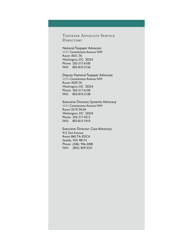

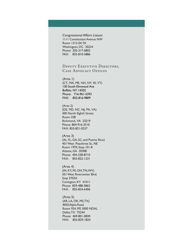

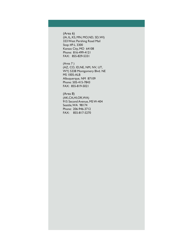

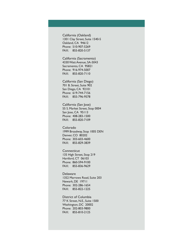

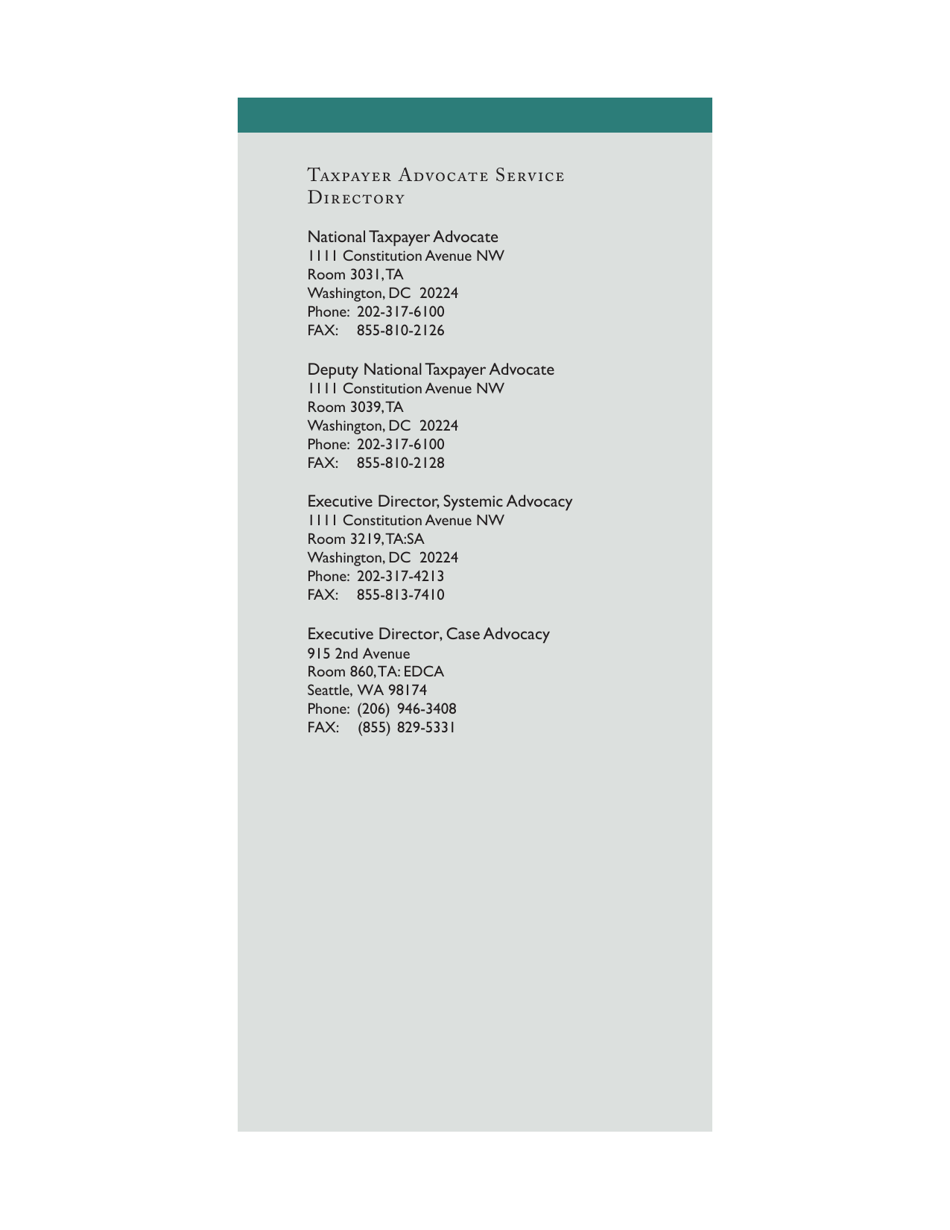

