This version of the form is not currently in use and is provided for reference only. Download this version of

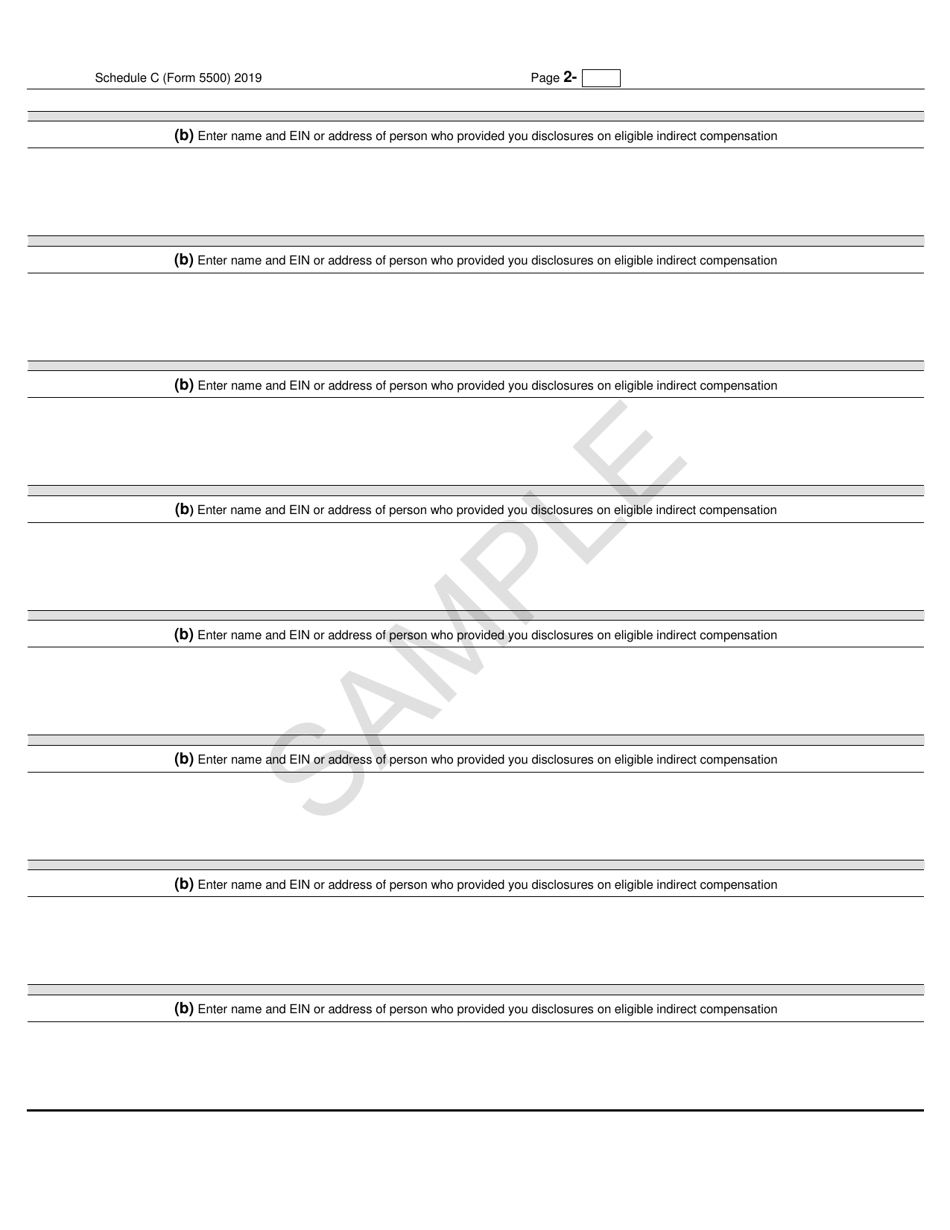

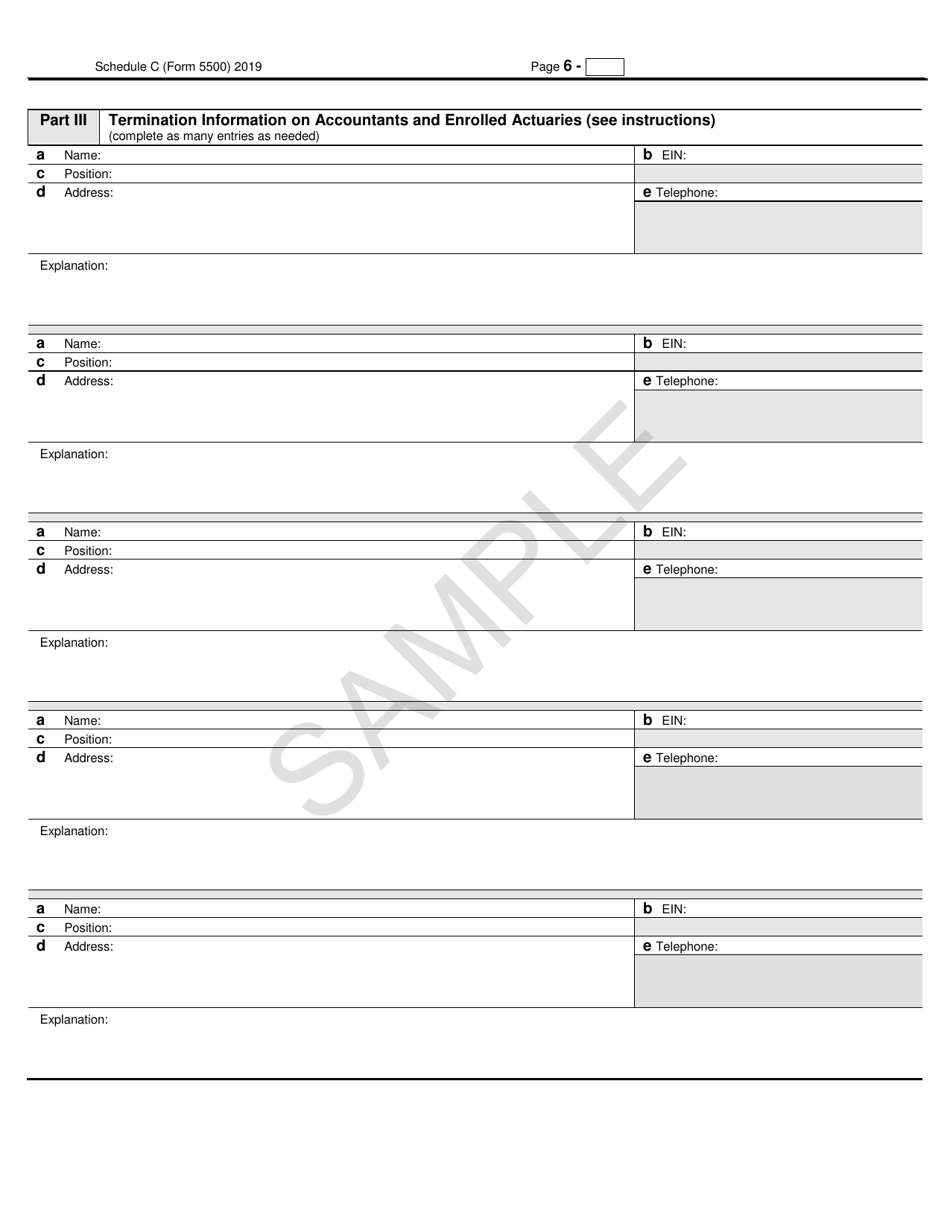

Form 5500 Schedule C

for the current year.

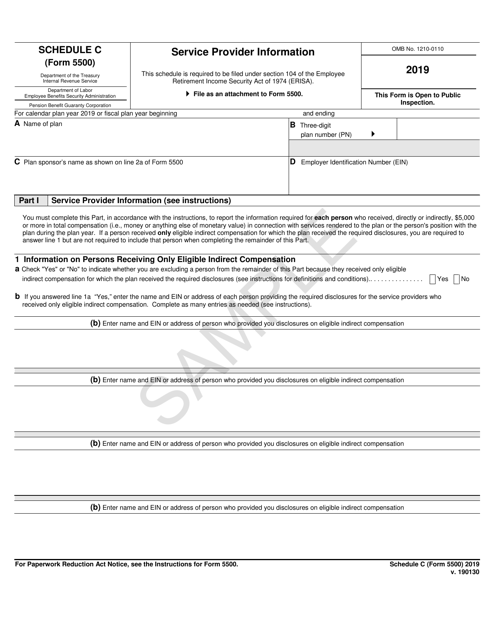

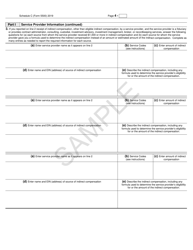

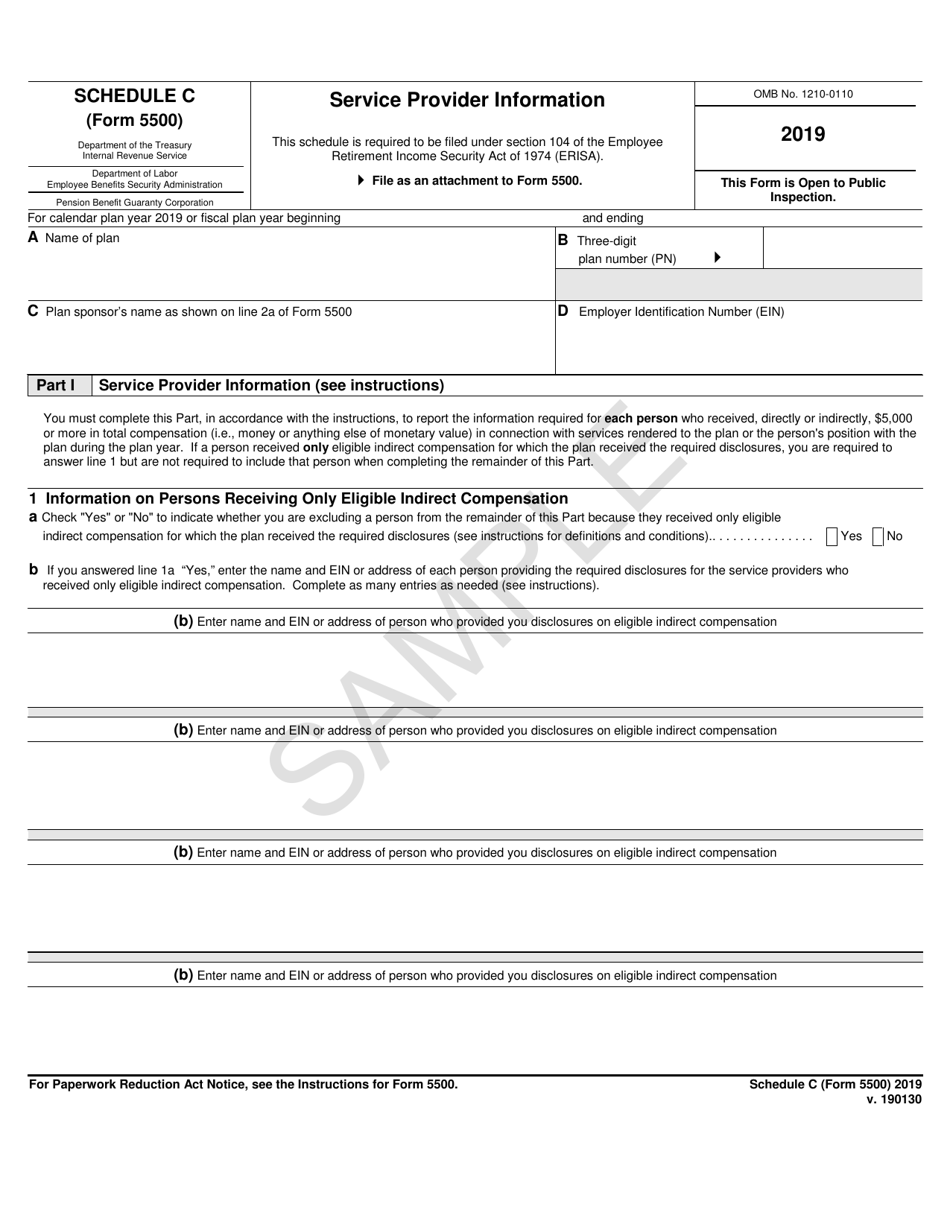

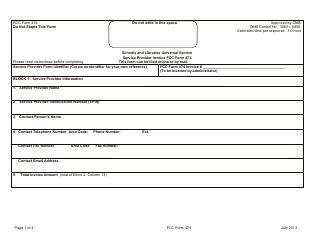

Form 5500 Schedule C Service Provider Information

What Is IRS Form 5500 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500 Schedule C?

