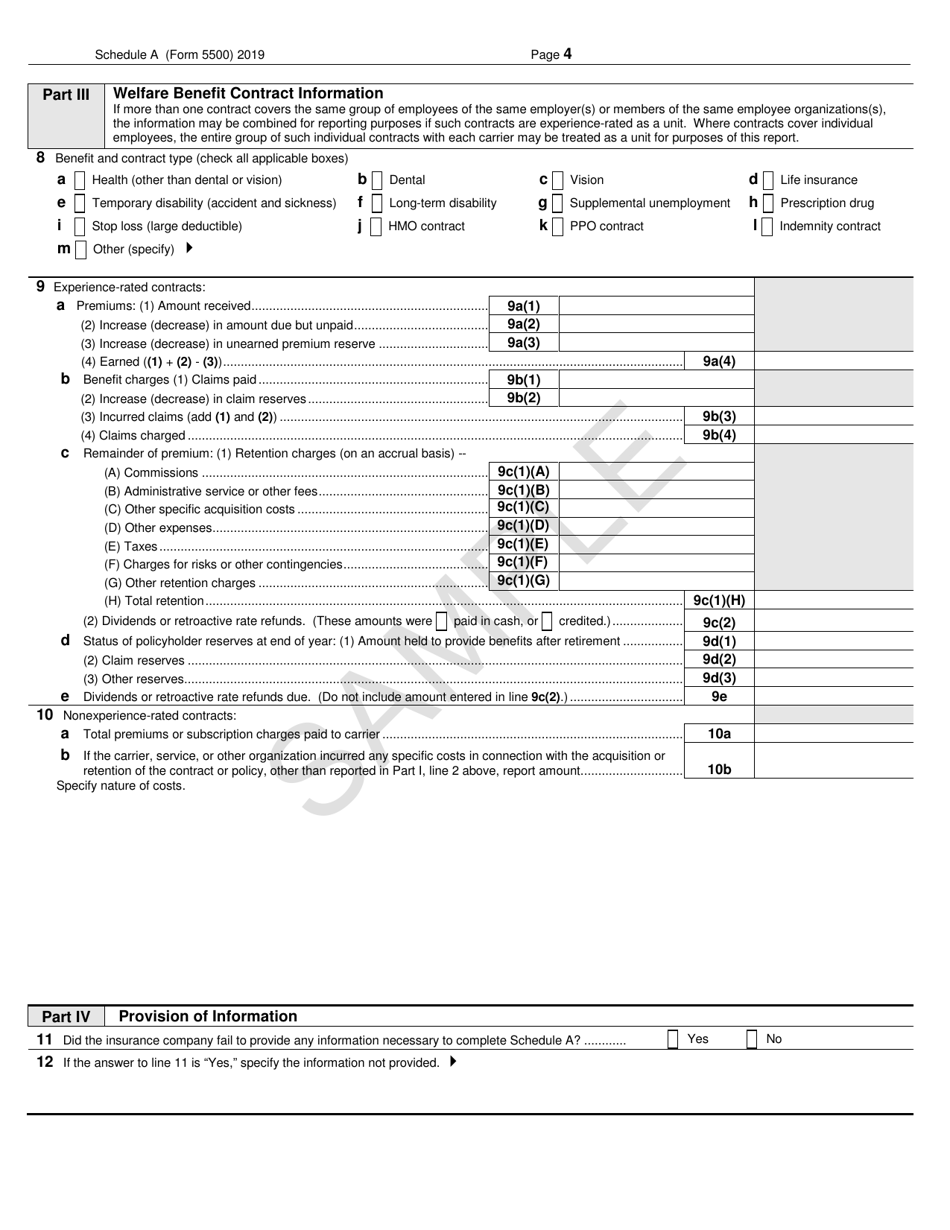

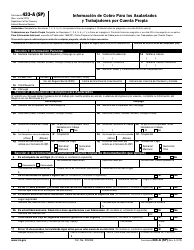

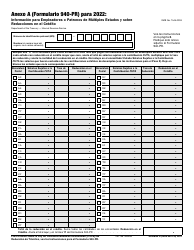

This version of the form is not currently in use and is provided for reference only. Download this version of

