Cancellation of Insurance Policy Letter Template

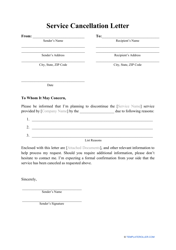

What Is a Cancellation of Insurance Policy Letter?

A Cancellation of Insurance Policy Letter is a type of Cancellation Letter prepared by the insured individual who no longer needs insurance coverage from their insurance company.

Alternate Name:

- Letter to Cancel Insurance.

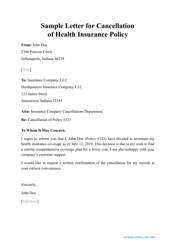

Whether you have found an insurer with better rates, sold your vehicle or residence, or are not satisfied with the service offered by your current insurance provider, you are within your rights to terminate the policy at any time. Download a printable Cancellation of Insurance Policy Letter template through the link below.

How to Request a Letter of Cancellation of Insurance Policy?

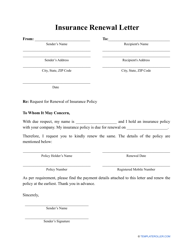

Read your policy carefully to see if there are any terms regarding the cancellation and notification of your insurance provider. Usually, there are instructions that explain how to cancel the policy, when to submit a notice, and to whom the letter should be addressed. If there are no specific instructions, you may call your insurer or visit their office to ask if they have any specific procedures and templates for this purpose or you can provide your own letter.

