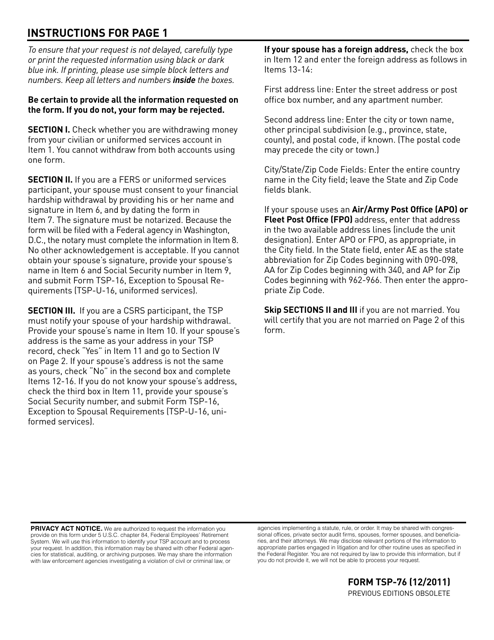

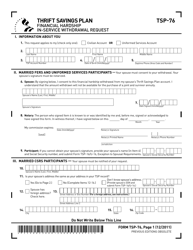

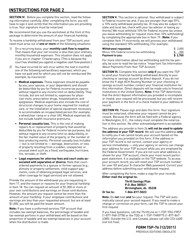

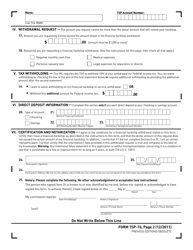

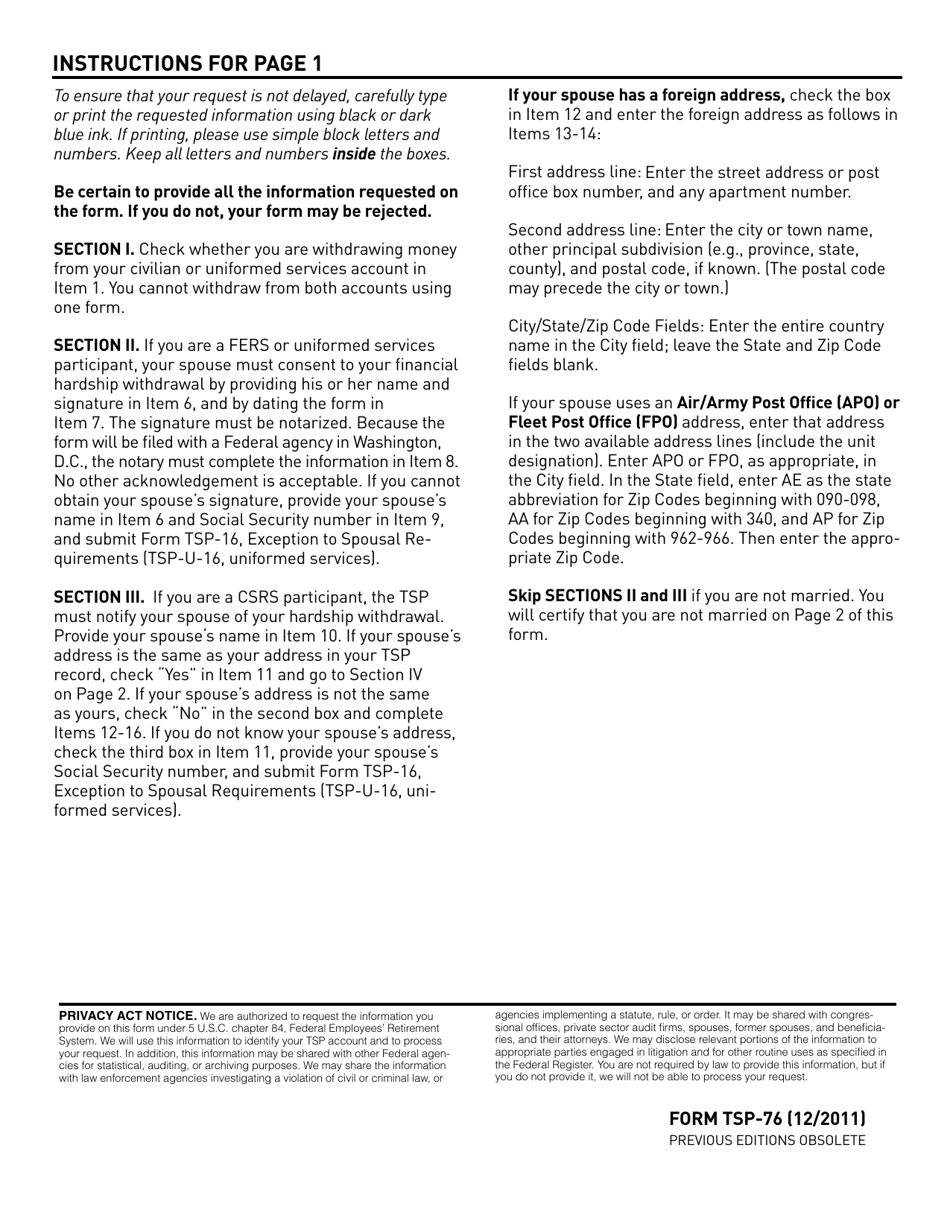

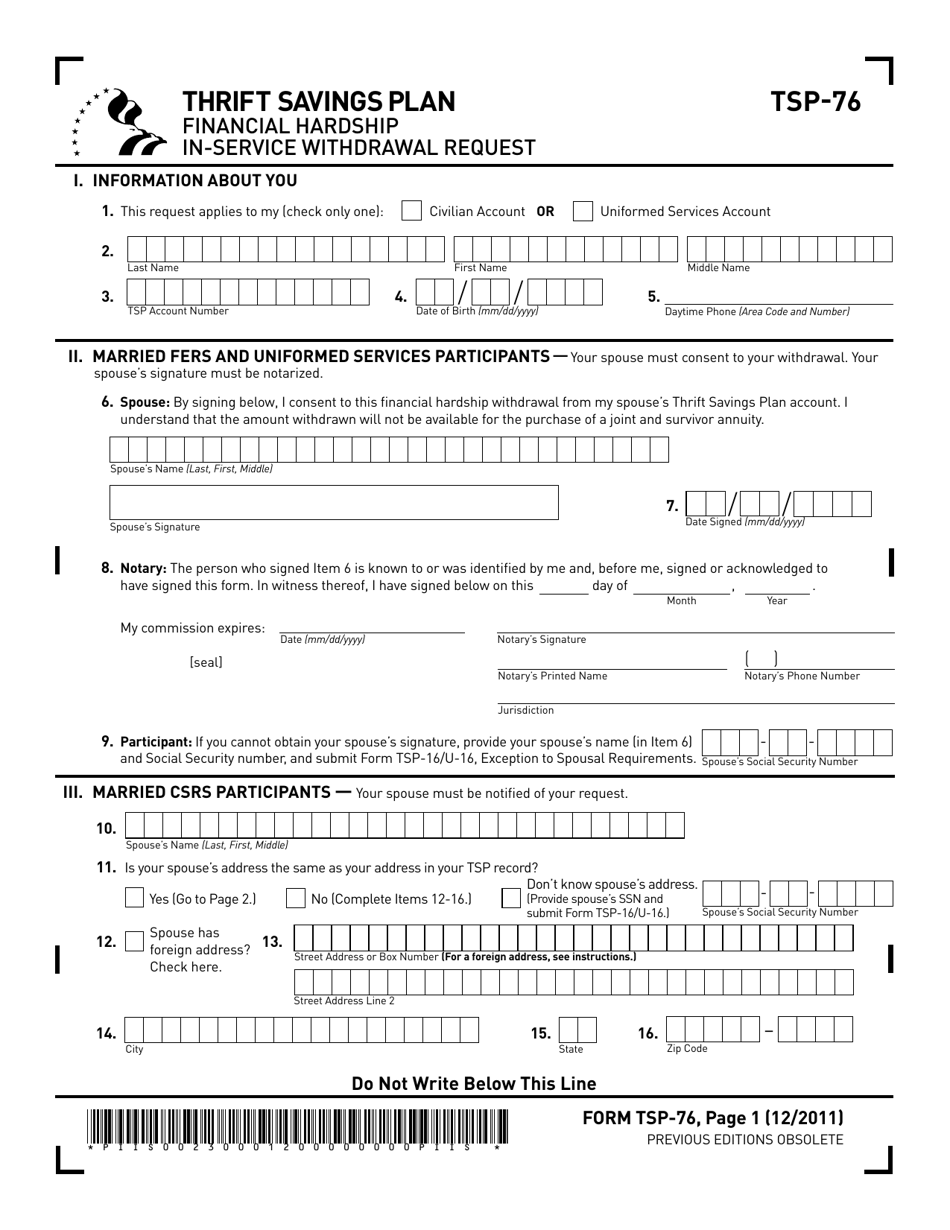

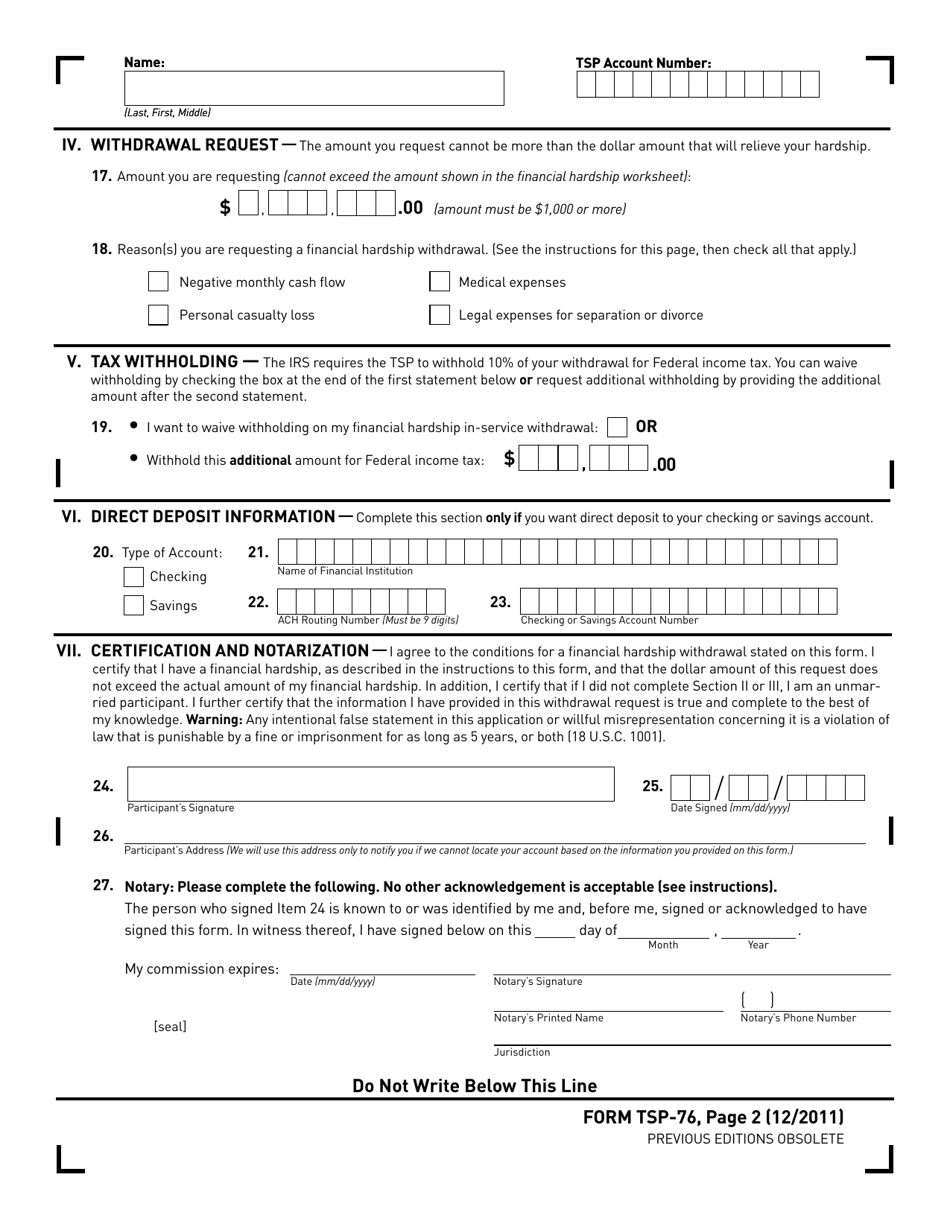

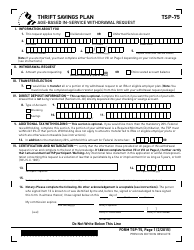

Form TSP-76 Financial Hardship In-Service Withdrawal Request

What Is Form TSP-76?

This is a legal form that was released by the Thrift Savings Plan on December 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

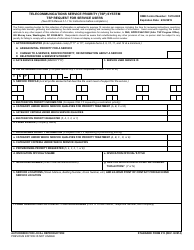

Q: What is Form TSP-76?

A: Form TSP-76 is a document used to request a financial hardship in-service withdrawal from the Thrift Savings Plan (TSP).

Q: What is a financial hardship in-service withdrawal?

A: A financial hardship in-service withdrawal allows participants in the TSP to withdraw money from their accounts before reaching the age of 59 ½ due to financial hardship.

Q: Who can use Form TSP-76?

A: Form TSP-76 can be used by TSP participants who are facing a financial hardship and need to access their TSP funds.

Q: What is the Thrift Savings Plan (TSP)?

A: The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the military, similar to a 401(k) for private sector employees.