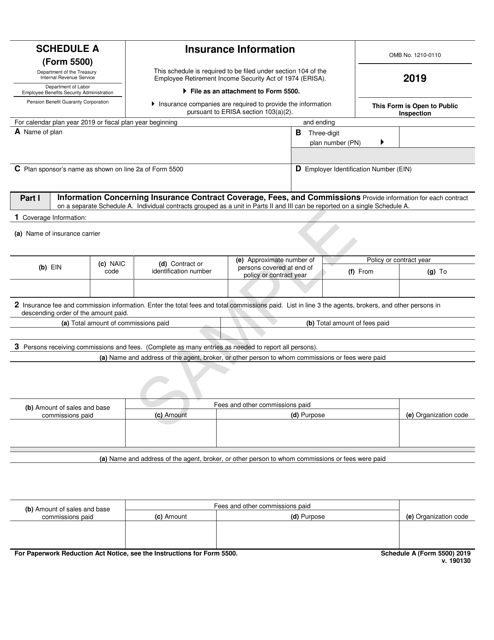

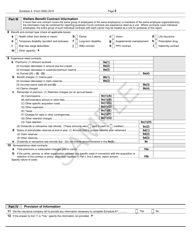

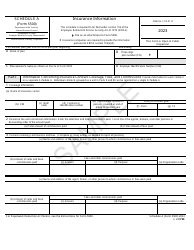

Form 5500 Schedule A

for the current year.

Form 5500 Schedule A Insurance Information

What Is IRS Form 5500 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500 Schedule A?

A: IRS Form 5500 Schedule A is a required form that reports insurance information for employee benefit plans.

Q: Who needs to file IRS Form 5500 Schedule A?

A: Employers or plan administrators of employee benefit plans that provide insurance coverage must file IRS Form 5500 Schedule A.

Q: What kind of insurance information is reported on IRS Form 5500 Schedule A?