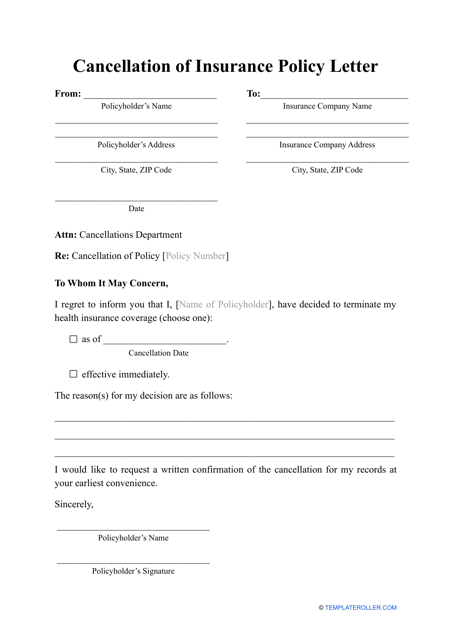

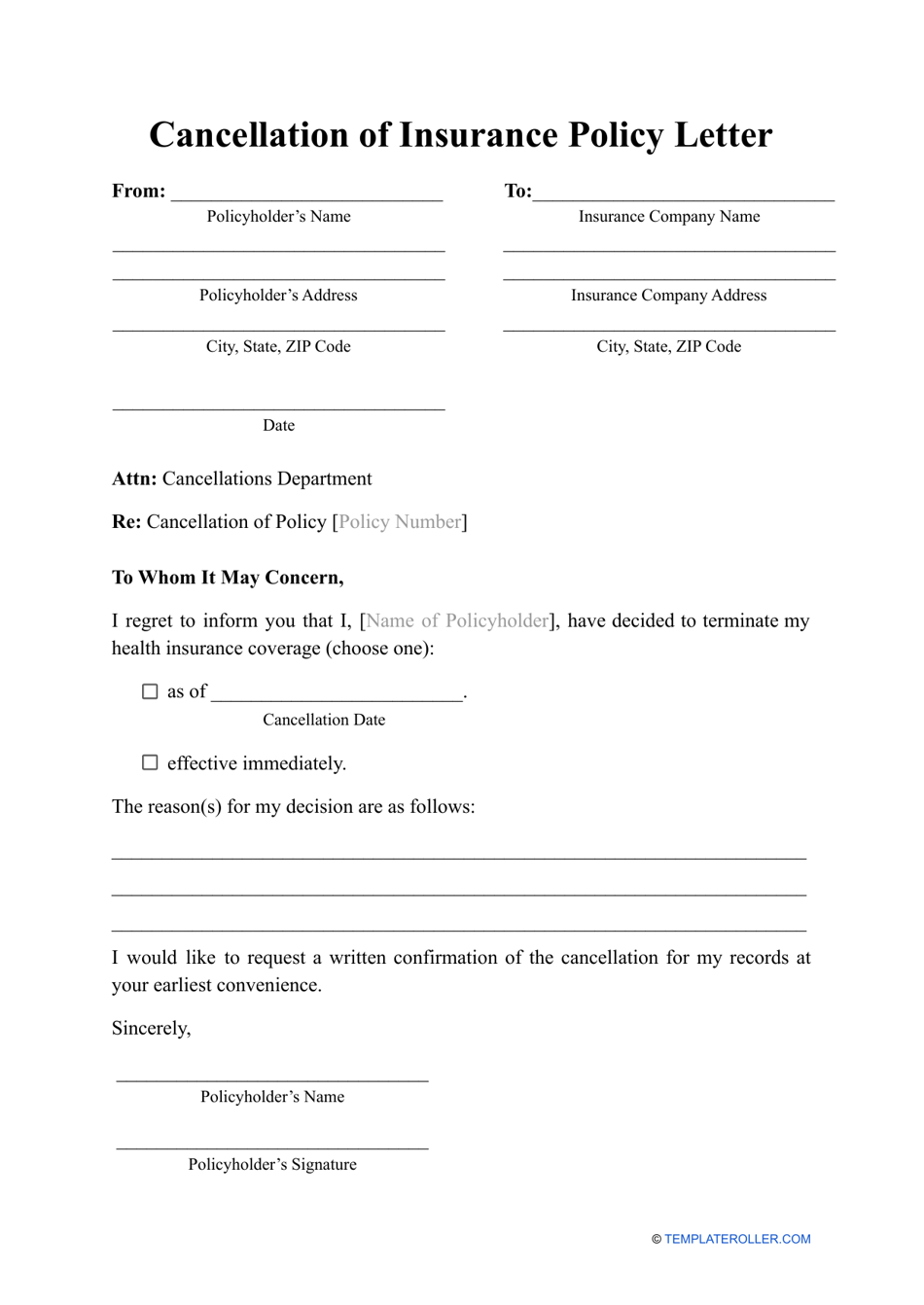

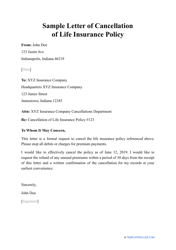

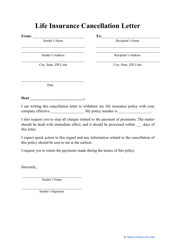

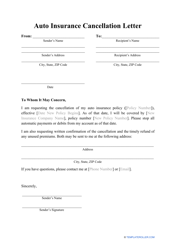

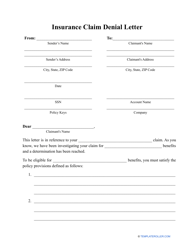

How to Write a Letter of Cancellation of Insurance Policy?

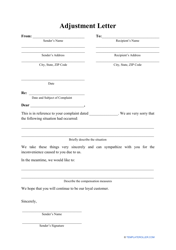

A Cancellation of Insurance Policy Letter should contain the following information:

- Write down the name and address of the insurance company. Indicate the department if necessary.

- Specify the current date. Add your name as it is written on your insurance policy, number, and period of the policy.

- Announce your request to cancel the policy mentioned above. Specify the date you want the cancellation to become effective. If you wish, you may state the reason for cancelation.

- Request the return of unused premiums or portions. Recall the insurer's authorization to withdraw money from your account.

- Ask for a written confirmation regarding the cancellation within a reasonable period of time - a month would be enough.

- Provide your contact information so that the insurance provider can contact you for any questions and concerns.

- Thank the addressee and sign your name.

It is highly recommended to send your Cancellation of Insurance Policy Letter letter via certified mail and keep a copy of the letter for your records in case there will be disagreements or disputes in the future.

How to Write an Appeal Letter to Insurance Company for Cancellation of Policy for Nonpayment?

If your policy was canceled for nonpayment, you have to get in touch with the insurer as soon as you can. An insurer is usually willing to work something out if the client tells them what is going on. Write a formal letter and ask them what you can do to keep your policy effective. If you have specific reasons why you did not pay, for instance, illness or death in the family, a hospital stay, or sudden financial problems, explain these circumstances in full detail and ask the insurance provider to reconsider.

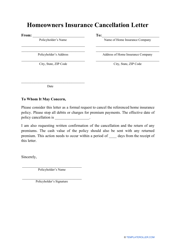

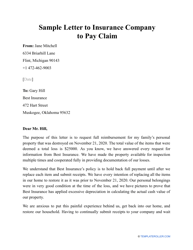

Check out these related letter templates: