This version of the form is not currently in use and is provided for reference only. Download this version of

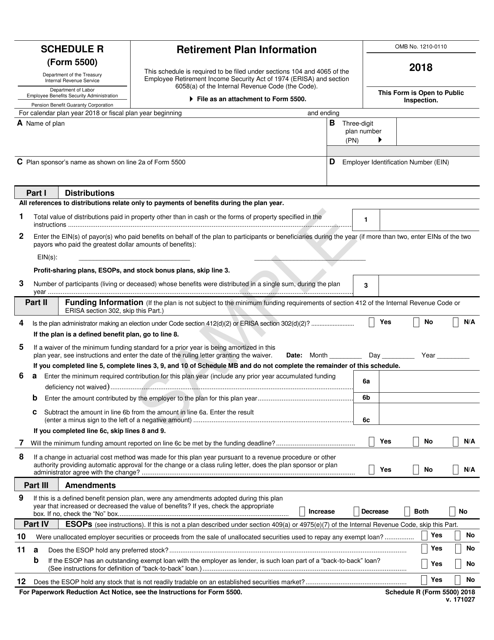

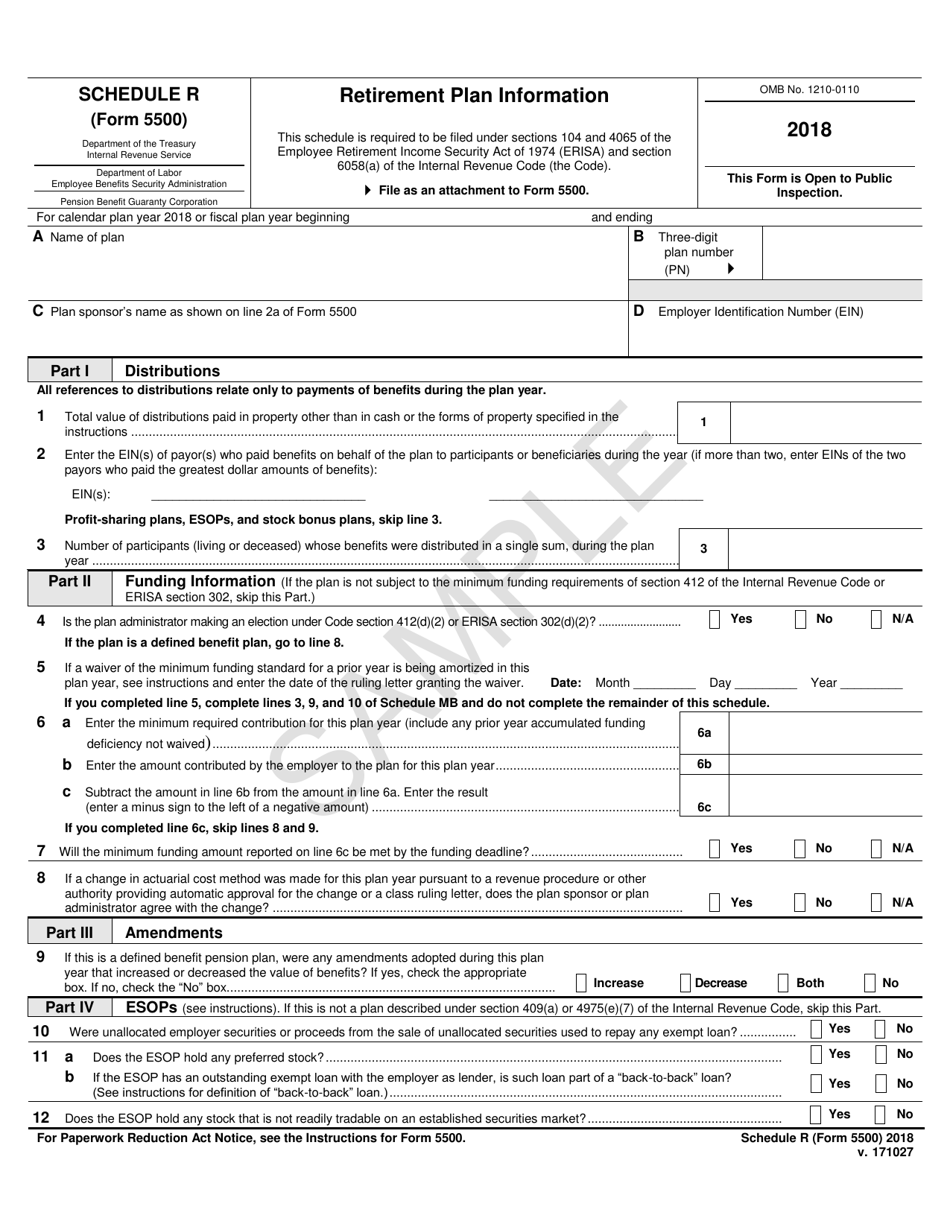

IRS Form 5500 Schedule R

for the current year.

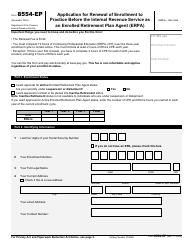

IRS Form 5500 Schedule R Retirement Plan Information

What Is IRS Form 5500 Schedule R?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 5500, Annual Return/Report of Employee Benefit Plan. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5500 Schedule R?

A: IRS Form 5500 Schedule R is a form used to report retirement plan information to the Internal Revenue Service (IRS).

Q: Who needs to file IRS Form 5500 Schedule R?

A: Employers who sponsor retirement plans, such as 401(k) or pension plans, need to file IRS Form 5500 Schedule R.

Q: What information is required on IRS Form 5500 Schedule R?

A: IRS Form 5500 Schedule R requires information about the retirement plan, including details about plan participants and contributions.

Q: When is IRS Form 5500 Schedule R due?

A: IRS Form 5500 Schedule R is typically due by the last day of the seventh month after the Plan Year ends.

Form Details:

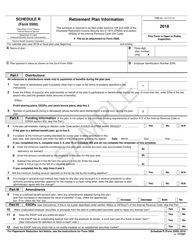

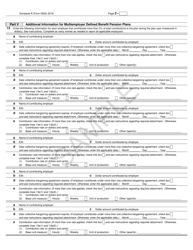

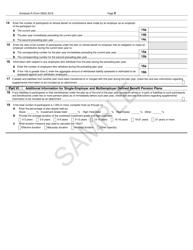

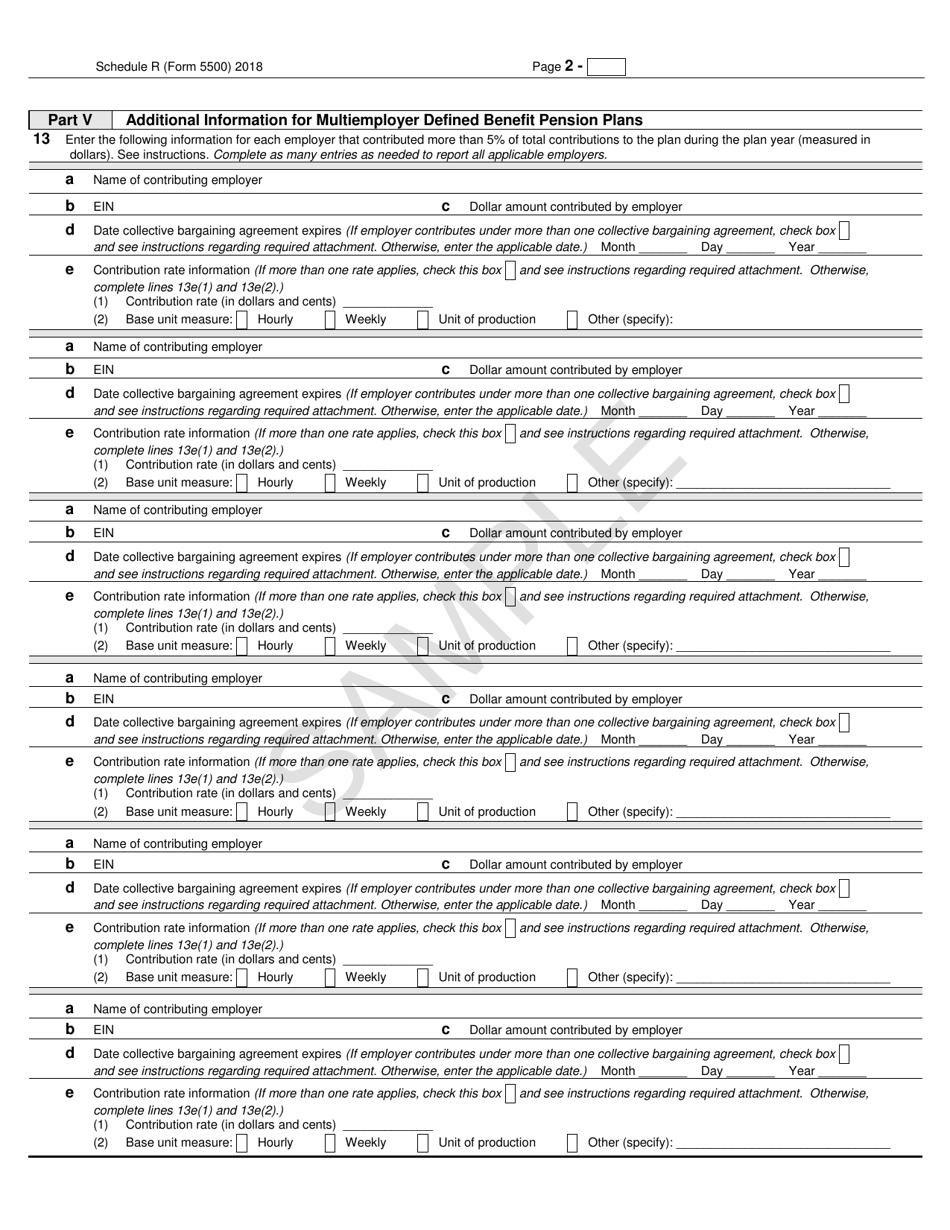

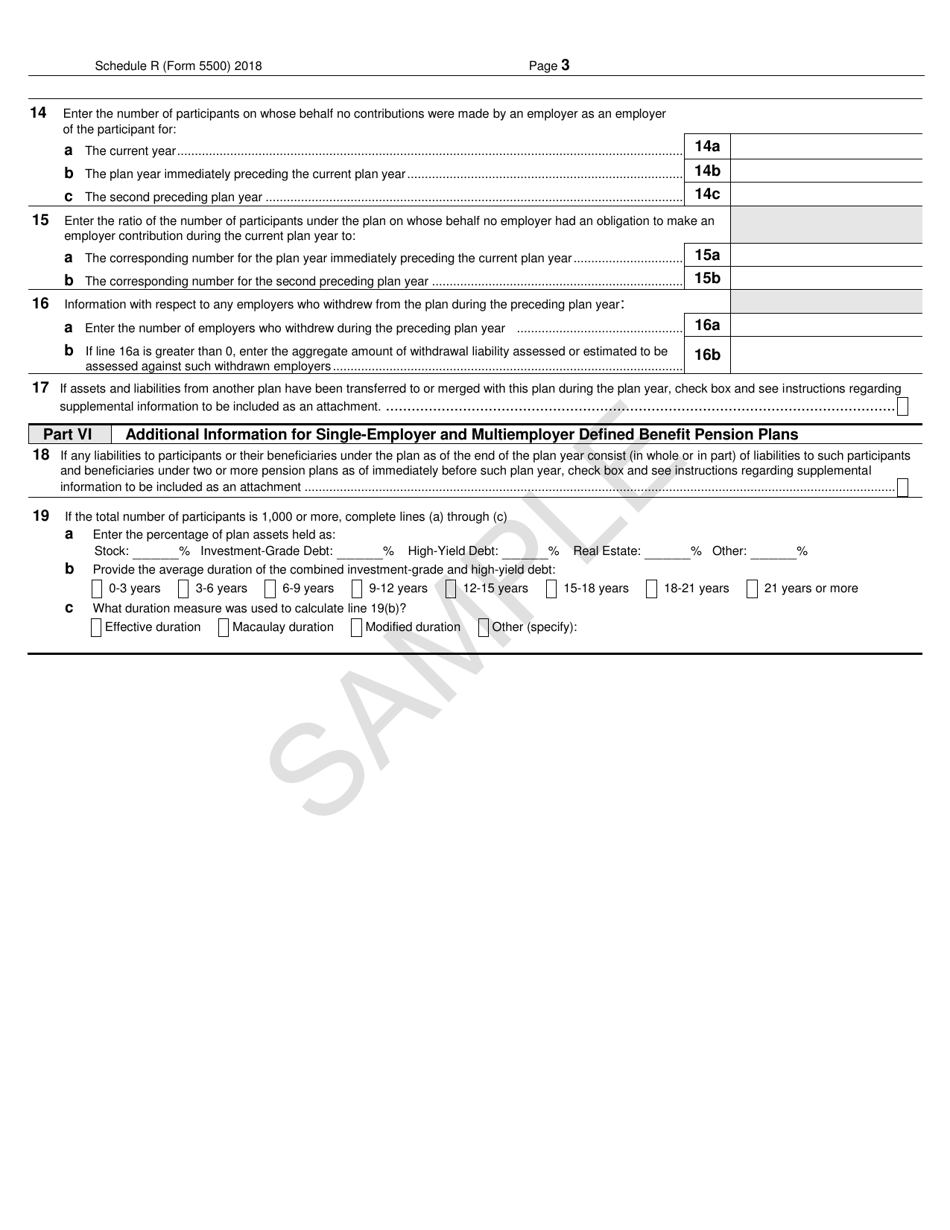

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500 Schedule R through the link below or browse more documents in our library of IRS Forms.