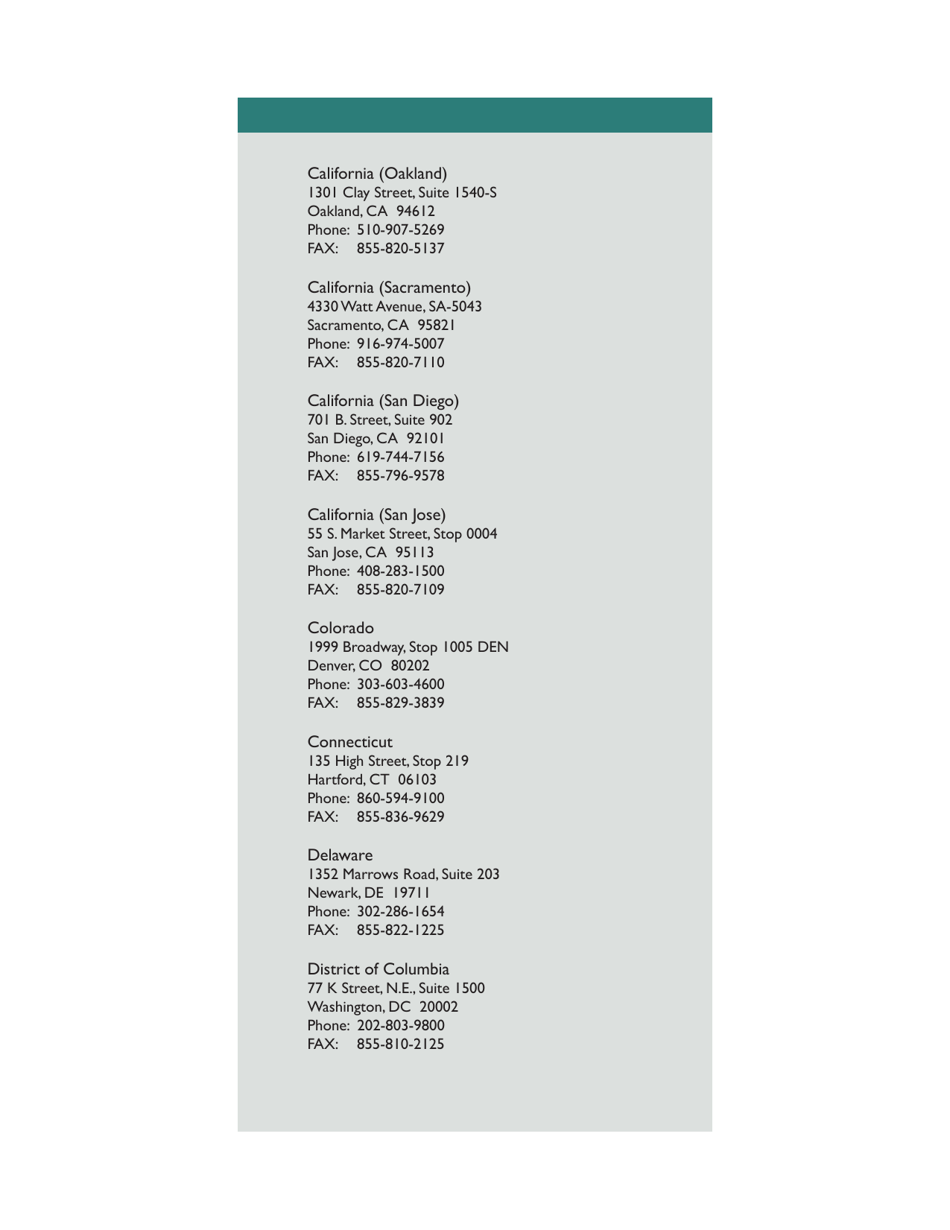

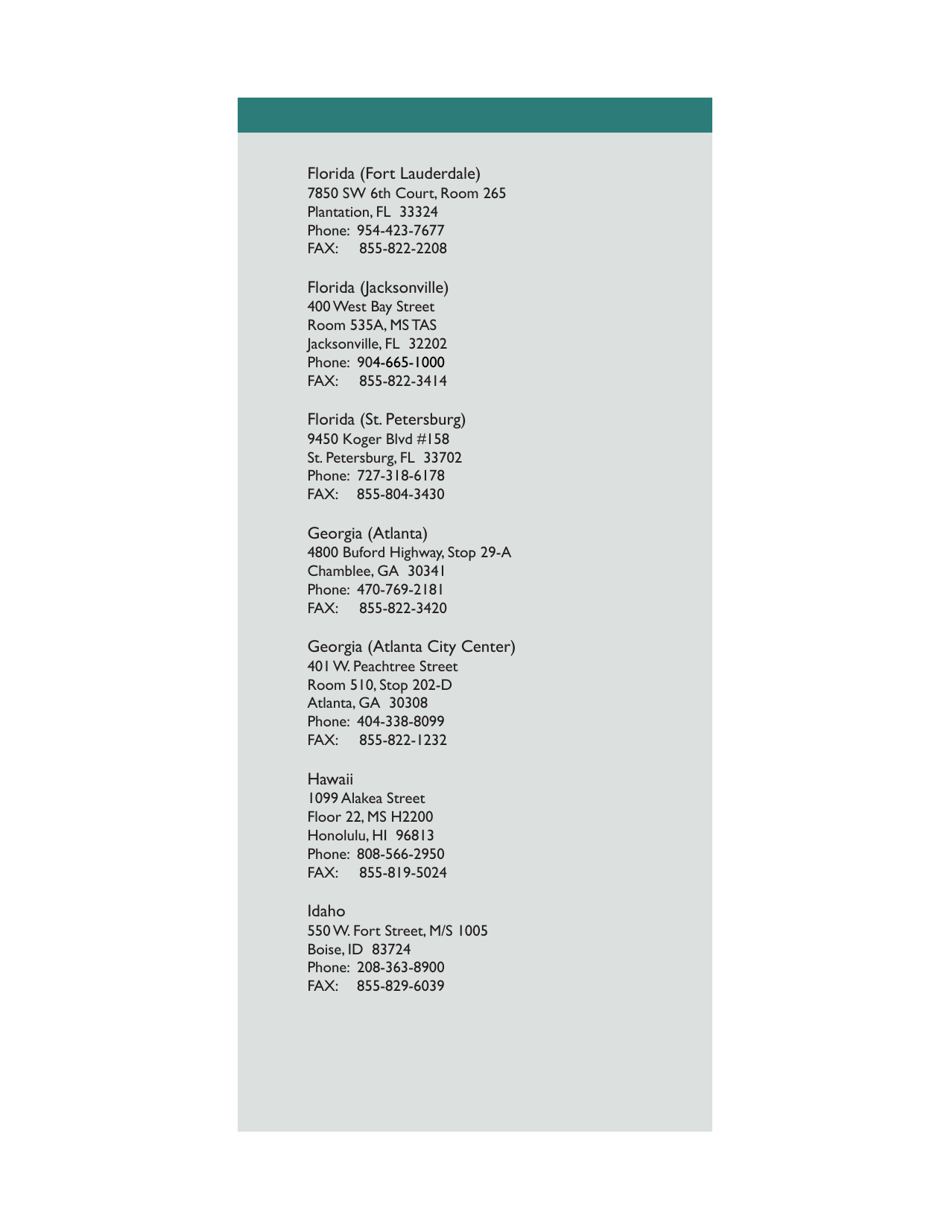

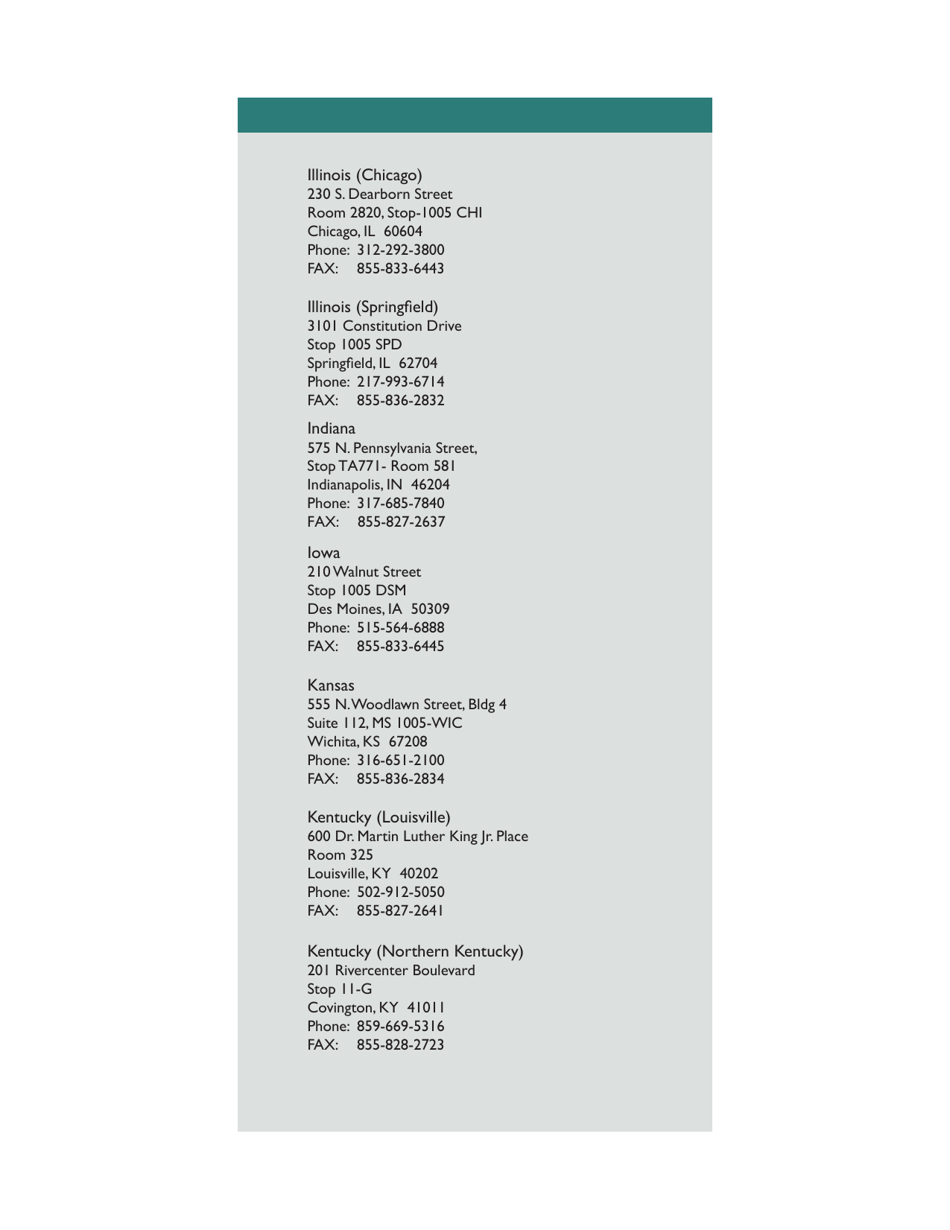