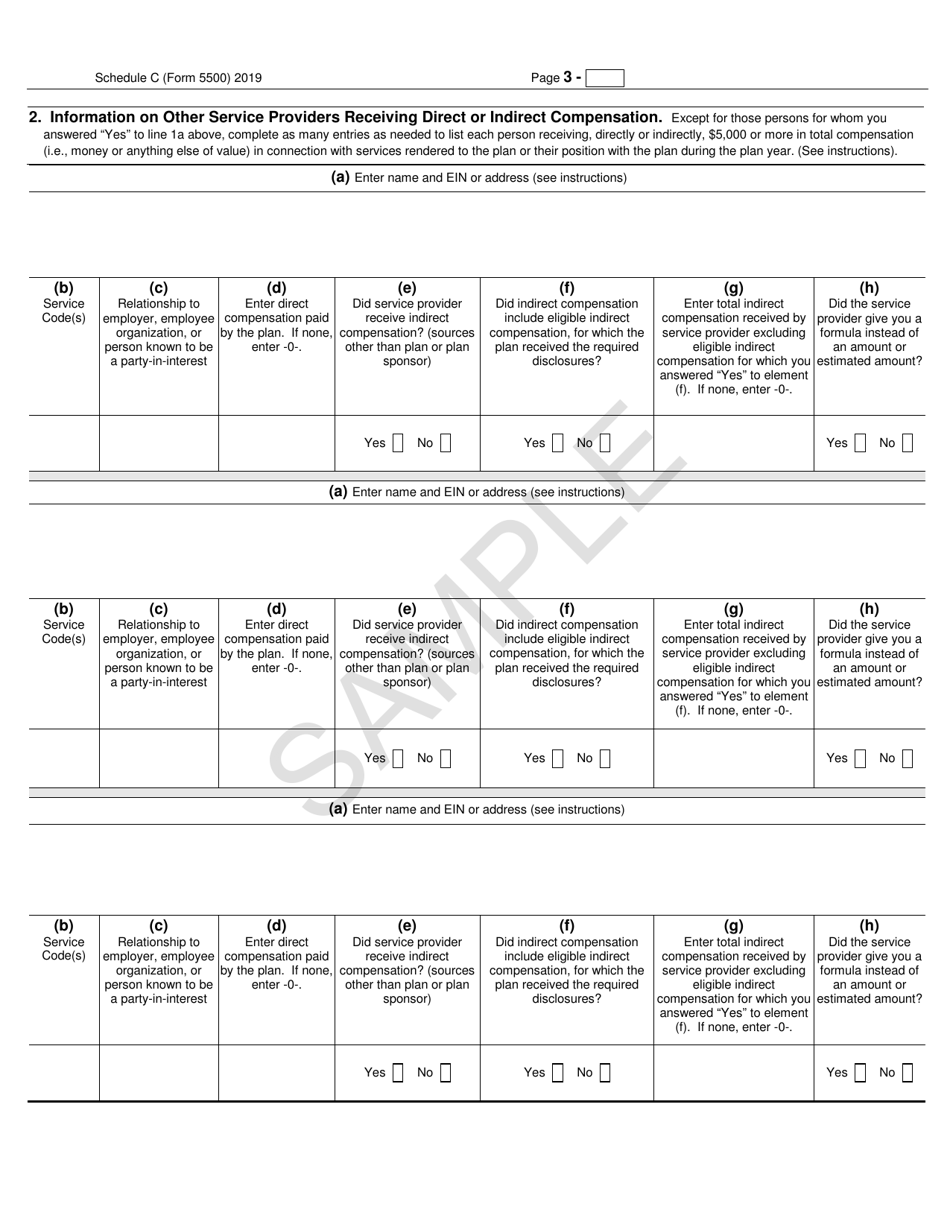

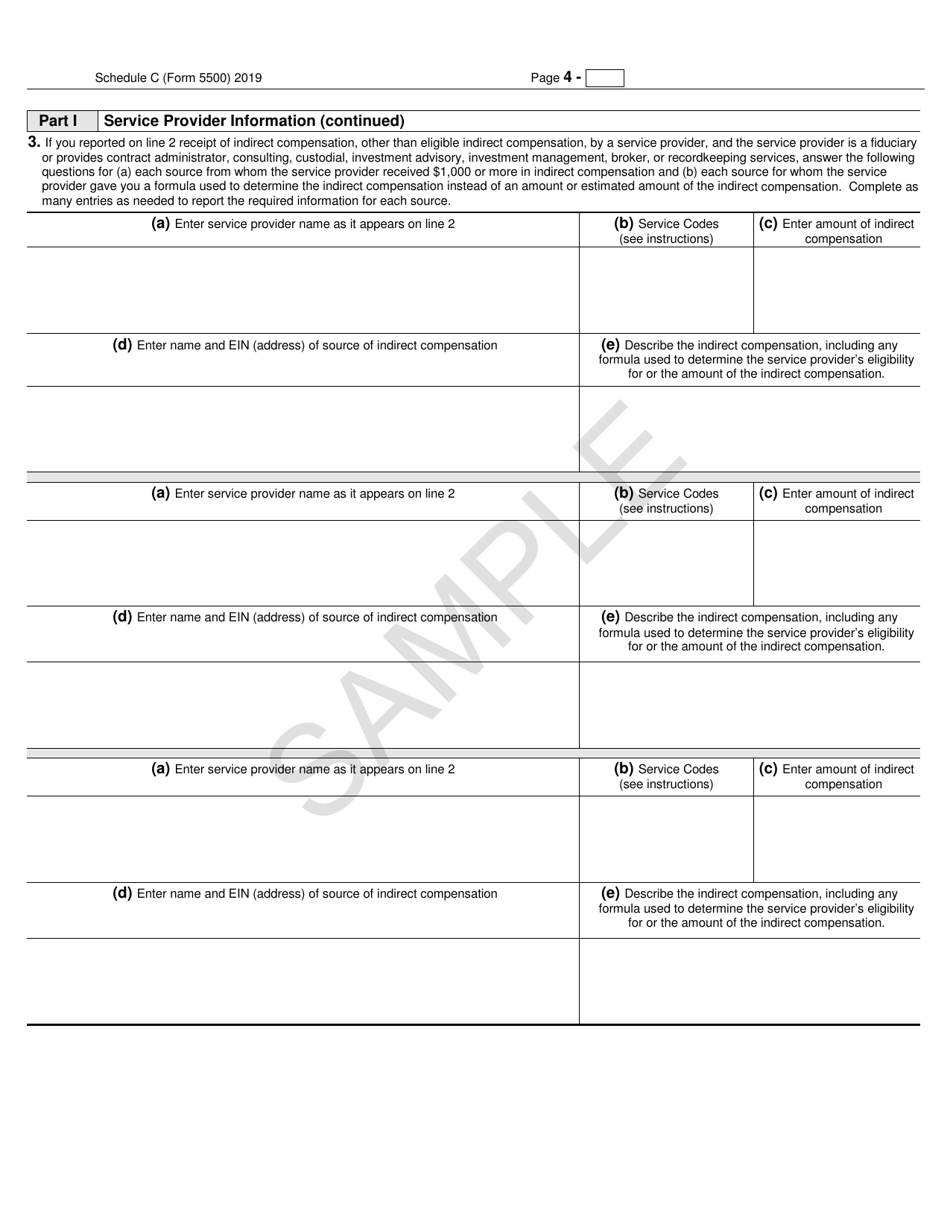

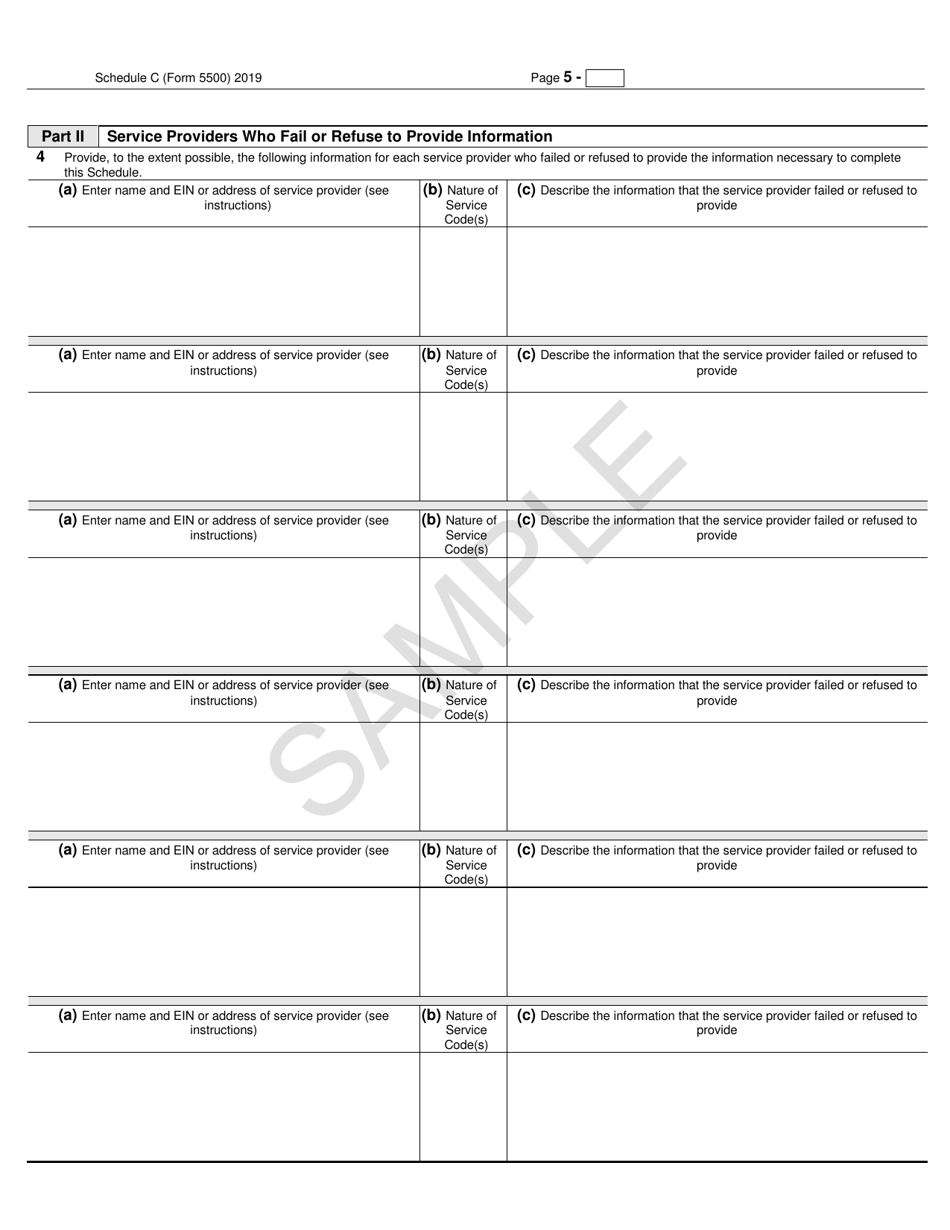

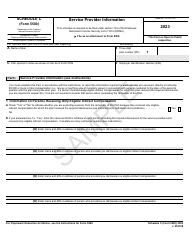

A: IRS Form 5500 Schedule C is a document used to report information about service providers who rendered services to a retirement plan.

Q: Who needs to fill out IRS Form 5500 Schedule C?

A: Plan sponsors or administrators of retirement plans need to fill out IRS Form 5500 Schedule C if they used the services of certain service providers.