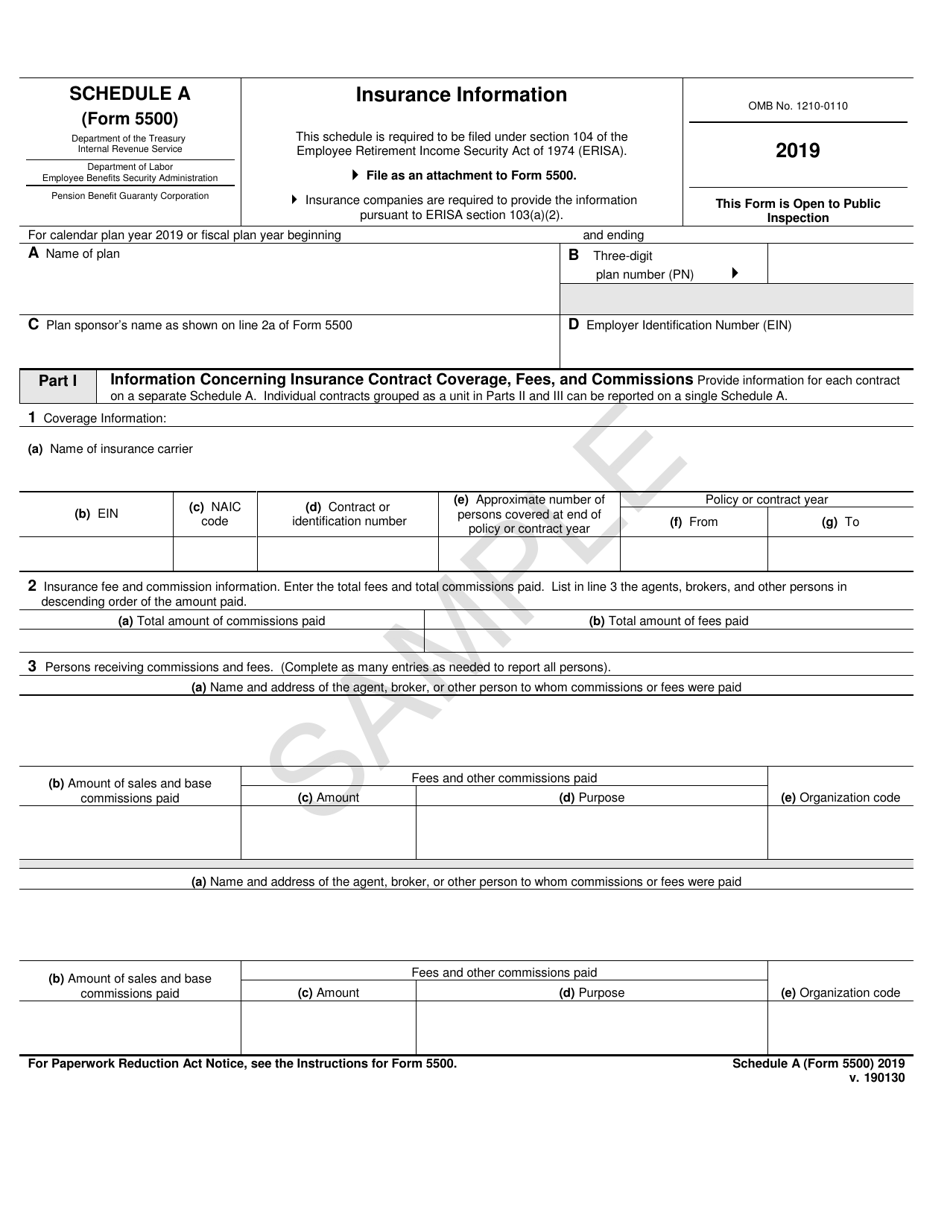

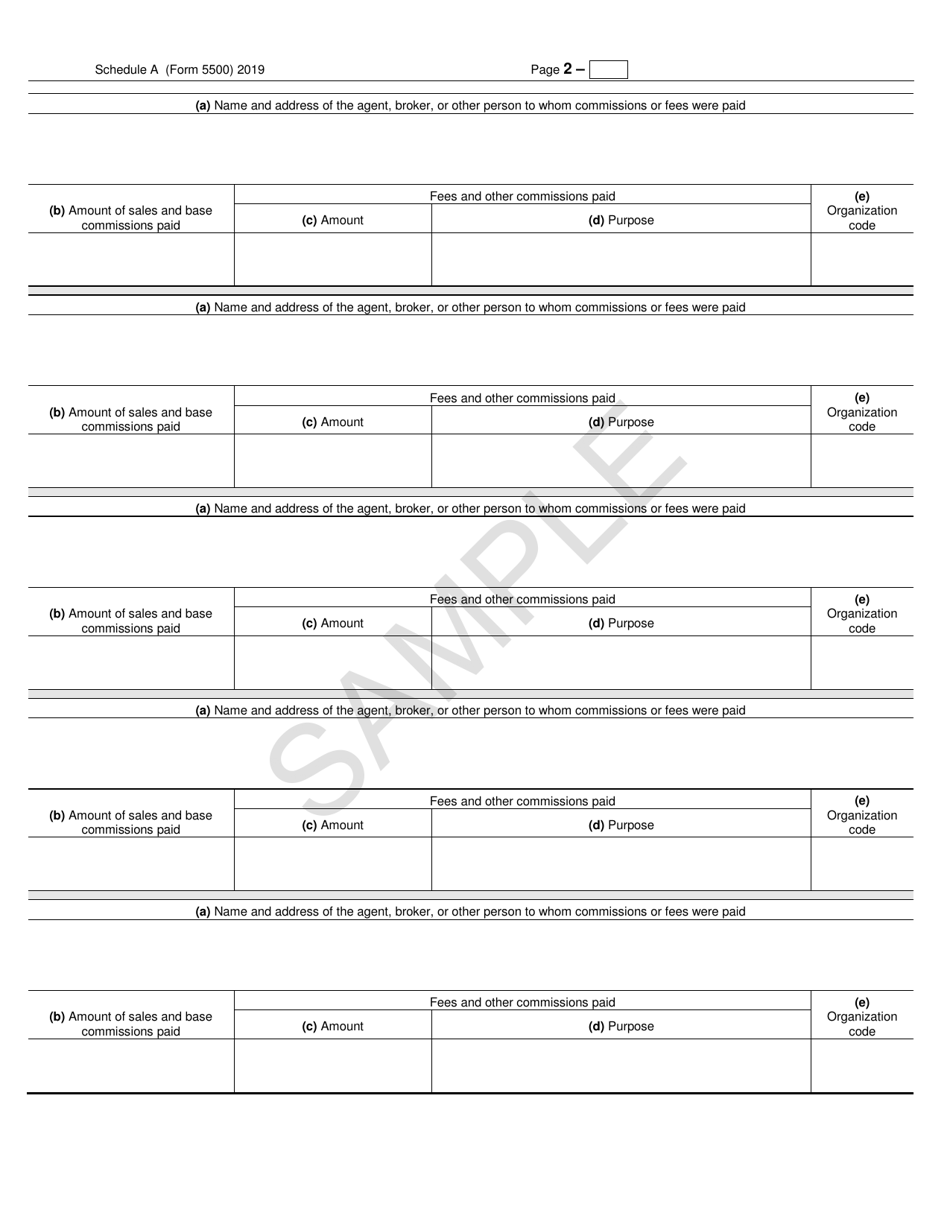

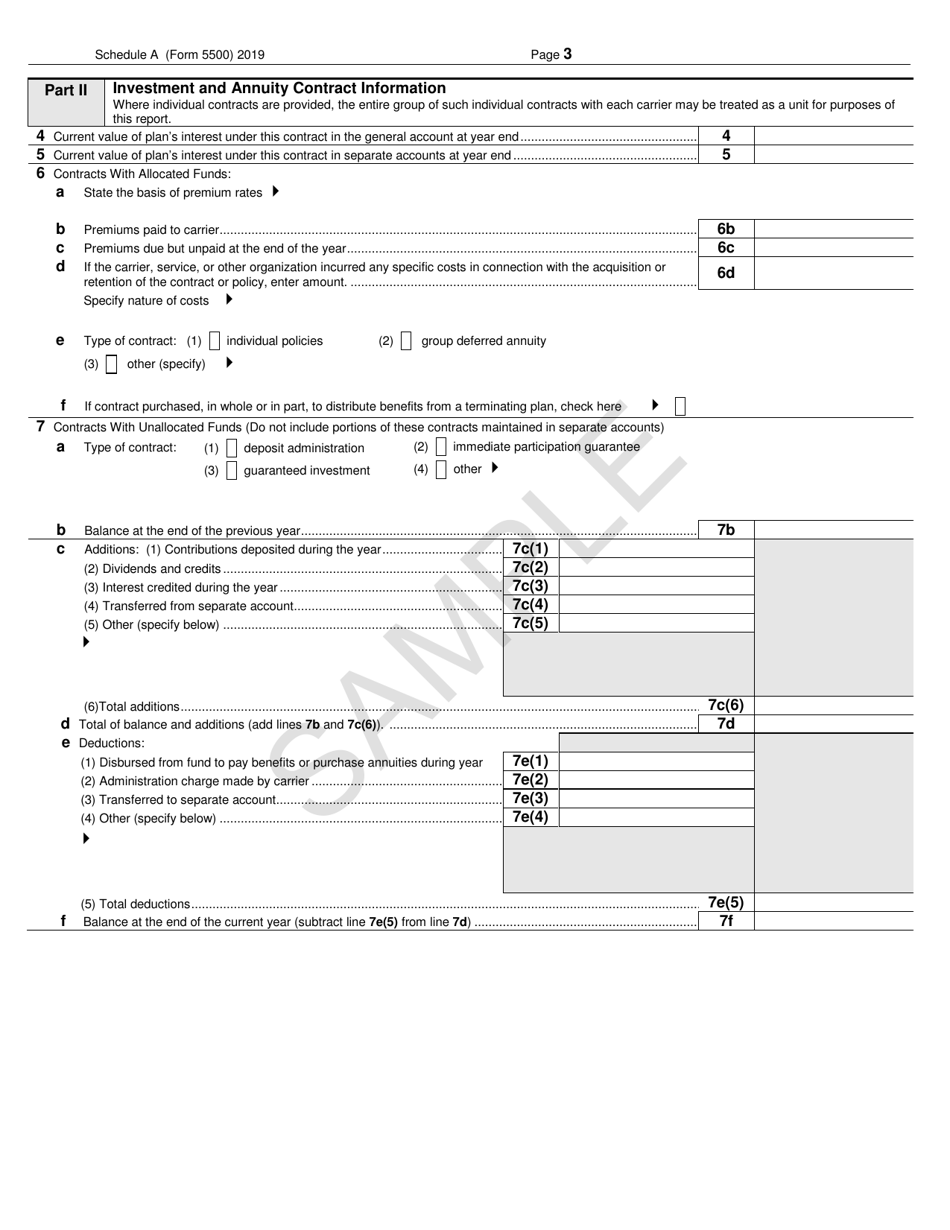

A: IRS Form 5500 Schedule A reports information about the insurance policies, premiums paid, and claims made for the employee benefit plans.

Q: When is IRS Form 5500 Schedule A due?

A: IRS Form 5500 Schedule A is typically due on the same date as the annual filing date for IRS Form 5500, which is the last day of the seventh month following the end of the plan year.

Form Details:

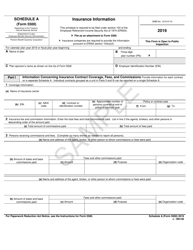

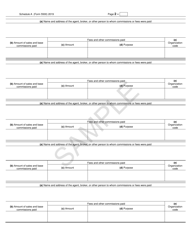

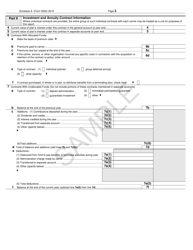

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule A through the link below or browse more documents in our library of IRS Forms.