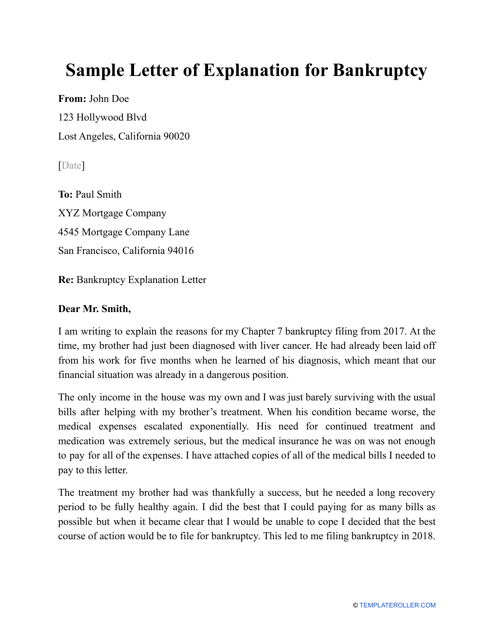

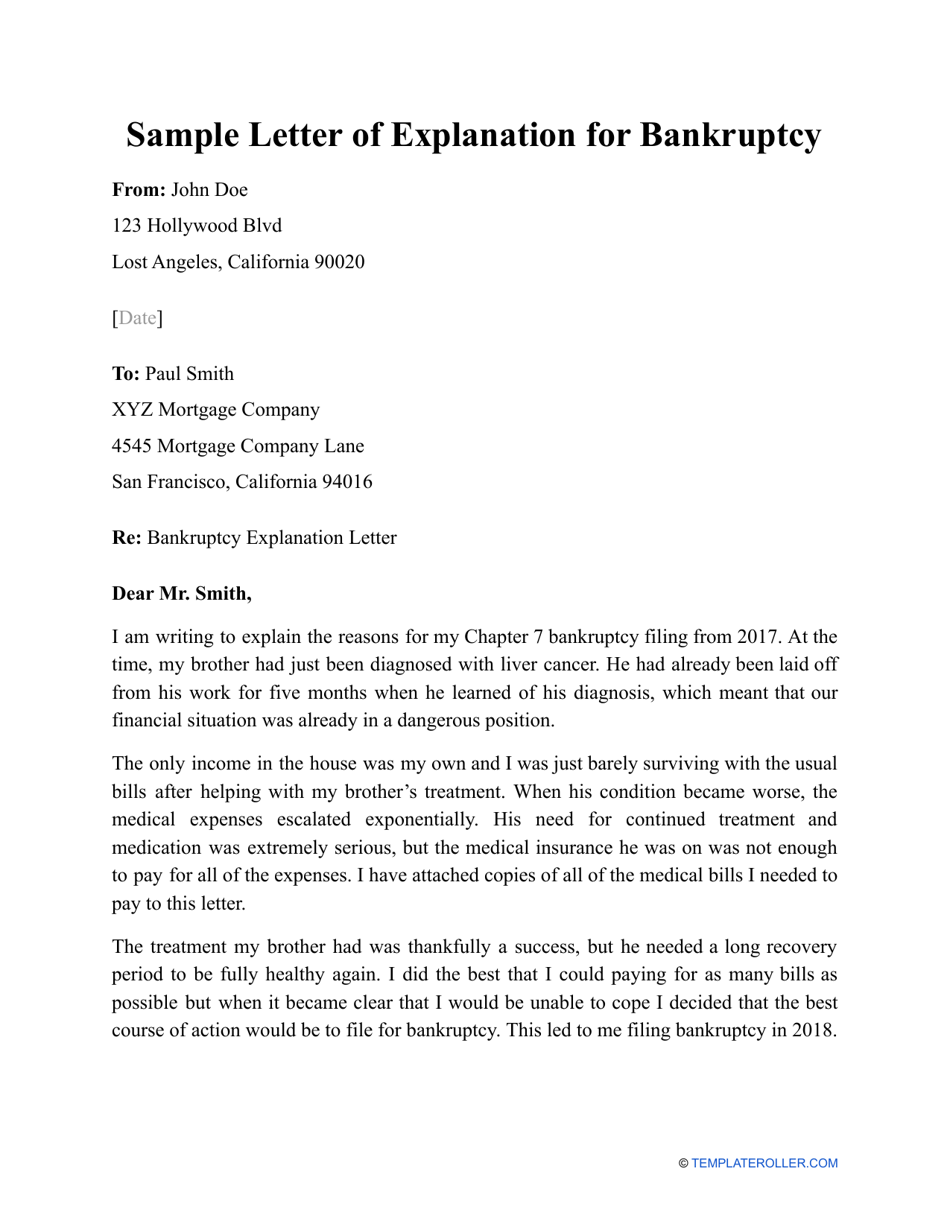

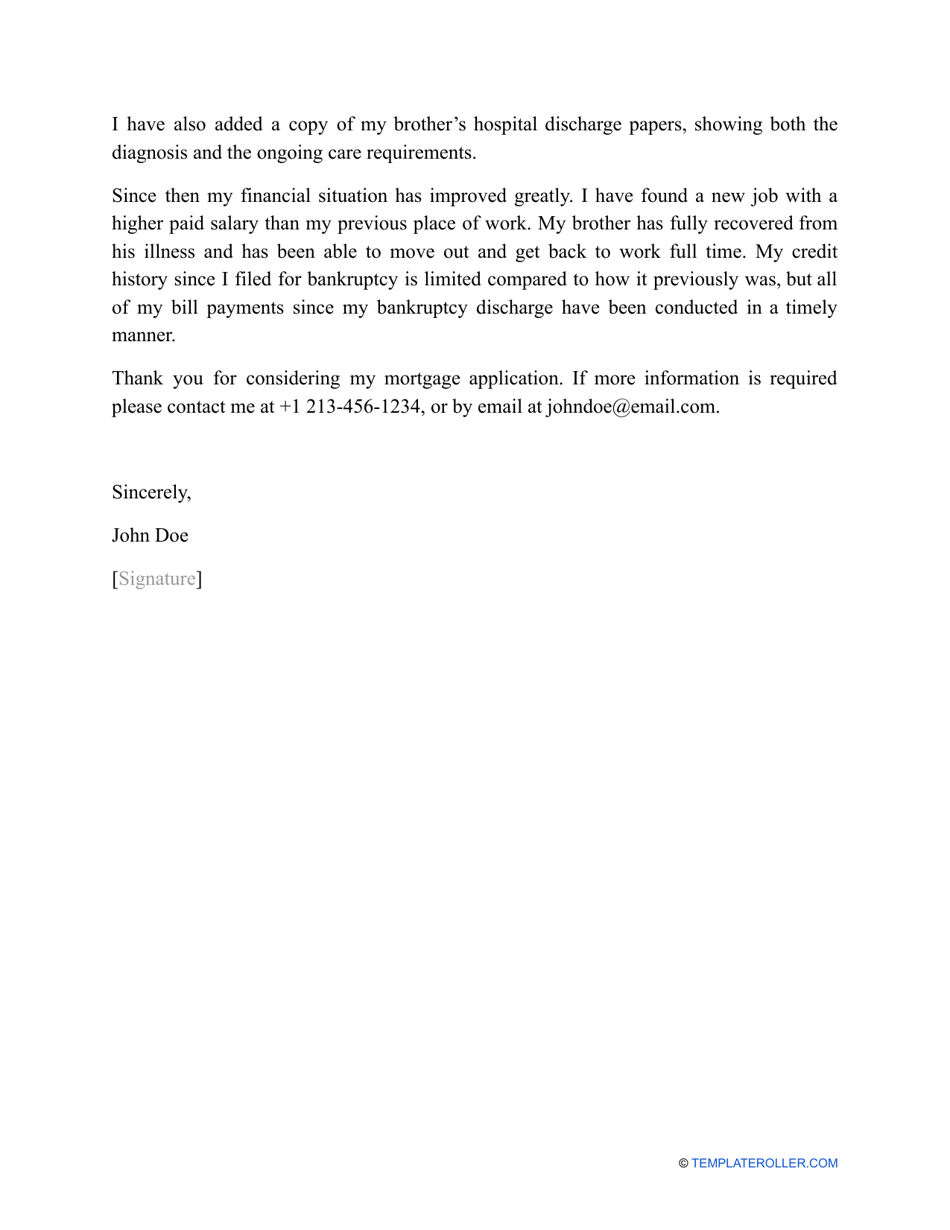

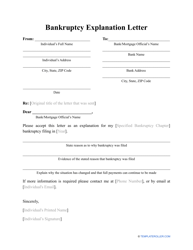

Sample Letter of Explanation for Bankruptcy

What Is a Letter of Explanation for Bankruptcy?

A Letter of Explanation for Bankruptcy is a statement prepared by a borrower and sent to the potential lender to clarify why they had to file for bankruptcy in the past. When you apply for a loan or want to obtain a credit card, your lender will check your creditworthiness, and if you were insolvent before, they may ask you to provide an explanation of the situation - or you may submit this document in advance before any questions are even asked. Whether you suffered a business failure or simply could not control your debts and resorted to bankruptcy, you need to show the lender it is all in the past and you have a stable source of income.

Download a Letter of Explanation for Bankruptcy template through the link below.

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy. You need to be convincing enough so that the representative of the financial institution understands the bankruptcy was a long time ago and you have rectified all financial issues that have caused it. Indicate how your current financial situation differs and offer proof - attach pay stubs, tax returns, bank and financial statements (from the bankruptcy timeline and most recent) to show you have been living within your financial means. Support the letter by enclosing documentation that confirms your hardships are behind you - for instance, if you were declared insolvent because you were fired or ill, attach documents that prove your successful employment and a clean bill of health.

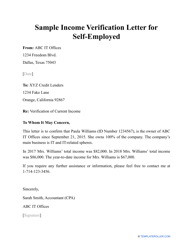

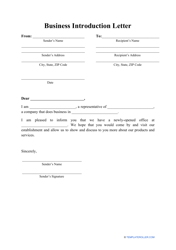

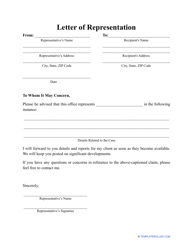

Related Letter Templates: