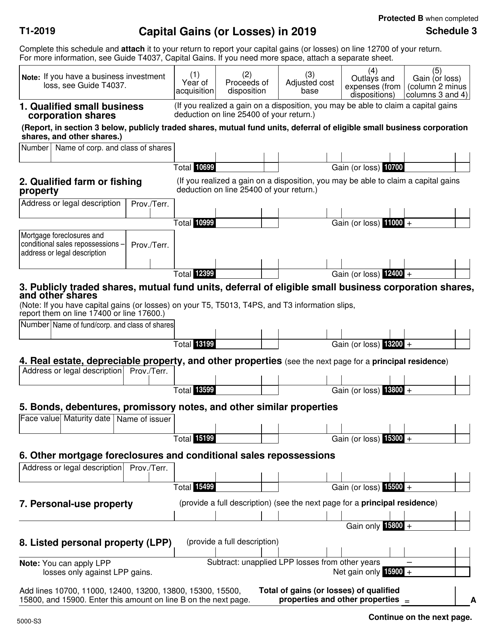

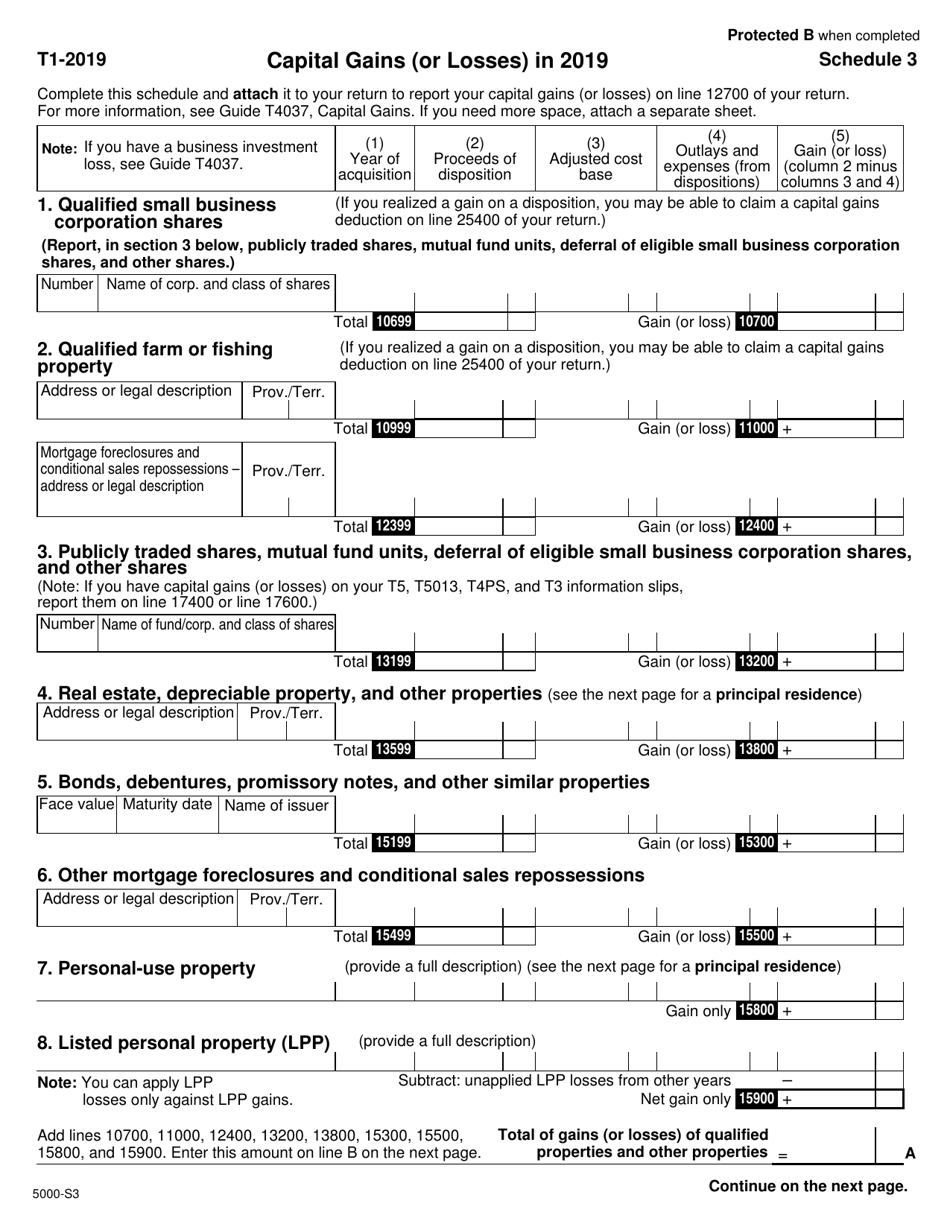

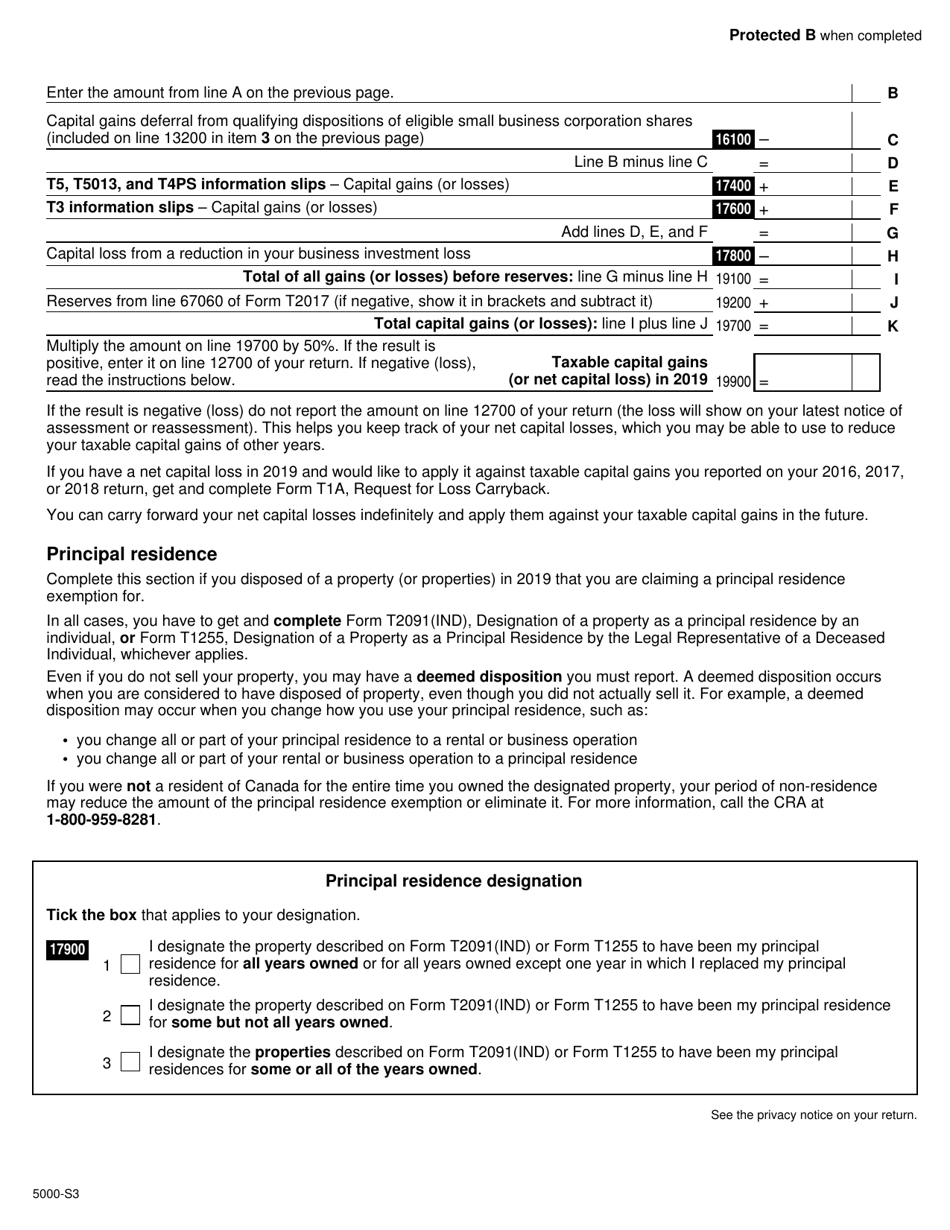

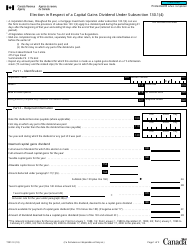

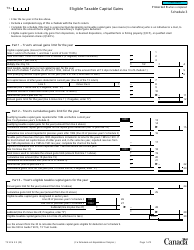

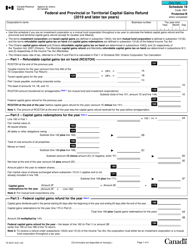

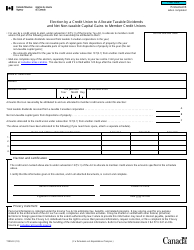

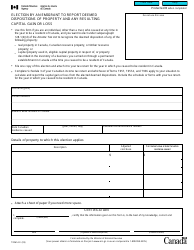

Form 5000 Schedule 3 Capital Gains (Or Losses) in 2019 - Canada

Form 5000 Schedule 3 Capital Gains (or Losses) in 2019 is used in Canada to report any capital gains or losses incurred during the tax year. It is often used to calculate the taxable amount of these gains or losses.

In Canada, individuals who have capital gains or losses in 2019 need to file the Form 5000 Schedule 3 as part of their income tax return.

FAQ

Q: What is Form 5000 Schedule 3?

A: Form 5000 Schedule 3 is a tax form used in Canada to report capital gains or losses in the year 2019.

Q: Who needs to fill out Form 5000 Schedule 3?

