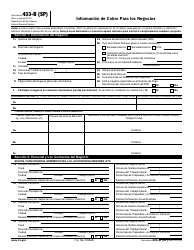

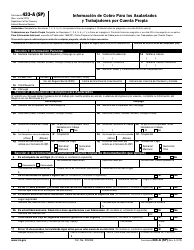

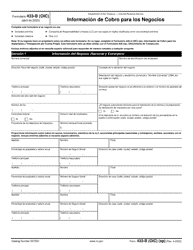

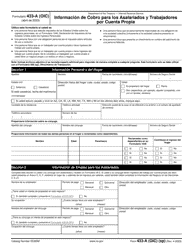

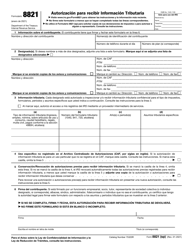

This version of the form is not currently in use and is provided for reference only. Download this version of

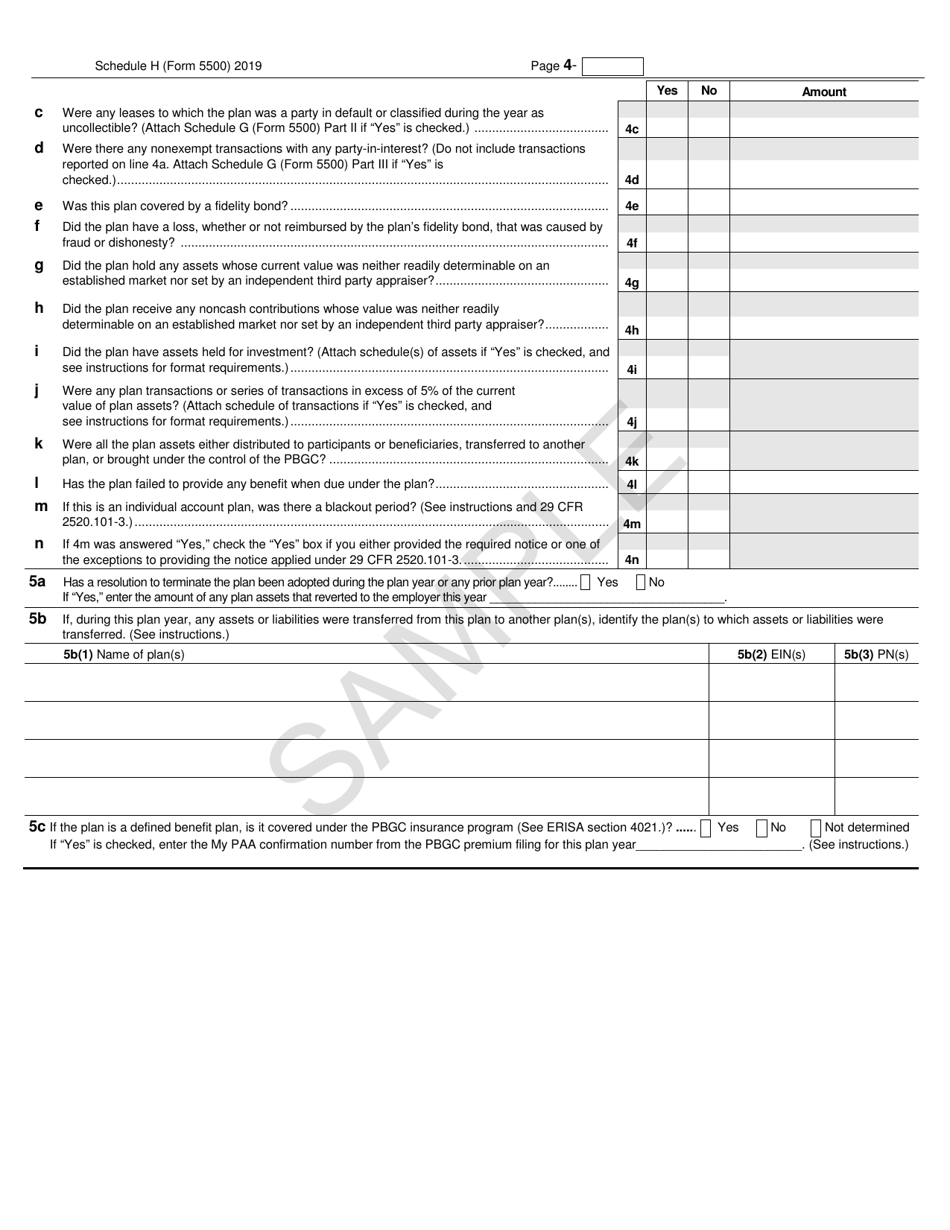

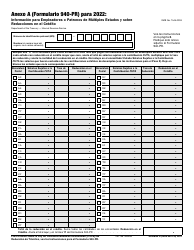

Form 5500 Schedule H

for the current year.