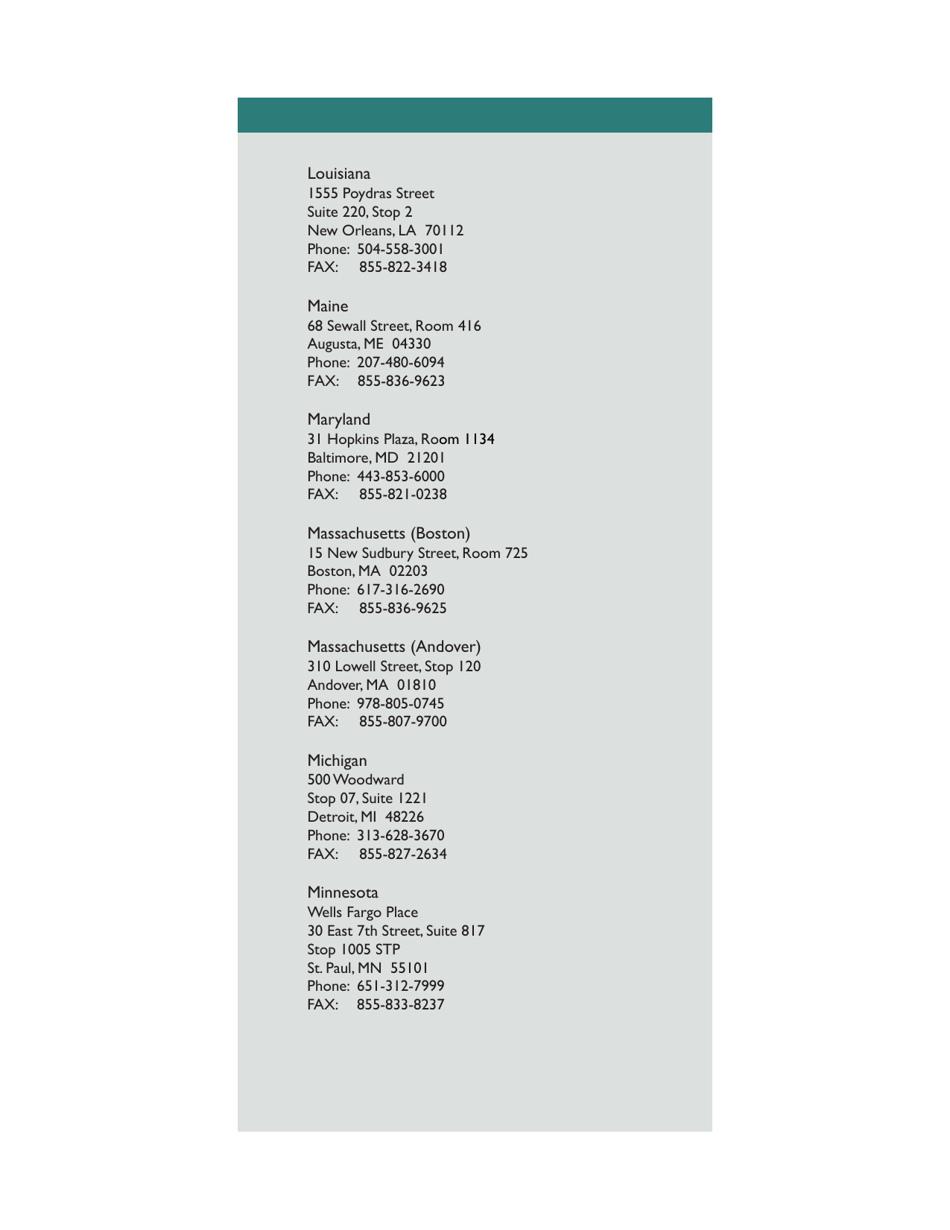

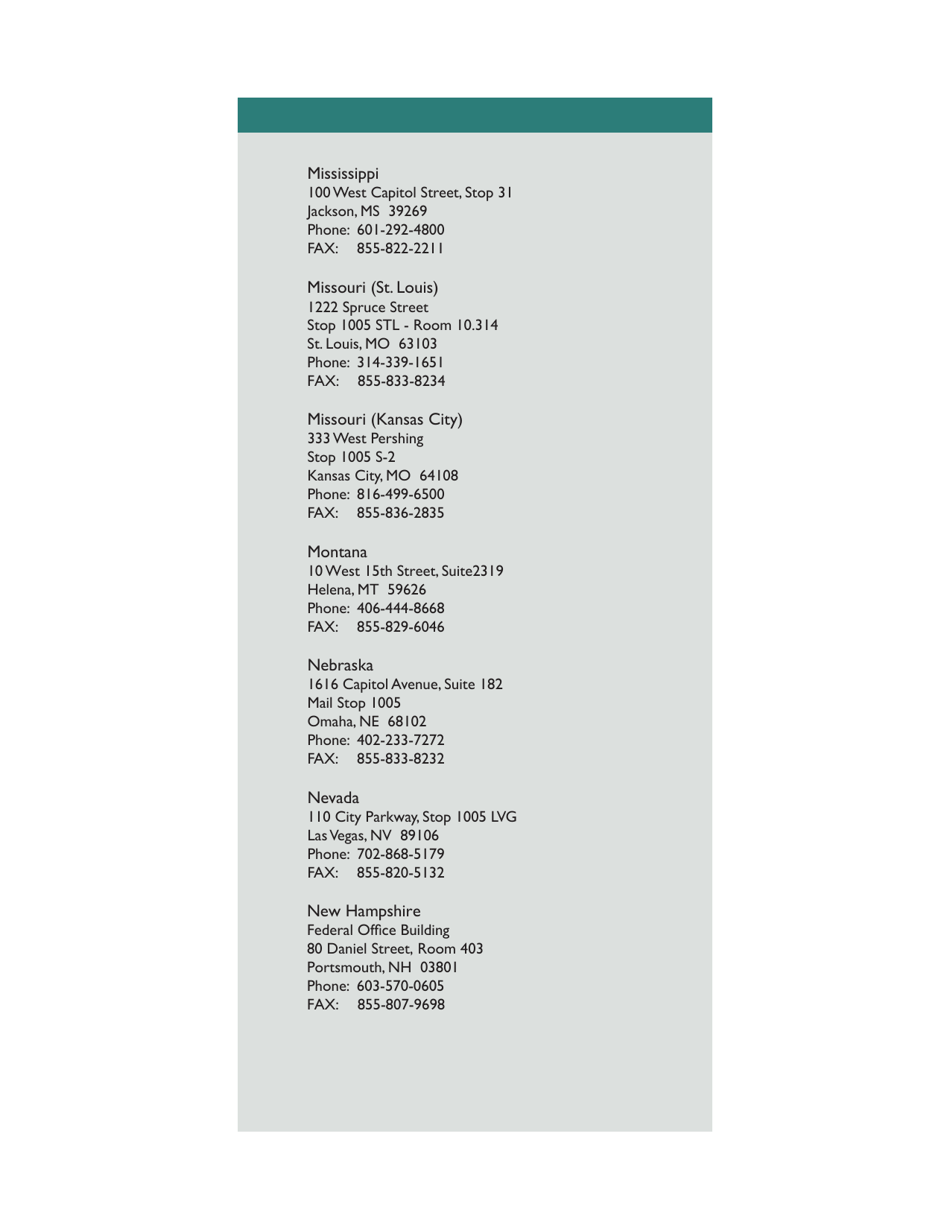