Q: What information is reported on IRS Form 5500 Schedule C?

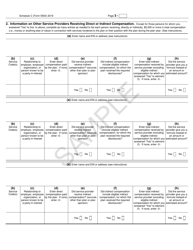

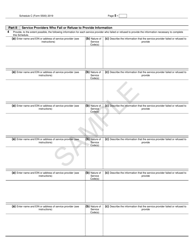

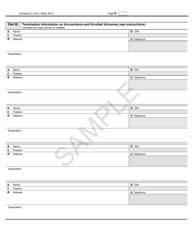

A: IRS Form 5500 Schedule C reports information about the service providers, such as their names, addresses, fees paid, and services provided.

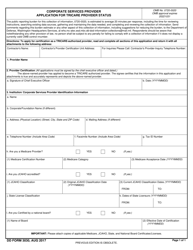

Q: When is IRS Form 5500 Schedule C due?

A: IRS Form 5500 Schedule C is generally due on the same date as the annual filing of IRS Form 5500, which is the last day of the seventh month after the end of the plan year.

Q: Are there any penalties for not filling out IRS Form 5500 Schedule C?

A: Yes, failure to file IRS Form 5500 Schedule C or providing incomplete or inaccurate information may result in penalties imposed by the IRS.

Form Details:

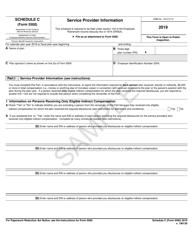

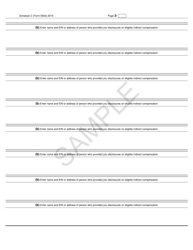

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule C through the link below or browse more documents in our library of IRS Forms.