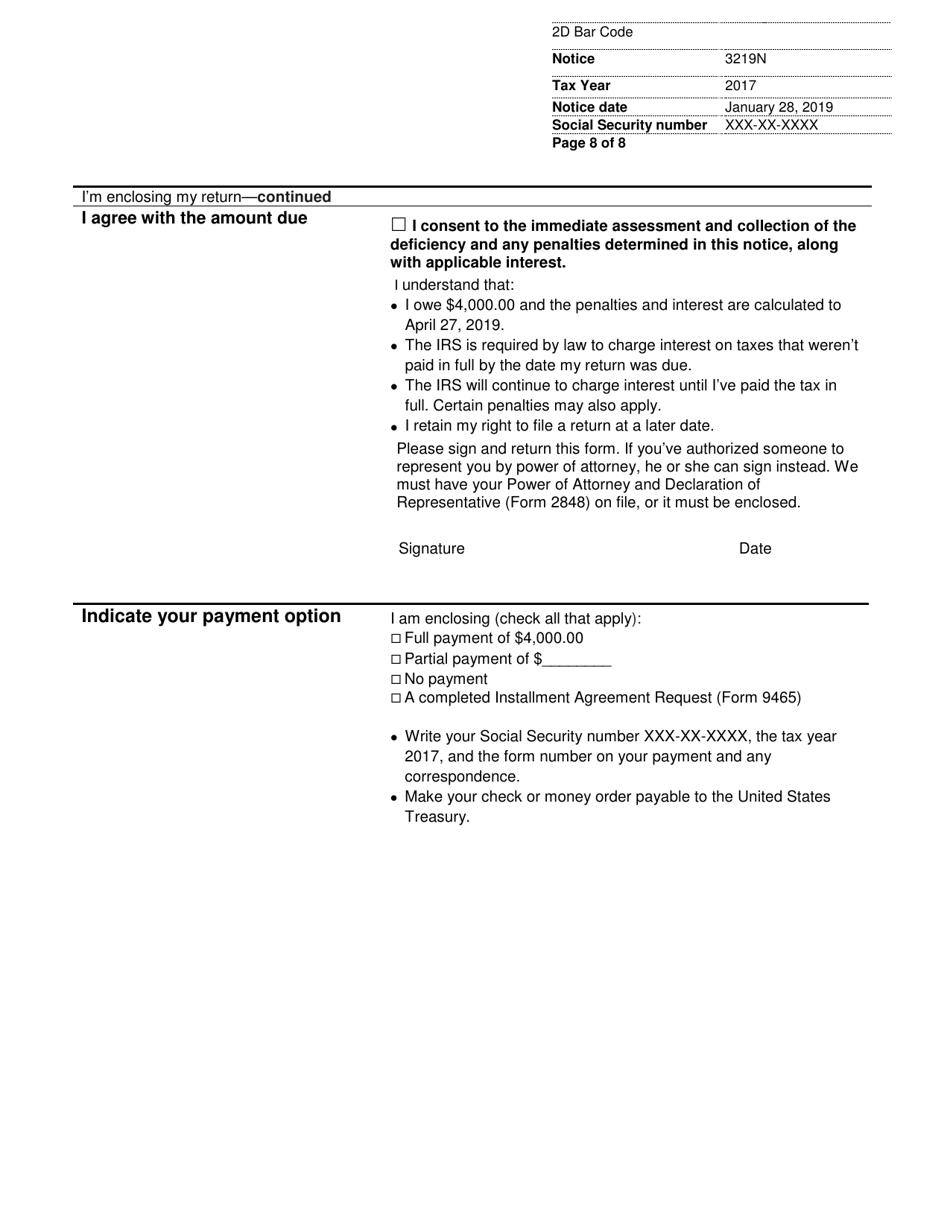

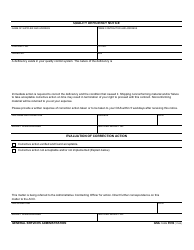

IRS Notice Cp3219n, Notice of Deficiency

IRS Notice Cp3219n, Notice of Deficiency is a 8-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Notice CP3219N?

