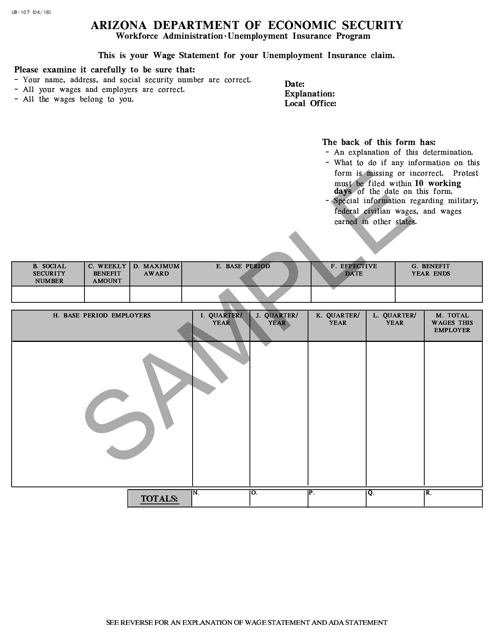

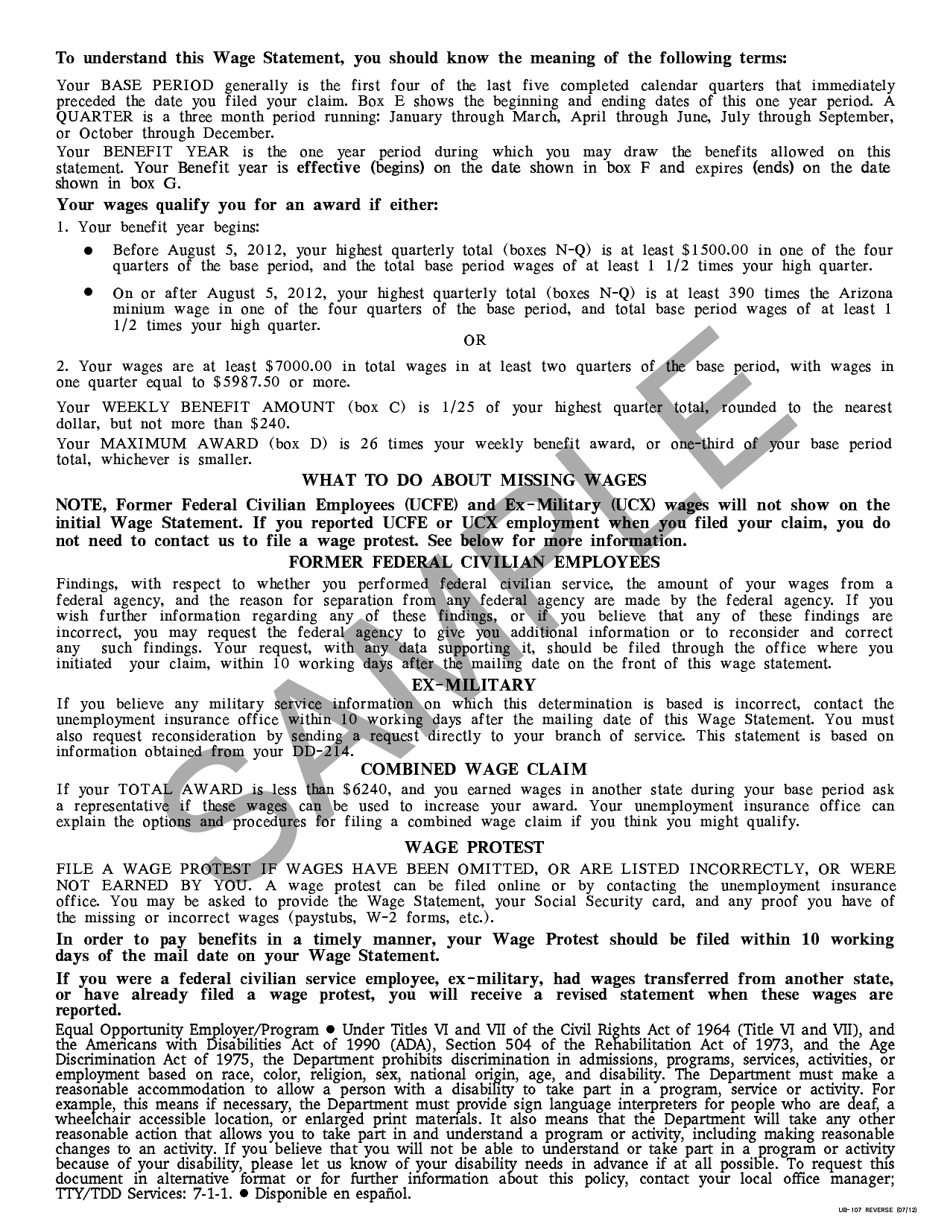

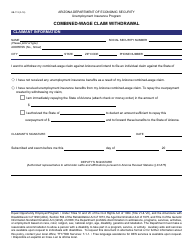

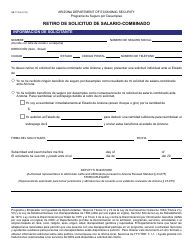

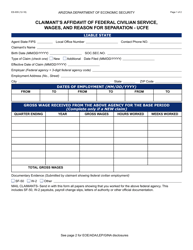

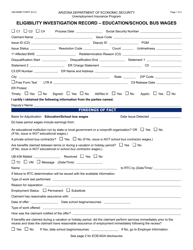

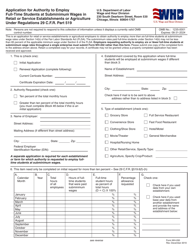

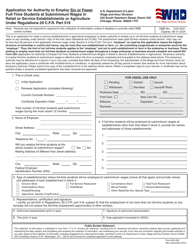

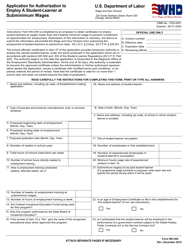

Form UB-107 Wage Statement - Arizona

What Is Form UB-107?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UB-107?