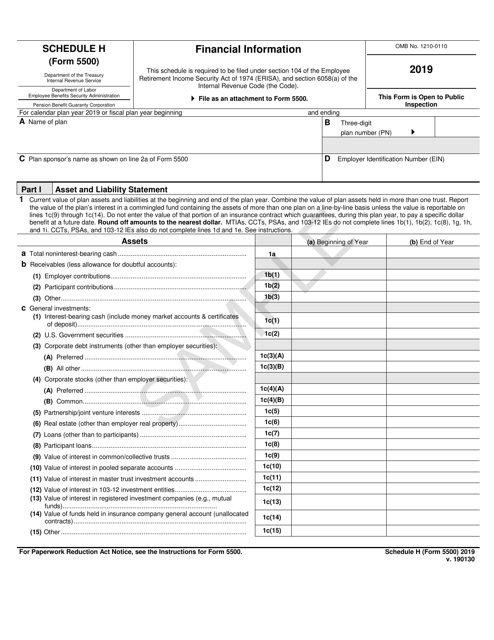

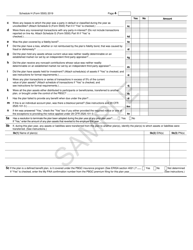

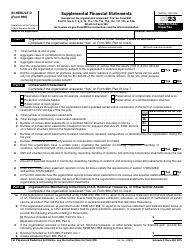

Form 5500 Schedule H Financial Information

What Is IRS Form 5500 Schedule H?

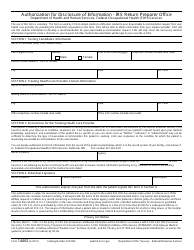

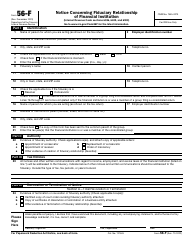

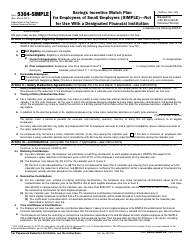

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500?

A: IRS Form 5500 is a tax form used for reporting information about employee benefit plans.

