This version of the form is not currently in use and is provided for reference only. Download this version of

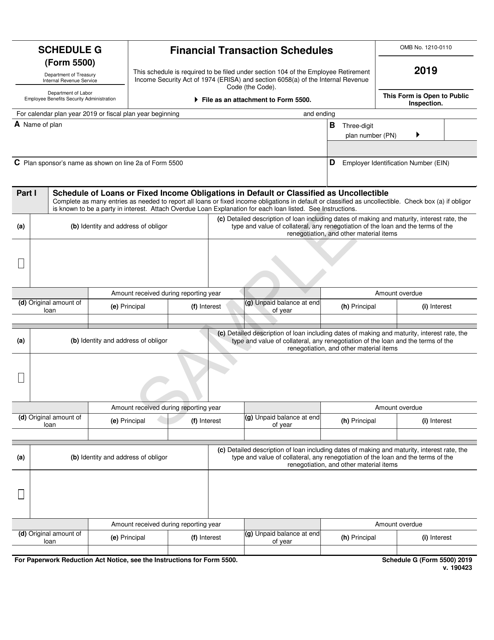

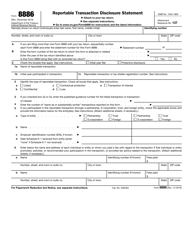

Form 5500 Schedule G

for the current year.