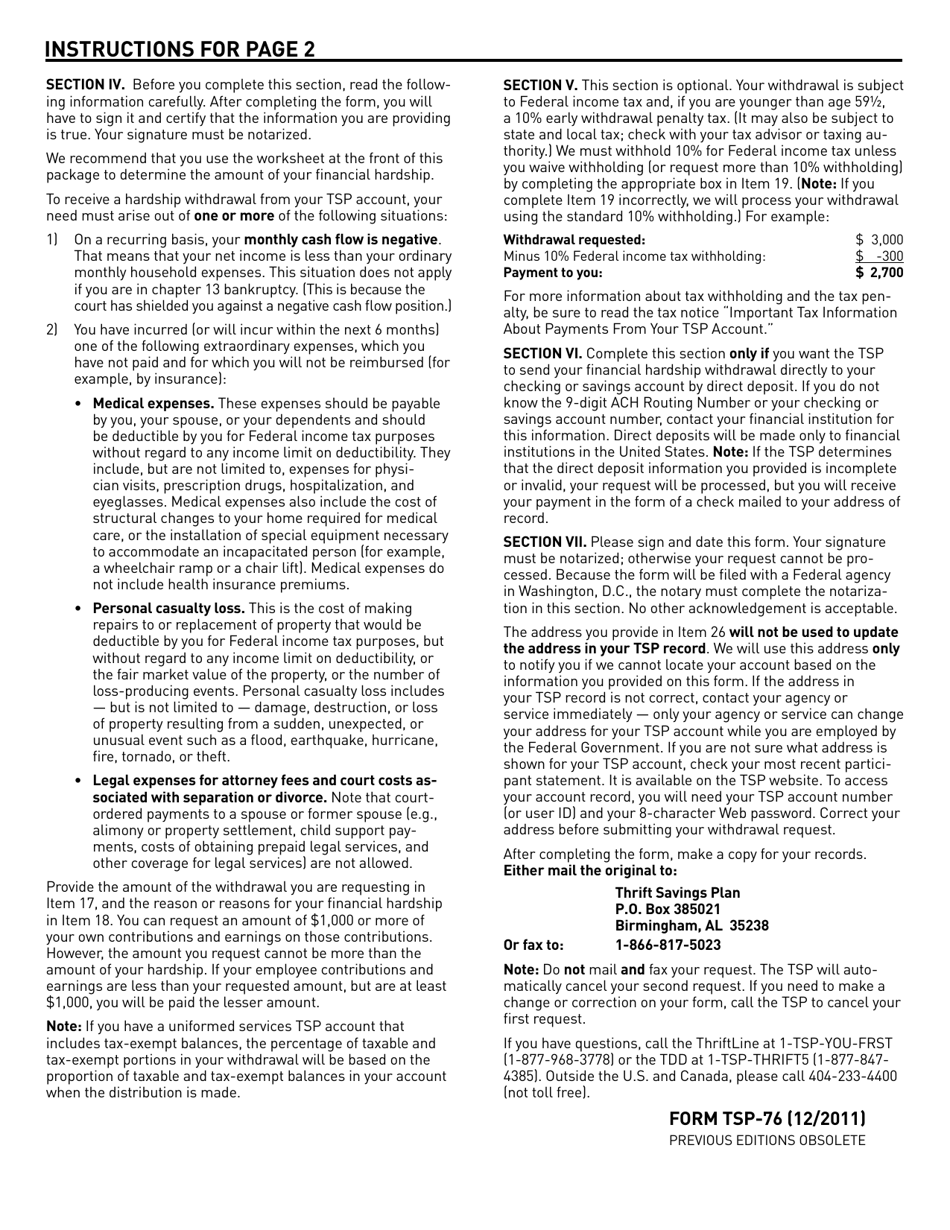

Q: What are some examples of financial hardship?

A: Examples of financial hardship that may qualify for a TSP in-service withdrawal include unpaid medical bills, funeral expenses, and preventing eviction or foreclosure.

Q: What documentation is required to support a financial hardship in-service withdrawal?

A: Participants must provide documentation, such as medical bills or eviction notices, to support their financial hardship in-service withdrawal request.

Q: What are the tax implications of a financial hardship in-service withdrawal?

A: Financial hardship in-service withdrawals are subject to federal income tax and may also be subject to a 10% early withdrawal penalty if the participant is under the age of 59 ½.

Q: Are there any restrictions on the amount that can be withdrawn as a financial hardship in-service withdrawal?

A: Yes, participants can only withdraw the amount necessary to meet their financial hardship. Any withdrawal amount must be specified on Form TSP-76.

Q: How long does it take to process a financial hardship in-service withdrawal?

A: The processing time for a financial hardship in-service withdrawal can vary, but typically takes a few weeks.

Q: Can a financial hardship in-service withdrawal be repaid?

A: No, once a financial hardship in-service withdrawal is made, it cannot be repaid to the TSP.

Form Details:

- Released on December 1, 2011;

- The latest available edition released by the Thrift Savings Plan;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TSP-76 by clicking the link below or browse more documents and templates provided by the Thrift Savings Plan.