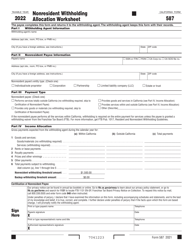

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 592-B

for the current year.

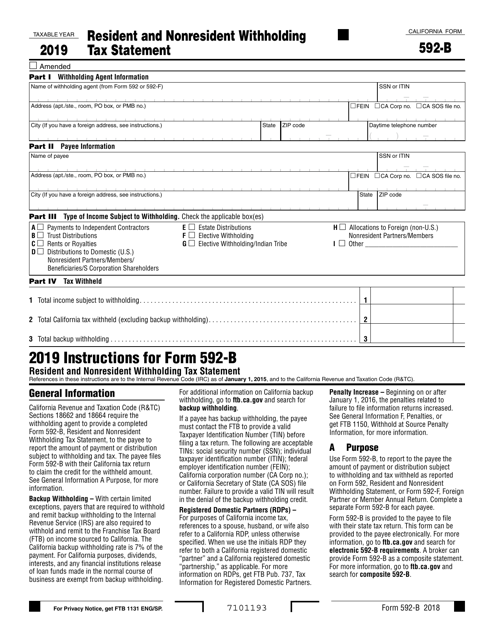

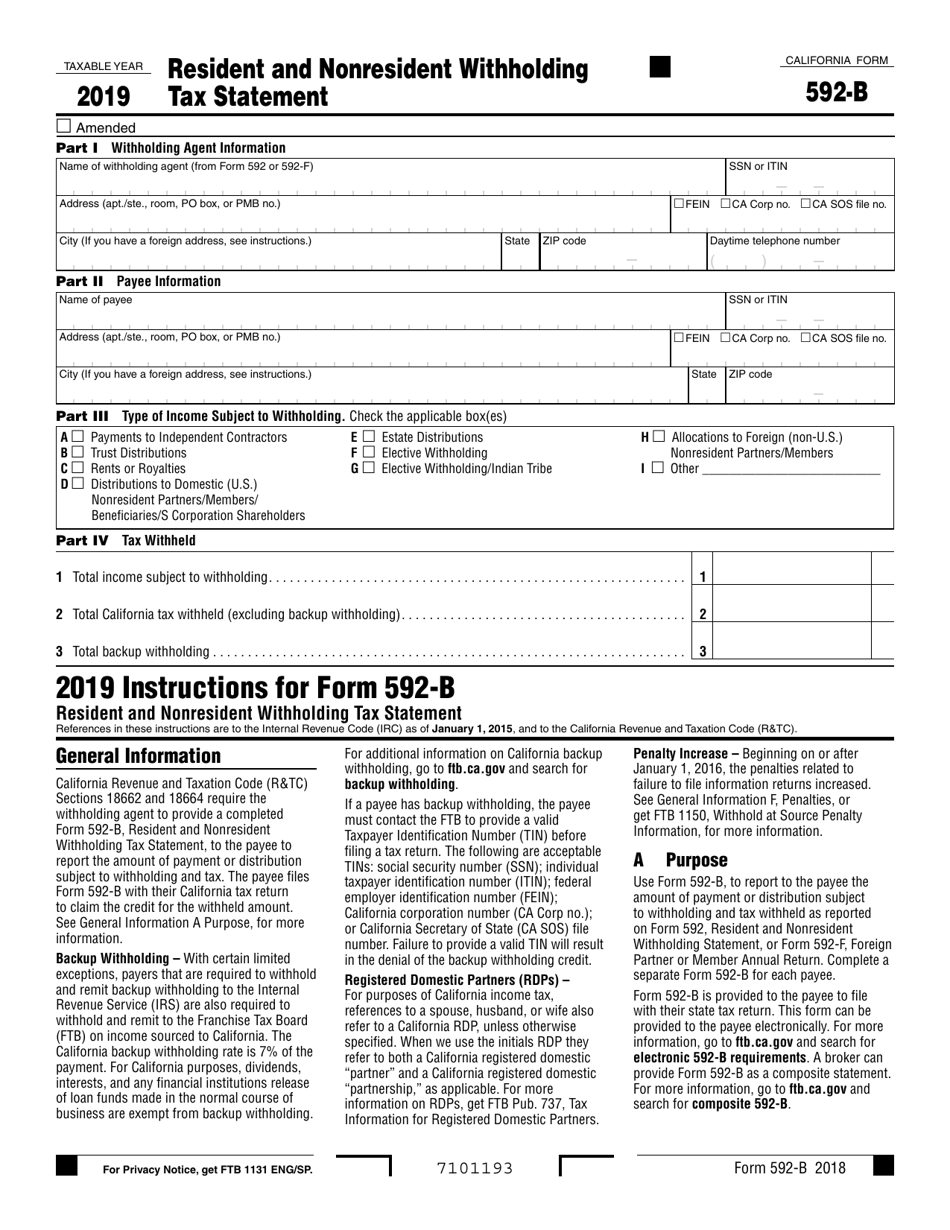

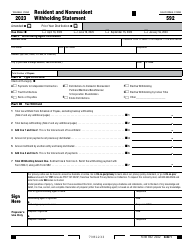

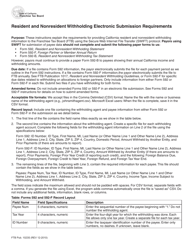

Form 592-B Resident and Nonresident Withholding Tax Statement - California

What Is Form 592-B?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

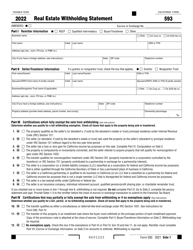

Q: What is Form 592-B?