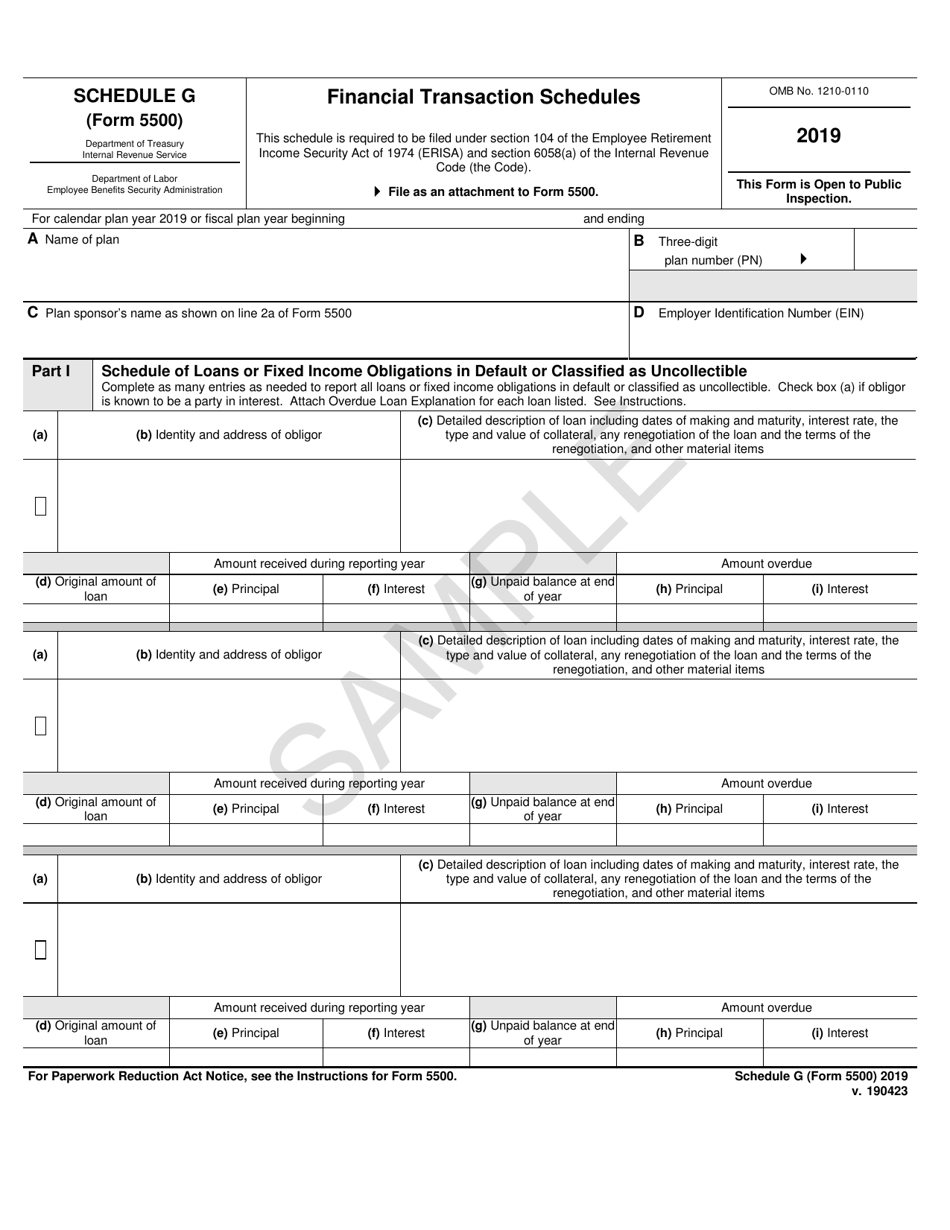

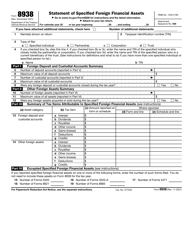

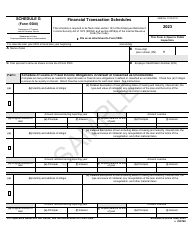

Form 5500 Schedule G Financial Transaction Schedules

What Is IRS Form 5500 Schedule G?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500 Schedule G?

A: IRS Form 5500 Schedule G is a financial transaction schedule for employee benefit plans.

Q: Who is required to file IRS Form 5500 Schedule G?

A: Employee benefit plans that meet certain criteria are required to file IRS Form 5500 Schedule G.

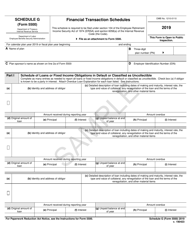

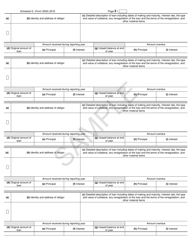

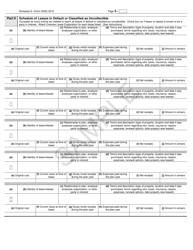

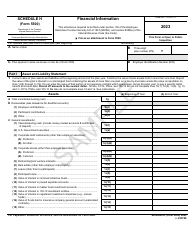

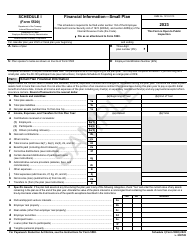

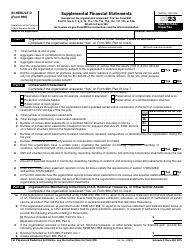

Q: What information is covered in IRS Form 5500 Schedule G?