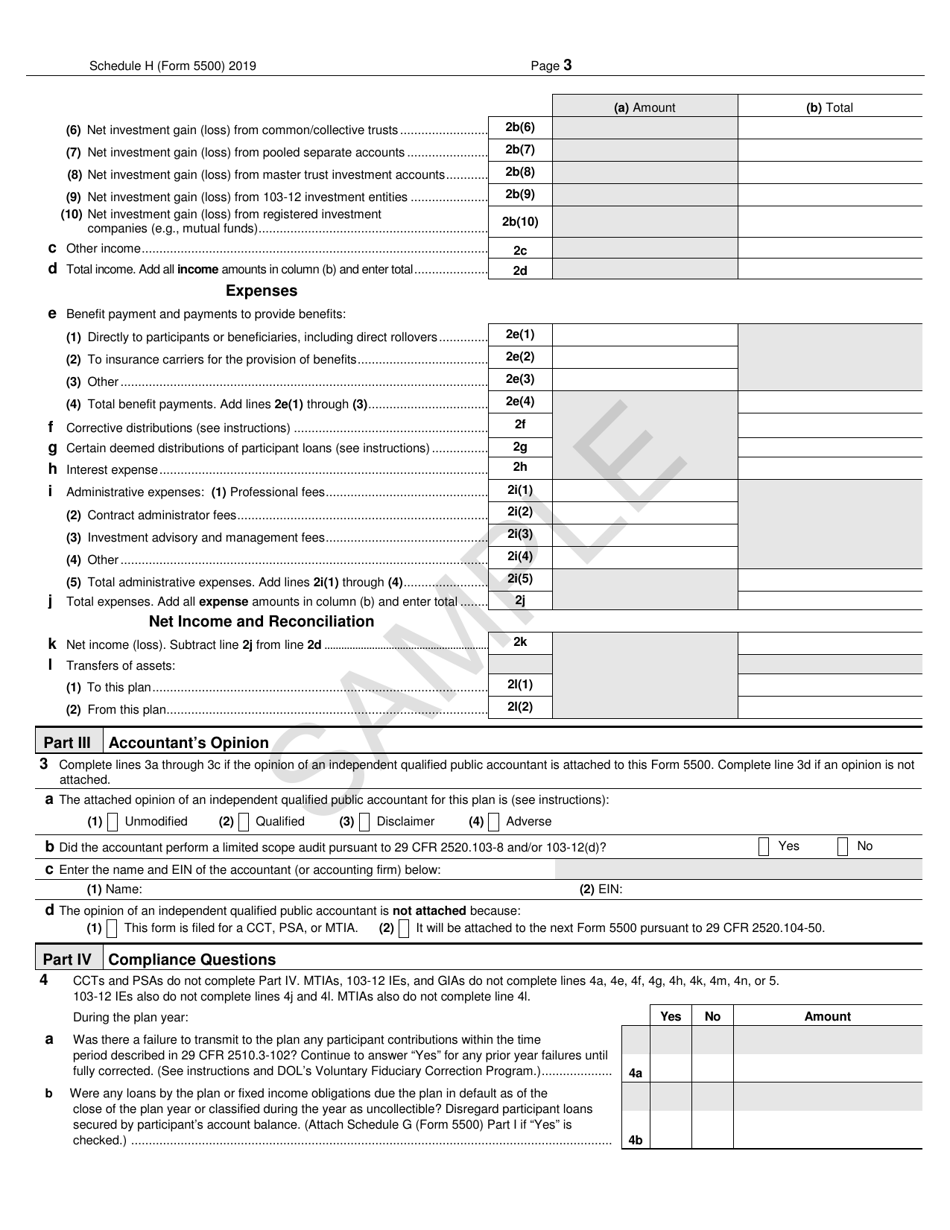

Q: What is Schedule H of Form 5500?

A: Schedule H is a section of Form 5500 used to report financial information related to employee benefit plans.