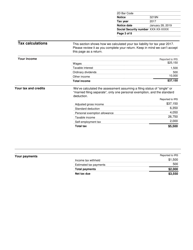

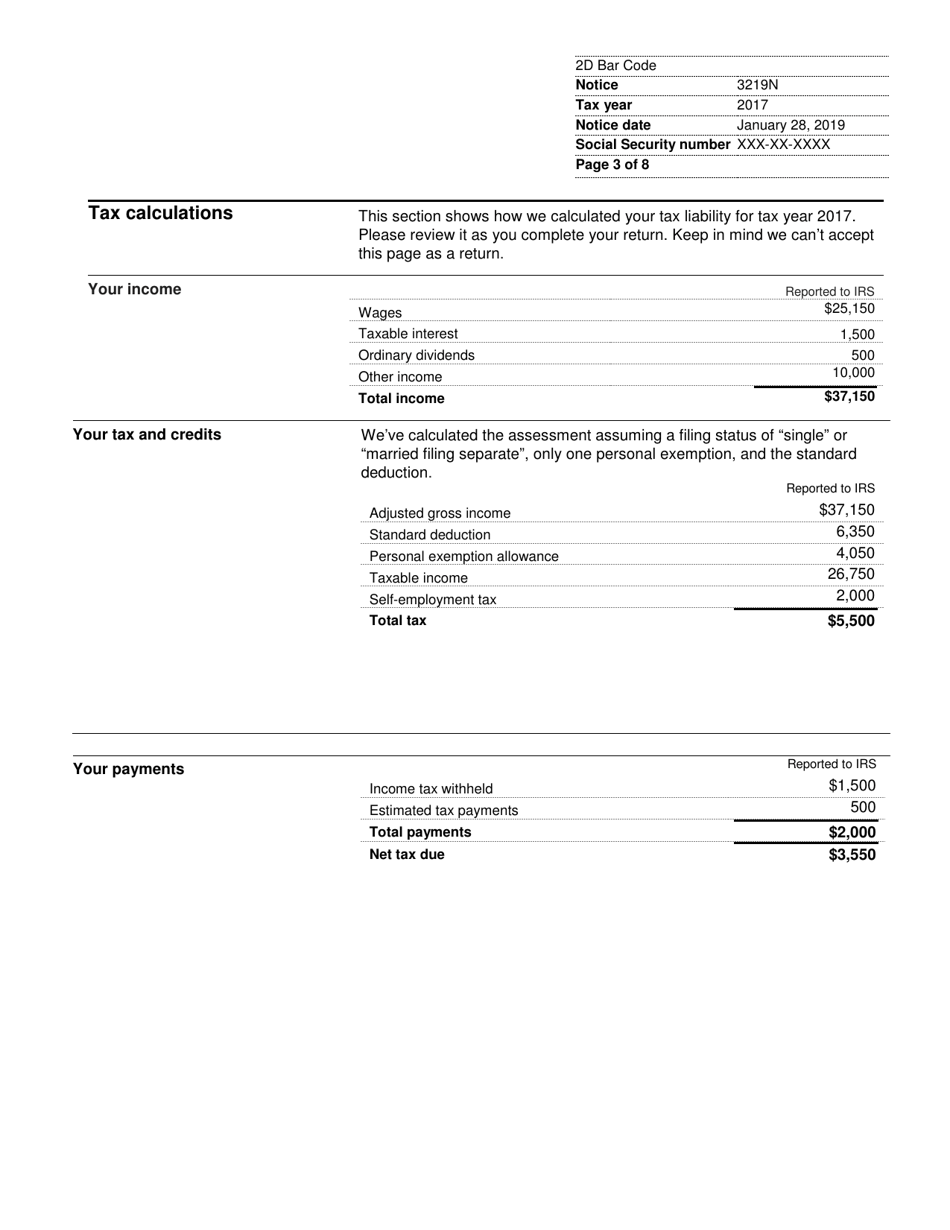

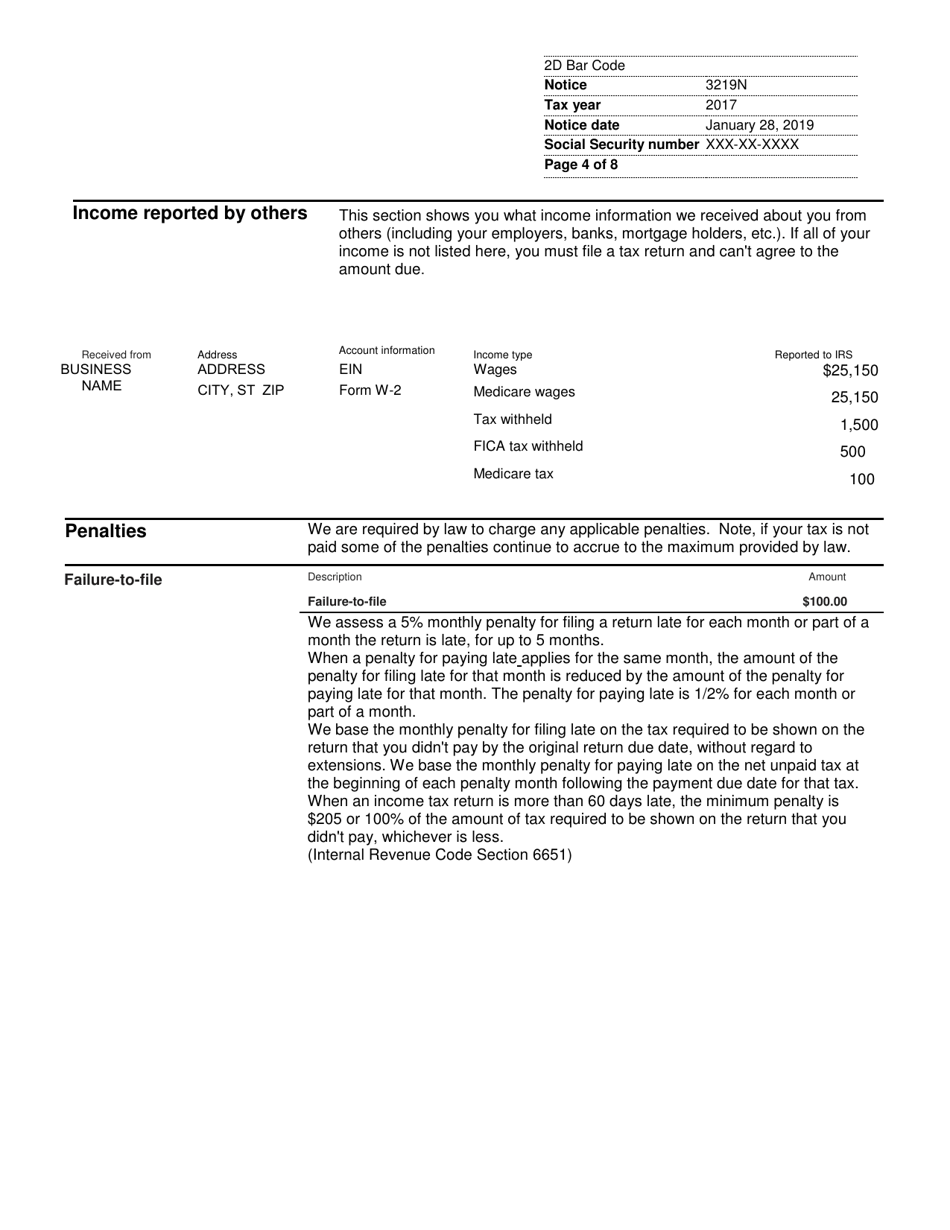

A: IRS Notice CP3219N is a Notice of Deficiency that the IRS sends to inform you of the changes they made to your tax return and the increased amount of tax you owe.

Q: Why did I receive IRS Notice CP3219N?

A: You received IRS Notice CP3219N because the IRS found discrepancies or errors in your tax return, resulting in a deficiency, and they are proposing changes to the original amount of tax you owed.

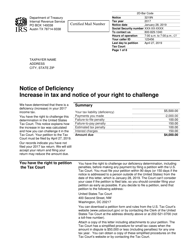

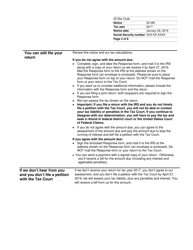

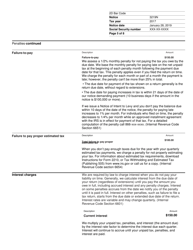

Q: What should I do if I receive IRS Notice CP3219N?

