IRS Publication 1546 - the Taxpayer Advocate Service Is Here to Help

IRS Publication 1546 - the Taxpayer Advocate Service Is Here to Help is a 4-page tax-related document that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2011.

FAQ

Q: What is IRS Publication 1546?

A: IRS Publication 1546 is a document.

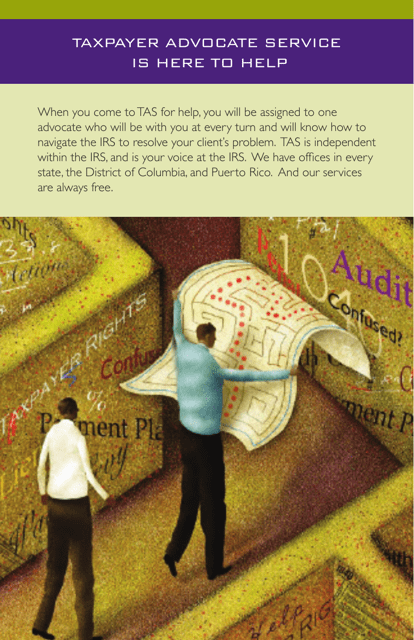

Q: What is the Taxpayer Advocate Service?

A: The Taxpayer Advocate Service is a department that helps taxpayers with their tax issues.

Q: How can the Taxpayer Advocate Service help me?

A: The Taxpayer Advocate Service can help you with tax problems you haven't been able to resolve with the IRS.

Q: How can I contact the Taxpayer Advocate Service?

A: You can contact the Taxpayer Advocate Service by phone, mail, or in person.

Q: Is the assistance from the Taxpayer Advocate Service free?

A: Yes, the assistance from the Taxpayer Advocate Service is free.

Q: Are there any eligibility requirements to receive help from the Taxpayer Advocate Service?

A: No, there are no eligibility requirements to receive help from the Taxpayer Advocate Service.

Form Details:

- Available for download in PDF;

- Actual and valid for 2023;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of the form through the link below or browse more documents in our library of IRS Forms.