This version of the form is not currently in use and is provided for reference only. Download this version of

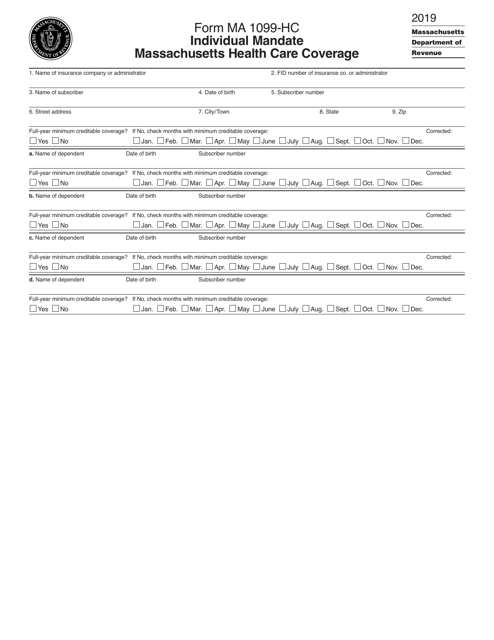

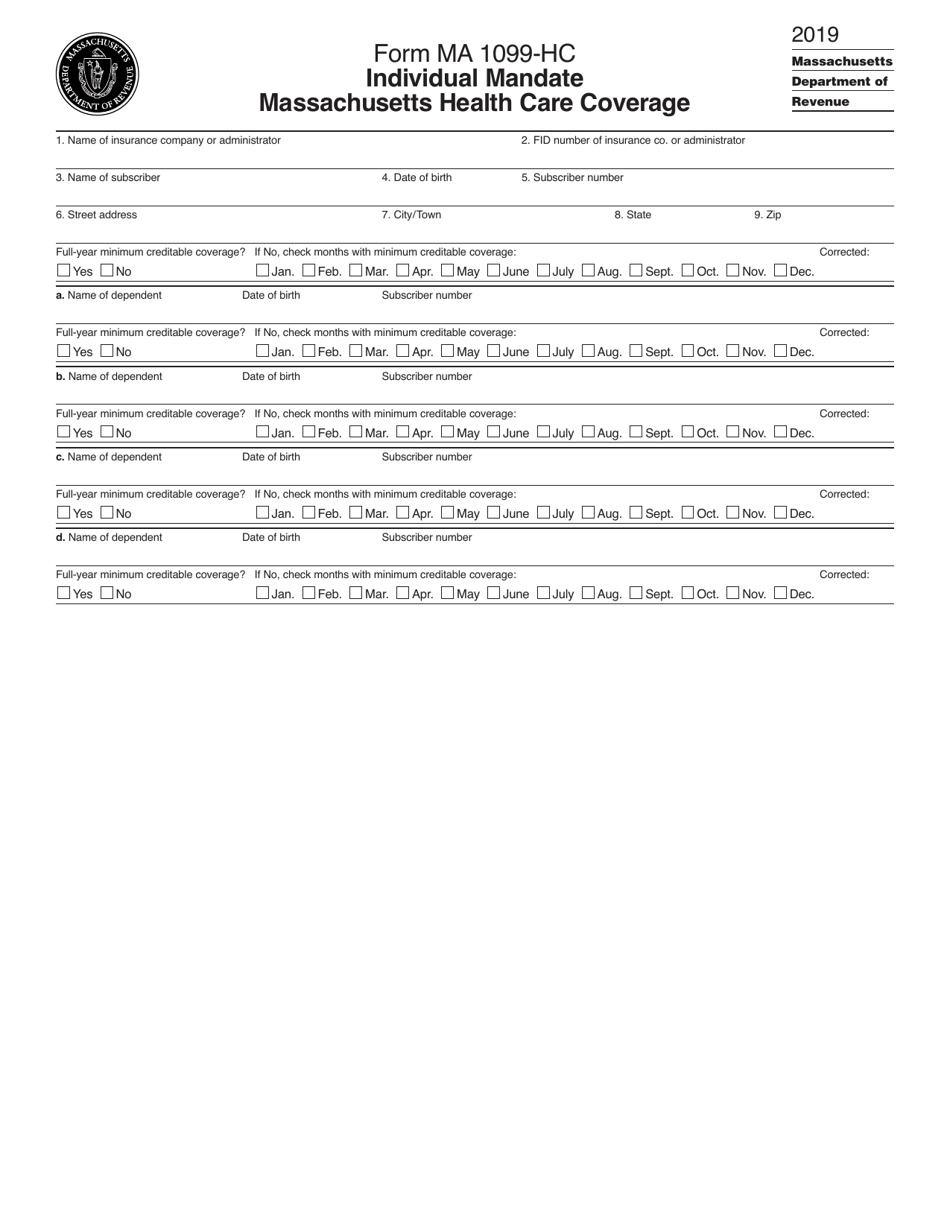

Form MA1099-HC

for the current year.

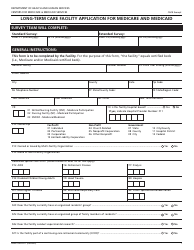

Form MA1099-HC Individual Mandate Massachusetts Health Care Coverage - Massachusetts

What Is Form MA1099-HC?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MA1099-HC?

A: Form MA1099-HC is a document used to report information about an individual's health care coverage in Massachusetts.

Q: Who needs to file Form MA1099-HC?

A: Any individual who had health care coverage in Massachusetts during the tax year needs to file Form MA1099-HC.

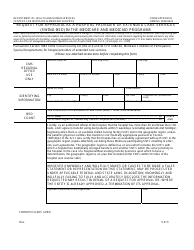

Q: What information is reported on Form MA1099-HC?

A: Form MA1099-HC reports details about the individual's health care coverage, including the type of coverage, dates of coverage, and the name of the insurance carrier.

Q: Why is Form MA1099-HC important?

A: Form MA1099-HC is used to provide proof of health care coverage in Massachusetts, which is required under the state's individual mandate.

Q: When is the deadline to file Form MA1099-HC?

A: Form MA1099-HC must be filed by January 31st of the following year.

Q: What happens if I don't file Form MA1099-HC?

A: Failure to file Form MA1099-HC or provide proof of health care coverage may result in penalties or fines.

Q: Do I need to include Form MA1099-HC with my federal tax return?

A: No, Form MA1099-HC is only required for Massachusetts state tax purposes and does not need to be included with your federal tax return.

Q: What if I didn't have health care coverage in Massachusetts?

A: If you did not have health care coverage in Massachusetts, you may be subject to penalties or exemptions. You should consult with a tax professional or the Massachusetts Department of Revenue for guidance.

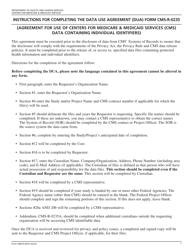

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MA1099-HC by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.