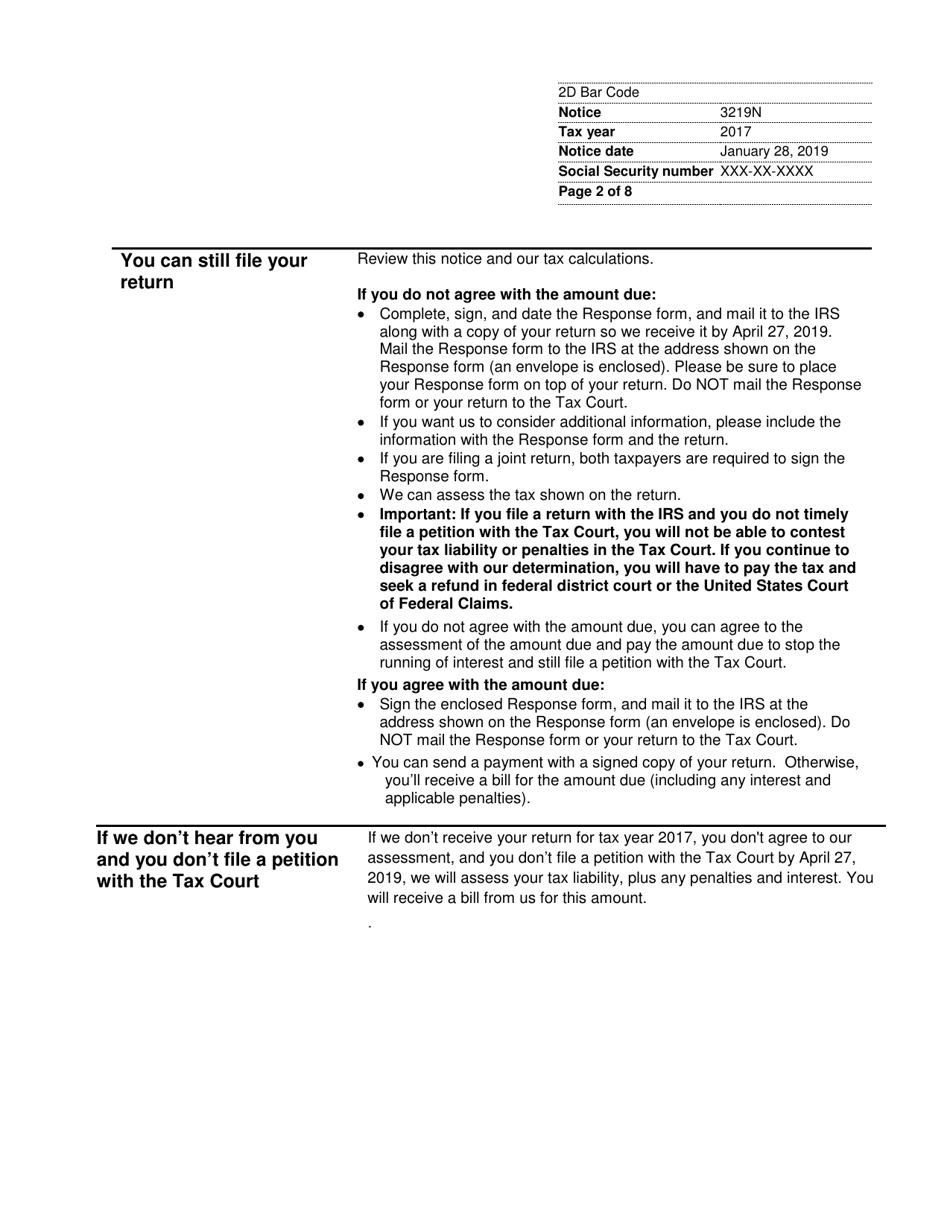

A: If you receive IRS Notice CP3219N, you should carefully review the proposed changes and compare them to your original tax return. You may agree with the changes and the amount owed, or you may disagree and need to file a petition with the Tax Court.

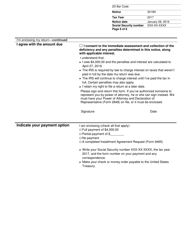

Q: What are my options after receiving IRS Notice CP3219N?

A: After receiving the notice, you have three options: 1) Agree with the changes and pay the additional tax owed, 2) Disagree with the changes and file a petition with the Tax Court, or 3) Do nothing and the IRS will proceed to assess the additional tax.

Q: How long do I have to respond to IRS Notice CP3219N?

A: You generally have 90 days from the date on the notice to respond, either by agreeing with the changes and paying the additional tax, or by filing a petition with the Tax Court if you disagree with the changes.

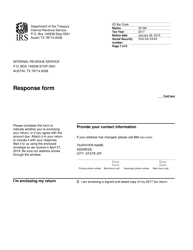

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.