A: Form 592-B is the Resident and Nonresident Withholding Tax Statement used in California.

Q: Who needs to file Form 592-B?

A: Form 592-B is used by payers to report withholding taxes on California-source income paid to non-residents and residents.

Q: What information is required on Form 592-B?

A: Form 592-B requires the payer's information, the payee's information, and details of the income and withholding.

Q: When is Form 592-B due?

A: Form 592-B is due on or before the last day of February of the following year.

Q: Can Form 592-B be e-filed?

A: No, Form 592-B cannot be e-filed. It must be filed by mail.

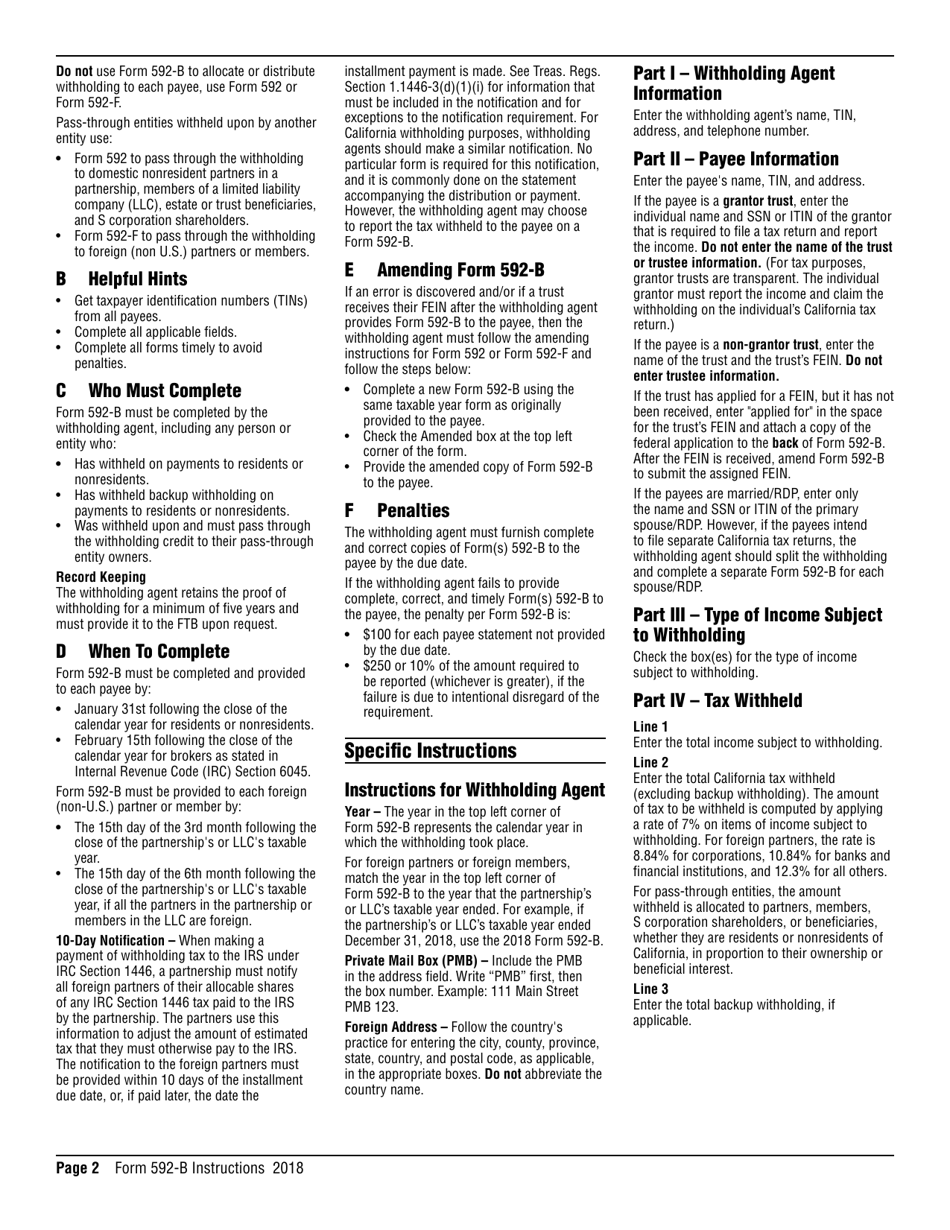

Q: Are there any penalties for late filing of Form 592-B?

A: Yes, there are penalties for late filing or failure to file Form 592-B. The amount of the penalty varies based on the amount of withholding and the delay in filing.

Q: What should I do if I make a mistake on Form 592-B?

A: If you make a mistake on Form 592-B, you should file an amended form with the correct information.

Q: Do I need to submit Form 592-B if no withholding occurred?

A: No, you do not need to submit Form 592-B if no withholding occurred.

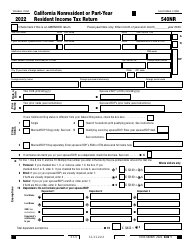

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-B by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.