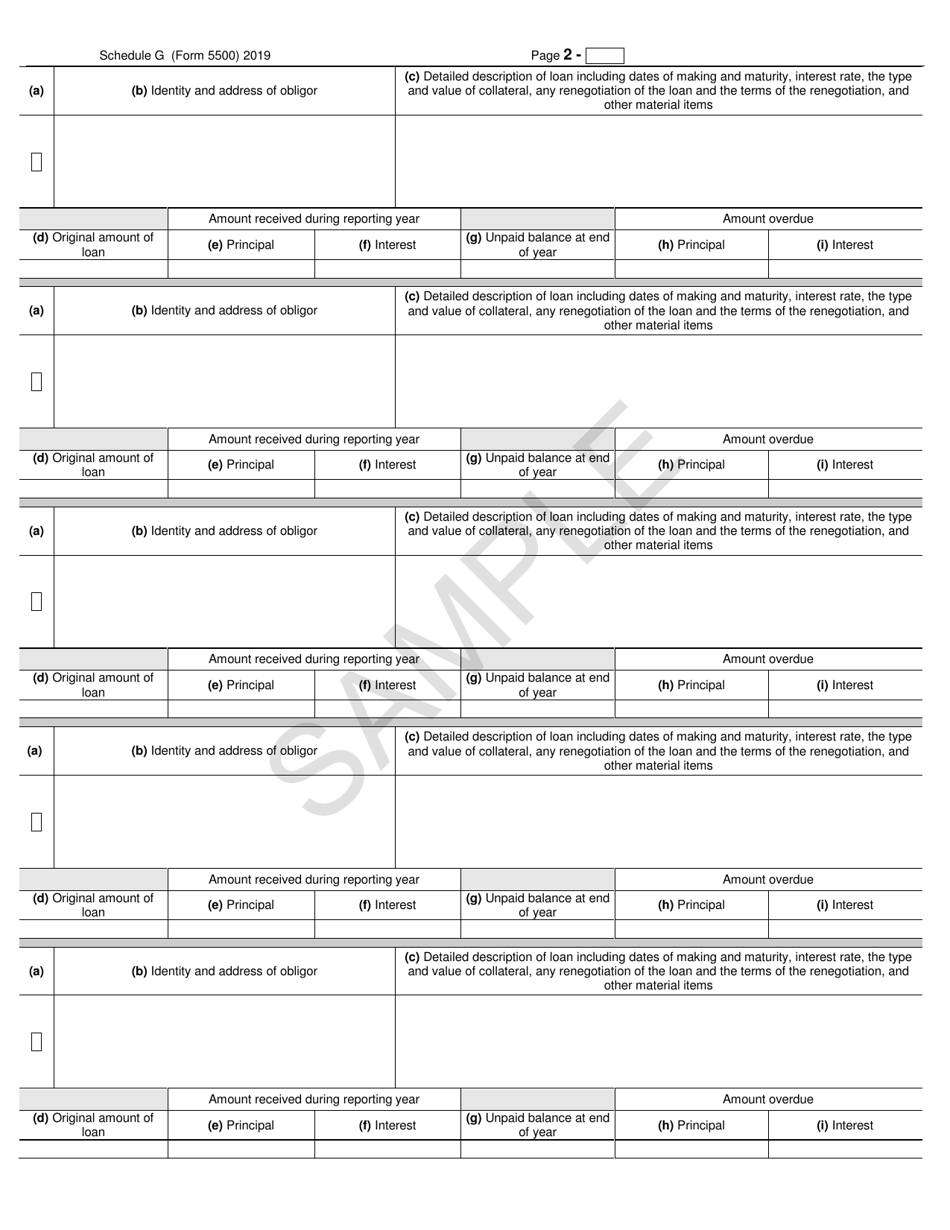

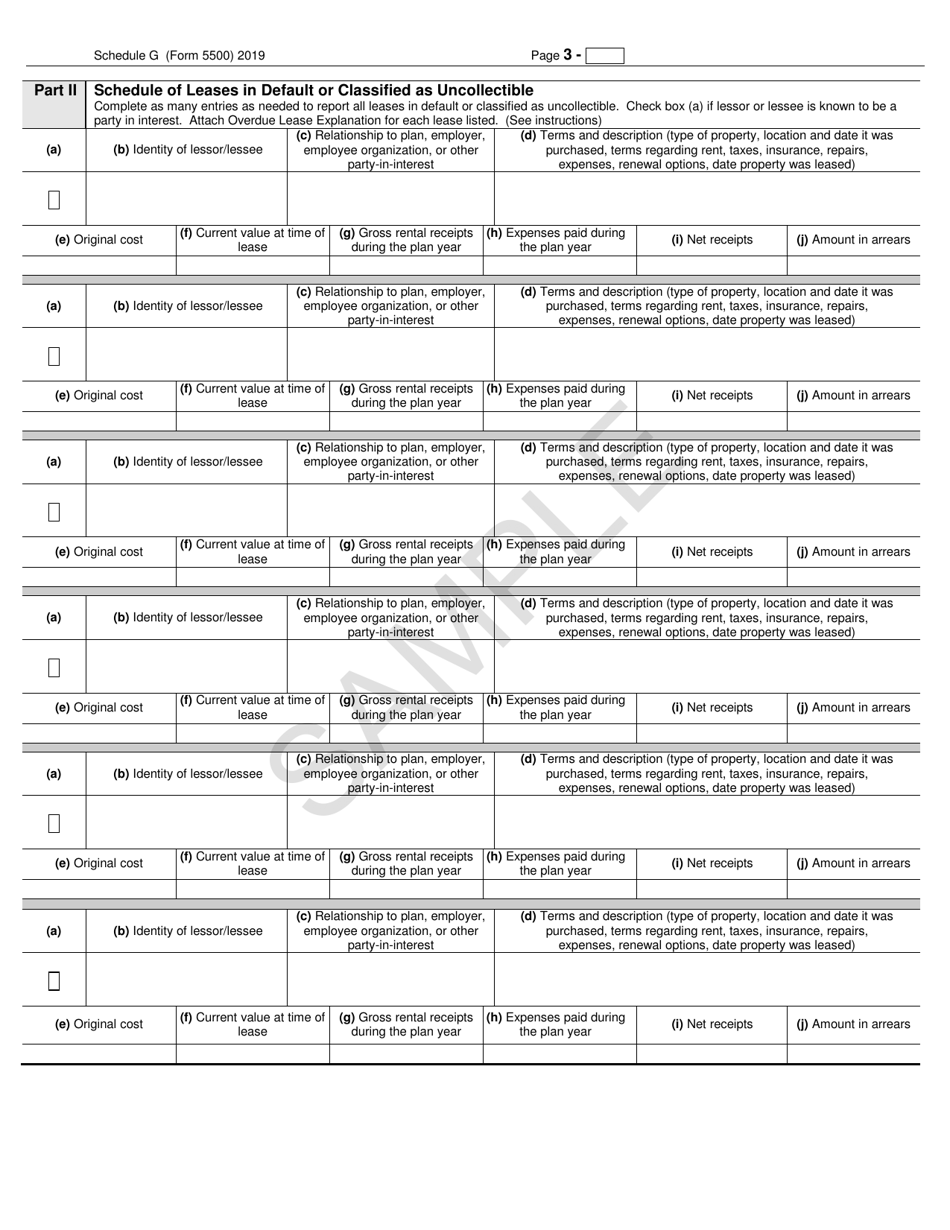

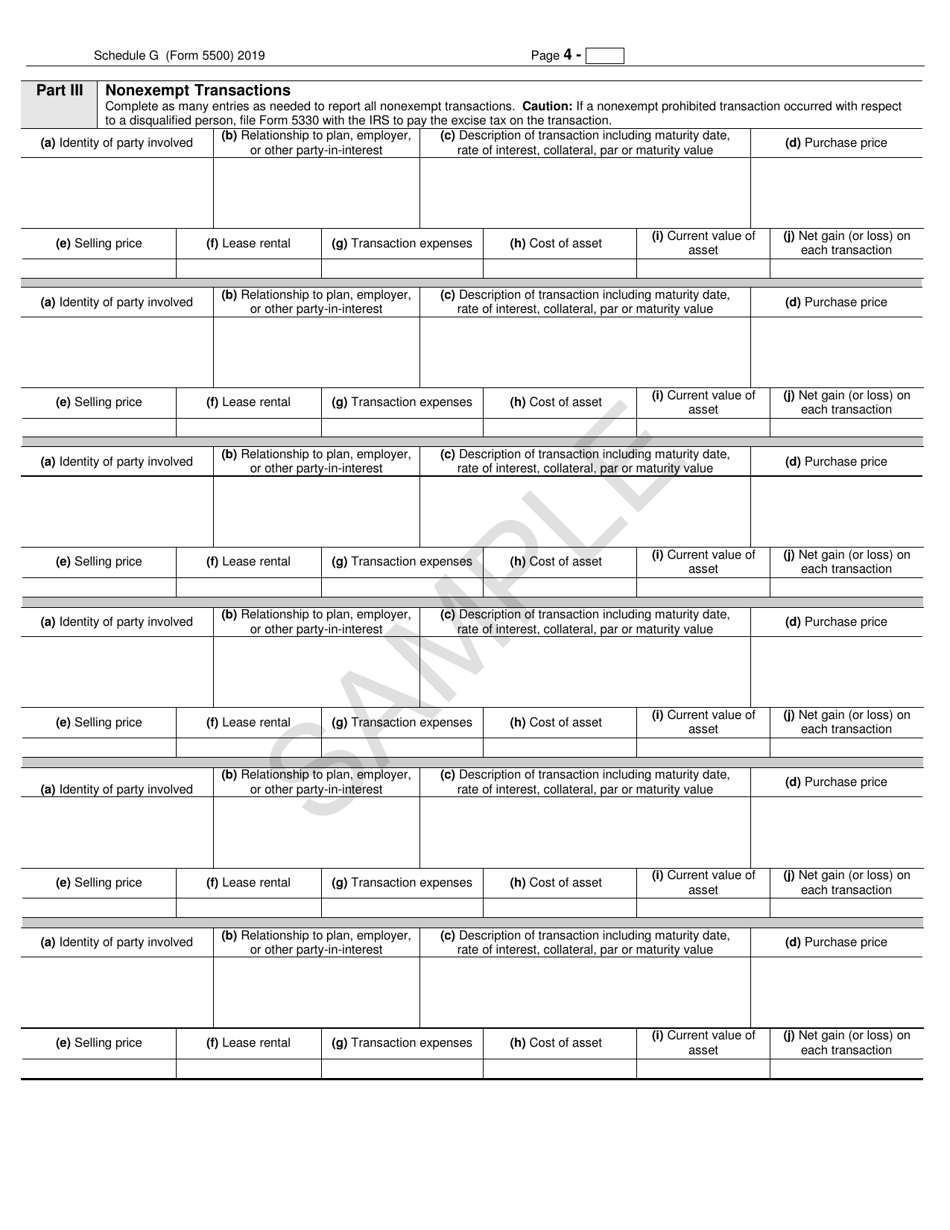

A: IRS Form 5500 Schedule G covers transactions involving employer securities, loans, leases, and other financial transactions of the employee benefit plan.

Q: Do I need to submit IRS Form 5500 Schedule G separately?

A: No, IRS Form 5500 Schedule G is filed as part of the overall IRS Form 5500 filing for the employee benefit plan.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule G through the link below or browse more documents in our library of IRS Forms.