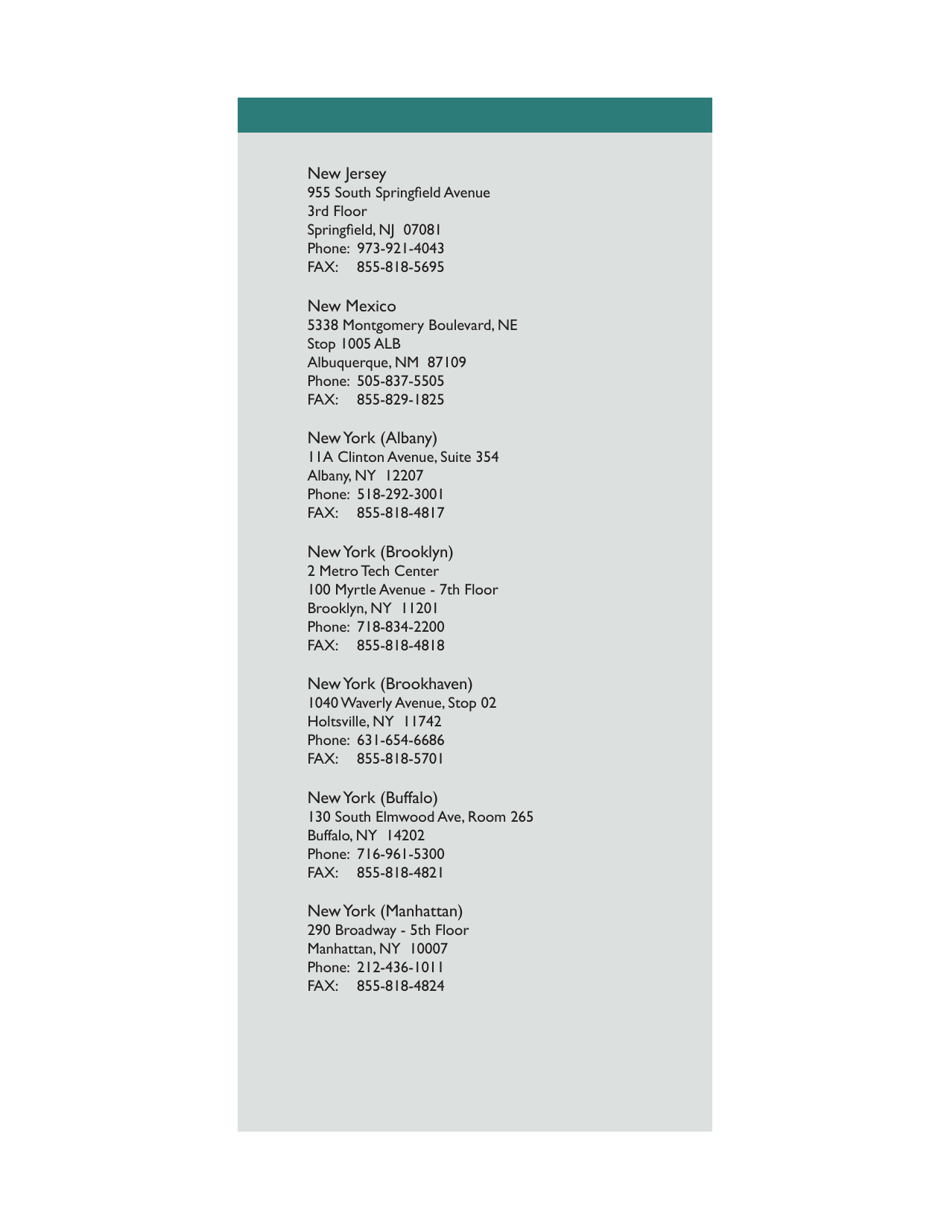

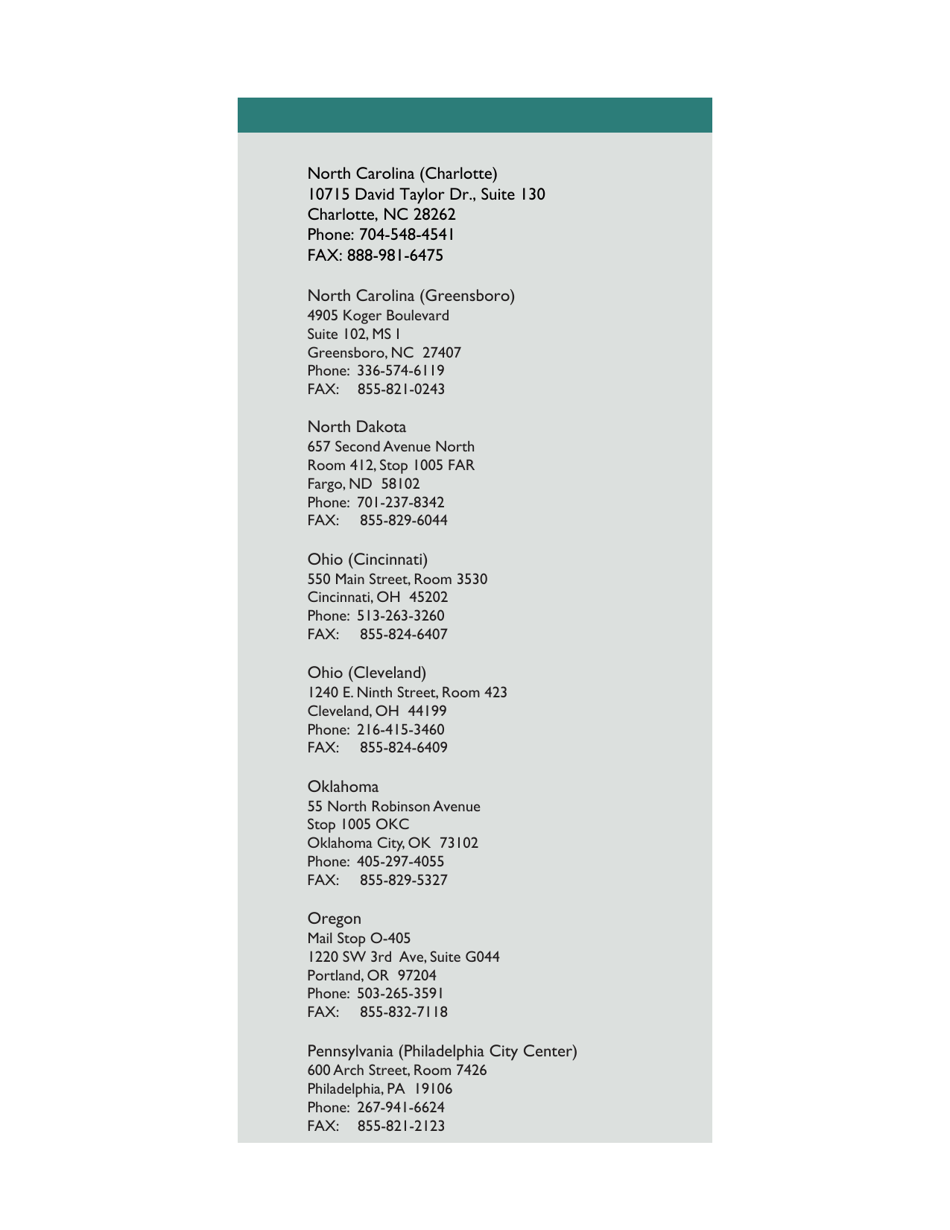

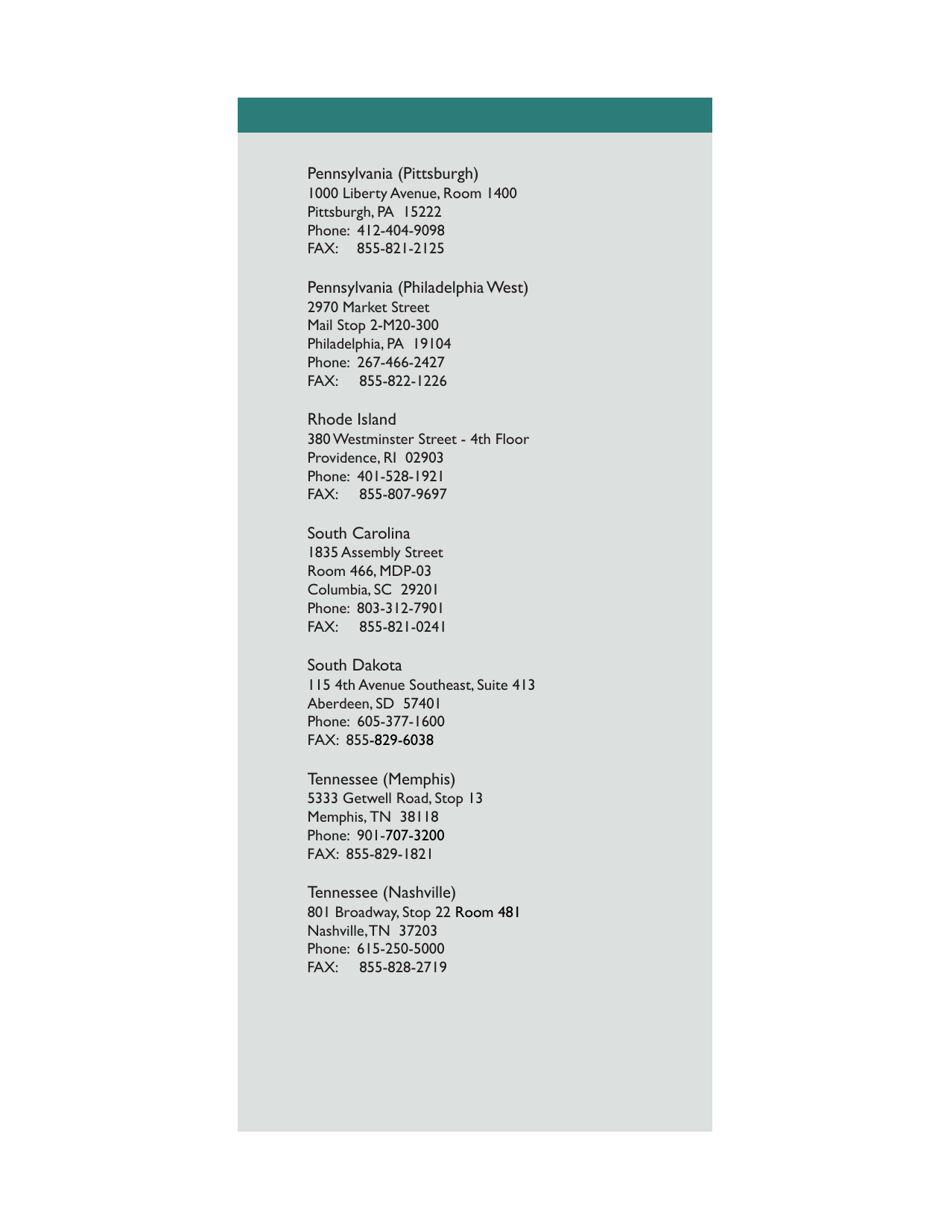

IRS Publication 1546 - the Taxpayer Advocate Service Is Here to Help

IRS Publication 1546 - the Taxpayer Advocate Service Is Here to Help is a 24-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2019.