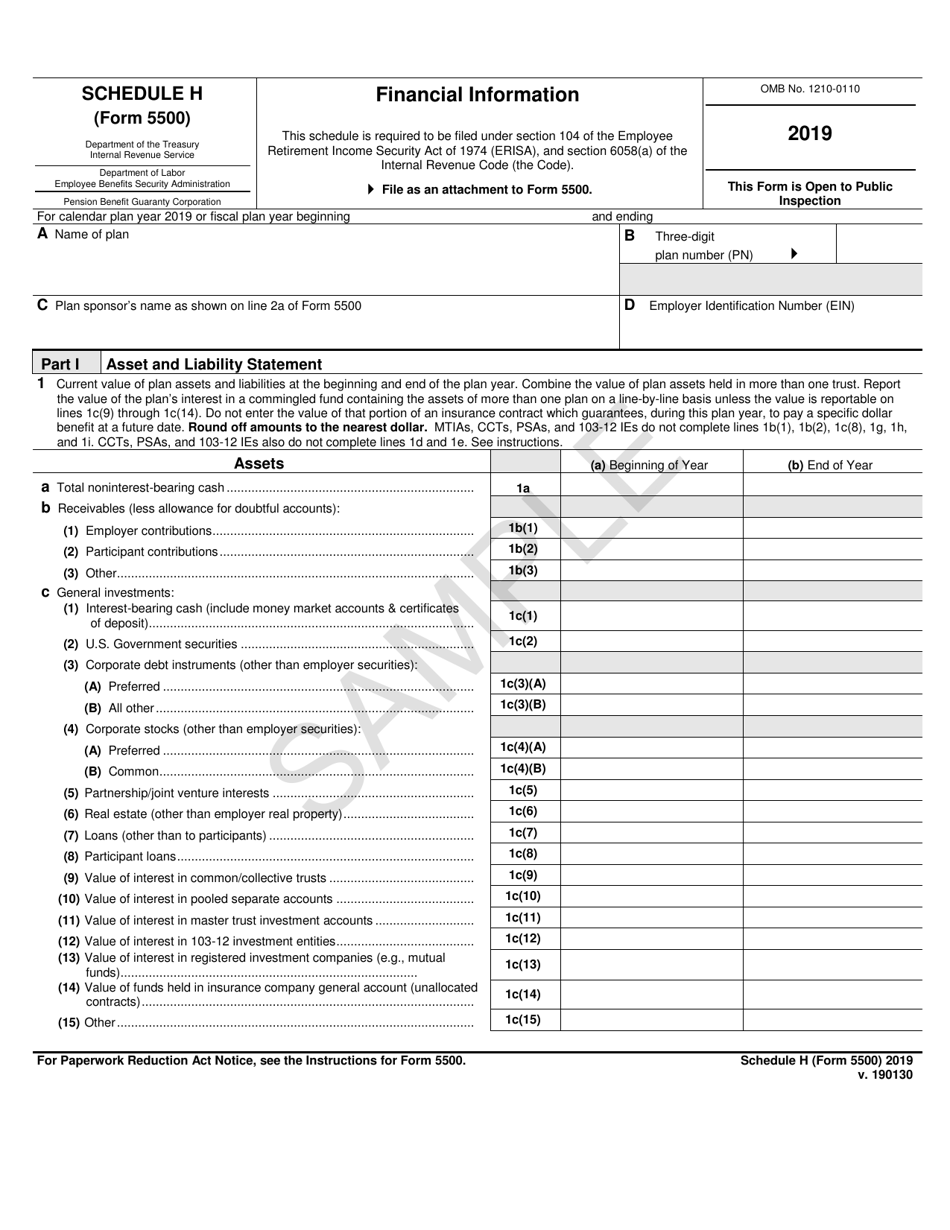

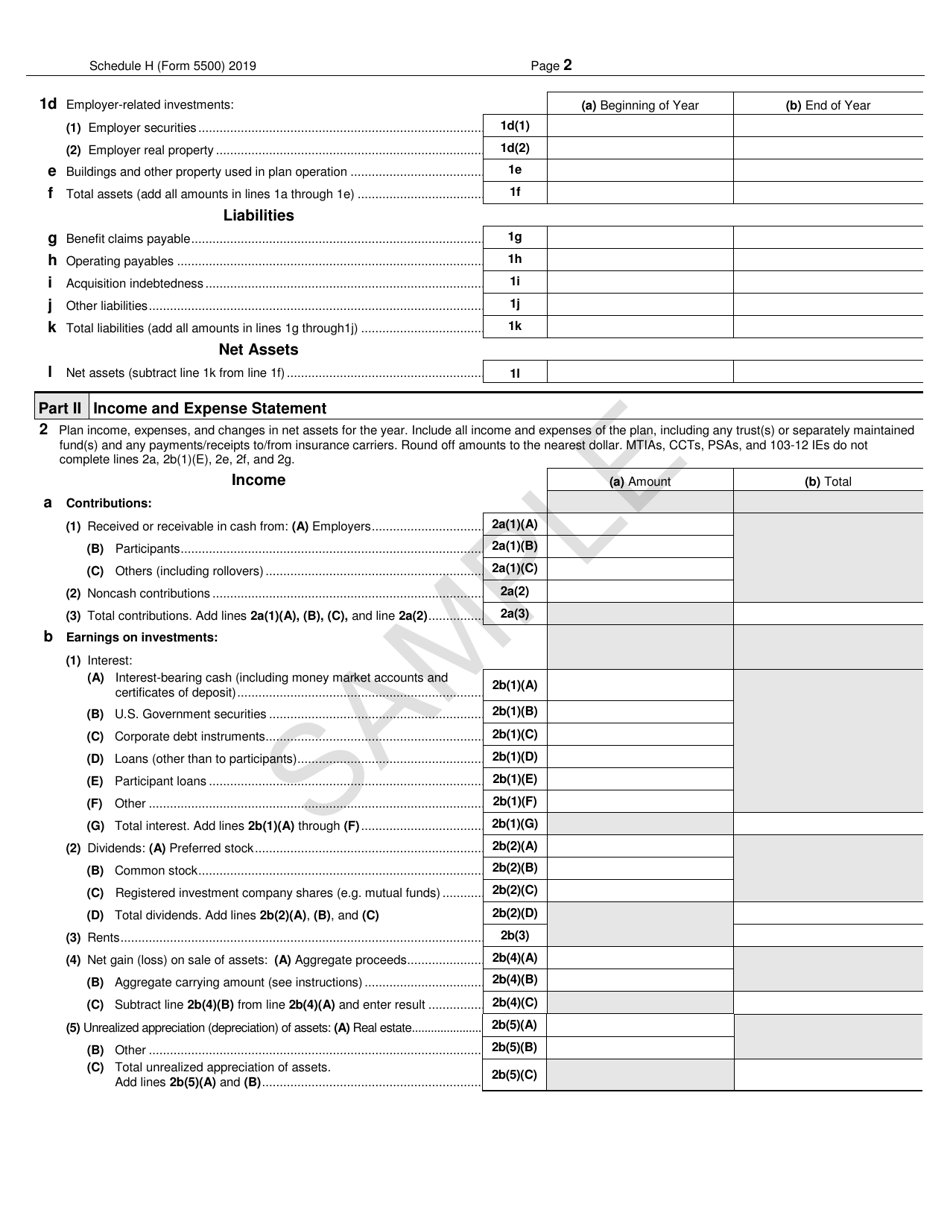

Q: What kind of financial information is required on Schedule H?

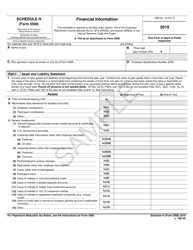

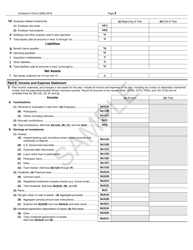

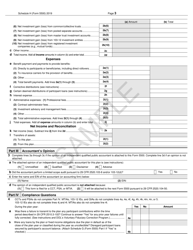

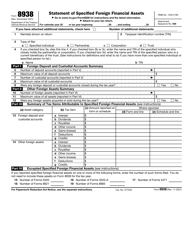

A: Schedule H requires information on the plan's assets, income, expenses, and investments.

Q: Who is required to file Form 5500?

A: Employers who sponsor certain employee benefit plans, such as pension plans and health plans, are required to file Form 5500.

Q: Why is it important to file Form 5500?

A: Filing Form 5500 ensures that employee benefit plans are in compliance with federal reporting requirements and provides transparency about the plan's financial operations.

Q: Are there any penalties for not filing Form 5500?

A: Yes, there are penalties for failing to file Form 5500, including potential fines and sanctions imposed by the IRS.

Q: Can I get an extension to file Form 5500?

A: Yes, you can request an extension to file Form 5500 by filing Form 5558 with the IRS.

Q: Do I need to include any attachments with Schedule H?

A: Yes, you may need to attach additional schedules or statements to provide more detailed information about the plan's financial activities.

Q: Is Schedule H the only section of Form 5500?

A: No, Form 5500 has multiple sections, including Schedule A, Form 5500-SF, and various attached schedules and statements based on the type of employee benefit plan.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule H through the link below or browse more documents in our library of IRS Forms.