A: Individuals who have realized capital gains or losses in 2019 need to fill out Form 5000 Schedule 3.

Q: What is considered a capital gain or loss?

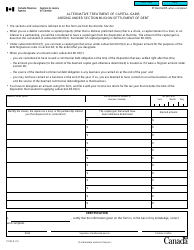

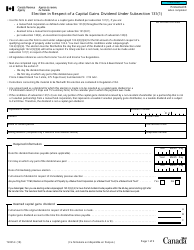

A: A capital gain occurs when you sell an asset for more than its adjusted cost base. A capital loss occurs when you sell an asset for less than its adjusted cost base.

Q: What information is required for Form 5000 Schedule 3?

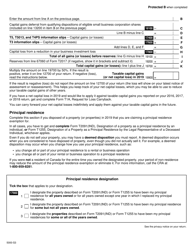

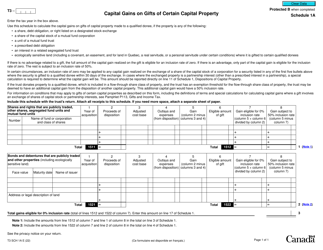

A: You will need to provide details about each capital property sold, including the date of sale, cost base, and proceeds of disposition.

Q: Are there any exemptions or deductions for capital gains?

A: Yes, there are exemptions and deductions available for certain types of capital gains, such as the principal residence exemption and the lifetime capital gains exemption.