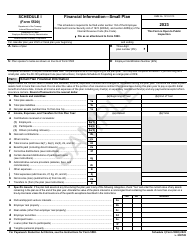

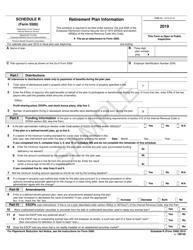

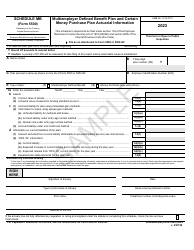

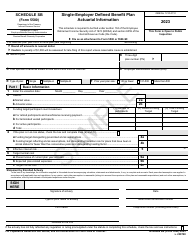

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5500 Schedule D

for the current year.

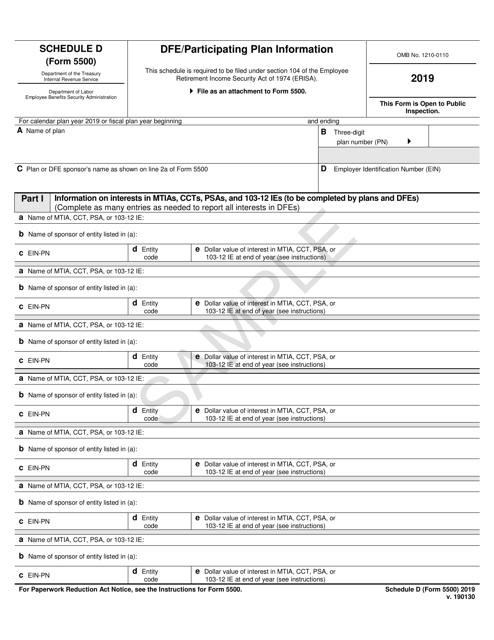

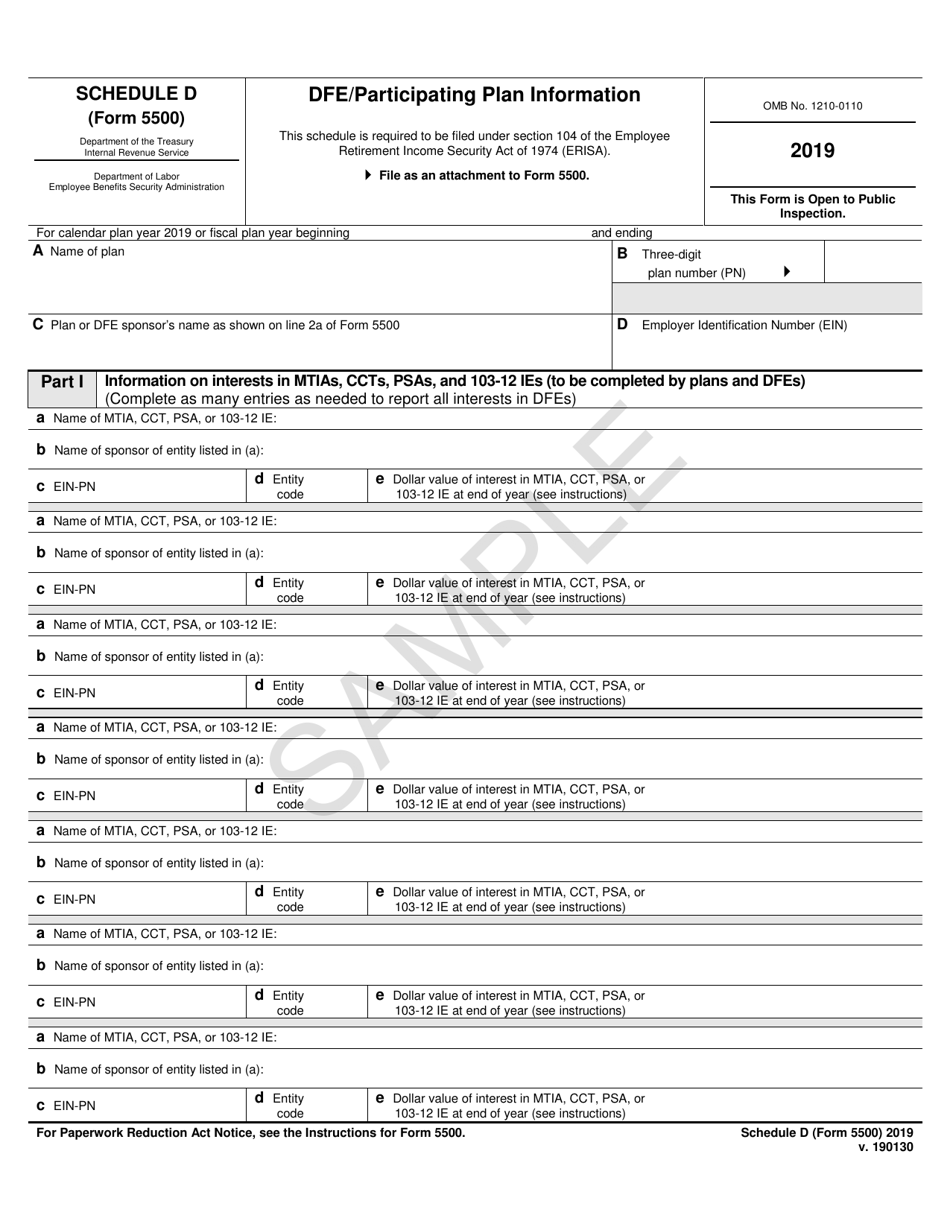

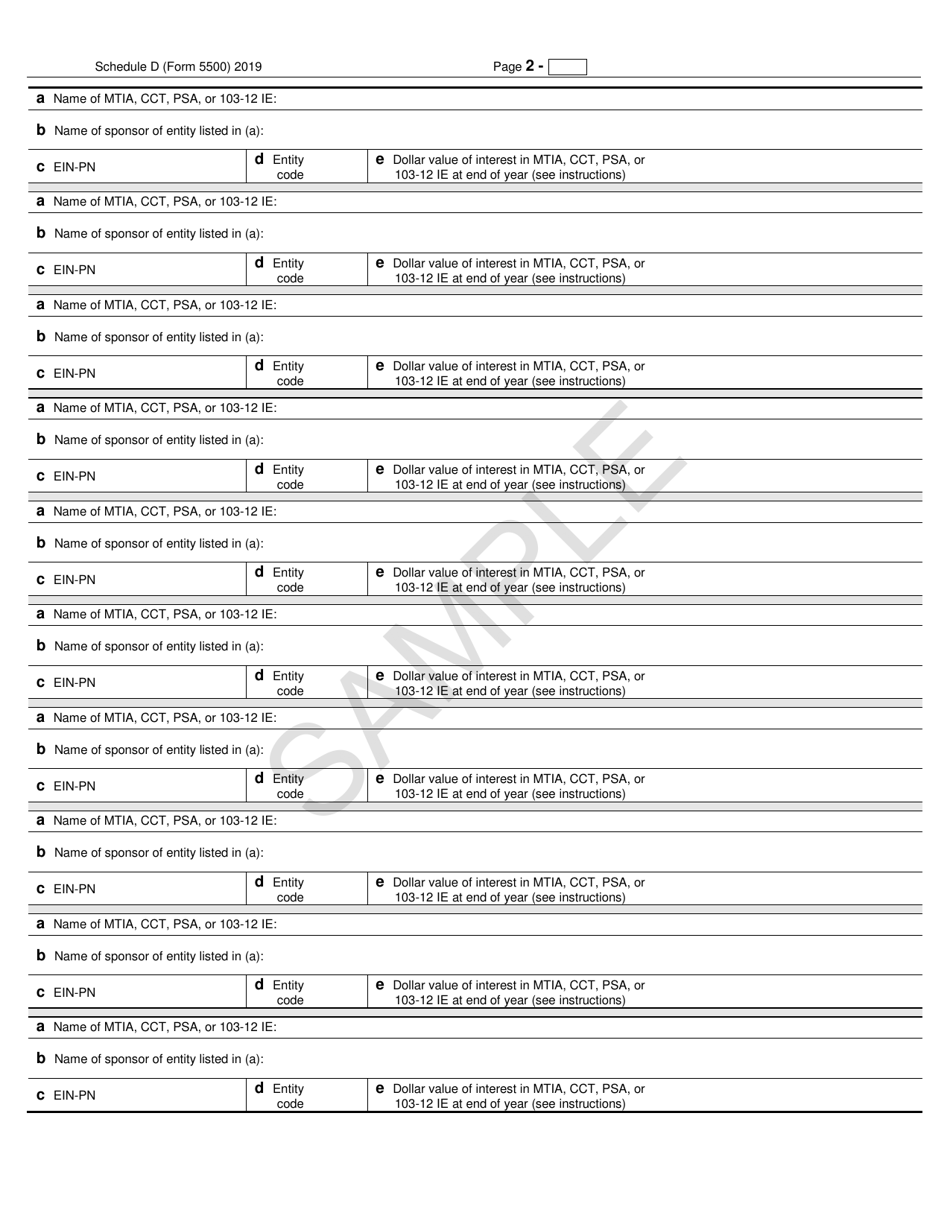

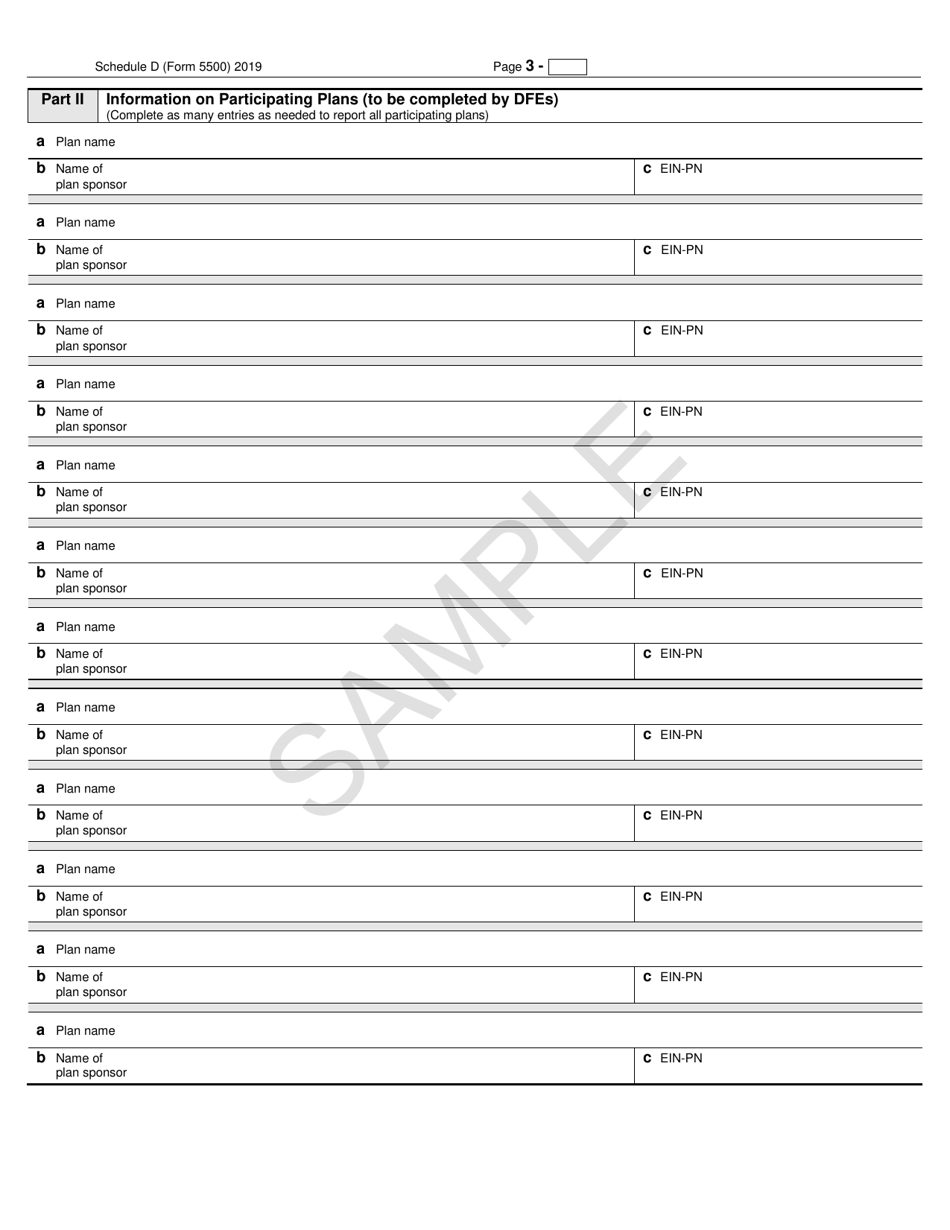

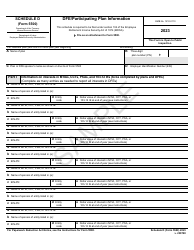

Form 5500 Schedule D Dfe / Participating Plan Information

What Is IRS Form 5500 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500 Schedule D?

A: IRS Form 5500 Schedule D is a form used to report information about a DFE (Direct Filing Entity) or participating plan.

Q: What is a DFE?

A: DFE stands for Direct Filing Entity and refers to an entity that files the IRS Form 5500 on behalf of multiple pension plans or welfare plans.

Q: What is a participating plan?

A: A participating plan is a pension or welfare plan that is included in the IRS Form 5500 filing by a DFE.

Q: What information is reported on IRS Form 5500 Schedule D?

A: IRS Form 5500 Schedule D reports information about the DFE or participating plan, such as plan number, plan name, plan sponsor's name, and plan administrator's name.

Q: Who is required to file IRS Form 5500 Schedule D?

A: DFEs or plan administrators of participating plans are required to file IRS Form 5500 Schedule D if certain conditions are met.

Q: When is IRS Form 5500 Schedule D due?

A: IRS Form 5500 Schedule D is generally due on the same date as the annual filing of IRS Form 5500, which is the last day of the seventh month after the plan year ends.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule D through the link below or browse more documents in our library of IRS Forms.