A: Form UB-107 is the wage statement form for the state of Arizona.

Q: Who needs to file Form UB-107?

A: Employers in Arizona are required to file Form UB-107 for each employee.

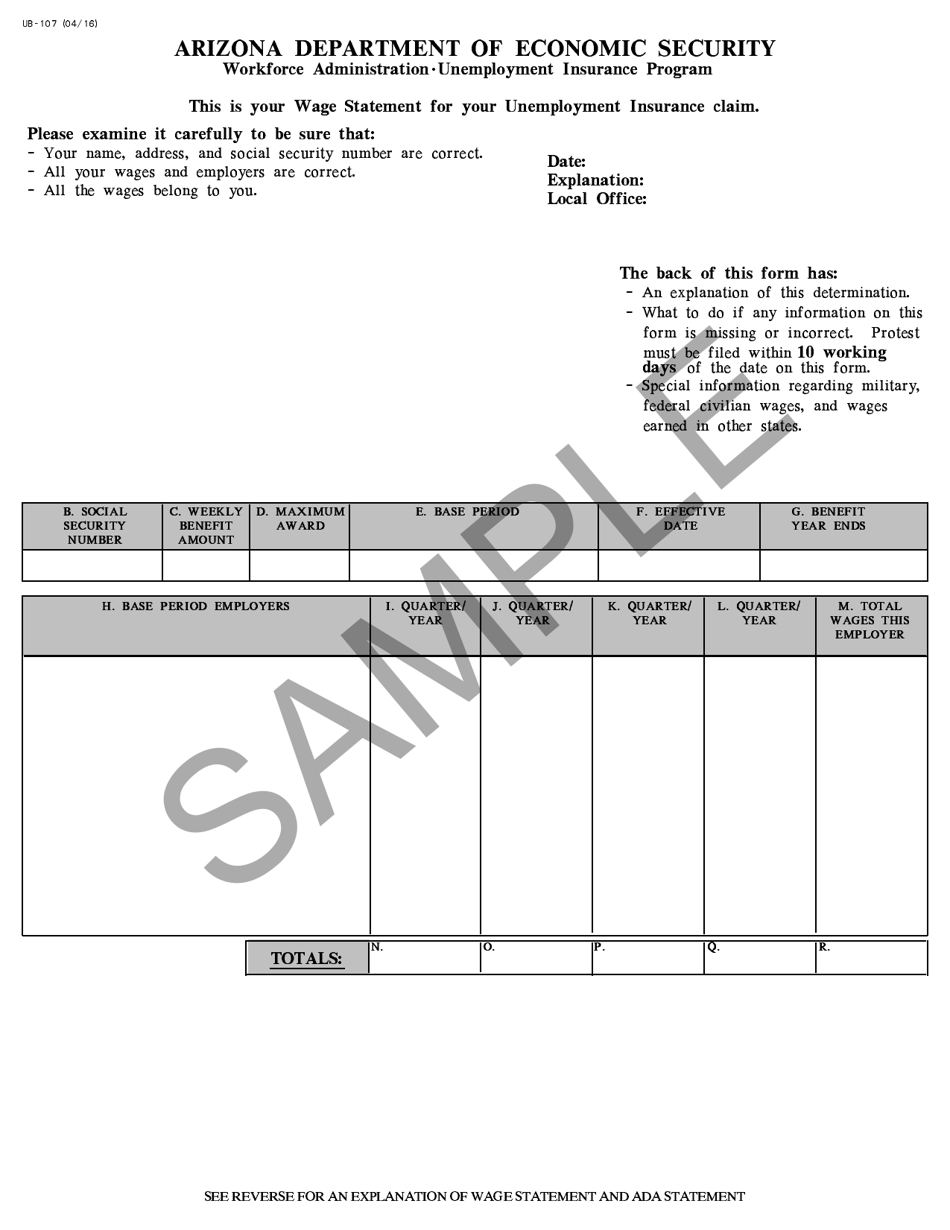

Q: What information is included on Form UB-107?

A: Form UB-107 includes details of an employee's wages, deductions, and taxes.

Q: When is Form UB-107 due?

A: Form UB-107 is due on or before January 31 of the year following the calendar year in which the wages were paid.

Q: Is Form UB-107 the same as Form W-2?

A: No, Form UB-107 is specific to the state of Arizona and is used to report wage information to the state. Form W-2 is used to report wage information to the federal government.

Q: Are there any penalties for not filing Form UB-107?

A: Yes, failure to file Form UB-107 or filing it late can result in penalties and fines.

Q: Do employees need to receive a copy of Form UB-107?

A: Yes, employers are required to provide employees with a copy of Form UB-107.

Q: Can Form UB-107 be filed electronically?

A: Yes, Arizona allows electronic filing of Form UB-107.

Q: Is Form UB-107 required for all employees, including part-time and temporary workers?

A: Yes, Form UB-107 is required for all employees regardless of their employment status.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UB-107 by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.