FAQ

Q: What is IRS Publication 1546?

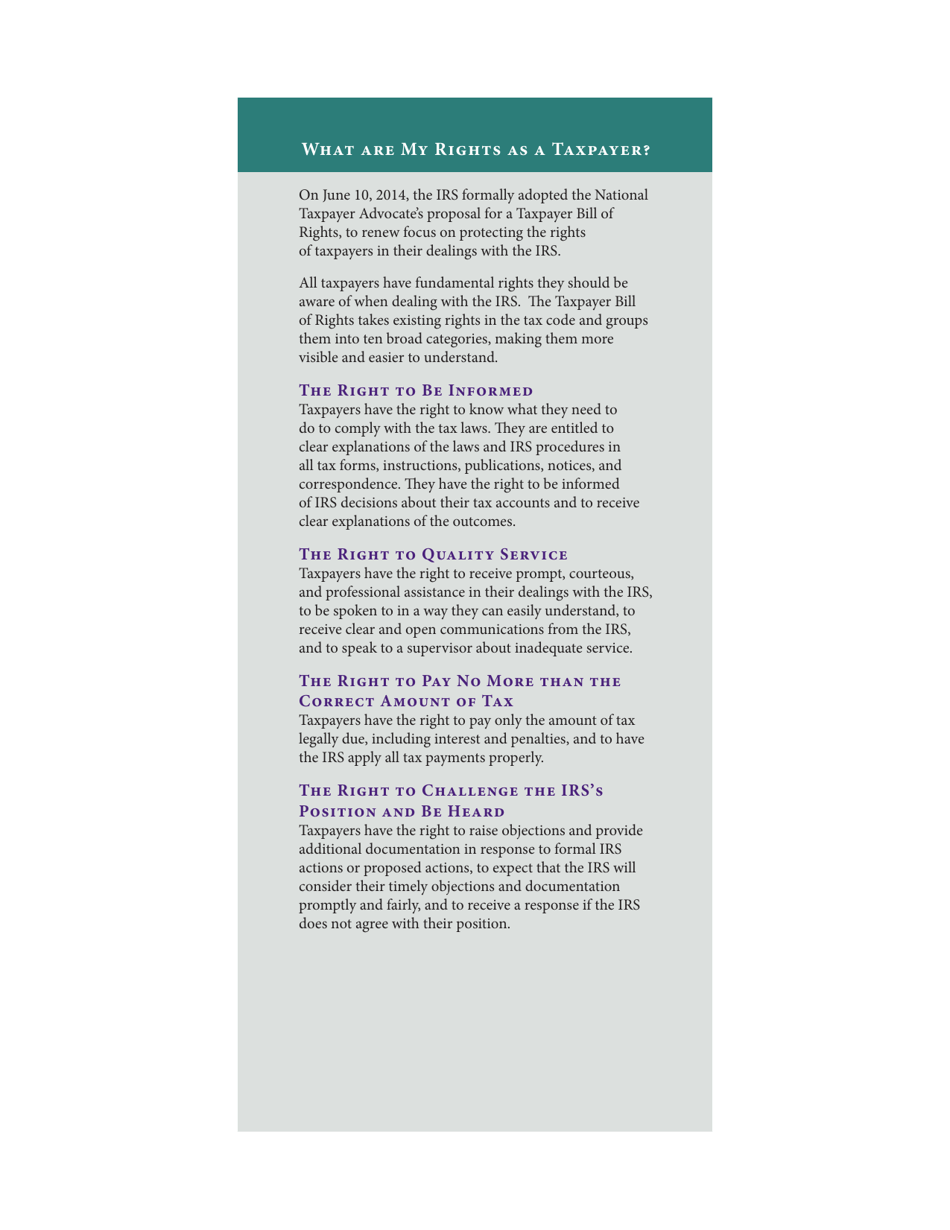

A: IRS Publication 1546 is a document that provides information about the Taxpayer Advocate Service.

Q: What is the Taxpayer Advocate Service?

A: The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers resolve tax problems.

Q: What does the Taxpayer Advocate Service do?

A: The Taxpayer Advocate Service assists taxpayers in resolving their tax issues, ensuring they are treated fairly by the IRS.

Q: Is the Taxpayer Advocate Service free?

A: Yes, the services provided by the Taxpayer Advocate Service are free of charge.

Q: Who qualifies for assistance from the Taxpayer Advocate Service?

A: Any taxpayer who is experiencing a significant hardship due to the IRS actions or inaction may qualify for assistance.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.